A TTACHMENT a Form

What is the A TTACHMENT A

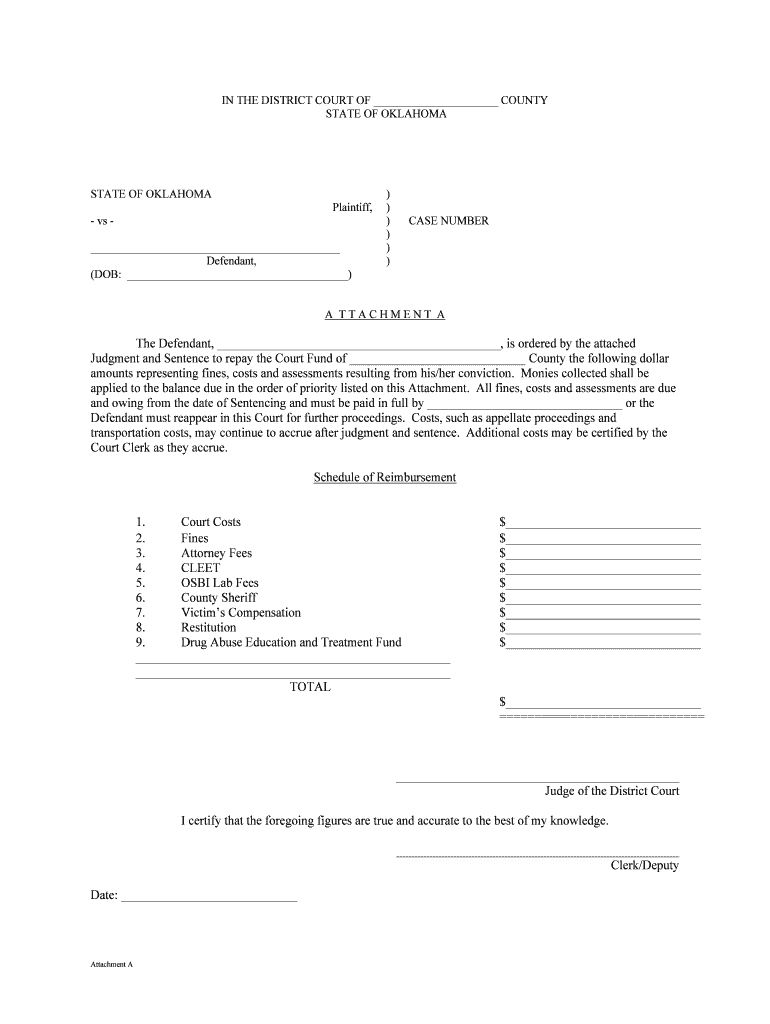

The A TTACHMENT A is a specific form used primarily in the context of tax filings in the United States. It is often associated with the reporting of various types of income, deductions, or credits that are not included on the main tax return. This form allows taxpayers to provide additional information required by the IRS, ensuring compliance with federal tax regulations. Understanding the purpose of this form is essential for accurate tax reporting and to avoid potential penalties.

How to use the A TTACHMENT A

Using the A TTACHMENT A involves gathering relevant financial information and filling out the form accurately. Taxpayers should start by identifying the specific income or deductions they need to report. Once the necessary data is collected, the form should be completed with precise figures and any required explanations. It is crucial to review the completed form for accuracy before submission to ensure that all information aligns with the main tax return.

Steps to complete the A TTACHMENT A

Completing the A TTACHMENT A involves several key steps:

- Gather all necessary financial documents, including income statements and receipts for deductions.

- Fill in personal information at the top of the form, ensuring it matches your main tax return.

- Report additional income or deductions in the designated sections, providing clear and accurate figures.

- Include any required explanations for specific entries, as needed.

- Review the form for completeness and accuracy before filing.

Legal use of the A TTACHMENT A

The A TTACHMENT A is legally recognized as part of the tax filing process in the United States. To ensure its legal validity, it must be filled out correctly and submitted alongside the main tax return. Compliance with IRS guidelines is essential, as improper use of the form can lead to audits or penalties. Taxpayers should keep copies of all submitted forms for their records and potential future reference.

Filing Deadlines / Important Dates

Filing deadlines for the A TTACHMENT A typically align with the main tax return deadlines. For most individuals, the deadline to file is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to be aware of any changes in deadlines and to file the A TTACHMENT A in a timely manner to avoid late fees or penalties.

Required Documents

To complete the A TTACHMENT A, several documents may be required, including:

- W-2 forms for reporting wages and salaries.

- 1099 forms for reporting other types of income.

- Receipts or statements for deductions being claimed.

- Any relevant documentation that supports the information reported on the form.

IRS Guidelines

The IRS provides specific guidelines for completing the A TTACHMENT A, which are essential for ensuring compliance. Taxpayers should refer to the IRS instructions for the form, which detail how to report various types of income and deductions. Following these guidelines closely helps minimize the risk of errors and potential audits.

Quick guide on how to complete a ttachment a

Effortlessly Prepare A TTACHMENT A on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents promptly and without hindrances. Manage A TTACHMENT A on any device via airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Edit and eSign A TTACHMENT A with Ease

- Find A TTACHMENT A and click Get Form to begin.

- Utilize the tools we offer to upload your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your changes.

- Choose your preferred method for delivering your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Modify and eSign A TTACHMENT A and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is A TTACHMENT A in airSlate SignNow?

A TTACHMENT A is a crucial component of airSlate SignNow that allows users to manage and organize their signed documents seamlessly. By using A TTACHMENT A, businesses can quickly access important files and ensure compliance with documentation standards. This feature enhances the overall efficiency of your document workflow.

-

How does airSlate SignNow pricing structure work for A TTACHMENT A?

airSlate SignNow offers a flexible pricing model that accommodates both individual users and teams looking to utilize A TTACHMENT A. With various plans available, businesses can choose a package that fits their needs and budget while taking full advantage of A TTACHMENT A's functionality. This ensures affordable access to powerful document signing capabilities.

-

What features does A TTACHMENT A offer for document management?

A TTACHMENT A provides a range of features including easy document sharing, secure storage, and seamless eSignature capabilities. These features enable users to efficiently track document progress and manage revisions. Additionally, A TTACHMENT A integrates with popular software, enhancing the versatility of your document management process.

-

Can I personalize documents using A TTACHMENT A?

Yes, A TTACHMENT A allows users to personalize documents with custom fields and branding elements. This ensures that your documents align with your business identity while providing a professional look. Personalization enhances user experience and fosters trust with clients during the signing process.

-

What are the benefits of using A TTACHMENT A for businesses?

The primary benefits of using A TTACHMENT A include increased efficiency, reduced turnaround times, and enhanced security for your documents. By streamlining the signing process, businesses can save time and resources. Furthermore, A TTACHMENT A ensures that all documents are securely stored and easily retrievable, which is critical for compliance.

-

Is A TTACHMENT A compatible with other applications?

Absolutely! A TTACHMENT A integrates seamlessly with various third-party applications and platforms, enhancing your existing workflows. These integrations allow businesses to expand their digital capabilities and improve collaborative efforts. You can connect A TTACHMENT A with popular tools to streamline your document management processes.

-

How secure is A TTACHMENT A for handling sensitive documents?

A TTACHMENT A employs robust security measures, including encryption and secure cloud storage, to protect sensitive documents. User permissions and authentication protocols further enhance document security, ensuring only authorized users can access signed files. This level of security is essential for businesses that deal with confidential information.

Get more for A TTACHMENT A

- Notice to set hearing courts state co form

- Out of state petitioner alcoholdrug evaluation uniform report 2016 2019

- Form 17 north carolina industrial commission ncgov

- General form 40

- Motion and order for continuance forms and instructions packet courts oregon

- Certificate for dogs cats fox raccoon or skunk to be imported to japan 2013 2019 form

- Application for certificate pd u1 for coordination of earned right to form

- Iraq visa pdf form 2015 2019

Find out other A TTACHMENT A

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word