Stock Transfer Form Usa

What is the Stock Transfer Form in the USA

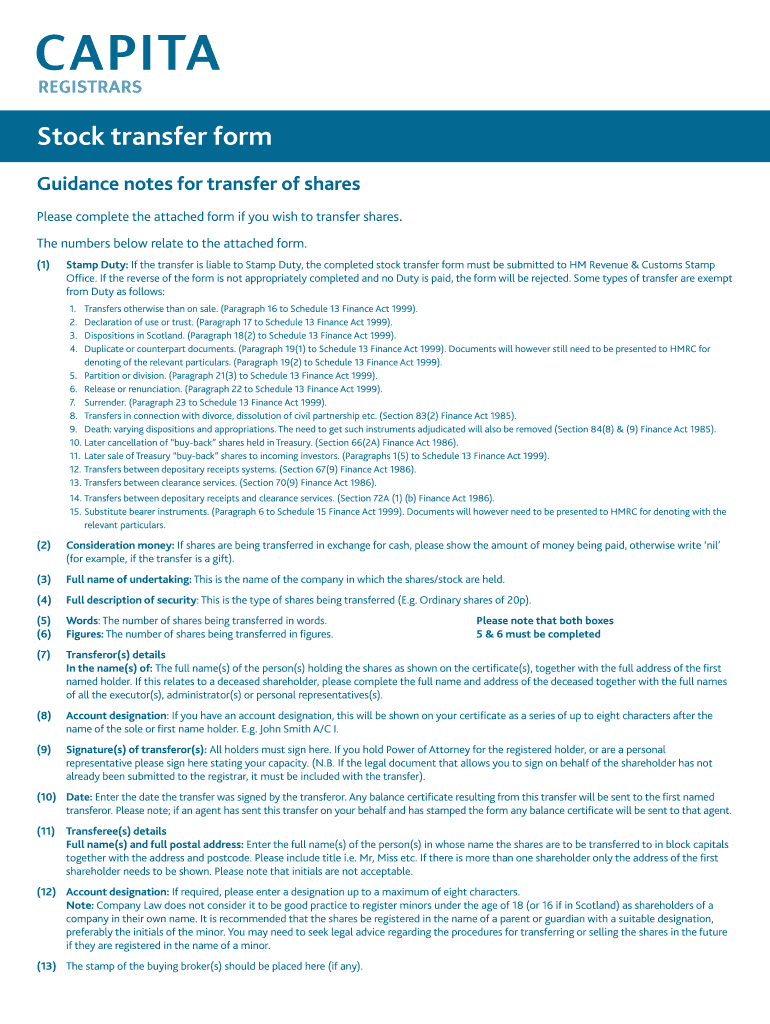

The Stock Transfer Form in the USA is a legal document used to transfer ownership of shares from one party to another. This form is essential for ensuring that the transaction is documented properly and that the new owner is recognized by the issuing company. It typically includes details such as the name of the current owner, the name of the new owner, the number of shares being transferred, and any relevant signatures. Proper completion of this form is crucial for maintaining accurate records and complying with legal requirements.

Steps to Complete the Stock Transfer Form in the USA

Completing the Stock Transfer Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the names and addresses of both the current and new shareholders. Next, specify the number of shares being transferred and the class of shares, if applicable. Both parties should then sign the form, and it may need to be notarized depending on the requirements of the issuing company. Finally, submit the completed form to the company’s transfer agent or the appropriate department to finalize the transfer.

Legal Use of the Stock Transfer Form in the USA

The Stock Transfer Form is legally binding when executed correctly. It serves as proof of the transfer of ownership and must comply with state laws and the rules of the issuing company. To ensure legal validity, the form should be filled out completely, signed by both parties, and submitted in a timely manner. Failing to adhere to these requirements may result in disputes over ownership or delays in the transfer process.

How to Obtain the Stock Transfer Form in the USA

Obtaining the Stock Transfer Form is a straightforward process. Most companies provide this form on their official websites, often in the investor relations section. Alternatively, shareholders can request the form directly from the company’s transfer agent or customer service department. It is important to ensure that the correct version of the form is used, as different companies may have specific requirements or formats.

Filing Deadlines and Important Dates

When transferring stock, it is essential to be aware of any filing deadlines or important dates associated with the transaction. Typically, the transfer should be completed before the record date set by the company to ensure that the new owner is eligible for dividends or voting rights. Additionally, certain tax implications may arise, so understanding the timing of the transfer in relation to tax time is important for both parties involved.

Examples of Using the Stock Transfer Form in the USA

There are various scenarios where the Stock Transfer Form may be utilized. For instance, when a shareholder sells their shares to another individual, this form documents the change in ownership. Additionally, it can be used in estate planning, where shares are transferred to heirs. Another common use is during corporate mergers or acquisitions, where stock ownership may change hands as part of the transaction. Each of these examples highlights the importance of properly executing the form to ensure legal compliance and accurate record-keeping.

Quick guide on how to complete stock transfer form con 40

Prepare Stock Transfer Form Usa effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed papers, as you can acquire the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents quickly without interruptions. Manage Stock Transfer Form Usa on any platform with airSlate SignNow Android or iOS applications and streamline any document-related operation today.

The simplest way to edit and eSign Stock Transfer Form Usa effortlessly

- Locate Stock Transfer Form Usa and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Stock Transfer Form Usa and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

Do you have to fill out a stock transfer ledger every time you sell a stock?

No man. Everything is digital now. You just press a button on your phone or your keyboard at home.1: Buy2: Sell3: Buy at ‘specific price’4: Sell at ‘specific price’It happens as soon as you can press the button.Open your account with TD Ameritrade soon so you can start ‘real’ trading and you can stop asking Quora about trading.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

Create this form in 5 minutes!

How to create an eSignature for the stock transfer form con 40

How to create an eSignature for your Stock Transfer Form Con 40 online

How to create an electronic signature for your Stock Transfer Form Con 40 in Google Chrome

How to make an eSignature for signing the Stock Transfer Form Con 40 in Gmail

How to make an electronic signature for the Stock Transfer Form Con 40 from your smartphone

How to create an electronic signature for the Stock Transfer Form Con 40 on iOS devices

How to generate an eSignature for the Stock Transfer Form Con 40 on Android OS

People also ask

-

How does airSlate SignNow simplify document management during tax time?

airSlate SignNow provides an intuitive platform for managing documents efficiently, especially during tax time. Users can quickly create, send, and eSign tax-related documents, ensuring a seamless workflow. This saves time and minimizes errors, making tax preparation easier for businesses.

-

What are the pricing options for airSlate SignNow during tax time?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes, especially important during tax time. You can choose from different tiers based on your needs, with options that provide additional features like advanced analytics or API access. This ensures that you get the best value for your document management requirements during tax season.

-

What features of airSlate SignNow are most beneficial for managing taxes?

Key features of airSlate SignNow that are beneficial during tax time include secure eSigning, template management, and real-time tracking of document status. These features help businesses streamline their tax document processes and reduce the stress associated with compliance and filing. Utilizing these tools can signNowly enhance your tax management efficiency.

-

Does airSlate SignNow integrate with other accounting software for tax purposes?

Yes, airSlate SignNow seamlessly integrates with various accounting and bookkeeping software, which is crucial during tax time. This integration allows users to synchronize their documents with financial records easily, minimizing the chances of discrepancies. By connecting tools, you can streamline your tax processes and ensure all your documents are accessible in one place.

-

Can I use airSlate SignNow to collect signatures for tax documents remotely?

Absolutely! airSlate SignNow enables you to collect eSignatures for tax documents from anywhere, which is especially beneficial during tax time. The platform allows for remote signing, ensuring that all parties can easily contribute to the tax documentation process without needing in-person meetings. This feature enhances flexibility and saves valuable time.

-

How secure is my tax information with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when handling sensitive tax information. The platform employs advanced encryption methods and complies with industry standards to ensure that your documents remain secure during tax time. You can trust that your data is protected while utilizing airSlate SignNow for document management.

-

What kind of support does airSlate SignNow provide during tax time?

airSlate SignNow offers robust customer support tailored to assist users during high-demand periods like tax time. Whether you need help with onboarding or specific features, the support team is readily available through various channels. Quick assistance ensures that you can resolve any issues and keep your tax processes running smoothly.

Get more for Stock Transfer Form Usa

- Unsatisfactory living conditions tenant to landlord form

- Attn pastor name form

- Bond form

- Instructions internal revenue service form

- In accordance with our telephone conversation this week i would like to explain the form

- This letter is notify you that my client a minor child suffered physical and form

- Sample crummy letter for ilit form

- Sample letter response to request for documents form

Find out other Stock Transfer Form Usa

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template