North Dakota Fixed Rate Note, Installment Payments Secured by Personal Property Form

What is the North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property

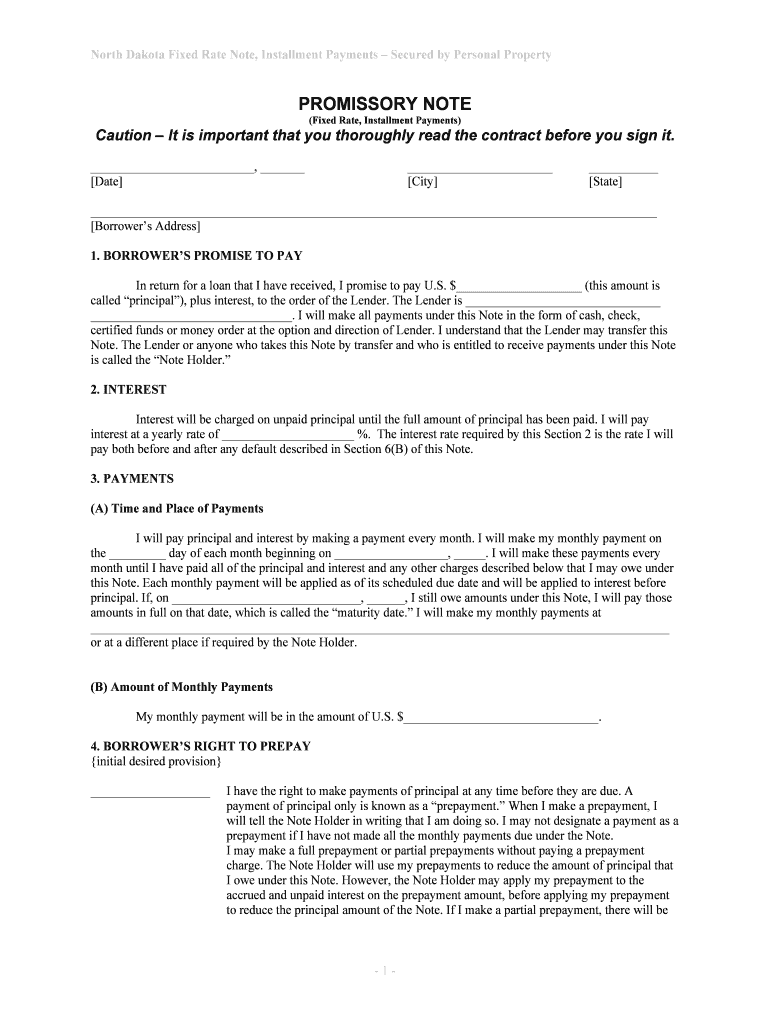

The North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property is a legal document used to outline the terms of a loan agreement where the borrower promises to repay the loan in fixed installments. This note is secured by personal property, which means that the lender has a claim on the specified personal assets if the borrower defaults on the loan. The document details the loan amount, interest rate, payment schedule, and the specific personal property that serves as collateral.

Key elements of the North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property

This note includes several essential components:

- Borrower and Lender Information: Names and addresses of both parties involved.

- Loan Amount: The total sum being borrowed.

- Interest Rate: The fixed rate applied to the loan amount.

- Payment Schedule: Dates and amounts of each installment payment.

- Collateral Description: Detailed information about the personal property securing the loan.

- Default Terms: Conditions under which the borrower would be considered in default.

How to complete the North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property

Completing the North Dakota Fixed Rate Note involves several steps to ensure all necessary information is accurately recorded:

- Begin by entering the names and addresses of both the borrower and lender at the top of the document.

- Clearly state the loan amount, ensuring it is written both numerically and in words to avoid ambiguity.

- Specify the fixed interest rate that will apply to the loan.

- Outline the payment schedule, including the frequency of payments and the total number of installments.

- Describe the personal property being used as collateral in detail, including any relevant identification numbers or descriptions.

- Include terms regarding default, specifying what actions will be taken if the borrower fails to meet payment obligations.

Legal use of the North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property

This note serves as a legally binding agreement when properly executed. For it to be enforceable, both parties must sign the document, and it should comply with North Dakota laws regarding secured transactions. The note provides legal recourse for the lender in the event of default, allowing them to claim the collateral specified in the agreement.

State-specific rules for the North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property

In North Dakota, specific regulations govern the use of fixed rate notes secured by personal property. It is essential to adhere to the Uniform Commercial Code (UCC) provisions, which outline the requirements for creating a security interest in personal property. Additionally, the note must be executed in compliance with state laws to ensure its validity and enforceability in a court of law.

Quick guide on how to complete north dakota fixed rate note installment payments secured by personal property

Effortlessly prepare North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property on any device

The management of documents online has gained signNow traction among businesses and individuals alike. It offers an optimal eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the essential tools to create, adjust, and electronically sign your documents quickly and without delays. Manage North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property with ease

- Find North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property and then click Get Form to get started.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, either by email, text message (SMS), invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced documents, tiresome form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property to ensure excellent communication at every stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property?

A North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property is a legal document that establishes a loan agreement with fixed interest rates, where payments are made in installments. This note is particularly beneficial for borrowers as it clearly outlines repayment terms and secures the loan against personal property, ensuring both parties understand their obligations.

-

How does the North Dakota Fixed Rate Note benefit borrowers?

The North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property offers borrowers predictability with fixed interest rates, which helps in managing monthly payments effectively. This type of note secures the loan with personal property, providing additional assurance to lenders and making it easier for borrowers to obtain financing.

-

What are the key features of the North Dakota Fixed Rate Note?

Key features of the North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property include a fixed interest rate, structured repayment schedule, and collateral security. These features create a clear framework for both borrowers and lenders, ensuring transparency and commitment in the loan agreement.

-

Is the North Dakota Fixed Rate Note customizable?

Yes, the North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property can be customized to fit the specific needs of the borrower and lender. This may include adjusting interest rates, payment terms, or collateral requirements to ensure that each party's needs are addressed in the agreement.

-

What types of personal property can secure a North Dakota Fixed Rate Note?

A variety of personal property can secure a North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property. Common options include vehicles, equipment, and other tangible assets that hold value and can serve as collateral for the loan.

-

What are the costs associated with obtaining a North Dakota Fixed Rate Note?

The costs for obtaining a North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property may vary based on factors such as the loan amount, interest rates, and any applicable fees. It is essential for potential borrowers to review these costs upfront to assess their financial impact.

-

How can businesses benefit from using airSlate SignNow for a North Dakota Fixed Rate Note?

Using airSlate SignNow to create and manage a North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property streamlines the document signing process. It allows businesses to send, eSign, and store important documents securely, ensuring efficiency and compliance in handling sensitive financial agreements.

Get more for North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property

- Attestato di qualifica professionale regione piemonte form

- Booking form photobooth events

- Westshore enforcement bureau swat operations ctapbrasil form

- Ruta quetzal bbva 2013 form

- Drop ball test form

- Modelo de formulario para autorizacao de viagem des ingles

- Cartrack subscriber application form

- Form mod 21 rfi

Find out other North Dakota Fixed Rate Note, Installment Payments Secured By Personal Property

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy