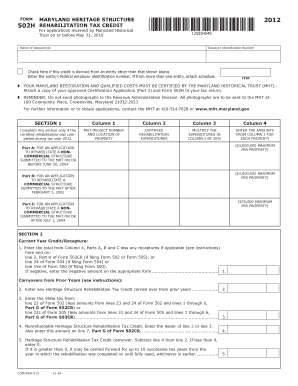

FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT for Applications Received by Maryland Historical Trust on O

Understanding the FORM 502H Maryland Heritage Structure Rehabilitation Tax Credit

The FORM 502H is essential for individuals seeking tax credits for the rehabilitation of heritage structures in Maryland. This form is specifically designed for applications received by the Maryland Historical Trust. The tax credit aims to encourage the preservation of historic properties by providing financial incentives to property owners who undertake qualified rehabilitation projects. Understanding the details of this form is crucial for applicants to ensure compliance and maximize their potential benefits.

Steps to Complete the FORM 502H

Completing the FORM 502H involves several key steps to ensure that all necessary information is accurately provided. First, gather all relevant documentation regarding the property, including its historical significance and details of the proposed rehabilitation work. Next, fill out the form by providing your personal information, property details, and a description of the rehabilitation project. It is important to include any required attachments, such as photographs or plans. Finally, review the completed form for accuracy before submission.

Eligibility Criteria for the FORM 502H

To qualify for the Maryland Heritage Structure Rehabilitation Tax Credit, applicants must meet specific eligibility criteria. The property must be a certified heritage structure listed on the Maryland Historical Trust's inventory. The rehabilitation work must adhere to the Secretary of the Interior's Standards for Rehabilitation. Additionally, the project must be completed within a specified timeframe, and the applicant must be the property owner or have authorization from the owner to apply for the tax credit.

Required Documents for the FORM 502H

When submitting the FORM 502H, applicants must include several required documents to support their application. These documents typically include proof of ownership, a detailed project description, photographs of the property before rehabilitation, and any architectural plans or specifications. Additional documentation may be necessary to demonstrate compliance with the eligibility criteria and the standards for rehabilitation.

Form Submission Methods for the FORM 502H

Applicants can submit the FORM 502H through various methods, ensuring flexibility in the application process. The form can be submitted online via the Maryland Historical Trust's website, allowing for a quicker processing time. Alternatively, applicants may choose to mail the completed form and supporting documents to the designated address provided by the Trust. In-person submissions may also be accepted, depending on the Trust's current policies and procedures.

Legal Use of the FORM 502H

The FORM 502H is legally binding when completed and submitted in accordance with the established guidelines. It is essential for applicants to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or denial of the tax credit. Utilizing a reliable electronic signature solution can enhance the legal standing of the submitted form, ensuring compliance with eSignature regulations and protecting the integrity of the application process.

Quick guide on how to complete form 502h 2012 maryland heritage structure rehabilitation tax credit for applications received by maryland historical trust on

Effortlessly Prepare FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Applications Received By Maryland Historical Trust On O on Any Device

Managing documents online has gained immense popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and efficiently. Handle FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Applications Received By Maryland Historical Trust On O on any device with airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The Simplest Way to Modify and Electronically Sign FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Applications Received By Maryland Historical Trust On O with Ease

- Obtain FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Applications Received By Maryland Historical Trust On O and click Get Form to commence.

- Leverage the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes just moments and carries the same legal validity as an ink signature.

- Review all details carefully and click the Done button to save your changes.

- Choose how you want to send your form, be it by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Applications Received By Maryland Historical Trust On O and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 502h 2012 maryland heritage structure rehabilitation tax credit for applications received by maryland historical trust on

How to create an eSignature for your Form 502h 2012 Maryland Heritage Structure Rehabilitation Tax Credit For Applications Received By Maryland Historical Trust On online

How to make an electronic signature for your Form 502h 2012 Maryland Heritage Structure Rehabilitation Tax Credit For Applications Received By Maryland Historical Trust On in Chrome

How to create an electronic signature for signing the Form 502h 2012 Maryland Heritage Structure Rehabilitation Tax Credit For Applications Received By Maryland Historical Trust On in Gmail

How to create an eSignature for the Form 502h 2012 Maryland Heritage Structure Rehabilitation Tax Credit For Applications Received By Maryland Historical Trust On right from your mobile device

How to generate an eSignature for the Form 502h 2012 Maryland Heritage Structure Rehabilitation Tax Credit For Applications Received By Maryland Historical Trust On on iOS devices

How to generate an electronic signature for the Form 502h 2012 Maryland Heritage Structure Rehabilitation Tax Credit For Applications Received By Maryland Historical Trust On on Android OS

People also ask

-

What is the FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Applications Received By Maryland Historical Trust On O.?

The FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Applications Received By Maryland Historical Trust On O. is a tax incentive program designed to encourage the rehabilitation of historic structures in Maryland. This form allows property owners to apply for tax credits based on qualified rehabilitation expenses, promoting the preservation of the state's heritage.

-

How can I qualify for the FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT?

To qualify for the FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Applications Received By Maryland Historical Trust On O., your property must be a certified historic structure. Additionally, the rehabilitation must meet specific guidelines set by the Maryland Historical Trust, and you must submit the completed form along with required documentation.

-

What are the benefits of using airSlate SignNow for submitting the FORM 502H?

Using airSlate SignNow to submit your FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Applications Received By Maryland Historical Trust On O. streamlines the process. You can easily eSign documents and send them securely, ensuring that your application is submitted on time and with all the necessary signatures.

-

Is there a cost associated with applying for the FORM 502H?

While there may be costs associated with the rehabilitation project itself, submitting the FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Applications Received By Maryland Historical Trust On O. through airSlate SignNow is cost-effective. SignNow offers affordable pricing plans that enable you to manage your document submissions without breaking the bank.

-

What features does airSlate SignNow provide for managing FORM 502H applications?

airSlate SignNow provides features such as document templates, secure eSigning, and cloud storage, making it easier to manage your FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Applications Received By Maryland Historical Trust On O. applications. You can track the status of your submissions and ensure all forms are completed accurately.

-

How can I track the status of my FORM 502H application submitted via airSlate SignNow?

Once you submit your FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Applications Received By Maryland Historical Trust On O. through airSlate SignNow, you can easily track its status through your account dashboard. The platform provides real-time updates, so you’ll know when your application has been received and processed.

-

Can I integrate airSlate SignNow with other tools for my FORM 502H application?

Yes, airSlate SignNow offers integrations with various productivity and document management tools. This allows you to streamline your workflow when preparing and submitting the FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Applications Received By Maryland Historical Trust On O., making it easier to manage all aspects of your project.

Get more for FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Applications Received By Maryland Historical Trust On O

Find out other FORM 502H MARYLAND HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Applications Received By Maryland Historical Trust On O

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form