Publication 487 Rev 1 Internal Revenue Service Form

What is the Publication 487 Rev 1 Internal Revenue Service

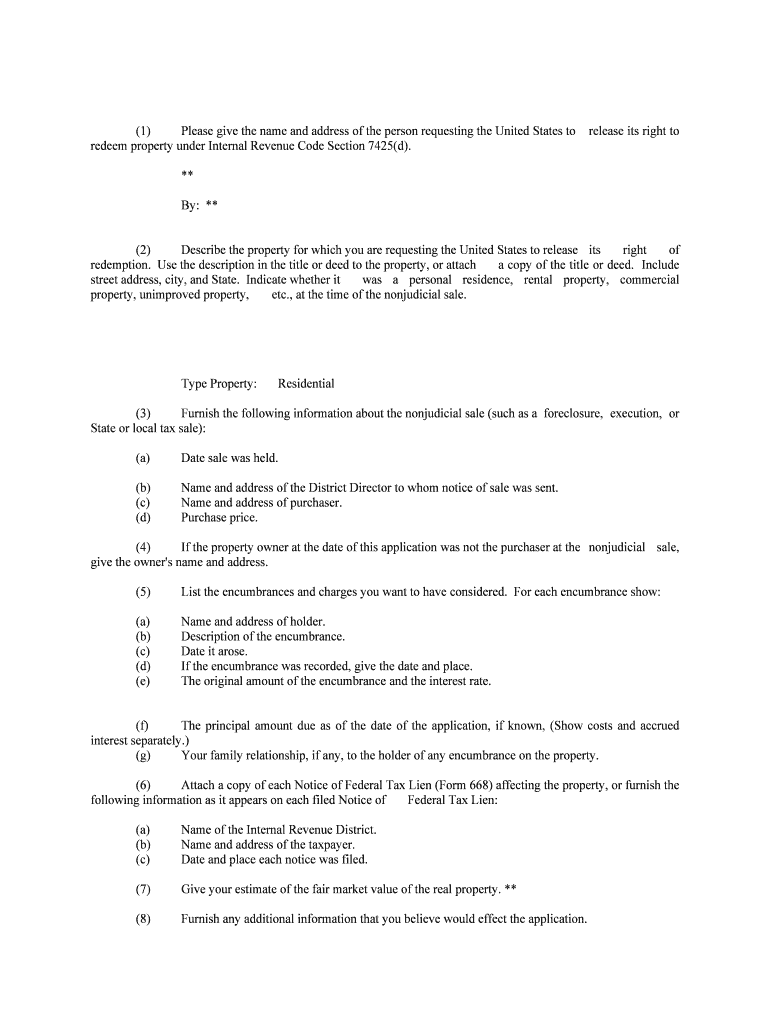

The Publication 487 Rev 1 is an essential document issued by the Internal Revenue Service (IRS) that provides guidelines and information regarding certain tax-related matters. This publication is particularly relevant for taxpayers seeking clarity on specific tax regulations, deductions, and credits applicable to their financial situations. Understanding this publication helps individuals and businesses navigate the complexities of tax compliance and ensures they are informed about their rights and responsibilities under U.S. tax law.

How to use the Publication 487 Rev 1 Internal Revenue Service

Using the Publication 487 Rev 1 involves carefully reviewing the information contained within the document to determine its relevance to your specific tax situation. Taxpayers should focus on the sections that pertain to their circumstances, such as eligibility for deductions or credits. It is advisable to cross-reference the publication with your tax forms to ensure accurate reporting. Additionally, consulting with a tax professional can provide further insights into how the guidelines apply to your financial activities.

Steps to complete the Publication 487 Rev 1 Internal Revenue Service

Completing the Publication 487 Rev 1 requires a systematic approach to ensure that all relevant information is accurately captured. Here are key steps to follow:

- Read through the publication thoroughly to understand the requirements.

- Gather all necessary financial documents, such as income statements and previous tax returns.

- Identify the specific sections of the publication that apply to your situation.

- Fill out the required forms, ensuring that all entries are accurate and complete.

- Review the completed forms for any errors or omissions before submission.

Legal use of the Publication 487 Rev 1 Internal Revenue Service

The legal use of the Publication 487 Rev 1 is grounded in its role as an authoritative source of information from the IRS. Taxpayers are encouraged to utilize the guidelines provided in this publication to ensure compliance with federal tax laws. Proper adherence to the instructions outlined in the publication can help avoid penalties and legal issues related to tax filings. Furthermore, understanding the legal implications of the information presented can empower taxpayers to make informed decisions regarding their tax obligations.

Filing Deadlines / Important Dates

Filing deadlines associated with the Publication 487 Rev 1 are critical for taxpayers to observe. Generally, tax returns must be filed by April 15 each year, but specific circumstances may alter this date. It is essential to stay informed about any changes in deadlines, including extensions that may apply to certain taxpayers. Marking these important dates on your calendar can help ensure timely compliance and avoid penalties for late submissions.

Required Documents

When preparing to use the Publication 487 Rev 1, it is vital to gather all required documents to facilitate accurate completion. Common documents include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous tax returns for reference

Having these documents on hand will streamline the process and enhance the accuracy of your tax filing.

Quick guide on how to complete publication 487 rev 1 2006 internal revenue service

Complete Publication 487 Rev 1 Internal Revenue Service effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without any delays. Manage Publication 487 Rev 1 Internal Revenue Service on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to modify and eSign Publication 487 Rev 1 Internal Revenue Service with ease

- Obtain Publication 487 Rev 1 Internal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and hit the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device you prefer. Modify and eSign Publication 487 Rev 1 Internal Revenue Service and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Publication 487 Rev 1 Internal Revenue Service?

Publication 487 Rev 1 Internal Revenue Service provides crucial guidelines for taxpayers regarding specific tax responsibilities. This document outlines essential information for filing taxes and understanding certain deductions and credits, making it an invaluable resource for both individuals and businesses alike.

-

How can airSlate SignNow help with the Publication 487 Rev 1 Internal Revenue Service?

airSlate SignNow streamlines the process of signing and sending documents related to the Publication 487 Rev 1 Internal Revenue Service. By using our eSignature platform, you can effortlessly manage your tax documents and ensure compliance with IRS requirements, saving you time and reducing stress.

-

What are the pricing options for airSlate SignNow offerings related to Publication 487 Rev 1 Internal Revenue Service?

Our pricing for airSlate SignNow is designed to be both cost-effective and scalable, especially for users dealing with documents like those outlined in Publication 487 Rev 1 Internal Revenue Service. We offer various plans to fit different business needs, ensuring you only pay for what you require while accessing all essential eSigning features.

-

What features does airSlate SignNow provide to assist with Publication 487 Rev 1 Internal Revenue Service-related documents?

airSlate SignNow offers a range of features including customizable templates, reminder notifications, and audit trails specifically beneficial for documents related to Publication 487 Rev 1 Internal Revenue Service. These features enhance document management, ensuring you can handle your tax-related paperwork efficiently and securely.

-

How does eSigning with airSlate SignNow benefit my tax document process, especially regarding Publication 487 Rev 1 Internal Revenue Service?

eSigning with airSlate SignNow signNowly enhances your tax document process by allowing you to sign documents quickly, track their status, and maintain compliance with Publication 487 Rev 1 Internal Revenue Service requirements. This efficiency reduces the time spent on paperwork, making your tax season smoother and more manageable.

-

Can I integrate airSlate SignNow with other tools for managing Publication 487 Rev 1 Internal Revenue Service-related tasks?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions like CRM and accounting platforms, simplifying your workflow for managing tasks related to Publication 487 Rev 1 Internal Revenue Service. This flexibility allows you to automate processes and enhance overall productivity across your business operations.

-

Is there customer support available for queries related to Publication 487 Rev 1 Internal Revenue Service and airSlate SignNow?

Yes, airSlate SignNow offers comprehensive customer support to assist clients with any questions or issues surrounding Publication 487 Rev 1 Internal Revenue Service. Our dedicated support team is available to ensure you get the help you need, whether it’s related to signing documents or understanding IRS guidelines.

Get more for Publication 487 Rev 1 Internal Revenue Service

- Ptoaia14 download form

- 1099 form 2011

- How to fill central bank of india form 2009

- Efs fillable pdf fail form

- 1019 notice of assessment taxable valuation and property form

- Mi 1041d michigan adjustments of capital gains and losses form

- Fillable online 4892 corporate income tax amended return form

- Issued for schedule ptw form

Find out other Publication 487 Rev 1 Internal Revenue Service

- How To eSignature Form

- eSignature Document Simple

- eSignature Document Easy

- How Can I eSignature Form

- eSignature PPT Secure

- Can I eSignature Form

- eSignature Presentation Now

- eSignature Presentation Myself

- eSignature Presentation Free

- How To eSignature Presentation

- eSignature Presentation Fast

- eSignature Presentation Simple

- eSignature Presentation Easy

- How Do I eSignature Presentation

- How To Electronic signature PDF

- Electronic signature PDF Computer

- Electronic signature PDF Online

- Electronic signature PDF Now

- How Do I Electronic signature PDF

- Electronic signature PDF Free