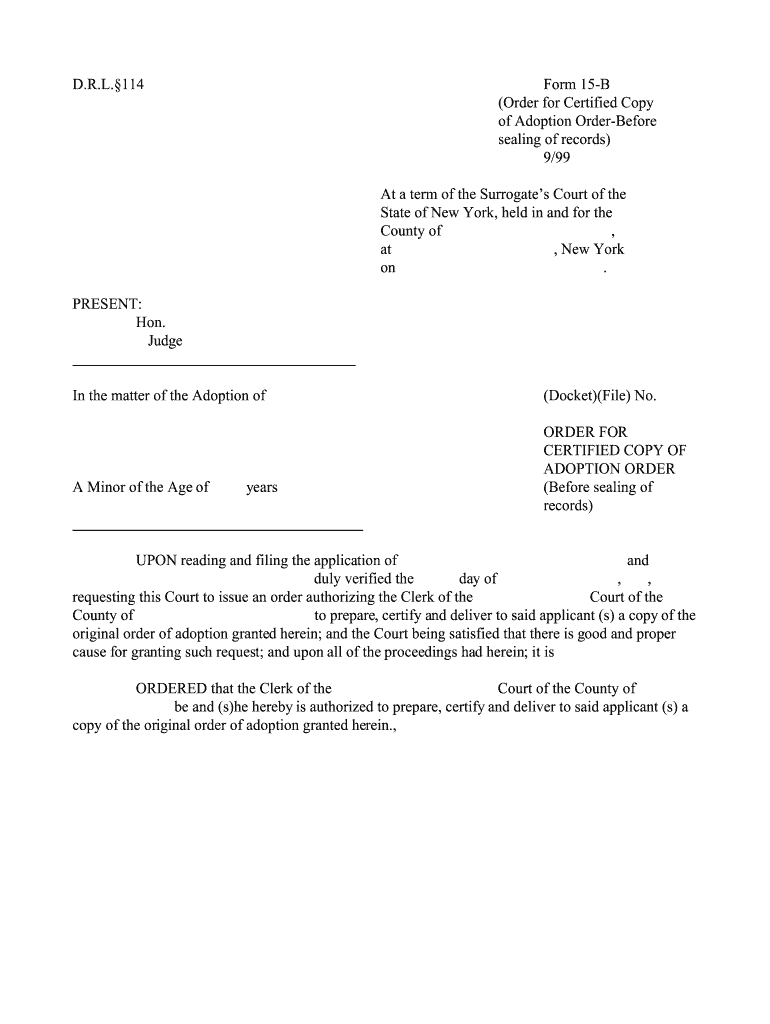

Form 15 B

What is the Form 15 B

The Form 15 B is a tax-related document used in the United States, primarily for reporting certain types of income. It is essential for individuals and businesses who need to provide information regarding the payments made to them that are subject to withholding. This form helps ensure compliance with federal tax regulations and assists in the accurate reporting of income to the Internal Revenue Service (IRS).

How to use the Form 15 B

Using the Form 15 B involves several steps to ensure that the information provided is accurate and complete. First, gather all necessary financial documents that pertain to the income being reported. Next, fill out the form with the required details, including your name, address, and taxpayer identification number. It is crucial to provide accurate income figures and any applicable deductions. Once completed, the form should be submitted to the relevant tax authority or included with your tax return, depending on your specific situation.

Steps to complete the Form 15 B

Completing the Form 15 B requires attention to detail. Follow these steps for a successful submission:

- Begin by downloading the latest version of the Form 15 B from the IRS website or other official sources.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Detail the types of income you are reporting, ensuring that all figures are accurate and supported by documentation.

- Review the form for any errors or omissions before finalizing it.

- Submit the completed form as instructed, either electronically or by mail, depending on the requirements.

Legal use of the Form 15 B

The legal use of the Form 15 B is crucial for compliance with IRS regulations. When filled out correctly, this form serves as an official record of income that helps prevent issues with tax audits. It is important to retain a copy of the submitted form and any supporting documents for your records. The form must be signed and dated to be considered valid, and it is advisable to use a reliable electronic signature solution to ensure its legal standing.

Key elements of the Form 15 B

Several key elements must be included in the Form 15 B to ensure it is complete and compliant:

- Personal Information: Your full name, address, and taxpayer identification number.

- Income Details: Accurate reporting of all income types, including wages, dividends, and interest.

- Signature: A valid signature is required to authenticate the form.

- Date: The date of submission must be included to establish a timeline for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 15 B can vary based on the type of income being reported and your individual tax situation. Typically, forms must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. It is essential to stay informed about any changes to deadlines that may occur due to new tax regulations or extensions granted by the IRS.

Quick guide on how to complete form 15 b

Complete Form 15 B effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Form 15 B on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Form 15 B effortlessly

- Locate Form 15 B and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that lead to reprinting copies. airSlate SignNow meets all your document management needs in just a few clicks from your selected device. Modify and eSign Form 15 B to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 15 B and why is it important?

Form 15 B is a declaration form required for individuals to submit to their banks when they wish to ensure that TDS deductions do not apply to their interest income. Understanding Form 15 B is crucial for effective tax planning and to avoid unnecessary tax liabilities.

-

How can airSlate SignNow help with the signing of Form 15 B?

airSlate SignNow provides a seamless platform for sending and electronically signing Form 15 B, ensuring the process is quick and hassle-free. With our user-friendly tools, you can manage your documents securely and track the signing process in real time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, including a free trial for new users. Our pricing is competitive and designed to provide a cost-effective solution for electronically signing Form 15 B and other documents.

-

Is airSlate SignNow suitable for businesses of all sizes?

Yes, airSlate SignNow is designed to support businesses of all sizes, from startups to large enterprises. Our platform's versatility makes it ideal for managing Form 15 B and other documents across various industries.

-

What integrations does airSlate SignNow offer?

airSlate SignNow seamlessly integrates with popular applications such as Google Drive, Dropbox, and various CRM systems. This allows businesses to easily access and manage Form 15 B along with other crucial documents directly from their preferred platforms.

-

Can I customize the Form 15 B template in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize the Form 15 B template according to their specific needs. You can add fields, instructions, and branding, ensuring that your form meets all necessary requirements while retaining a professional look.

-

How secure is my data when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Your data, including completed Form 15 B documents, is protected with advanced encryption and compliance with industry standards, ensuring your sensitive information remains safe and secure.

Get more for Form 15 B

Find out other Form 15 B

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading