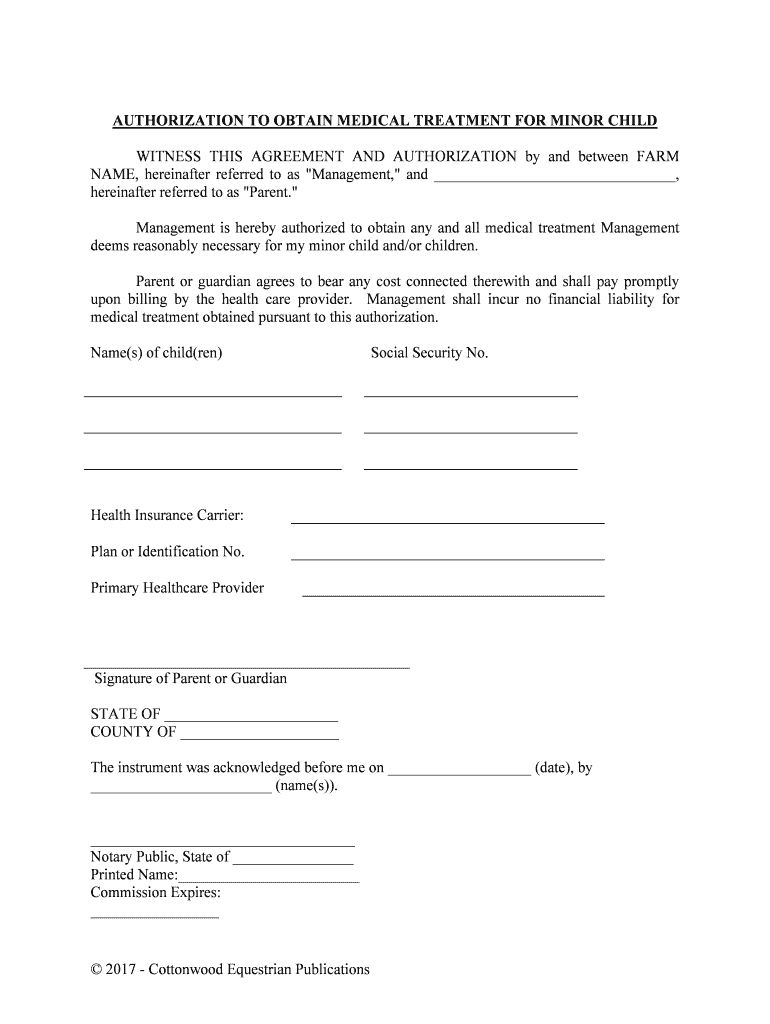

Health Insurance Carrier Form

What is the Health Insurance Carrier

A health insurance carrier is a company that provides health insurance coverage to individuals and groups. These carriers can be private entities, such as for-profit or non-profit organizations, or public entities like government programs. They are responsible for underwriting policies, managing claims, and ensuring compliance with healthcare regulations. Understanding the role of a health insurance carrier is essential for individuals seeking coverage, as it directly impacts the types of plans available and the benefits provided.

How to use the Health Insurance Carrier

Using a health insurance carrier involves several steps, starting with selecting a plan that meets your healthcare needs. Individuals typically review available options based on coverage, premiums, and out-of-pocket costs. Once a plan is chosen, enrollment can occur through the carrier's website, via phone, or through an insurance broker. After enrollment, policyholders can access services by presenting their insurance card when seeking medical care, ensuring that the provider bills the carrier directly for covered services.

Steps to complete the Health Insurance Carrier

Completing the health insurance carrier process generally includes the following steps:

- Research available health insurance plans from various carriers.

- Compare coverage options, premiums, and deductibles to find a suitable plan.

- Gather necessary personal information, such as Social Security numbers and income details.

- Complete the application either online, by phone, or through an agent.

- Review and sign the policy documents, ensuring understanding of the terms.

- Receive your insurance card and policy details once approved.

Legal use of the Health Insurance Carrier

The legal use of a health insurance carrier involves adhering to federal and state regulations governing health insurance. This includes compliance with the Affordable Care Act (ACA), which mandates certain coverage requirements and protections for consumers. Policyholders must also ensure they provide accurate information during the application process to avoid issues with claims or coverage. Understanding these legalities helps individuals navigate their rights and responsibilities when dealing with health insurance carriers.

Key elements of the Health Insurance Carrier

Key elements of a health insurance carrier include:

- Premiums: The amount paid for coverage, usually on a monthly basis.

- Deductibles: The amount the insured must pay out-of-pocket before the carrier begins to cover costs.

- Copayments and Coinsurance: The share of costs that policyholders are responsible for after meeting their deductible.

- Network of Providers: A list of doctors and hospitals that have agreements with the carrier to provide services at negotiated rates.

- Coverage Benefits: Specific services and treatments that are included in the policy.

Required Documents

When applying for health insurance through a carrier, several documents may be required, including:

- Proof of identity, such as a driver's license or passport.

- Social Security numbers for all applicants.

- Income documentation, such as pay stubs or tax returns.

- Previous insurance information, if applicable.

Eligibility Criteria

Eligibility for health insurance through a carrier typically depends on factors such as age, residency, and income level. Individuals may need to meet specific criteria set by the carrier or mandated by law, such as being a U.S. citizen or legal resident. Additionally, some plans may have open enrollment periods during which individuals can apply for coverage, while others may allow for enrollment under special circumstances, such as a change in employment or family status.

Quick guide on how to complete health insurance carrier

Effortlessly prepare Health Insurance Carrier on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and safely keep it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents promptly and without holdups. Handle Health Insurance Carrier on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The simplest method to edit and electronically sign Health Insurance Carrier effortlessly

- Obtain Health Insurance Carrier and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and press the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign Health Insurance Carrier and ensure superior communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Health Insurance Carrier?

A Health Insurance Carrier is a company that provides health insurance plans to individuals and businesses. They manage the policies, premiums, claims, and benefits for their members. Understanding the role of a Health Insurance Carrier can help you navigate your healthcare options effectively.

-

How can airSlate SignNow benefit my Health Insurance Carrier?

airSlate SignNow streamlines the documentation process for Health Insurance Carriers by allowing them to easily send, sign, and manage documents electronically. This efficiency reduces paperwork and speeds up processing times, ultimately improving customer satisfaction. An easy-to-use solution like airSlate SignNow can simplify operations for both carriers and their clients.

-

What features should I look for in a Health Insurance Carrier?

When selecting a Health Insurance Carrier, look for features such as comprehensive coverage options, user-friendly digital tools, and strong customer support. Additionally, assess the carrier's claims process and review feedback from existing customers. Choosing the right Health Insurance Carrier ensures you receive adequate coverage and assistance when needed.

-

How does airSlate SignNow handle pricing for Health Insurance Carrier integrations?

airSlate SignNow offers competitive pricing that varies based on the features and integrations you choose. For Health Insurance Carriers, there are flexible plans designed to meet diverse business needs. Our pricing structure is transparent, ensuring that you only pay for what you need when you use our e-signature solution.

-

Can airSlate SignNow integrate with existing tools used by Health Insurance Carriers?

Yes, airSlate SignNow seamlessly integrates with a variety of tools commonly used by Health Insurance Carriers, such as CRM systems and document management software. These integrations enhance workflow efficiency by allowing easy document signing and management directly from your existing applications. This ensures a smoother experience for both carriers and insured individuals.

-

What benefits does airSlate SignNow offer to Health Insurance Carriers?

AirSlate SignNow provides numerous benefits for Health Insurance Carriers, including increased efficiency, reduced paperwork, and enhanced compliance with legal standards. By digitizing the signing process, carriers can expedite document turnaround times and focus more on customer service. This ultimately leads to a better experience for policyholders.

-

How secure is airSlate SignNow for Health Insurance Carrier documents?

AirSlate SignNow prioritizes security by implementing industry-standard encryption and strong data protection protocols, ensuring that documents for Health Insurance Carriers remain confidential and secure. We are compliant with various regulations, which is crucial for maintaining trust with your clients. Secure handling of sensitive health information is our top priority.

Get more for Health Insurance Carrier

- Government ampamp 157619 form

- Oxygen therapy request for prior authorization and form

- Roof replacement contract template form

- Roof residential contract template form

- Roofing contract template 787755104 form

- Room and board contract template form

- Room contract template form

- Room for rent contract template form

Find out other Health Insurance Carrier

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History