Affidavit Claiming Senior Citizen Exemption from Transfer Tax Form

What is the Affidavit Claiming Senior Citizen Exemption From Transfer Tax

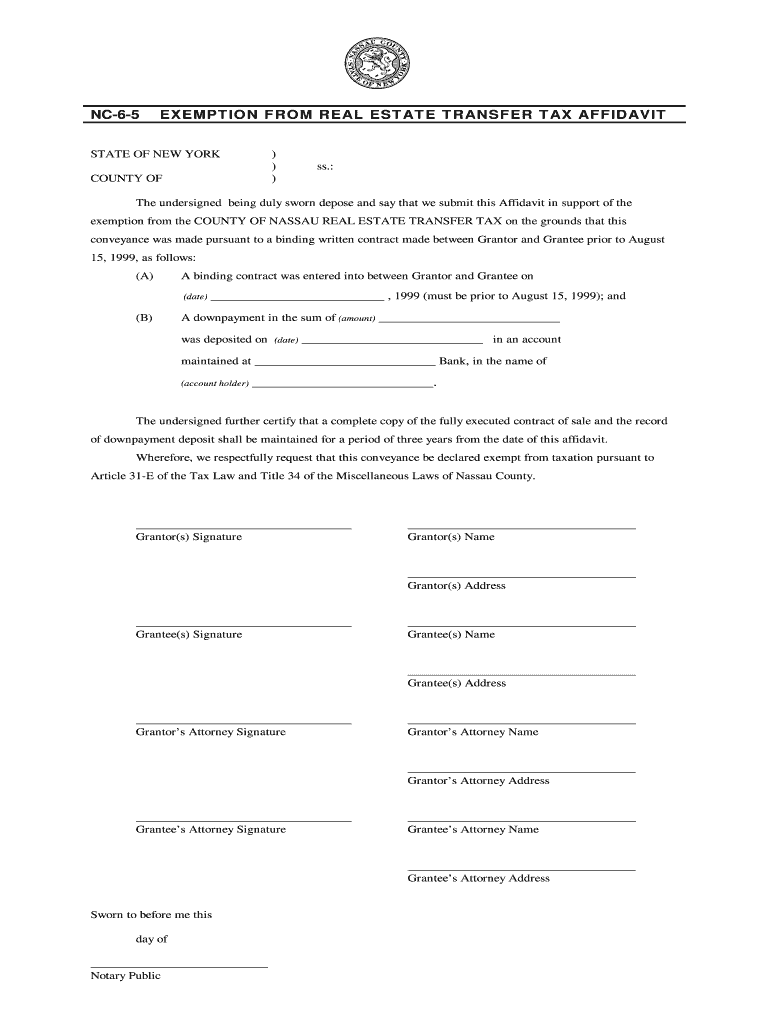

The Affidavit Claiming Senior Citizen Exemption From Transfer Tax is a legal document that allows eligible senior citizens to claim an exemption from certain transfer taxes when transferring property. This exemption is designed to alleviate the financial burden on seniors, particularly those on fixed incomes. The affidavit typically requires the senior citizen to provide information about their age, residency, and the property in question. It serves as a formal declaration to the relevant tax authorities, affirming the individual's eligibility for the exemption.

Steps to Complete the Affidavit Claiming Senior Citizen Exemption From Transfer Tax

Completing the Affidavit Claiming Senior Citizen Exemption From Transfer Tax involves several key steps:

- Gather necessary documentation, including proof of age and residency.

- Obtain the affidavit form from your local tax authority or online.

- Fill out the form with accurate information, ensuring all fields are completed.

- Sign the affidavit in the presence of a notary public to validate the document.

- Submit the completed affidavit to the appropriate tax authority, either online or by mail.

Legal Use of the Affidavit Claiming Senior Citizen Exemption From Transfer Tax

The legal use of the Affidavit Claiming Senior Citizen Exemption From Transfer Tax is crucial for ensuring that the exemption is recognized by tax authorities. The affidavit must be completed in accordance with state laws and regulations. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or denial of the exemption. The affidavit serves as a legal document that can be used in case of disputes regarding the transfer tax exemption.

Eligibility Criteria

To qualify for the Affidavit Claiming Senior Citizen Exemption From Transfer Tax, individuals typically must meet specific eligibility criteria, which may vary by state. Common requirements include:

- The applicant must be a senior citizen, usually defined as being sixty-five years of age or older.

- The property being transferred must be the applicant's primary residence.

- The applicant must provide proof of residency and age, such as a driver's license or state-issued ID.

State-Specific Rules for the Affidavit Claiming Senior Citizen Exemption From Transfer Tax

Each state in the U.S. may have its own specific rules and regulations regarding the Affidavit Claiming Senior Citizen Exemption From Transfer Tax. It is essential for applicants to familiarize themselves with their state’s requirements, as these can include variations in eligibility criteria, documentation needed, and submission processes. Some states may also have additional exemptions or benefits for seniors, making it important to consult local tax authorities or legal resources for accurate information.

Form Submission Methods

The Affidavit Claiming Senior Citizen Exemption From Transfer Tax can typically be submitted through various methods, depending on the local tax authority's regulations. Common submission methods include:

- Online submission through the tax authority's website, if available.

- Mailing the completed affidavit to the designated tax office.

- In-person submission at local tax offices or designated locations.

Quick guide on how to complete affidavit claiming senior citizen exemption from transfer tax

Effortlessly Prepare Affidavit Claiming Senior Citizen Exemption From Transfer Tax on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly and without hesitation. Manage Affidavit Claiming Senior Citizen Exemption From Transfer Tax on any device using the airSlate SignNow Android or iOS applications and simplify any document-oriented process today.

How to Modify and Electronically Sign Affidavit Claiming Senior Citizen Exemption From Transfer Tax with Ease

- Locate Affidavit Claiming Senior Citizen Exemption From Transfer Tax and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight essential sections of the documents or redact sensitive information using tools specifically available from airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere moments and holds the same legal validity as a traditional handwritten signature.

- Verify the information and then click the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form hunts, or errors that necessitate reprinting documents. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Affidavit Claiming Senior Citizen Exemption From Transfer Tax to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Affidavit Claiming Senior Citizen Exemption From Transfer Tax?

An Affidavit Claiming Senior Citizen Exemption From Transfer Tax is a legal document stating that a senior citizen qualifies for an exemption from transfer tax on property transactions. This affidavit can help seniors save substantial amounts during property transfers. Properly filing this affidavit is crucial to ensure compliance with local tax regulations.

-

How can airSlate SignNow help me with the Affidavit Claiming Senior Citizen Exemption From Transfer Tax?

airSlate SignNow simplifies the process of creating and signing the Affidavit Claiming Senior Citizen Exemption From Transfer Tax. Our platform allows you to easily draft the affidavit, add required signatures, and securely store documents. This streamlined approach saves time and reduces errors, making it ideal for seniors.

-

Is there a cost associated with using airSlate SignNow for the affidavit?

Yes, airSlate SignNow offers various pricing plans depending on your needs. Users can choose a basic plan for straightforward document signing or premium features for more advanced needs. Regardless of the plan, the benefits of using airSlate SignNow, especially for the Affidavit Claiming Senior Citizen Exemption From Transfer Tax, outweigh the costs.

-

What features does airSlate SignNow provide for eSigning documents?

airSlate SignNow offers features such as secure eSigning, customizable templates, and cloud storage. These tools assist users in efficiently handling documents, including the Affidavit Claiming Senior Citizen Exemption From Transfer Tax. Additionally, users can track document status and receive alerts when the affidavit is signed.

-

What are the benefits of using airSlate SignNow for senior citizens?

Using airSlate SignNow offers senior citizens a straightforward and efficient way to manage important documents like the Affidavit Claiming Senior Citizen Exemption From Transfer Tax. The platform is user-friendly and accessible, ensuring that seniors can easily navigate it. Moreover, eSigning helps eliminate the need for physical signatures, which can be challenging for some seniors.

-

Can I integrate airSlate SignNow with other applications for processing affidavits?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing the management process of the Affidavit Claiming Senior Citizen Exemption From Transfer Tax. Integrations with tools like Google Drive and Dropbox ensure that your documents are easily accessible and organized within your existing workflow.

-

Is the Affidavit Claiming Senior Citizen Exemption From Transfer Tax legally binding?

Yes, when properly executed using airSlate SignNow, the Affidavit Claiming Senior Citizen Exemption From Transfer Tax is legally binding. Electronic signatures are recognized legally in many jurisdictions, making this method a valid choice for seniors. Always ensure compliance with local laws to uphold the affidavit's validity.

Get more for Affidavit Claiming Senior Citizen Exemption From Transfer Tax

- Dealer application for certificate of mobile home ownership michigan form

- University letter appreciation form

- Annual inspection of swinging fire door assemblies healthandwelfare idaho form

- Interview guide linda toupinpdf amy stokes mary kay form

- Eft authorization form calpers long term care

- Adaorg caries risk assessment 0 6 american dental association form

- Driver nomination form icbc

- F11278 pncc outreach mgmt planfinal 0612doc dhs wisconsin form

Find out other Affidavit Claiming Senior Citizen Exemption From Transfer Tax

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement