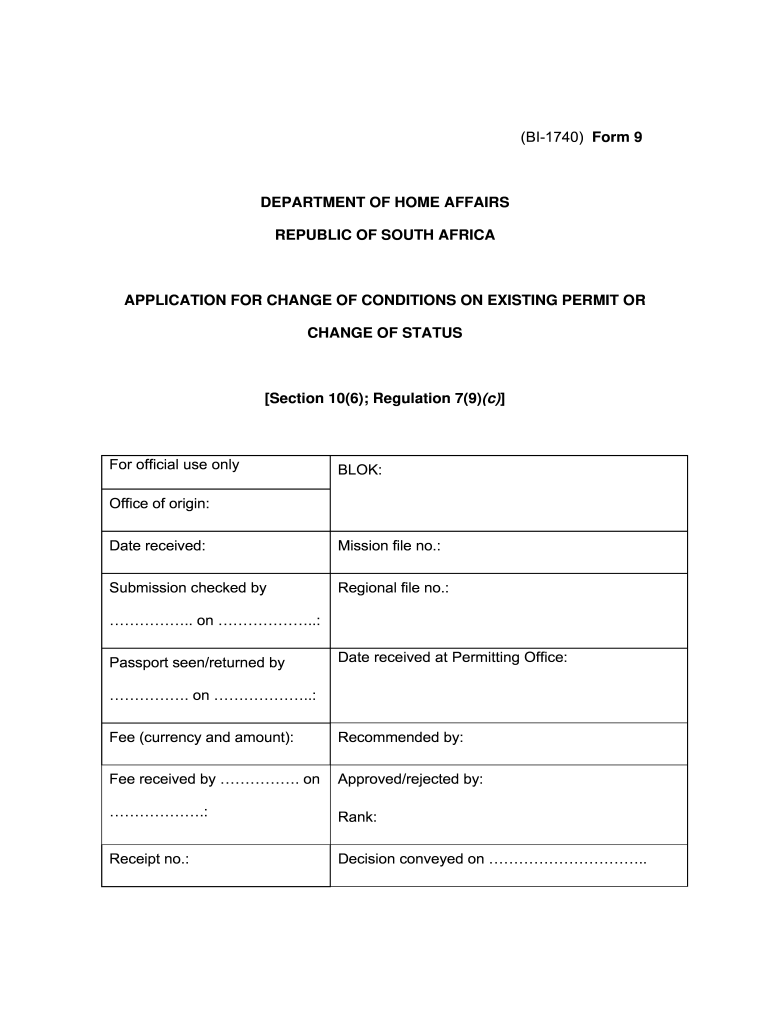

1740 Form

What is the 1740 Form

The 1740 Form is a crucial document used for various applications, particularly in legal and administrative contexts. It serves as a standardized method for individuals and businesses to submit specific information to government agencies. Understanding the purpose and requirements of the 1740 Form is essential for ensuring compliance and avoiding potential issues.

How to obtain the 1740 Form

Obtaining the 1740 Form is a straightforward process. Individuals can typically download it directly from the relevant government agency's website. It is important to ensure that you are accessing the most current version of the form. In some cases, physical copies may be available at local government offices or through official mail requests.

Steps to complete the 1740 Form

Completing the 1740 Form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather all necessary information and documents required for the form.

- Fill in each section of the form clearly and accurately, avoiding any errors.

- Double-check all entries for correctness, ensuring that all required fields are completed.

- Sign and date the form where indicated to validate your submission.

Legal use of the 1740 Form

The legal use of the 1740 Form is governed by specific regulations and guidelines. It is essential to ensure that the form is filled out correctly and submitted to the appropriate authorities. Misuse or incorrect completion of the form can lead to legal complications, including penalties or delays in processing.

Filing Deadlines / Important Dates

Filing deadlines for the 1740 Form vary depending on the specific context in which it is used. It is crucial to be aware of these dates to avoid late submissions. Check the relevant agency's website for the most accurate and updated information regarding deadlines.

Required Documents

When completing the 1740 Form, several supporting documents may be required. These can include identification, proof of residency, or other relevant paperwork. Ensure that you have all necessary documents ready to facilitate a smooth application process.

Quick guide on how to complete bi form 9

A concise guide on how to create your 1740 Form

Finding the correct template can pose difficulties when you need to submit formal global documentation. Even if you possess the necessary form, it can be tedious to swiftly prepare it in accordance with all the regulations if you utilize paper copies instead of managing everything electronically. airSlate SignNow is the digital eSignature platform that assists you in overcoming these obstacles. It allows you to obtain your 1740 Form and efficiently complete and sign it on-site without the need to reprint documents whenever you make a mistake.

Here are the actions you need to undertake to prepare your 1740 Form with airSlate SignNow:

- Click the Get Form button to upload your document into our editor immediately.

- Begin with the first empty field, enter the required information, and continue with the Next option.

- Complete the empty fields using the Cross and Check features from the toolbar above.

- Select the Highlight or Line options to emphasize the most important information.

- Click on Image and upload one if your 1740 Form necessitates it.

- Utilize the right-side pane to add additional fields for yourself or others to fill out if needed.

- Review your entries and validate the template by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it with a camera or QR code.

- Conclude modifying the form by clicking the Done button and selecting your file-sharing preferences.

Once your 1740 Form is ready, you can share it however you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documentation in your account, organized in folders according to your liking. Don’t spend time on manual form entry; give airSlate SignNow a try!

Create this form in 5 minutes or less

FAQs

-

If you are an American, how far back do you have to go in your family tree before you get to someone whose first language was not English?

Back in 1991, before Ancestry dot com was a thing, I got interested in genealogy… my family’s, in particular. So, I set out on a mission to find out all I could, and put together a family tree. Less than two years after the World Wide Web was created (aka: WWW). So, I wasn’t really on the internet yet. I had to do it old skool; although I did use a computer to draw the actual “tree”, as there were no genealogical tree templates that I knew of, yet. I sent out a form letter to every single person I knew, who was even remotely related to me. I even had to take a quick crash course in Russian Cyrillic, so that I could communicate with my relatives behind the Iron Curtain (which was half of them, in various countries). The curtain fell the following year, which made communication much easier, but at the time, I wasn’t even sure if any of my correspondence would get there and back. Amazingly, it all did. I sent out these form letters with pre-drawn, empty “trees”, for everyone to fill out. I also included a self-addressed stamped envelope, to make things as easy as possible for everyone.By the autumn of that year, I had received nearly all my templates back, all filled out as best as everyone could manage. Then began the task of making sense out of all of them, and compiling them into one massive tree. I ended up with nearly 600 people to list. For every person, I listed 6 bits of information: Name, place & year of birth, place & year of death, and their occupation. It took me about 6 months, but by Christmas, I had a surprisingly full family tree. I printed these all out on 17″ x 24″ sheets of parchment, rolled them up into scrolls, and handed them out to everybody as Christmas gifts. It was a big hit, as no one had ever seen the big picture yet. This is my Pociask Family Tree:This was in 1991, so I suggested everyone add to their branches by hand, as the years go by. By now, there are probably another 100 or more kids and grand-kids born. But that’s me, in the lower-right corner, above the block of text. I drew a chain of heavy links around the whole thing to signify that we were all linked together.The furthest back I got for my lineage was 1796, in Prussia. My great-great-great grandfather, with the last name of Busz, was born there. This part of Prussia had previously been part of the Polish Kingdom, and afterwards, once again became part of Poland after WWII. They eventually moved to the Kingdom of Bohemia, which became Czechoslovakia. My four grandparent's lineages basically hailed from 4 places: Prussia/Bohemia, Ukraine, and two from southern Poland, in the mountains. So… I am pretty much Prussian/Bohemian/Ukrainian/Polish. The late 1700’s was as far as I could get back for my family. My daughter, on the other hand, through her mom, I could trace back through Stephen Austin, one of the founders of Texas, and then all the way back to Mary Queen of Scots.As far as my family… they were refugees after WWII. They lost everything there, and both my father, and my mother came to America as Displaced Persons, although they came separately. My father alone, and my mother with her parents and 9 siblings. This is my grandfather’s “Reiseausweis” or Travel ID Card for the voyage from post-WWII Germany, to NYC in September of 1952:And here is the ship they came over on, the USS A.W. Greely, that was named after a US General, Polar explorer, and Medal of Honor winner:This ship was in service from 1944, all the way to 1986. It had a pretty good run, and was an important ship, as it brought my family to America! They all came here under the sponsorship of a farmer near Buffalo, NY who would house and feed them in return for a couple years of what was basically indentured servitude on his farm, picking lettuce, strawberries and all of that kind of stuff that many migrant workers from Mexico and Central America do today.So… how far back do I have to go in my family tree before I get to someone whose first language was not English?Well… that would be me!I didn’t really learn English until I went to kindergarten in Buffalo, NY. We were a bi-lingual family. Actually, tri-lingual, unbeknownst to me. You see, my grandmother only spoke Czech, while everyone else spoke Polish. Somehow, I spoke in Czech to my grandmother and Polish to everyone else, without even knowing it! Yeah, I didn’t realize that until I was in my teens. That was kind of a weird revelation.So… yeah, there’s that.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

Why does my property management ask me to fill out a W-9 form?

To collect data on you in case they want to sue you and enforce a judgment.If the management co is required to pay inerest on security deposits then they need to account to ou for that interest income.If you are in a coop or condo they may apportion tax benefits or capital costs to you for tax purposes.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

Create this form in 5 minutes!

How to create an eSignature for the bi form 9

How to create an electronic signature for the Bi Form 9 in the online mode

How to create an eSignature for your Bi Form 9 in Chrome

How to make an eSignature for putting it on the Bi Form 9 in Gmail

How to make an electronic signature for the Bi Form 9 straight from your mobile device

How to generate an electronic signature for the Bi Form 9 on iOS devices

How to generate an electronic signature for the Bi Form 9 on Android devices

People also ask

-

What is the 1740 Form and how can airSlate SignNow help with it?

The 1740 Form is a document used for specific tax reporting purposes. With airSlate SignNow, you can easily prepare, send, and eSign the 1740 Form, ensuring compliance and accuracy in your submissions. Our platform simplifies the process, making it quick and efficient for businesses to handle their documentation.

-

How does airSlate SignNow ensure the security of my 1740 Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols to protect your 1740 Form and any other sensitive documents. Additionally, our platform offers secure cloud storage, so you can manage your files with peace of mind.

-

What features does airSlate SignNow offer for managing the 1740 Form?

airSlate SignNow provides a range of features designed to streamline the management of the 1740 Form. Users can edit, fill out, and eSign documents seamlessly, along with features like templates, reminders, and audit trails to ensure every step is documented and accessible.

-

Is airSlate SignNow compatible with other software for handling the 1740 Form?

Yes, airSlate SignNow integrates with various software applications, making it easier to handle the 1740 Form alongside other business tools. You can connect it with platforms like Google Drive, Salesforce, and more, enhancing your workflow and document management.

-

What are the pricing options for using airSlate SignNow for the 1740 Form?

airSlate SignNow offers flexible pricing plans based on your business needs. Our cost-effective solutions ensure that you can efficiently manage the 1740 Form without breaking the bank. Visit our pricing page to find a plan that best fits your requirements.

-

Can I track the status of my 1740 Form using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your 1740 Form in real-time. You will receive notifications when the document is viewed, signed, or completed, ensuring you stay informed throughout the signing process.

-

How can airSlate SignNow help ensure compliance when filling out the 1740 Form?

airSlate SignNow helps ensure compliance for the 1740 Form by providing templates that adhere to current regulations. Our platform also allows for easy edits and revisions, so you can stay up-to-date with any changes in tax laws or requirements.

Get more for 1740 Form

- As we discussed on the telephone this morning i have represented form

- Enclosed herewith please find the objection to claims form

- Send a notice to owner certified mail or certified mail return receipt form

- Enclosed herewith please find the closing statement where i purchased the above form

- Enclosed herewith please find a clerks motion to dismiss for want of prosecution form

- Name secretary form

- Re zoning ordinance violation form

- Cause no form

Find out other 1740 Form

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement