Before of Each Year Form

What is the Before Of Each Year

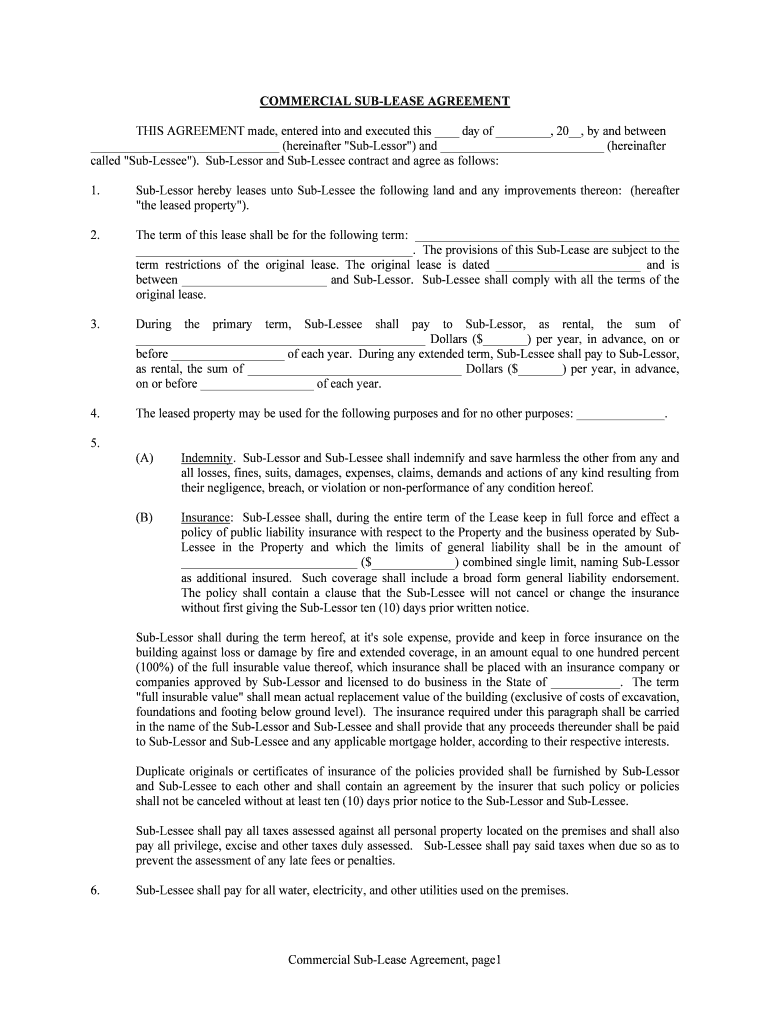

The Before Of Each Year form is a crucial document for individuals and businesses, typically used to report financial information to the IRS or other relevant authorities. This form may vary in purpose, depending on the specific requirements of the entity requesting it. It often serves as a declaration of income, deductions, or other financial activities that occurred in the previous year. Completing this form accurately is essential for compliance with tax regulations and to avoid potential penalties.

How to use the Before Of Each Year

Using the Before Of Each Year form involves several straightforward steps. First, gather all necessary financial documents, including income statements, receipts for deductible expenses, and any other relevant records. Next, fill out the form with accurate information, ensuring that all figures are correct and reflect your financial situation. Once completed, the form can be submitted electronically or via traditional mail, depending on the requirements of the issuing authority. Utilizing a digital solution can streamline this process, making it easier to manage and submit your documents securely.

Steps to complete the Before Of Each Year

Completing the Before Of Each Year form requires careful attention to detail. Here are the key steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and expense receipts.

- Review the instructions provided with the form to understand the required information.

- Fill out the form, ensuring accuracy in all reported figures.

- Double-check your entries for any errors or omissions.

- Submit the form electronically or by mail, following the specified submission guidelines.

Legal use of the Before Of Each Year

The Before Of Each Year form is legally binding when completed correctly and submitted to the appropriate authority. Compliance with federal and state regulations is essential to ensure that the information provided is accepted as valid. This includes adhering to guidelines set forth by the IRS and any applicable state tax agencies. Failure to comply with these regulations can result in penalties, including fines or audits.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Before Of Each Year form. Typically, these deadlines align with the annual tax filing schedule. For individuals, the deadline is often April 15 of the following year. Businesses may have different deadlines based on their entity type and fiscal year. Keeping track of these dates is crucial to avoid late submissions and potential penalties.

Examples of using the Before Of Each Year

Several scenarios illustrate the use of the Before Of Each Year form. For instance, a self-employed individual may use this form to report income and expenses incurred throughout the year. A small business owner might utilize it to summarize financial activities for tax reporting purposes. Additionally, individuals may need to complete this form to claim deductions or credits that require detailed financial reporting.

Quick guide on how to complete before of each year

Effortlessly Prepare Before Of Each Year on Any Device

The management of documents online has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Before Of Each Year on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Edit and Electronically Sign Before Of Each Year with Ease

- Locate Before Of Each Year and select Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to share your form, whether via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Before Of Each Year and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer before of each year?

Before of each year, airSlate SignNow provides features like document templates, real-time tracking, and customizable workflows. These functionalities help businesses streamline their signing processes and enhance productivity. With a user-friendly interface, you can easily manage your documents and signatures throughout the year.

-

How does pricing work for airSlate SignNow before of each year?

Before of each year, airSlate SignNow offers various pricing plans that fit different business needs. You can choose from monthly or yearly subscriptions with options tailored for startups, small businesses, and enterprises. Pricing is transparent and designed to provide the greatest value for the features offered.

-

What are the benefits of using airSlate SignNow before of each year?

Before of each year, airSlate SignNow helps businesses save time and reduce paperwork by facilitating digital signatures. The service enhances security and compliance, ensuring that your documents are safely signed and stored electronically. This not only improves efficiency but also contributes to better overall business workflows.

-

How does airSlate SignNow integrate with other tools before of each year?

Before of each year, airSlate SignNow can integrate seamlessly with various platforms such as Google Workspace, Salesforce, and Microsoft Office. These integrations facilitate a smoother workflow, allowing users to access and send documents directly from their preferred applications. This centralizes your processes and enhances collaboration among teams.

-

Can airSlate SignNow handle large volumes of documents before of each year?

Yes, airSlate SignNow can efficiently handle large volumes of documents before of each year. The platform is designed to support bulk sending and signing, making it suitable for businesses that require high-volume document management. You can streamline your workflow by sending multiple documents for signature at once.

-

Is training required to use airSlate SignNow before of each year?

Before of each year, no extensive training is required to use airSlate SignNow. The user-friendly interface ensures that even those with limited technical skills can navigate the platform effortlessly. Moreover, airSlate SignNow provides tutorials and customer support to assist users in maximizing their experience.

-

What security measures does airSlate SignNow implement before of each year?

Before of each year, airSlate SignNow employs robust security measures, including encryption and multi-factor authentication, to protect your documents. Compliance with industry standards ensures that your data remains confidential and secure. This is particularly crucial for businesses that handle sensitive information.

Get more for Before Of Each Year

- Sales and use tax construction contract exemption certificate form

- Www pdffiller com500426850 tax department cityfillable online tax department city of oregon ohiocity of form

- Mv 413 new york state dmv dmv ny form

- Employers quarterly return of tax toledo ohio form

- Transitioning to the michigan corporate income tax form

- 382 gas severance tax return form

- Mi form 4884 fill and sign printable template

- 4976 michigan home heating credit claim mi 1040cr 7 supplemental 4976 michigan home heating credit claim mi 1040cr 7 form

Find out other Before Of Each Year

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document