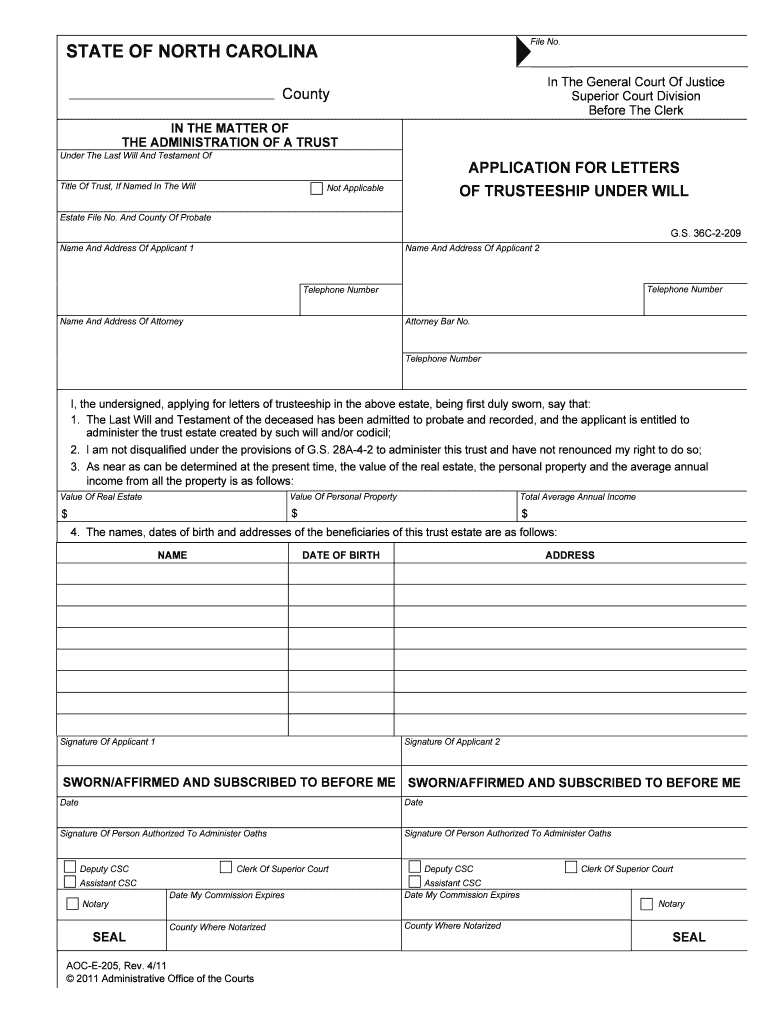

The ADMINISTRATION of a TRUST Form

What is the administration of a trust?

The administration of a trust involves managing the assets placed in the trust according to the terms set forth in the trust document. This process includes overseeing the distribution of assets to beneficiaries, ensuring compliance with relevant laws, and maintaining accurate records. The trustee, who is appointed to manage the trust, has a fiduciary duty to act in the best interests of the beneficiaries. This role requires transparency, accountability, and adherence to the specific instructions detailed in the trust agreement.

Key elements of the administration of a trust

Several critical components are essential for effective trust administration:

- Trust document: This legal document outlines the terms of the trust, including the roles of the trustee and beneficiaries.

- Asset management: The trustee is responsible for managing the trust's assets, which may include investments, real estate, and personal property.

- Distribution of assets: The trustee must distribute assets to beneficiaries as specified in the trust document, adhering to any timelines or conditions.

- Record-keeping: Accurate and detailed records must be maintained to document all transactions, distributions, and communications related to the trust.

- Tax obligations: The trustee must ensure that any tax liabilities associated with the trust are met, including filing tax returns as required.

Steps to complete the administration of a trust

Completing the administration of a trust involves several key steps:

- Review the trust document: Understand the terms, conditions, and specific instructions outlined in the trust.

- Identify and value assets: Compile a list of all assets held in the trust and determine their current market value.

- Notify beneficiaries: Inform all beneficiaries of the trust's existence and provide them with relevant details regarding their rights and entitlements.

- Manage assets: Oversee the investment and maintenance of trust assets to ensure they are preserved and grow in value.

- Distribute assets: Follow the instructions in the trust document to distribute assets to beneficiaries, ensuring compliance with any conditions.

- File tax returns: Complete any necessary tax filings for the trust, ensuring all obligations are met.

- Close the trust: Once all assets have been distributed and obligations fulfilled, formally close the trust.

Legal use of the administration of a trust

The legal administration of a trust must comply with state laws and regulations governing trusts. This includes adhering to fiduciary duties, maintaining transparency with beneficiaries, and ensuring that all actions taken by the trustee are in line with the trust document. Failure to comply with legal requirements can result in legal disputes, penalties, or even personal liability for the trustee. It is advisable for trustees to consult with legal professionals to navigate complex legal landscapes effectively.

State-specific rules for the administration of a trust

Each state in the United States has its own laws governing the administration of trusts. These laws can affect various aspects, including the duties of trustees, the rights of beneficiaries, and the tax implications associated with trusts. It is essential for trustees to familiarize themselves with the specific regulations in their state to ensure compliance. Consulting with a local attorney who specializes in trust law can provide valuable guidance tailored to the state's legal framework.

Required documents for the administration of a trust

To effectively administer a trust, several documents are typically required:

- Trust agreement: The foundational document outlining the terms and conditions of the trust.

- Asset inventory: A comprehensive list of all assets held in the trust.

- Tax identification number: Required for filing tax returns associated with the trust.

- Financial statements: Documentation of the trust's financial status, including income and expenses.

- Beneficiary information: Details regarding each beneficiary, including their contact information and entitlements.

Quick guide on how to complete the administration of a trust

Complete THE ADMINISTRATION OF A TRUST effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage THE ADMINISTRATION OF A TRUST on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign THE ADMINISTRATION OF A TRUST without hassle

- Obtain THE ADMINISTRATION OF A TRUST and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight signNow sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign THE ADMINISTRATION OF A TRUST and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is THE ADMINISTRATION OF A TRUST?

THE ADMINISTRATION OF A TRUST involves managing and distributing assets according to the trust's terms. This includes handling property, investments, and ensuring that beneficiaries receive their rightful shares. Proper administration is crucial to maintain compliance and protect beneficiaries' interests.

-

How can airSlate SignNow assist in THE ADMINISTRATION OF A TRUST?

airSlate SignNow streamlines THE ADMINISTRATION OF A TRUST by providing a secure platform for eSigning and managing trust documents. With easy access to templates and the ability to track document statuses, users can efficiently handle trust agreements and modifications. This ensures smooth communication among trustees and beneficiaries.

-

What are the pricing options for airSlate SignNow's services?

airSlate SignNow offers various pricing plans tailored for different needs, making THE ADMINISTRATION OF A TRUST accessible for all sizes of organizations. Each plan comes with features suited for efficient document management and eSigning. Prospective customers can choose a plan that aligns with their budget and requirements.

-

What features does airSlate SignNow offer for managing trust documents?

Features of airSlate SignNow beneficial for THE ADMINISTRATION OF A TRUST include customizable templates, secure cloud storage, and real-time notifications. These tools enhance the management of trust documents, make collaboration easier, and ensure that all parties are informed throughout the process. This streamlines the overall administration efficiently.

-

Can I integrate airSlate SignNow with other software for managing trusts?

Yes, airSlate SignNow seamlessly integrates with various tools and platforms, making THE ADMINISTRATION OF A TRUST simple and effective. Users can connect to popular CRM, cloud storage, and business management software to enhance workflow and document security. This ensures that all data remains consistent across platforms.

-

What are the benefits of using airSlate SignNow for trust administration?

Using airSlate SignNow for THE ADMINISTRATION OF A TRUST brings numerous benefits including enhanced security, easy access to documents, and improved efficiency. The eSigning feature saves time, allowing trustees to manage multiple documents effortlessly. This leads to better compliance and a smoother process overall.

-

How does airSlate SignNow ensure the security of trust documents?

Security is a top priority for airSlate SignNow, especially in THE ADMINISTRATION OF A TRUST. The platform utilizes encryption and advanced security protocols to protect sensitive documents. Additionally, user access controls ensure that only authorized individuals can view or edit trust-related files.

Get more for THE ADMINISTRATION OF A TRUST

Find out other THE ADMINISTRATION OF A TRUST

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors