REVOCABLE LIVING TRUST and is Created in Accordance with Section 59 0901 Et Seq Form

What is the revocable living trust and is created in accordance with section 59 0901 et seq

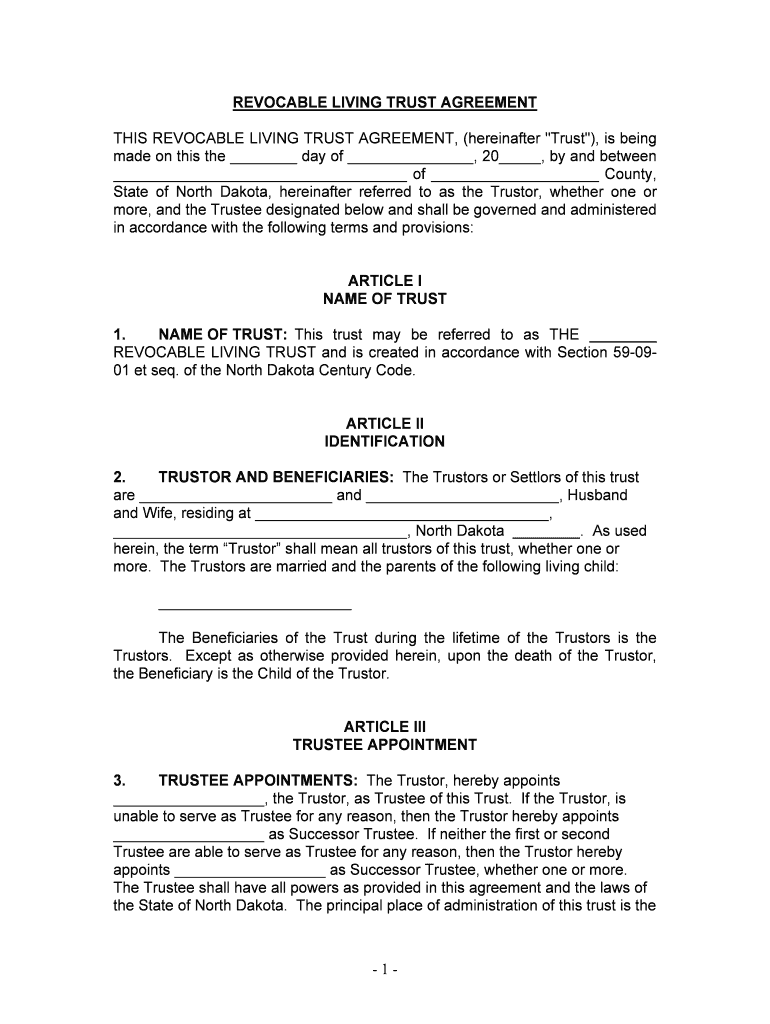

A revocable living trust is a legal document that allows individuals to manage their assets during their lifetime and dictate how those assets will be distributed after their death. This type of trust is established in accordance with section 59 0901 et seq, which outlines specific legal requirements and provisions for creating and maintaining such trusts. The primary feature of a revocable living trust is that the grantor retains the right to alter or revoke the trust at any time, providing flexibility in asset management.

Key elements of the revocable living trust and is created in accordance with section 59 0901 et seq

Several key elements define a revocable living trust under section 59 0901 et seq. These include:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or institution responsible for managing the trust's assets. The grantor often serves as the initial trustee.

- Beneficiaries: Individuals or entities designated to receive the trust assets upon the grantor's death.

- Asset Management: The trust allows for the management of assets, including real estate, investments, and personal property.

- Revocation Clause: A provision that permits the grantor to modify or revoke the trust at any time.

Steps to complete the revocable living trust and is created in accordance with section 59 0901 et seq

Completing a revocable living trust involves several important steps:

- Identify Assets: Determine which assets you want to include in the trust.

- Select a Trustee: Choose a reliable person or institution to manage the trust.

- Draft the Trust Document: Create a written document that outlines the terms of the trust, including the revocation clause.

- Transfer Assets: Legally transfer ownership of the selected assets into the trust.

- Review and Update: Regularly review the trust to ensure it meets your needs and make updates as necessary.

Legal use of the revocable living trust and is created in accordance with section 59 0901 et seq

The legal use of a revocable living trust is recognized under section 59 0901 et seq, which establishes the framework for its creation and enforcement. This trust serves as a valid estate planning tool, allowing for the seamless transfer of assets without the need for probate. It is essential to comply with the legal requirements outlined in this section to ensure the trust is valid and enforceable.

How to use the revocable living trust and is created in accordance with section 59 0901 et seq

Using a revocable living trust involves several practical considerations. Once established, the trust can be utilized to manage assets during the grantor's lifetime. The grantor can make changes as needed, including adding or removing assets and modifying beneficiaries. Upon the grantor's death, the trust assets are distributed according to the terms set forth in the trust document, bypassing the probate process, which can save time and legal costs.

State-specific rules for the revocable living trust and is created in accordance with section 59 0901 et seq

While section 59 0901 et seq provides a general framework for revocable living trusts, it is important to be aware of state-specific rules that may apply. Each state may have unique regulations regarding the creation, management, and taxation of trusts. Consulting with a legal professional familiar with your state's laws can help ensure compliance and optimize the benefits of your revocable living trust.

Quick guide on how to complete revocable living trust and is created in accordance with section 59 0901 et seq

Effortlessly Prepare REVOCABLE LIVING TRUST And Is Created In Accordance With Section 59 0901 Et Seq on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the proper format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly, without any delays. Manage REVOCABLE LIVING TRUST And Is Created In Accordance With Section 59 0901 Et Seq on any device using airSlate SignNow's Android or iOS applications and simplify your document-driven processes today.

The easiest method to alter and electronically sign REVOCABLE LIVING TRUST And Is Created In Accordance With Section 59 0901 Et Seq effortlessly

- Locate REVOCABLE LIVING TRUST And Is Created In Accordance With Section 59 0901 Et Seq and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with the features provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to retain your modifications.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting duplicates. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign REVOCABLE LIVING TRUST And Is Created In Accordance With Section 59 0901 Et Seq and maintain exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a REVOCABLE LIVING TRUST And Is Created In Accordance With Section 59 0901 Et Seq.?

A REVOCABLE LIVING TRUST And Is Created In Accordance With Section 59 0901 Et Seq. is a legal arrangement that allows individuals to manage their assets during their lifetime and specify their distribution after death. This type of trust can be modified or revoked at any time, providing flexibility for the trust creator. It follows specific guidelines established by law to ensure validity and enforceability.

-

How can airSlate SignNow facilitate the creation of a REVOCABLE LIVING TRUST?

airSlate SignNow provides user-friendly tools that streamline the process of drafting and executing a REVOCABLE LIVING TRUST And Is Created In Accordance With Section 59 0901 Et Seq. With customizable templates and e-signature capabilities, users can create and finalize trust documents efficiently, ensuring legal compliance and ease of use.

-

What are the benefits of establishing a REVOCABLE LIVING TRUST?

The primary benefits of a REVOCABLE LIVING TRUST And Is Created In Accordance With Section 59 0901 Et Seq. include avoiding probate, maintaining privacy, and providing flexibility in asset management. This trust type ensures that your assets are distributed according to your wishes without the complications of a public probate process. Additionally, it can help reduce estate taxes and facilitates smoother family transitions.

-

Is there a cost associated with setting up a REVOCABLE LIVING TRUST using airSlate SignNow?

The cost of setting up a REVOCABLE LIVING TRUST And Is Created In Accordance With Section 59 0901 Et Seq. with airSlate SignNow is competitive and tailored to meet the needs of different users. Pricing typically includes access to customizable templates, e-signature features, and ongoing support. This makes it a cost-effective solution compared to traditional legal methods.

-

Can I modify my REVOCABLE LIVING TRUST after it has been created?

Yes, one of the defining features of a REVOCABLE LIVING TRUST And Is Created In Accordance With Section 59 0901 Et Seq. is that it can be amended or revoked at any time during your lifetime. This flexibility allows you to adjust the trust to accommodate changes in your personal or financial situation. airSlate SignNow makes it easy to update your trust documents whenever necessary.

-

What integrations does airSlate SignNow offer for managing a REVOCABLE LIVING TRUST?

airSlate SignNow integrates with various tools and platforms, enhancing the management of your REVOCABLE LIVING TRUST And Is Created In Accordance With Section 59 0901 Et Seq. These integrations allow for streamlined workflows, from document creation to storage and sharing, ensuring that you have all the necessary tools at your disposal to manage your trust effectively.

-

How is a REVOCABLE LIVING TRUST different from a will?

A REVOCABLE LIVING TRUST And Is Created In Accordance With Section 59 0901 Et Seq. differs from a will primarily in how assets are distributed after death. While a will goes through probate, a living trust avoids this process, providing quicker access to assets for beneficiaries. Additionally, trusts can manage assets during the creator's lifetime, whereas wills only take effect upon death.

Get more for REVOCABLE LIVING TRUST And Is Created In Accordance With Section 59 0901 Et Seq

Find out other REVOCABLE LIVING TRUST And Is Created In Accordance With Section 59 0901 Et Seq

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself