A Montana Corporation Form

What is the A Montana Corporation

An A Montana Corporation is a legal entity formed under the laws of Montana, designed to conduct business activities. This type of corporation is recognized as a separate legal entity from its owners, providing limited liability protection to its shareholders. This means that the personal assets of the shareholders are generally protected from business debts and liabilities. Establishing a corporation in Montana involves filing specific documents with the Secretary of State and adhering to state regulations.

How to obtain the A Montana Corporation

To obtain an A Montana Corporation, one must follow a series of steps that include selecting a unique name for the corporation, appointing a registered agent, and preparing the Articles of Incorporation. The Articles must include key information such as the corporation's name, purpose, duration, and the number of shares authorized. Once these documents are prepared, they must be filed with the Montana Secretary of State along with the required filing fee. After approval, the corporation will receive a Certificate of Incorporation, signifying its legal existence.

Steps to complete the A Montana Corporation

Completing the A Montana Corporation involves several important steps:

- Select a unique name that complies with Montana naming requirements.

- Designate a registered agent who will receive legal documents on behalf of the corporation.

- Draft and file the Articles of Incorporation with the Montana Secretary of State.

- Obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

- Comply with any local business licenses or permits required to operate legally.

Legal use of the A Montana Corporation

The legal use of an A Montana Corporation includes conducting business activities such as entering into contracts, hiring employees, and owning property. It is essential for the corporation to adhere to state and federal regulations, including annual reporting and tax obligations. Proper governance, including holding regular meetings and maintaining corporate records, is crucial to uphold the corporation's legal status and protect the limited liability afforded to its shareholders.

Key elements of the A Montana Corporation

Key elements of an A Montana Corporation include:

- Limited liability: Shareholders are not personally liable for corporate debts.

- Perpetual existence: The corporation continues to exist beyond the life of its owners.

- Transferability of shares: Ownership can be easily transferred through the sale of shares.

- Corporate governance: The corporation must have a structured management system, including a board of directors.

Required Documents

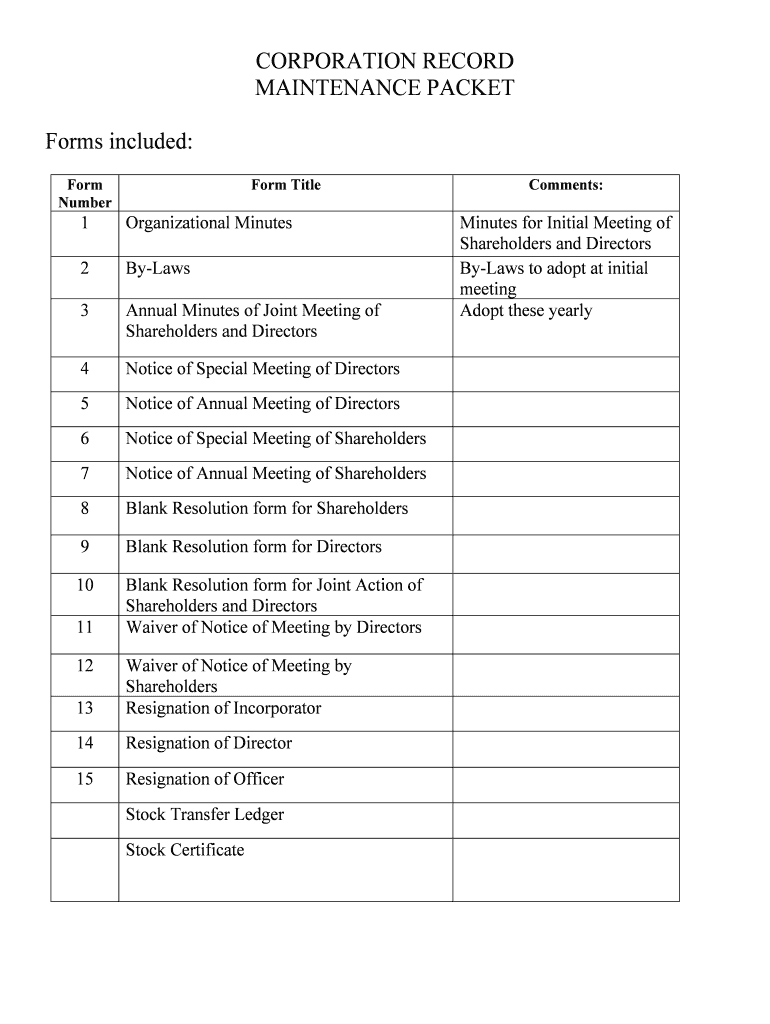

To establish an A Montana Corporation, several documents are required:

- Articles of Incorporation: This foundational document outlines the corporation's structure and purpose.

- Bylaws: Internal rules governing the management and operation of the corporation.

- Registered agent consent form: A document confirming the registered agent's agreement to serve.

- Employer Identification Number (EIN): Necessary for tax identification and reporting.

Quick guide on how to complete a montana corporation

Effortlessly Prepare A Montana Corporation on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents promptly without any delays. Handle A Montana Corporation on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Edit and eSign A Montana Corporation with Ease

- Find A Montana Corporation and click on Get Form to begin.

- Use the tools available to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details carefully and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign A Montana Corporation and guarantee seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is A Montana Corporation and how can airSlate SignNow help?

A Montana Corporation refers to a business entity registered in Montana that offers limited liability protection. airSlate SignNow can help a Montana Corporation streamline document management and simplify the eSigning process, making it easy to handle essential paperwork efficiently and securely.

-

What features does airSlate SignNow offer for A Montana Corporation?

For A Montana Corporation, airSlate SignNow provides features such as customizable templates, in-person signing, and automated workflows. These tools enable businesses to create, send, and manage documents effectively, helping to reduce turnaround times and improve productivity.

-

Is airSlate SignNow cost-effective for A Montana Corporation?

Yes, airSlate SignNow is designed to be a cost-effective solution for A Montana Corporation. With various pricing plans available, businesses can choose an option that suits their needs and budget while still benefiting from robust eSigning capabilities.

-

Can A Montana Corporation integrate airSlate SignNow with other applications?

Absolutely! A Montana Corporation can easily integrate airSlate SignNow with a variety of applications, including CRM systems and document storage platforms. This seamless integration helps ensure smooth data transfer and enhances overall operational efficiency.

-

What are the benefits of using airSlate SignNow for A Montana Corporation?

Using airSlate SignNow provides several benefits for A Montana Corporation, including increased efficiency, improved security, and higher customer satisfaction. By utilizing an easy-to-use eSigning solution, businesses can accelerate their document workflows and focus on core operational tasks.

-

How secure is airSlate SignNow for A Montana Corporation?

airSlate SignNow prioritizes security, ensuring that all documents signed by A Montana Corporation are protected through encryption and industry-standard security protocols. This commitment to security helps safeguard sensitive business information during the eSigning process.

-

Does airSlate SignNow support mobile signing for A Montana Corporation?

Yes, airSlate SignNow supports mobile signing, making it convenient for clients of A Montana Corporation to sign documents on the go. This mobile functionality enhances user experience and ensures that important agreements are executed timely, regardless of location.

Get more for A Montana Corporation

Find out other A Montana Corporation

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will