IL 4852, Substitute for Unobtainable Form W 2

What is the IL 4852, Substitute For Unobtainable Form W-2

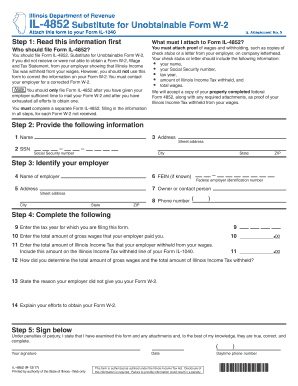

The IL 4852 is a substitute form used by taxpayers who are unable to obtain their original Form W-2 from their employer. This situation may arise if the employer fails to provide the W-2, or if the taxpayer has lost it. The IL 4852 allows individuals to estimate their wages and withholding amounts based on their pay stubs or other records. It is essential for ensuring accurate tax reporting and compliance with IRS requirements.

How to use the IL 4852, Substitute For Unobtainable Form W-2

To use the IL 4852 effectively, taxpayers should first gather all relevant information regarding their earnings and tax withholdings from pay stubs or other documentation. The form requires details such as the taxpayer's name, address, Social Security number, and the employer's information. After filling out the form, it should be submitted along with the taxpayer's federal tax return. This ensures that the IRS has the necessary information to process the return accurately.

Steps to complete the IL 4852, Substitute For Unobtainable Form W-2

Completing the IL 4852 involves several key steps:

- Collect all relevant pay stubs or records that indicate your earnings and tax withholdings.

- Fill out the IL 4852 form with your personal information and details about your employer.

- Estimate your total wages and withholdings based on the collected documentation.

- Review the completed form for accuracy and completeness.

- Submit the IL 4852 along with your federal tax return to the IRS.

IRS Guidelines

The IRS provides specific guidelines for using the IL 4852. Taxpayers must ensure that the information reported on the form is as accurate as possible to avoid discrepancies. It is advisable to retain copies of any documentation used to complete the form in case the IRS requests further information. Additionally, taxpayers should be aware that using the IL 4852 may result in longer processing times for their tax return.

Filing Deadlines / Important Dates

When using the IL 4852, it is crucial to be aware of the filing deadlines. Typically, the deadline for submitting federal tax returns is April 15. However, if a taxpayer is using the IL 4852, they should aim to submit their return as early as possible to allow for any potential follow-up from the IRS. Extensions may be available, but it is essential to file the IL 4852 and the tax return by the original deadline to avoid penalties.

Penalties for Non-Compliance

Failing to file a tax return or inaccurately reporting income can lead to significant penalties. If a taxpayer does not provide the necessary documentation, such as the IL 4852, they may face fines or additional taxes owed. It is important to complete the form accurately and submit it on time to avoid these repercussions. Taxpayers should also be aware that the IRS may conduct audits if discrepancies arise.

Quick guide on how to complete 2017 il 4852 substitute for unobtainable form w 2

Effortlessly Complete IL 4852, Substitute For Unobtainable Form W 2 on Any Device

Managing documents online has become increasingly popular with both businesses and individuals. It offers an excellent environmentally friendly option to traditional printed and signed paperwork, as you can easily access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without delays. Manage IL 4852, Substitute For Unobtainable Form W 2 on any device through airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign IL 4852, Substitute For Unobtainable Form W 2 Stress-Free

- Obtain IL 4852, Substitute For Unobtainable Form W 2 and click on Get Form to commence.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information using the tools specifically designed for this purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet signature.

- Review all information and click the Done button to finalize your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or the need to print new copies due to errors. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign IL 4852, Substitute For Unobtainable Form W 2 to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

If I have to fill out Form WH-4852, should I also send in my original W-2 and file it?

The purpose of Form 4852 is to substitute for the original W-2 if for some reason you didn't receive one and couldn't get one from an employer. If you have the original W-2, you don't file Form 4852.

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

Create this form in 5 minutes!

How to create an eSignature for the 2017 il 4852 substitute for unobtainable form w 2

How to make an electronic signature for your 2017 Il 4852 Substitute For Unobtainable Form W 2 online

How to make an eSignature for the 2017 Il 4852 Substitute For Unobtainable Form W 2 in Google Chrome

How to generate an electronic signature for signing the 2017 Il 4852 Substitute For Unobtainable Form W 2 in Gmail

How to generate an electronic signature for the 2017 Il 4852 Substitute For Unobtainable Form W 2 from your smart phone

How to make an eSignature for the 2017 Il 4852 Substitute For Unobtainable Form W 2 on iOS

How to create an eSignature for the 2017 Il 4852 Substitute For Unobtainable Form W 2 on Android OS

People also ask

-

What is an idoc w2 substitute?

An idoc W2 substitute is a document format that replaces traditional W2 forms for reporting employee wages and tax information. This digital alternative allows businesses to streamline their reporting processes and ensure compliance with tax regulations efficiently.

-

How does airSlate SignNow support the creation of idoc W2 substitutes?

AirSlate SignNow provides an intuitive platform to create, send, and eSign idoc W2 substitutes quickly. With its user-friendly features, you can customize your documents, ensuring that they meet regulatory requirements without hassle.

-

Is airSlate SignNow a cost-effective solution for generating idoc W2 substitutes?

Yes, airSlate SignNow offers competitive pricing plans that help businesses save money while generating idoc W2 substitutes. The platform eliminates the need for costly paper processes, making it an economical choice for all sizes of businesses.

-

What features does airSlate SignNow offer for idoc W2 substitutes?

AirSlate SignNow includes essential features such as customizable templates, electronic signatures, document tracking, and secure cloud storage, which enhance the process of creating idoc W2 substitutes. These functionalities ensure a smoother workflow and improved document management.

-

Can I integrate airSlate SignNow with my existing payroll systems for idoc W2 substitutes?

Absolutely! AirSlate SignNow easily integrates with various payroll systems, enabling seamless generation and distribution of idoc W2 substitutes. This integration helps synchronize your payroll and tax reporting processes for better efficiency.

-

What are the benefits of using airSlate SignNow for idoc W2 substitutes?

Using airSlate SignNow for idoc W2 substitutes enhances efficiency, reduces errors, and accelerates the document signing process. Businesses can benefit from increased compliance and ease of access to digital records, which are essential for year-end reporting.

-

How secure is the signing process for idoc W2 substitutes with airSlate SignNow?

AirSlate SignNow prioritizes security and employs advanced encryption protocols to safeguard the signing process for idoc W2 substitutes. Your sensitive employee data is protected throughout the document lifecycle, ensuring compliance with industry regulations.

Get more for IL 4852, Substitute For Unobtainable Form W 2

Find out other IL 4852, Substitute For Unobtainable Form W 2

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe