Until a Change is Requested All Tax Statements Form

What is the Until A Change Is Requested All Tax Statements

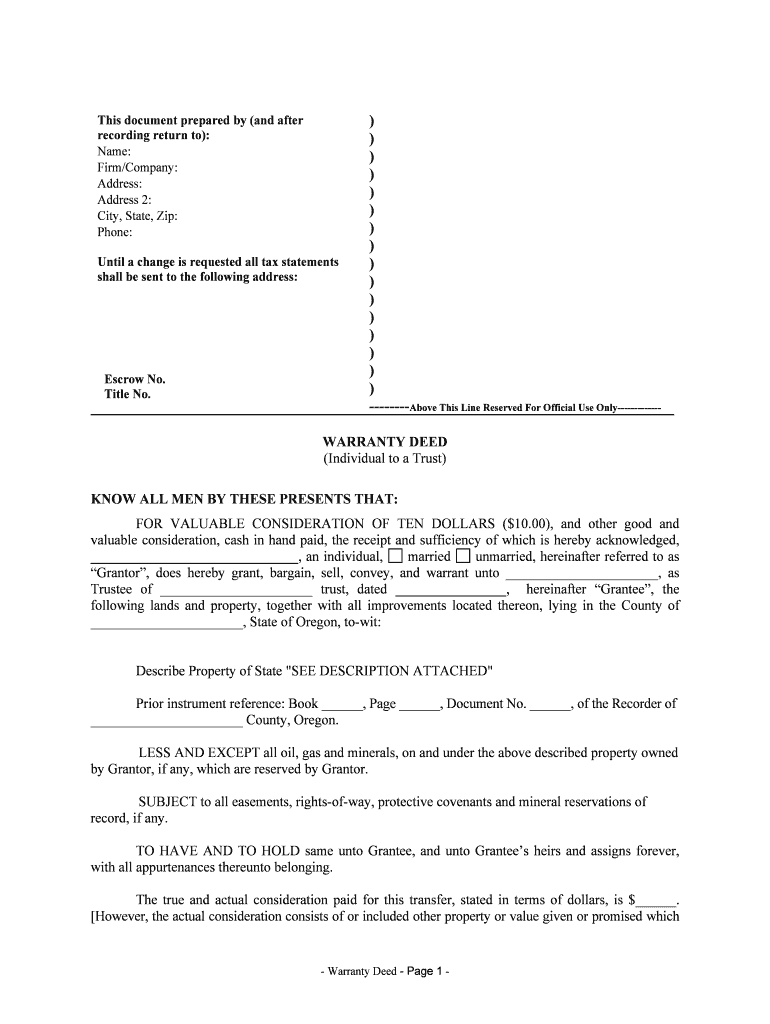

The "Until A Change Is Requested All Tax Statements" form is a crucial document used in the United States for tax reporting purposes. This form allows taxpayers to indicate that they wish to receive all future tax statements until they request a change. It ensures that individuals and businesses maintain accurate and up-to-date records for tax compliance. This form is particularly important for those who may have multiple income sources or changing financial situations, as it helps streamline the process of receiving necessary tax documentation.

How to use the Until A Change Is Requested All Tax Statements

Using the "Until A Change Is Requested All Tax Statements" form involves several straightforward steps. First, gather all necessary personal and financial information, including Social Security numbers, tax identification numbers, and any relevant financial documents. Next, fill out the form accurately, ensuring all information is complete. Once filled, submit the form according to the instructions provided, which may include online submission or mailing it to the appropriate tax authority. It is essential to keep a copy of the submitted form for your records.

Steps to complete the Until A Change Is Requested All Tax Statements

Completing the "Until A Change Is Requested All Tax Statements" form requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary information, including personal identification and financial details.

- Obtain the form from the relevant tax authority or download it from an authorized source.

- Fill out the form, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form as directed, either online or via mail.

- Retain a copy of the submitted form for your records.

Legal use of the Until A Change Is Requested All Tax Statements

The "Until A Change Is Requested All Tax Statements" form is legally binding when completed and submitted according to the guidelines set forth by the Internal Revenue Service (IRS). Compliance with federal and state regulations is essential to ensure that the form is recognized as valid. This includes providing accurate information and adhering to deadlines for submission. Failure to comply with these legal requirements may result in penalties or delays in receiving tax statements.

IRS Guidelines

The IRS provides specific guidelines for the "Until A Change Is Requested All Tax Statements" form to ensure proper use and compliance. Taxpayers must follow these guidelines closely to avoid complications. Key points include:

- Ensure that all information is accurate and up to date.

- Submit the form by the designated deadlines to maintain eligibility for receiving tax statements.

- Understand the implications of submitting the form, including how it affects future tax filings.

Required Documents

To complete the "Until A Change Is Requested All Tax Statements" form, certain documents are typically required. These may include:

- Proof of identity, such as a driver's license or Social Security card.

- Tax identification numbers for individuals or businesses.

- Previous tax returns or financial statements that support the information provided.

Quick guide on how to complete until a change is requested all tax statements

Finish Until A Change Is Requested All Tax Statements seamlessly on any gadget

Web-based document organization has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct template and securely save it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents promptly without complications. Manage Until A Change Is Requested All Tax Statements on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest method to modify and eSign Until A Change Is Requested All Tax Statements effortlessly

- Obtain Until A Change Is Requested All Tax Statements and click Get Form to initiate the process.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your document, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Until A Change Is Requested All Tax Statements to ensure excellent communication at any point in the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What happens to my tax statements until a change is requested?

Until a change is requested, all tax statements are securely managed within our platform. This ensures that your important tax documents are readily accessible and monitored for any updates or adjustments needed to maintain accuracy. You can rest assured knowing your information stays protected and compliant while you manage your taxes efficiently.

-

How does airSlate SignNow manage tax statement updates?

At airSlate SignNow, until a change is requested, all tax statements are automatically retained in their latest version. Our platform supports easy updates, ensuring that any modifications you make are reflected immediately. This feature provides peace of mind, allowing you to focus on your business without worrying about outdated information.

-

What features make airSlate SignNow ideal for managing tax documents?

AirSlate SignNow offers a range of features tailored for efficient tax document management. These include a user-friendly eSignature solution, secure document storage, and real-time tracking of changes. Up until a change is requested, all tax statements can be effortlessly accessed, making our platform a perfect fit for your tax management needs.

-

Is there a cost associated with sending and eSigning tax statements?

Yes, airSlate SignNow offers competitive pricing plans designed to suit various business needs. Until a change is requested, all tax statements can be sent and eSigned at no additional cost beyond the regular subscription. This transparency in pricing ensures businesses can manage their tax statements efficiently without hidden fees.

-

Can airSlate SignNow integrate with my accounting software?

Absolutely! AirSlate SignNow easily integrates with major accounting software, allowing for seamless management of tax statements. Until a change is requested, all tax statements can be synchronized directly with your system, enhancing workflow efficiency and accuracy in your financial documentation.

-

What benefits does airSlate SignNow provide for small businesses?

For small businesses, airSlate SignNow delivers an easy-to-use and cost-effective solution for managing tax documents. Until a change is requested, all tax statements can be handled digitally, saving time and minimizing paperwork. These benefits help small businesses focus on growth while ensuring compliance and organization.

-

How secure is the storage of my tax statements on airSlate SignNow?

Security is a top priority at airSlate SignNow. Until a change is requested, all tax statements are stored in a secure environment that meets industry standards. This includes encryption and regular security audits to safeguard your sensitive information against unauthorized access.

Get more for Until A Change Is Requested All Tax Statements

- 2016 form 943 employers annual federal tax return for agricultural employees eitc irs

- Western towing authorization form

- Application for a maltese seamans book form

- Receiving checklist food safe form

- Online vocal adjudication template form

- Snap financial equal payment application form j amp a heating

- Myihcgroup form

- V20 character sheet form

Find out other Until A Change Is Requested All Tax Statements

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple