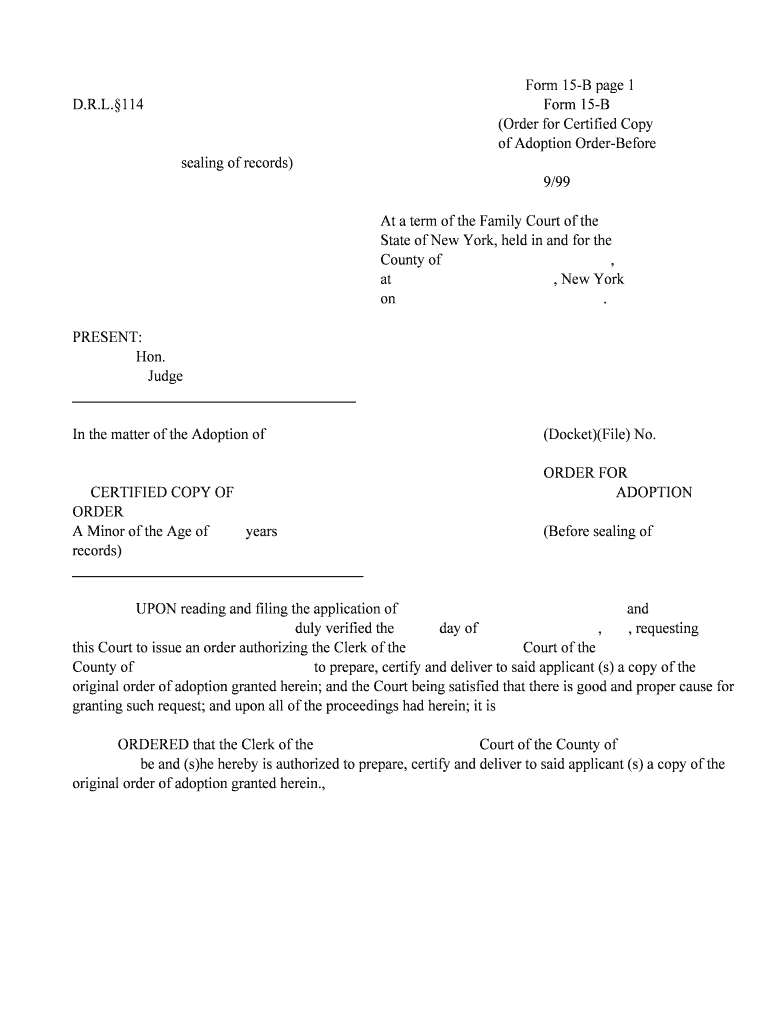

Form 15 B Page 1

What is the Form 15 B Page 1

The Form 15 B Page 1 is a document used primarily for tax purposes in the United States. It serves as a declaration for certain types of income that may be subject to withholding. This form is essential for individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). Understanding its purpose is crucial for ensuring compliance with tax regulations and avoiding potential penalties.

How to use the Form 15 B Page 1

Using the Form 15 B Page 1 involves several steps to ensure accurate completion. First, gather all necessary financial documents that pertain to the income being reported. Next, fill out the form with the required information, including personal details and income specifics. It is important to review the form for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on the requirements of the IRS.

Steps to complete the Form 15 B Page 1

Completing the Form 15 B Page 1 requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents.

- Enter your personal information, including name and address.

- Detail the types of income being reported.

- Double-check all entries for accuracy.

- Submit the form electronically or by mail as required.

Legal use of the Form 15 B Page 1

The legal use of the Form 15 B Page 1 is governed by IRS regulations. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated timeframes. Compliance with eSignature laws is also essential if the form is filled out electronically. Utilizing a reliable eSignature solution can enhance the legal standing of the document, ensuring it meets all necessary legal requirements.

Key elements of the Form 15 B Page 1

Several key elements must be included in the Form 15 B Page 1 for it to be valid. These elements include:

- Accurate personal identification information.

- Specific income details that are subject to withholding.

- Signature of the individual or authorized representative.

- Date of completion.

Ensuring these elements are present will help maintain the form's integrity and compliance with IRS regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 15 B Page 1 are crucial for compliance. Typically, the form must be submitted by the end of the tax year or as specified by the IRS for specific income types. It is important to stay informed about any changes in deadlines to avoid penalties. Marking these dates on a calendar can help ensure timely submission.

Quick guide on how to complete form 15 b page 1

Complete Form 15 B Page 1 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as a perfect environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Form 15 B Page 1 on any device with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to adjust and eSign Form 15 B Page 1 with ease

- Find Form 15 B Page 1 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 15 B Page 1 and maintain effective communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 15 B Page 1?

Form 15 B Page 1 is a declaration used in India to ensure that no TDS (Tax Deducted at Source) is applicable on certain payments. This form is essential for taxpayers seeking to claim exemption from TDS on interest earned or payments received. By accurately completing Form 15 B Page 1, businesses can streamline their tax obligations.

-

How can airSlate SignNow help with Form 15 B Page 1?

airSlate SignNow facilitates the electronic signing and sending of Form 15 B Page 1 and similar documents, making the process faster and more efficient. With our platform, users can easily manage their forms and ensure they are sent securely and promptly. This feature can signNowly enhance compliance and reduce paperwork.

-

What are the pricing plans for using airSlate SignNow for Form 15 B Page 1?

AirSlate SignNow offers various pricing plans designed to accommodate different business sizes and needs. Each plan includes access to eSigning capabilities, secure storage, and document management tools for handling Form 15 B Page 1. You can explore our website for detailed pricing and choose a plan that best fits your budget.

-

Is airSlate SignNow compliant with legal regulations for Form 15 B Page 1?

Yes, airSlate SignNow is fully compliant with legal regulations surrounding electronic signatures, ensuring that documents like Form 15 B Page 1 are legally binding. We prioritize security and compliance, so users can confidently eSign their forms knowing they meet all regulatory standards. This compliance is essential for businesses dealing with financial documents.

-

What features does airSlate SignNow offer for managing Form 15 B Page 1?

With airSlate SignNow, you can easily create, send, and track Form 15 B Page 1. Our platform offers features like customizable templates, reminders for signers, and real-time tracking of document statuses. These features ensure efficient management of your forms while maintaining an organized workflow.

-

Can I integrate airSlate SignNow with other software for Form 15 B Page 1 processing?

Yes, airSlate SignNow supports various integrations with other software, allowing seamless processing of Form 15 B Page 1. Whether you use CRM systems, accounting software, or cloud storage solutions, our integrations enable you to boost your productivity and streamline operations. This flexibility is crucial for businesses looking to optimize their workflow.

-

What benefits does airSlate SignNow provide for eSigning Form 15 B Page 1?

Using airSlate SignNow for eSigning Form 15 B Page 1 offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform reduces the need for physical signatures and paperwork, enabling faster processing of documents. Additionally, eSigning helps minimize errors associated with manual entries.

Get more for Form 15 B Page 1

- Assisted living isp form

- Service modification form

- Maryland notary public application office of sos state md form

- California bureau of unclaimed property form

- Cpat form the alabama fire college alabamafirecollege

- Autopsy report request broward county florida broward form

- Hershey medical center medical records release form

- Program application 2015 california institute of medical science form

Find out other Form 15 B Page 1

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself