EFW Individuals Can Make an Extension or Estimated Tax Payment Form

Understanding the EFW Individuals Can Make An Extension Or Estimated Tax Payment

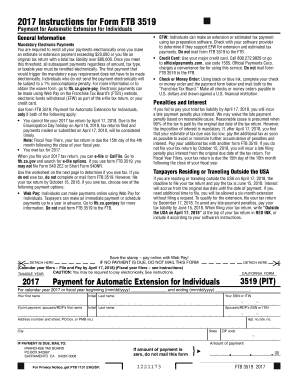

The EFW (Electronic Funds Withdrawal) option allows individuals to make an extension or estimated tax payment electronically. This method is particularly beneficial for taxpayers who prefer a streamlined process without the need for paper checks. By using EFW, individuals can ensure that their payments are processed quickly and securely, reducing the risk of late payments and associated penalties.

Steps to Complete the EFW Individuals Can Make An Extension Or Estimated Tax Payment

To successfully complete the EFW process for making an extension or estimated tax payment, follow these steps:

- Gather your tax information, including your Social Security number and the amount you wish to pay.

- Visit the official IRS website or authorized tax preparation software that supports EFW.

- Select the option for making an extension or estimated tax payment.

- Choose the EFW payment method and enter your banking information as prompted.

- Review your payment details to ensure accuracy before submitting.

- Confirm the transaction and save the confirmation number for your records.

Legal Use of the EFW Individuals Can Make An Extension Or Estimated Tax Payment

The EFW payment method is legally recognized by the IRS, making it a valid option for submitting tax payments. Compliance with IRS guidelines ensures that payments made through EFW are considered timely and legitimate. It is essential to keep documentation of the transaction, including confirmation numbers and payment amounts, to protect against any potential disputes or issues with payment processing.

Filing Deadlines / Important Dates

Understanding the filing deadlines for tax payments is crucial to avoid penalties. For most individuals, the deadline for making an estimated tax payment or filing for an extension typically falls on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to check the IRS calendar for specific dates relevant to the current tax year.

Required Documents

When preparing to make an EFW payment, certain documents are necessary to ensure a smooth process. These include:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

- The total amount of tax owed or the estimated payment amount.

- Bank account information for the EFW transaction.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting their payments. The EFW method allows for online submissions, which is often the fastest and most efficient way to make payments. Alternatively, individuals can choose to mail a check or money order to the IRS or visit a local IRS office for in-person payments. Each method has its own processing times and requirements, so selecting the appropriate method based on personal circumstances is advisable.

Quick guide on how to complete efw individuals can make an extension or estimated tax payment

Complete EFW Individuals Can Make An Extension Or Estimated Tax Payment effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed papers, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage EFW Individuals Can Make An Extension Or Estimated Tax Payment on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to adjust and electronically sign EFW Individuals Can Make An Extension Or Estimated Tax Payment without hassle

- Obtain EFW Individuals Can Make An Extension Or Estimated Tax Payment and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign EFW Individuals Can Make An Extension Or Estimated Tax Payment and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

Can the W-9 tax form be filled out under a company’s name or only under an individual's name?

According to the instructions for line 1, which is where the name should be entered, it appears a company name is acceptable:b. Sole proprietor or single-member LLC. Enter your individual name as shown on your 1040/1040A/1040EZ on line 1. You may enter your business, trade, or “doing business as” (DBA) name on line 2.c. Partnership, LLC that is not a single-member LLC, C corporation, or S corporation. Enter the entity's name as shown on the entity's tax return on line 1 and any business, trade, or DBA name on line 2.d. Other entities. Enter your name as shown on required U.S. federal tax documents on line 1. This name should match the name shown on the charter or other legal document creating the entity. You may enter any business, trade, or DBA name on line 2.

-

I can't figure out if I should claim 1 dependent or 2 dependents on my W-4 tax form. When and how do you make changes to your W-4 tax form after having children?

OK, first off I’m going to say *IGNORE* the instructions on the updated W-4 form. It’s not worth anything. And yes, I’ve seen and followed the directions, which are wildly inaccurate and misleading.Here’s how exemptions and the W-4 work.As of last year, per the Tax Cuts and Job Act, you can NO LONGER, claim yourself as a dependent/exemption. You can, if you are married, no longer claim your spouse as a dependent/exemption.IF you have minor children (Age 19 and under) you *MAY* claim one exemption per child. IF you have a child, enrolled ‘full time in school’ who is age 24 or under, and that schooling is College, Trade School, Vo-Tech, etc and NOT primary education (IE High School education, GED classes, etc) you may claim an exemption for them.So simple example. Jack and Jane Darling are married. They have one child born June 1st.From January to June, Jack and Jane can *ONLY* claim ZERO EXEMPTIONS on their W-4. From June 1st, when the child is born, on wards, they can each claim ONE Exemption on their W-4.Hopefully that helps and simplifies it down. And yes, I’m a tax preparer as well. I spent all of last year warning various clients and I’m doing the same this year, along with explaining how many you can *legally* claim on your W-4.

-

Assuming I collect sales tax from residents of all 50 states as an online seller, & send a check to each state annually, how do I avoid fines/penalties for technical bsignNowes (didn’t make estimated payments, use correct form, file quarterly etc.)?

Great question!To begin, you will only want to register for a sales tax permit in states where you have nexus. For states in which you have nexus, the best way to avoid fines/penalties due to technical bsignNowes is to either 1) pay early or 2) use a third party tool to automate your sales tax filings.That’s where a company like TaxJar comes in. TaxJar can automate your sales tax filings in every state so you never need to worry about deadlines, payments, fines, or forms again. TaxJar is able to do this by connecting with the places you sell via one-click integrations. Whether it’s a marketplace like Amazon, eBay, and Etsy or an eCommerce platform like Shopify, Magento, and Squarespace, TaxJar can get you set up in minutes.If you’re new to sales tax, I recommend reading TaxJar’s free guide to getting sales tax compliant in 2018. Whether you choose to use a third party tool or do it yourself, TaxJar’s free guide will get you moving in the right direction.

-

How does a single-member LLC pay their estimated quarterly taxes? I’m helping my wife with her taxes for her newly formed LLC and I am not sure if she has to pay as a business or an individual. We live in CA.

In a Single Member LLC (“SMLLC”) the entity is not recognized by the IRS and is “disregarded”.The owner of the SMLLC is responsible for the estimated tax payments personally.The entity does not have a tax obligation.When the return is filed it will be on Schedule C of the Form 1040 and the owner, and spouse if filed married jointly, is personally responsible for the tax owed.The CA Franchise Tax Board works the same way.This assumes no tax elections have been taken.Pay the taxes personally and when you file your 1040 those ES payments will count towards your tax obligation.

Create this form in 5 minutes!

How to create an eSignature for the efw individuals can make an extension or estimated tax payment

How to create an electronic signature for the Efw Individuals Can Make An Extension Or Estimated Tax Payment in the online mode

How to make an electronic signature for your Efw Individuals Can Make An Extension Or Estimated Tax Payment in Chrome

How to generate an eSignature for putting it on the Efw Individuals Can Make An Extension Or Estimated Tax Payment in Gmail

How to create an electronic signature for the Efw Individuals Can Make An Extension Or Estimated Tax Payment right from your smartphone

How to make an electronic signature for the Efw Individuals Can Make An Extension Or Estimated Tax Payment on iOS

How to generate an eSignature for the Efw Individuals Can Make An Extension Or Estimated Tax Payment on Android

People also ask

-

What is the process for EFW individuals to make an extension or estimated tax payment?

EFW individuals can make an extension or estimated tax payment through airSlate SignNow by easily eSigning the necessary documents online. The platform simplifies the process, allowing users to fill out their forms, sign them electronically, and submit their payments efficiently. This ensures compliance with tax deadlines without the hassle of paper forms.

-

Are there any fees associated with making an extension or estimated tax payment using airSlate SignNow?

While airSlate SignNow offers a cost-effective solution for eSigning documents, there may be transaction fees imposed by your bank or payment processor when making an extension or estimated tax payment. It’s important to check with your financial institution for any additional charges. Overall, using airSlate SignNow helps streamline your payment process at a competitive price.

-

Can I use airSlate SignNow to track my extension or estimated tax payment status?

Yes, airSlate SignNow provides tracking features that allow EFW individuals to monitor the status of their extension or estimated tax payments. Once you eSign and submit your documents, you can receive notifications and access a history of your transactions. This transparency helps you stay informed about your payment status.

-

What features does airSlate SignNow offer for EFW individuals making tax payments?

airSlate SignNow offers a range of features for EFW individuals making an extension or estimated tax payment, including a user-friendly interface, secure eSigning, and document storage. Additionally, the platform supports integrations with popular accounting software, making it easier to manage your tax obligations efficiently.

-

Is airSlate SignNow suitable for both personal and business tax payments?

Absolutely! airSlate SignNow is designed to accommodate both personal and business needs, including EFW individuals making an extension or estimated tax payment. The platform’s flexibility allows users to manage documents for various tax scenarios, ensuring a smooth experience whether you’re filing for yourself or a business.

-

How does airSlate SignNow ensure the security of my tax payment information?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption protocols to protect the sensitive information of EFW individuals making an extension or estimated tax payment. Additionally, airSlate SignNow complies with industry standards to ensure that your personal and financial data remains secure throughout the eSigning process.

-

Can I integrate airSlate SignNow with my existing tax software?

Yes, airSlate SignNow offers seamless integrations with many popular tax software programs. This allows EFW individuals to make an extension or estimated tax payment directly from their preferred tools, enhancing efficiency and reducing the need for manual data entry. Check the integrations page for a list of compatible software options.

Get more for EFW Individuals Can Make An Extension Or Estimated Tax Payment

Find out other EFW Individuals Can Make An Extension Or Estimated Tax Payment

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word