NJ DO 10 Form

What is the NJ DO 10

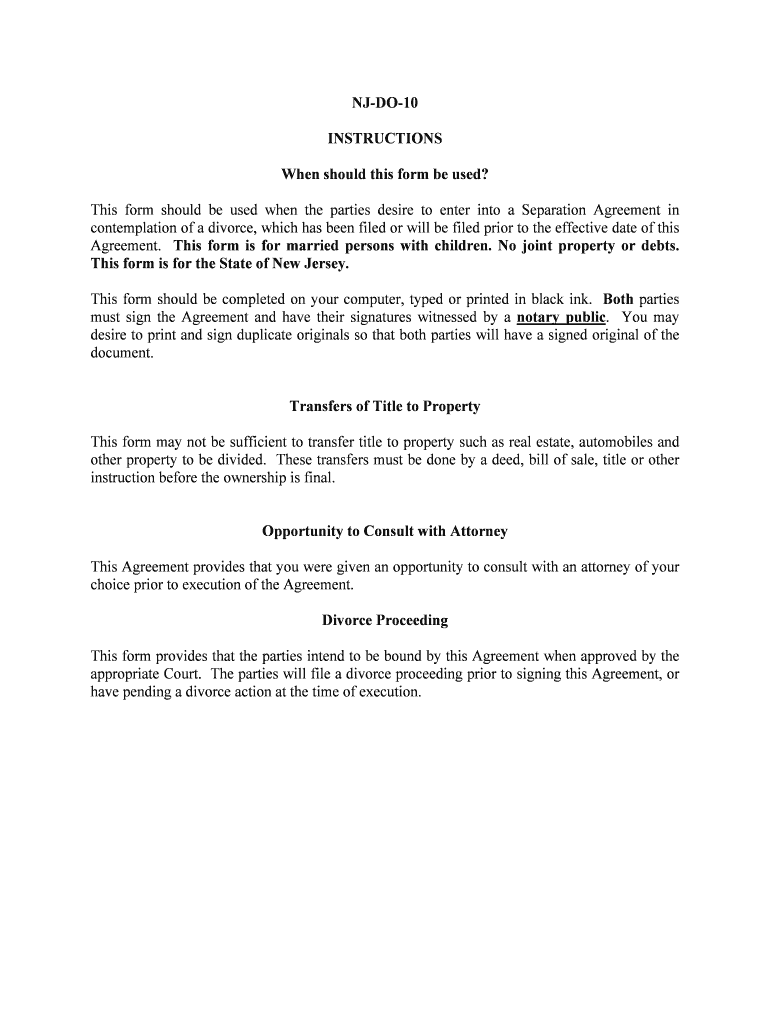

The NJ DO 10 form, also known as the New Jersey Division of Taxation's "Application for a Business Registration Certificate," is a crucial document for businesses operating in New Jersey. This form is essential for registering a business entity with the state and is required for various types of businesses, including corporations, partnerships, and sole proprietorships. Completing the NJ DO 10 ensures that your business complies with state regulations and can legally operate within New Jersey.

How to use the NJ DO 10

Using the NJ DO 10 form involves several key steps. First, gather all necessary information about your business, including its structure, ownership details, and contact information. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays. After completing the form, you can submit it either online or by mail, depending on your preference. It is important to retain a copy of the completed form for your records.

Steps to complete the NJ DO 10

To complete the NJ DO 10 form, follow these steps:

- Access the NJ DO 10 form from the New Jersey Division of Taxation website or a trusted source.

- Provide your business name, address, and type of business entity.

- Include information about the owners or partners, such as names and addresses.

- Fill in the contact information for the business.

- Review the form for accuracy and completeness.

- Submit the form online or print it for mailing to the appropriate address.

Legal use of the NJ DO 10

The NJ DO 10 form is legally binding once submitted and processed by the state. It serves as proof that your business is registered with New Jersey and complies with state laws. This registration is necessary for obtaining licenses, permits, and for tax purposes. Using electronic signatures for the NJ DO 10 is permissible, provided that the electronic signature meets the legal standards outlined by the ESIGN Act and UETA.

Key elements of the NJ DO 10

Several key elements must be included in the NJ DO 10 form to ensure its validity:

- Business Name: The official name under which the business will operate.

- Business Structure: Identification of whether the business is a corporation, partnership, or sole proprietorship.

- Owner Information: Details about the business owners or partners, including names and addresses.

- Contact Information: A valid phone number and email address for business communications.

- Signature: An authorized signature to validate the application.

Form Submission Methods

The NJ DO 10 form can be submitted through various methods, providing flexibility for business owners. You can complete the form online via the New Jersey Division of Taxation's website, which allows for immediate processing. Alternatively, you can print the form and mail it to the designated address. In-person submission is also an option at local tax offices, ensuring that you have support if needed during the process.

Quick guide on how to complete nj do 10

Complete NJ DO 10 effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without obstacles. Handle NJ DO 10 on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign NJ DO 10 with ease

- Locate NJ DO 10 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you prefer to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your preference. Modify and eSign NJ DO 10 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is NJ DO 10 and how does it relate to airSlate SignNow?

NJ DO 10 refers to specific document regulations in New Jersey that businesses must comply with. airSlate SignNow provides a seamless platform to ensure that your documents meet these requirements, making it easier to manage your compliance with NJ DO 10.

-

How does airSlate SignNow help with eSigning documents for NJ DO 10?

With airSlate SignNow, you can easily eSign documents that pertain to NJ DO 10 requirements. Our platform offers legally binding electronic signatures that ensure your documents are compliant and securely stored.

-

What are the pricing options for using airSlate SignNow with NJ DO 10 documents?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes needing to handle NJ DO 10 documents. You can choose from various tiers that suit your volume of transactions and features required, making it a cost-effective solution.

-

What features does airSlate SignNow provide for NJ DO 10 document management?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure compliance tracking specifically for NJ DO 10 documents. These tools empower businesses to streamline their document processes effectively.

-

Can airSlate SignNow integrate with other tools for managing NJ DO 10?

Yes, airSlate SignNow seamlessly integrates with various software platforms, which helps in managing documents related to NJ DO 10. Integrations with CRMs, cloud storage, and productivity tools enhance your document workflows.

-

Is airSlate SignNow secure for handling NJ DO 10 documents?

Absolutely! airSlate SignNow prioritizes security with encryption and compliance features that protect your NJ DO 10 documents. You can trust our platform to keep your sensitive information safe.

-

What benefits can businesses expect from using airSlate SignNow for NJ DO 10?

By using airSlate SignNow for NJ DO 10, businesses can expect reduced processing time, lower costs, and improved compliance. Our efficient solution allows for a faster turnaround on important documents while ensuring adherence to regulations.

Get more for NJ DO 10

- Consent form ultherapy

- Court receipt form

- Order of support will county illinois circuit court clerk form

- Dependent student petition asu students site students asu form

- Visa bangladesh form

- Uphs form 2

- National board of chiropractic examiners transcript request form

- Small works roster application central kitsap school district cksd wednet form

Find out other NJ DO 10

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself