Nebraska Trust Deeds Act Form

What is the Nebraska Trust Deeds Act

The Nebraska Trust Deeds Act is a legal framework that governs the creation and enforcement of trust deeds in Nebraska. Trust deeds serve as a security instrument for real estate transactions, allowing lenders to secure loans with property as collateral. This act outlines the rights and obligations of both borrowers and lenders, ensuring that the process is transparent and legally binding. Understanding this act is crucial for anyone involved in real estate transactions in Nebraska, as it provides essential guidelines on how trust deeds should be executed and enforced.

How to use the Nebraska Trust Deeds Act

Utilizing the Nebraska Trust Deeds Act involves several steps that ensure compliance with state laws when creating a trust deed. First, both parties must agree on the terms of the loan and the property involved. Next, the trust deed must be drafted, including key details such as the loan amount, interest rate, repayment schedule, and the legal description of the property. After drafting, the document must be signed by the borrower and the lender, and it should be notarized to enhance its legal standing. Finally, the trust deed must be recorded with the appropriate county office to protect the lender's interest in the property.

Key elements of the Nebraska Trust Deeds Act

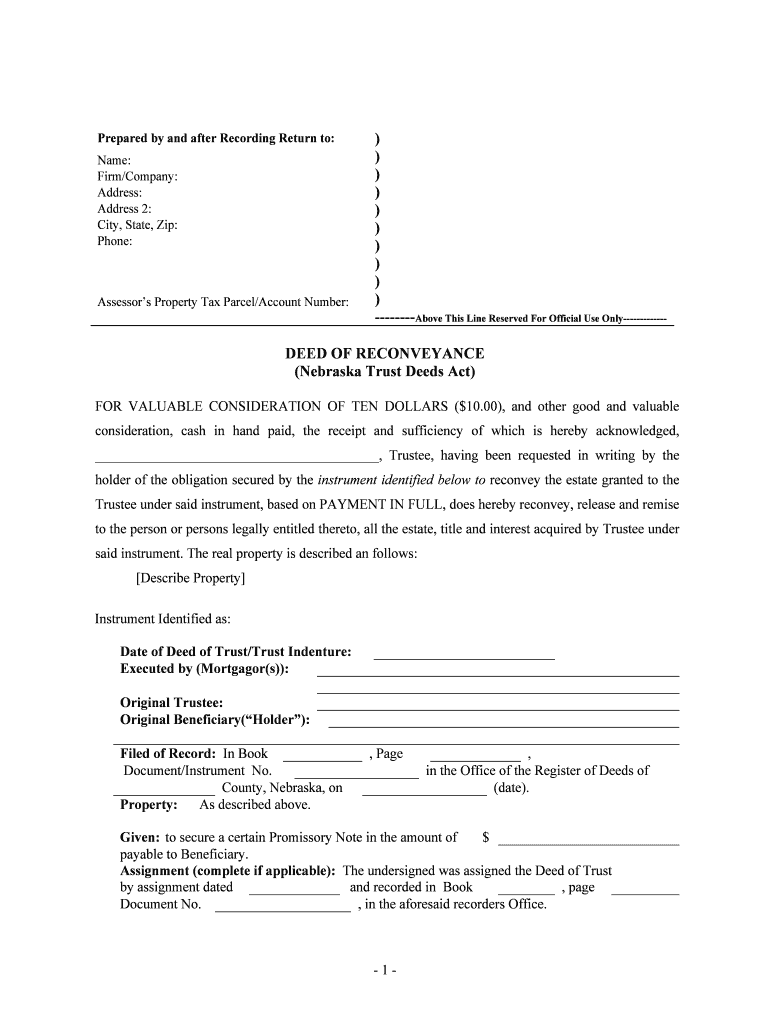

Several key elements define the Nebraska Trust Deeds Act. These include the requirements for a valid trust deed, such as the necessity for a written agreement, the identification of the parties involved, and the description of the property being secured. Additionally, the act outlines the rights of the trustee, who is responsible for managing the trust deed and ensuring compliance with its terms. It also specifies the procedures for foreclosure in case of default, providing a clear process for lenders to reclaim their investment while protecting the rights of borrowers.

Steps to complete the Nebraska Trust Deeds Act

Completing the Nebraska Trust Deeds Act involves a series of methodical steps. Initially, parties must gather all necessary information regarding the loan and property. Next, they should draft the trust deed, ensuring it includes all required elements as stipulated by the act. Once the document is prepared, both parties must sign it in the presence of a notary public. After notarization, the trust deed must be filed with the county recorder's office to make it a matter of public record. This process not only secures the lender's interest but also provides legal protection for the borrower.

Legal use of the Nebraska Trust Deeds Act

The legal use of the Nebraska Trust Deeds Act is essential for ensuring that all transactions involving trust deeds are valid and enforceable. This includes adhering to the act's provisions regarding the execution, recording, and enforcement of trust deeds. Parties must also comply with any additional state regulations that may apply. By following the legal guidelines established by the act, individuals and businesses can protect their interests and reduce the risk of disputes arising from real estate transactions.

Required Documents

When engaging with the Nebraska Trust Deeds Act, specific documents are required to ensure compliance and proper execution. These documents typically include the trust deed itself, which outlines the terms of the loan and property details. Additionally, a promissory note may be necessary to document the borrower's promise to repay the loan. A notarization form is also required to validate the signatures of the parties involved. Lastly, any documents related to the property, such as title deeds or property surveys, may be needed to complete the transaction.

Examples of using the Nebraska Trust Deeds Act

Examples of using the Nebraska Trust Deeds Act can be seen in various real estate transactions. For instance, a homeowner seeking to refinance their mortgage may utilize a trust deed to secure a new loan. Similarly, a real estate investor purchasing rental properties often relies on trust deeds to finance their acquisitions. In both cases, the Nebraska Trust Deeds Act provides the legal framework necessary for these transactions, ensuring that all parties understand their rights and obligations under the law.

Quick guide on how to complete nebraska trust deeds act

Prepare Nebraska Trust Deeds Act effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Nebraska Trust Deeds Act on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Nebraska Trust Deeds Act with ease

- Obtain Nebraska Trust Deeds Act and click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any chosen device. Edit and electronically sign Nebraska Trust Deeds Act and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Nebraska Trust Deeds Act?

The Nebraska Trust Deeds Act is a legal framework that governs the creation, modification, and enforcement of trust deeds within the state of Nebraska. It provides guidelines on how trust deeds are executed and the rights and responsibilities of involved parties. Understanding this act is crucial for anyone dealing with real estate transactions in Nebraska.

-

How can airSlate SignNow assist with compliance to the Nebraska Trust Deeds Act?

airSlate SignNow offers a comprehensive eSigning solution that ensures all documents, including trust deeds, comply with the Nebraska Trust Deeds Act. Its user-friendly platform allows for secure and legally binding electronic signatures that meet Nebraska's legal requirements. This can signNowly streamline your document management process while ensuring compliance.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit different business needs, including a plan that is ideal for those focusing on legal documents like trust deeds under the Nebraska Trust Deeds Act. Pricing is competitive and designed to ensure you have access to all necessary features without breaking the bank. Contact us for a detailed breakdown of our plans.

-

What features does airSlate SignNow offer for managing trust deeds?

airSlate SignNow provides several features beneficial for managing trust deeds, including customizable templates, automated workflows, and secure cloud storage. These features allow you to create, send, and sign trust deeds efficiently while adhering to the guidelines of the Nebraska Trust Deeds Act. Enhanced tracking and reporting also ensure you have full visibility throughout the signing process.

-

Can airSlate SignNow integrate with other software for managing legal documents?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow for managing legal documents, including those governed by the Nebraska Trust Deeds Act. Integrations with platforms like Google Drive, Salesforce, and more ensure that your documents are easily accessible and organized. This connectivity helps streamline the entire document signing process.

-

What benefits does airSlate SignNow provide for businesses handling trust deeds?

Using airSlate SignNow can offer several benefits for businesses managing trust deeds under the Nebraska Trust Deeds Act, including improved efficiency and reduced turnaround time. By facilitating electronic signatures, your team can finalize documents faster and with less hassle while ensuring compliance with legal standards. This efficiency can translate into signNow time and cost savings.

-

Is airSlate SignNow legally compliant with the Nebraska Trust Deeds Act?

Yes, airSlate SignNow is designed to be compliant with the Nebraska Trust Deeds Act, ensuring that all eSigned documents are legally enforceable. The platform adheres to national and state-level regulations regarding electronic signatures, giving you peace of mind that your trust deeds meet all necessary legal requirements. Always consult with a legal professional for additional guidance.

Get more for Nebraska Trust Deeds Act

Find out other Nebraska Trust Deeds Act

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation