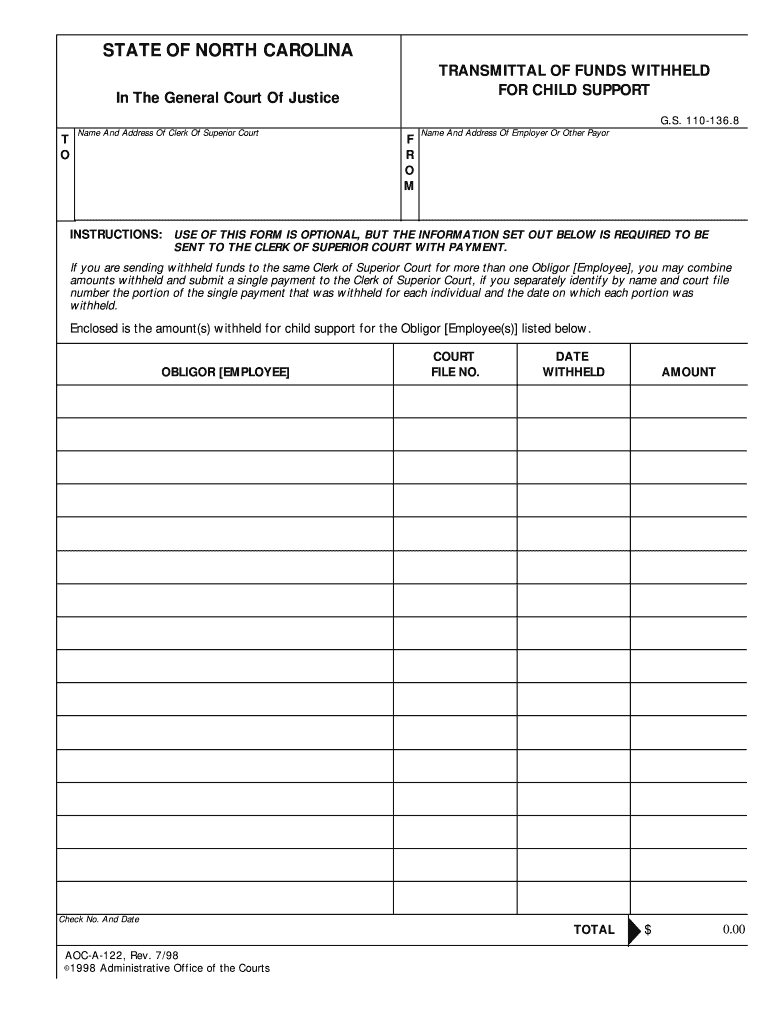

TRANSMITTAL of FUNDS WITHHELD Form

What is the transmittal of funds withheld?

The transmittal of funds withheld is a formal document used primarily in financial and legal contexts to indicate the transfer of funds that have been retained for specific reasons. This form is often utilized in situations involving contract disputes, tax withholdings, or other financial transactions where certain amounts are held back until specific conditions are met. Understanding this form is crucial for businesses and individuals who need to manage their financial obligations accurately.

Steps to complete the transmittal of funds withheld

Completing the transmittal of funds withheld requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including the names and addresses of all parties involved.

- Clearly state the amount of funds being withheld and the reason for withholding.

- Include any relevant contract or agreement numbers that pertain to the transaction.

- Ensure all signatories provide their signatures, which may need to be verified through a reliable eSignature platform.

- Review the completed form for accuracy before submission.

Legal use of the transmittal of funds withheld

The legal validity of the transmittal of funds withheld form hinges on compliance with applicable laws and regulations. In the United States, it is essential to adhere to the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA), which govern the use of electronic signatures and records. Proper execution of this form ensures that it is recognized in legal proceedings, making it vital for parties to retain copies for their records.

Key elements of the transmittal of funds withheld

Several key elements must be included in the transmittal of funds withheld to ensure its effectiveness:

- Identification of parties: Clearly identify all parties involved in the transaction.

- Amount withheld: Specify the exact amount of funds being withheld.

- Reason for withholding: Provide a detailed explanation of why the funds are being withheld.

- Signatures: Ensure all relevant parties sign the document to validate its contents.

- Date: Include the date of completion to establish a timeline for the transaction.

How to use the transmittal of funds withheld

Using the transmittal of funds withheld effectively involves several considerations. First, ensure the form is filled out accurately, reflecting all necessary details. Once completed, the form can be submitted electronically or via traditional mail, depending on the requirements of the involved parties. It is advisable to retain copies for personal records and to confirm receipt by the other party to ensure that the transaction is documented properly.

Form submission methods

The transmittal of funds withheld can be submitted through various methods, including:

- Online: Many organizations accept electronic submissions through secure platforms, making the process faster and more efficient.

- Mail: Traditional postal services can be used for physical submissions, ensuring that the form is sent to the appropriate address.

- In-person: Some situations may require the form to be delivered in person, especially if immediate confirmation or additional documentation is needed.

Quick guide on how to complete transmittal of funds withheld

Complete TRANSMITTAL OF FUNDS WITHHELD seamlessly on any gadget

Digital document management has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage TRANSMITTAL OF FUNDS WITHHELD on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The easiest way to modify and electronically sign TRANSMITTAL OF FUNDS WITHHELD effortlessly

- Locate TRANSMITTAL OF FUNDS WITHHELD and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to store your updates.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign TRANSMITTAL OF FUNDS WITHHELD and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for a TRANSMITTAL OF FUNDS WITHHELD using airSlate SignNow?

The process for a TRANSMITTAL OF FUNDS WITHHELD using airSlate SignNow involves creating a digital document that specifies the funds being withheld. You can easily eSign and send this document to relevant parties, ensuring compliance and tracking throughout the process. Our platform simplifies the management of financial agreements, making it more efficient for all users.

-

What features does airSlate SignNow offer for managing a TRANSMITTAL OF FUNDS WITHHELD?

airSlate SignNow offers a range of features for managing a TRANSMITTAL OF FUNDS WITHHELD, including automated workflows, document templates, and secure eSigning capabilities. These features enhance transparency and ensure that your transactions are handled efficiently. Additionally, our platform provides real-time tracking, so you stay informed every step of the way.

-

Is airSlate SignNow cost-effective for small businesses handling TRANSMITTAL OF FUNDS WITHHELD?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses dealing with TRANSMITTAL OF FUNDS WITHHELD. Our pricing plans are tailored to fit various budgets, allowing you to scale your document management needs without breaking the bank. Plus, the time saved with streamlined processes can translate to signNow cost savings.

-

Can I integrate airSlate SignNow with my existing software for TRANSMITTAL OF FUNDS WITHHELD?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to incorporate TRANSMITTAL OF FUNDS WITHHELD into your existing workflows. Whether you're using CRM systems, accounting software, or project management tools, our platform can streamline the process and enhance collaboration across teams.

-

What are the benefits of using airSlate SignNow for TRANSMITTAL OF FUNDS WITHHELD?

Using airSlate SignNow for TRANSMITTAL OF FUNDS WITHHELD provides several benefits, including enhanced security, improved efficiency, and reduced paper usage. The ability to eSign documents securely helps protect sensitive information while expediting transactions. Additionally, our user-friendly interface ensures that your team can adapt quickly and efficiently.

-

How does airSlate SignNow ensure the security of TRANSMITTAL OF FUNDS WITHHELD?

airSlate SignNow ensures the security of TRANSMITTAL OF FUNDS WITHHELD with state-of-the-art encryption protocols and compliance with industry standards. We prioritize the protection of sensitive information across all transactions. This means that your financial documents are handled with the utmost care, helping you maintain trust with your clients and partners.

-

What types of businesses can benefit from airSlate SignNow's TRANSMITTAL OF FUNDS WITHHELD solution?

Various types of businesses can benefit from airSlate SignNow's TRANSMITTAL OF FUNDS WITHHELD solution, including construction companies, real estate firms, and financial institutions. Any organization that needs to manage financial transactions or contracts can leverage our platform for efficient document handling. Our flexible features cater to diverse industries and specific business needs.

Get more for TRANSMITTAL OF FUNDS WITHHELD

- Dor enterprise zone forms

- Filing state income taxes in the military form

- Utah state income tax form fill out and sign

- Pit 1 form

- Economic development for a growing economy edge form

- Indianas collegechoice 529 education savings plan credit form

- Indiana income tax forms

- Schedule k 1 form 1120 s shareholders share of

Find out other TRANSMITTAL OF FUNDS WITHHELD

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself