, an Individual Residing at Form

Understanding the Form for an Individual Residing At

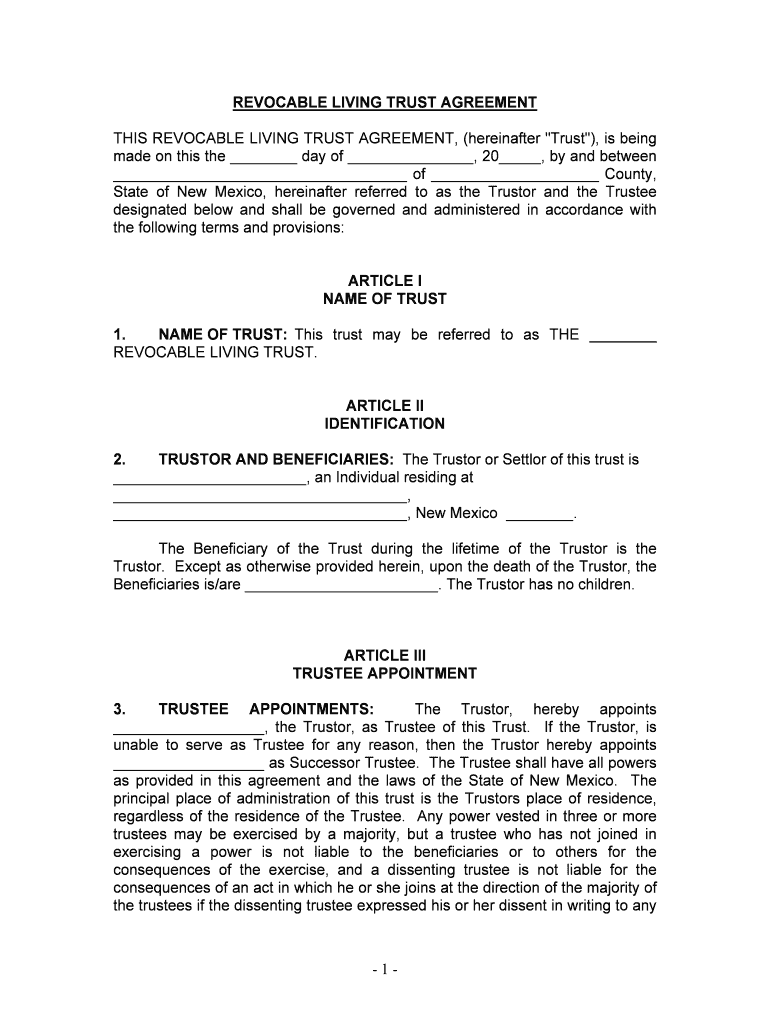

The form for an individual residing at is essential for various legal and administrative purposes. It typically serves to establish residency for tax, legal, or identification purposes. This form can be required in situations such as applying for a driver's license, registering to vote, or filing taxes. Understanding the specific requirements and implications of this form is crucial for ensuring compliance with local and federal regulations.

Steps to Complete the Form for an Individual Residing At

Completing the form for an individual residing at involves several clear steps:

- Gather necessary personal information, including your full name, address, and date of birth.

- Identify the purpose of the form to ensure you include all required details.

- Fill out the form accurately, ensuring that all information is correct and up to date.

- Review the form for any errors or omissions before submission.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Legal Use of the Form for an Individual Residing At

The legal use of the form for an individual residing at is significant, as it can impact various legal rights and responsibilities. For instance, this form may be used to establish residency for tax purposes, which can affect your tax obligations. Additionally, it may be required for legal documents, such as leases or contracts, where proof of residency is necessary. Ensuring that the form is filled out correctly is vital for maintaining legal standing.

Required Documents for the Form for an Individual Residing At

When completing the form for an individual residing at, several documents may be required to verify your identity and residency. Commonly requested documents include:

- A government-issued photo ID, such as a driver's license or passport.

- Utility bills or bank statements showing your name and address.

- Lease agreements or mortgage statements as proof of residency.

Having these documents ready can streamline the process and ensure that your form is accepted without delays.

Examples of Using the Form for an Individual Residing At

There are various scenarios where the form for an individual residing at is utilized. For example:

- When applying for a state-issued identification card, individuals must prove their residency.

- In the context of tax filings, individuals may need to declare their residency to determine their tax obligations.

- During the process of registering to vote, residency verification is often required.

These examples illustrate the importance of accurately completing the form to meet legal requirements.

State-Specific Rules for the Form for an Individual Residing At

Each state may have its own specific rules and requirements regarding the form for an individual residing at. It is essential to check the regulations applicable in your state to ensure compliance. Some states may require additional documentation or have different submission methods. Understanding these nuances can help avoid complications during the submission process.

Quick guide on how to complete an individual residing at

Complete , An Individual Residing At effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed materials, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle , An Individual Residing At on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to alter and eSign , An Individual Residing At without hassle

- Find , An Individual Residing At and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form navigation, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign , An Individual Residing At and ensure exceptional communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for businesses residing at remote locations?

airSlate SignNow provides a comprehensive suite of features designed for businesses residing at any location. With functionalities like document signing, secure storage, and team collaboration, users can efficiently manage documents from anywhere. These tools are essential for maintaining productivity, especially for teams that operate remotely.

-

How does airSlate SignNow ensure the security of documents for users residing at different locations?

For users residing at various locations, airSlate SignNow implements top-notch security measures. Our platform utilizes industry-standard encryption, ensuring that documents remain confidential and secure during transmission and storage. This focus on security allows businesses to operate confidently, regardless of where their team members are located.

-

What are the pricing plans available for businesses residing at different scales?

AirSlate SignNow offers tiered pricing plans to accommodate businesses residing at various scales, from startups to large enterprises. Each plan provides a versatile range of features tailored to meet specific needs and budgets. Users can choose the plan that best fits their requirements, ensuring they get maximum value for their investment.

-

Can airSlate SignNow integrate with other tools for teams residing at multiple sites?

Absolutely! AirSlate SignNow can seamlessly integrate with various third-party applications, making it perfect for teams residing at multiple sites. This integration capability allows for a smooth workflow and helps users connect their favorite apps effortlessly, enhancing overall productivity and efficiency.

-

What benefits can remote teams residing at different locations expect from using airSlate SignNow?

Remote teams residing at different locations can experience numerous benefits from using airSlate SignNow. These include faster turnaround times for document signing, enhanced collaboration, and reduced paper usage. By streamlining the document process, teams can stay connected and work effectively, regardless of their physical locations.

-

Is it easy to use airSlate SignNow for beginners residing at non-tech savvy environments?

Yes, airSlate SignNow is designed to be user-friendly for everyone, including beginners residing at non-tech savvy environments. The intuitive interface makes it simple to navigate the platform, allowing users to send and eSign documents easily. Comprehensive tutorials and support are also available to assist users in getting started quickly.

-

What types of documents can be signed using airSlate SignNow for individuals residing at home?

Individuals residing at home can sign a variety of documents using airSlate SignNow, including contracts, agreements, and permission slips. The platform supports different document formats, making it adaptable for personal or professional use. This versatility ensures that users can handle all their signing needs from the comfort of their homes.

Get more for , An Individual Residing At

- Nhics form 260 individual resident evacuation

- Snf nf formpdffillercom

- Long term care facility evacuation resident assessment form for

- Affidavit of registered agent glassboro online form

- Centrex insurance form

- Usli trust supplemental questionnaire form

- Rent receipt month fill form

- Specialty non profit package irwin siegel agency inc form

Find out other , An Individual Residing At

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself