For Use by Buyer Form

What is the For Use By Buyer

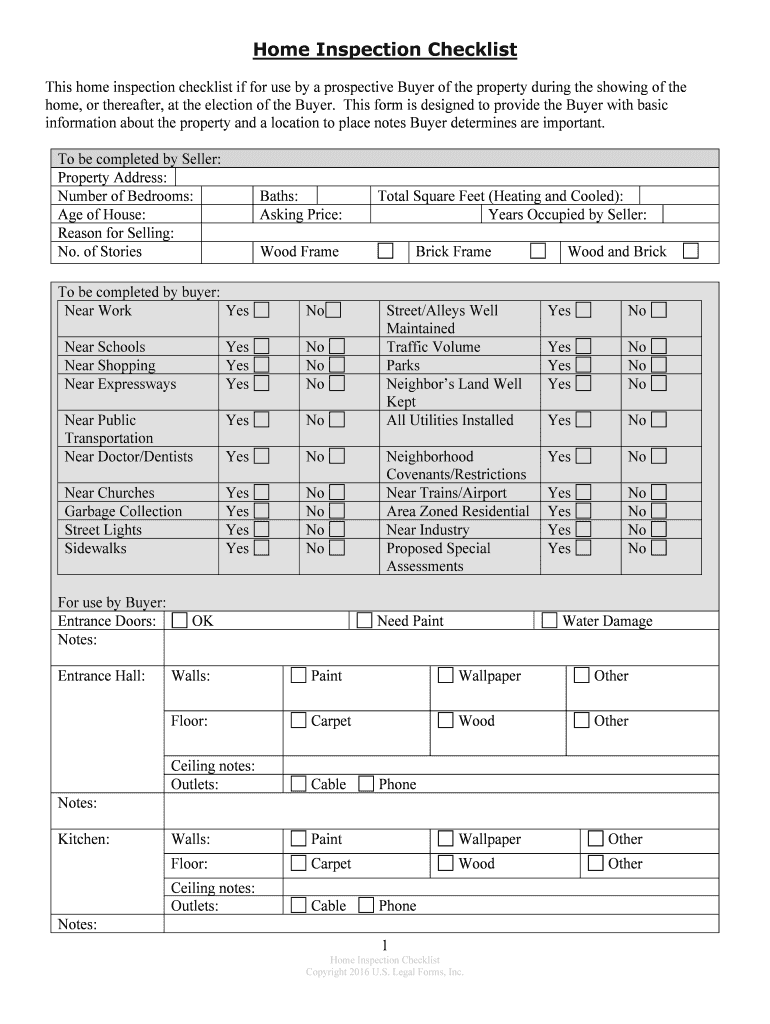

The For Use By Buyer form is a document commonly utilized in real estate transactions. It serves as a formal declaration by the buyer, indicating their intent to purchase a property. This form is essential for ensuring that all parties involved are aware of the buyer's commitment and the terms under which the purchase will occur. It provides a clear framework for the transaction, outlining the responsibilities and expectations of the buyer.

How to use the For Use By Buyer

Using the For Use By Buyer form involves several steps. First, the buyer should obtain the form from a reliable source, such as a real estate agent or legal advisor. Once in possession of the form, the buyer must fill it out with accurate information, including details about the property, purchase price, and any contingencies. After completing the form, the buyer should review it for accuracy before signing and submitting it to the relevant parties, such as the seller or real estate broker.

Steps to complete the For Use By Buyer

Completing the For Use By Buyer form requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the form from a trusted source.

- Fill in the buyer's name and contact information.

- Provide details about the property, including the address and legal description.

- Specify the purchase price and any earnest money deposit.

- Include any contingencies, such as financing or inspection requirements.

- Review the completed form for accuracy.

- Sign and date the form before submitting it to the appropriate parties.

Legal use of the For Use By Buyer

The For Use By Buyer form is legally binding when executed properly. To ensure its legal validity, it must comply with applicable state laws and regulations governing real estate transactions. This includes obtaining signatures from all necessary parties and adhering to any specific requirements set forth by local jurisdictions. Using a reputable electronic signature solution can further enhance the form's legality by providing secure and verifiable signatures.

Key elements of the For Use By Buyer

Several key elements must be included in the For Use By Buyer form to ensure its effectiveness. These elements typically include:

- The buyer's full name and contact information.

- A detailed description of the property being purchased.

- The agreed-upon purchase price and payment terms.

- Any contingencies that must be met before the sale is finalized.

- Signatures of all parties involved in the transaction.

Examples of using the For Use By Buyer

There are various scenarios in which the For Use By Buyer form is utilized. For instance, a first-time homebuyer may use the form to formally express their intent to purchase a residential property. Similarly, an investor looking to acquire rental properties would also employ this form to outline the terms of their purchase. Each use case emphasizes the importance of clarity and mutual understanding between the buyer and seller.

Quick guide on how to complete for use by buyer

Effortlessly prepare For Use By Buyer on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without any delays. Manage For Use By Buyer on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to edit and eSign For Use By Buyer with ease

- Find For Use By Buyer and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of submitting the form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow simplifies your document management needs in just a few clicks from any device you prefer. Edit and eSign For Use By Buyer to ensure excellent communication at every step of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for use by buyer?

airSlate SignNow provides a comprehensive range of features for use by buyer, including customizable templates, advanced eSignature capabilities, and real-time document tracking. These features streamline the signing process, making it efficient and user-friendly. Buyers can also benefit from integrations with popular applications to enhance their workflow.

-

How does airSlate SignNow ensure document security for use by buyer?

Document security is a top priority at airSlate SignNow for use by buyer. The platform employs industry-standard encryption, secure hosting, and compliance with global regulations such as GDPR and HIPAA. Buyers can trust that their documents are protected throughout the entire signing process.

-

What is the pricing structure for airSlate SignNow for use by buyer?

The pricing structure for airSlate SignNow for use by buyer is designed to be flexible and affordable. Various subscription plans are available, allowing buyers to choose the one that best fits their needs. Additionally, there are often promotional offers that make it even more cost-effective for users.

-

Can airSlate SignNow be integrated with other business tools for use by buyer?

Yes, airSlate SignNow offers seamless integrations with a wide range of business tools for use by buyer. This includes CRM systems, project management platforms, and cloud storage services. Such integrations allow for a more streamlined process, enhancing productivity and collaboration within teams.

-

What are the benefits of using airSlate SignNow for use by buyer?

Using airSlate SignNow provides numerous benefits for use by buyer, including time savings, increased efficiency, and reduced paper waste. The platform automates the eSigning process, enabling buyers to meet deadlines and keep operations flowing smoothly. Furthermore, the intuitive interface makes it easy for users of all skill levels.

-

Is there a mobile app for airSlate SignNow for use by buyer?

Yes, airSlate SignNow offers a mobile app for use by buyer, allowing users to send and sign documents on the go. This feature ensures that signing can be done from anywhere, making it exceptionally convenient for busy professionals. The mobile app retains all the functionalities found on the desktop version.

-

How does airSlate SignNow handle customer support for use by buyer?

airSlate SignNow provides robust customer support for use by buyer through multiple channels, including live chat, email, and phone. Buyers can expect timely assistance to resolve any issues they may encounter. Additionally, comprehensive resources such as tutorials and FAQs are readily available for user guidance.

Get more for For Use By Buyer

Find out other For Use By Buyer

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement