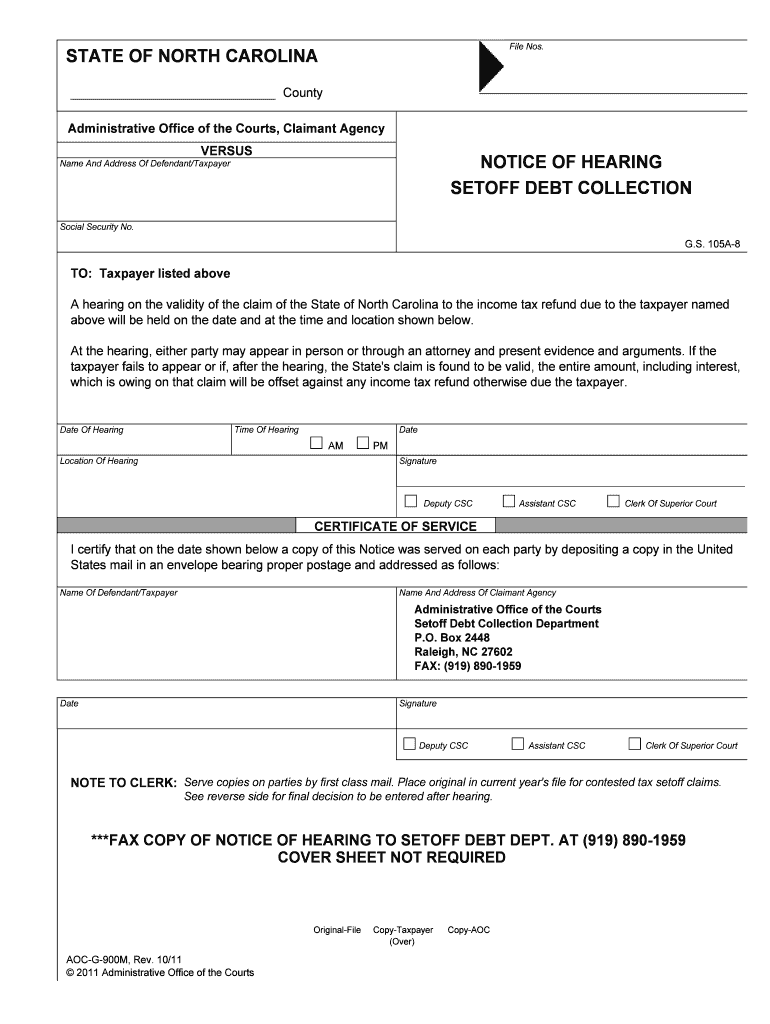

North Carolina Debt Setoff Program North Carolina Tax Form

What is the North Carolina Debt Setoff Program North Carolina Tax

The North Carolina Debt Setoff Program is a state initiative designed to assist in the collection of debts owed to various state agencies. This program allows the state to intercept tax refunds and other payments to offset outstanding debts. It primarily targets individuals who have unpaid obligations, such as child support, student loans, or other state debts. By utilizing this program, the state aims to recover funds efficiently while ensuring that taxpayers are aware of their outstanding liabilities.

How to use the North Carolina Debt Setoff Program North Carolina Tax

Using the North Carolina Debt Setoff Program involves several steps. First, individuals should verify if they have any outstanding debts that may qualify for setoff. This can typically be done through the relevant state agency. Once confirmed, taxpayers can complete the required forms, which may include providing personal information and details about the debt. After submitting the forms, the state will review the information and determine if the debt will be set off against any forthcoming tax refunds or payments.

Steps to complete the North Carolina Debt Setoff Program North Carolina Tax

Completing the North Carolina Debt Setoff Program requires careful attention to detail. Here are the essential steps:

- Identify any outstanding debts that qualify for the program.

- Gather necessary documentation, including identification and debt details.

- Fill out the required forms accurately, ensuring all information is correct.

- Submit the forms to the appropriate state agency, either online or by mail.

- Monitor the status of your submission and any potential setoff against future payments.

Eligibility Criteria

To be eligible for the North Carolina Debt Setoff Program, individuals must have outstanding debts owed to state agencies. These debts can include various obligations, such as unpaid taxes, child support, or loans. Additionally, the individual must be a taxpayer in North Carolina and have a valid tax identification number. It is essential to ensure that all information provided is accurate to avoid delays in processing.

Required Documents

When participating in the North Carolina Debt Setoff Program, specific documents are necessary to support the application. These typically include:

- Proof of identity, such as a driver's license or state ID.

- Documentation of the outstanding debt, including account numbers and amounts owed.

- Completed application forms as required by the state agency.

Form Submission Methods

Individuals can submit their application for the North Carolina Debt Setoff Program through various methods. The most common submission methods include:

- Online submission through the official state agency website.

- Mailing the completed forms to the designated address for processing.

- In-person submission at local state agency offices, if available.

Quick guide on how to complete north carolina debt setoff program north carolina tax

Effortlessly Prepare North Carolina Debt Setoff Program North Carolina Tax on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can easily access the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any holdups. Manage North Carolina Debt Setoff Program North Carolina Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Simple Steps to Modify and Electronically Sign North Carolina Debt Setoff Program North Carolina Tax

- Find North Carolina Debt Setoff Program North Carolina Tax and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that reason.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Opt for your preferred method of submitting your form, whether through email, SMS, or a shareable link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign North Carolina Debt Setoff Program North Carolina Tax to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the North Carolina Debt Setoff Program?

The North Carolina Debt Setoff Program is a state initiative that allows government agencies to collect unpaid debts by intercepting state tax refunds. This program is aimed at helping state and local governments recoup owed funds, making it an essential aspect of North Carolina tax debt management.

-

How can I apply for the North Carolina Debt Setoff Program?

To apply for the North Carolina Debt Setoff Program, you must complete the required forms and submit them to the appropriate agency. Ensure that all relevant information regarding your debts is accurately provided, as this will facilitate the process and improve your chances of recovery.

-

What types of debts can be collected through the North Carolina Debt Setoff Program?

The North Carolina Debt Setoff Program can be used to collect a variety of debts, including unpaid taxes, child support, and other government fees. This comprehensive approach ensures that signNow debts are addressed effectively under North Carolina tax regulations.

-

Is there a cost associated with participating in the North Carolina Debt Setoff Program?

Generally, there are no direct costs to individuals regarding the North Carolina Debt Setoff Program. However, government agencies may incur administrative costs when processing debt applications, ensuring efficient operation of the program without burdening taxpayers.

-

What are the benefits of utilizing the North Carolina Debt Setoff Program?

Utilizing the North Carolina Debt Setoff Program provides effective debt recovery for government agencies while allowing individuals the opportunity to settle their debts. By leveraging state tax refunds, this program minimizes financial loss for agencies and supports the state’s fiscal health.

-

Can I dispute a debt that is being collected through the North Carolina Debt Setoff Program?

Yes, if you believe that a debt being collected through the North Carolina Debt Setoff Program is incorrect, you can dispute it. It’s crucial to gather evidence documenting your claim and submit this information to the relevant authorities for review and resolution.

-

How does the North Carolina Debt Setoff Program affect my tax refund timing?

Participation in the North Carolina Debt Setoff Program can delay the distribution of your state tax refund if you owe a debt. The program prioritizes the collection of debts before tax refunds are issued, making it vital to understand your obligations under North Carolina tax guidelines.

Get more for North Carolina Debt Setoff Program North Carolina Tax

- Connecticut department of mental health and addiction servicesddap 2010 form

- Harbor request 2013 2019 form

- Tsi form texas stroke institute

- United airline claim form

- Eia annual electric power industry report form

- Texaslawhelporg expunction form

- Portsmouth redevelopment and housing authority form

- Form cr 001 stanislaus 2012

Find out other North Carolina Debt Setoff Program North Carolina Tax

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT