Form RI 00431 C

What is the Form RI 00431 C

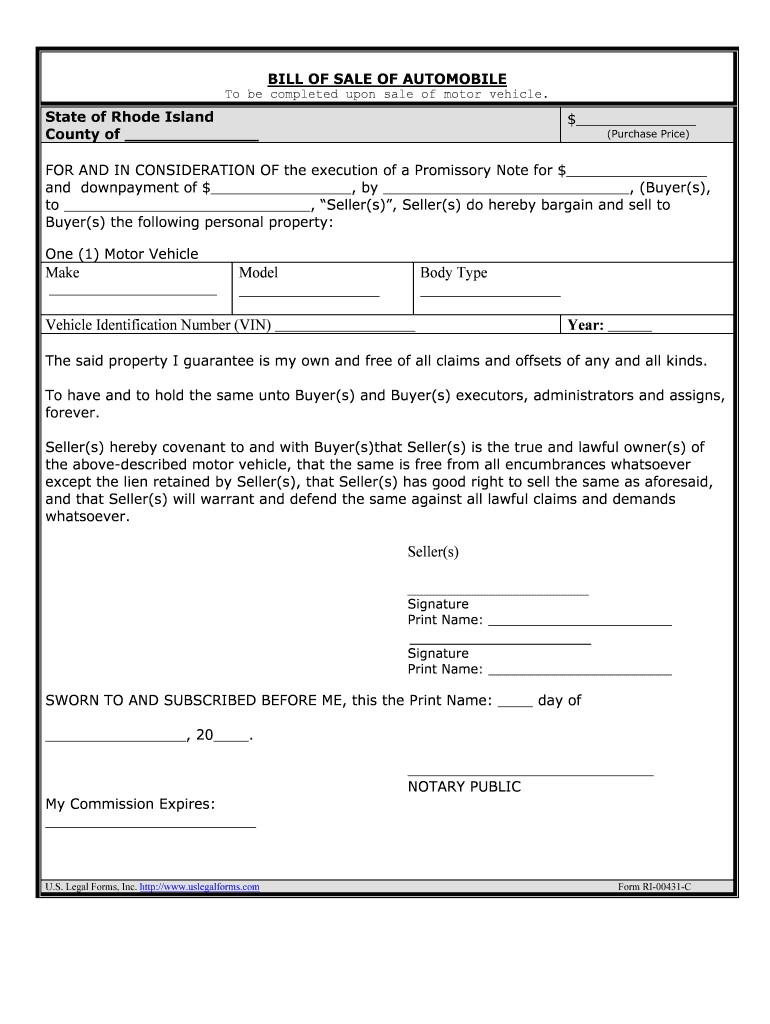

The Form RI 00431 C is a specific document utilized in the state of Rhode Island. This form is primarily used for reporting certain tax-related information and is essential for ensuring compliance with state regulations. Understanding the purpose of this form is crucial for individuals and businesses operating within Rhode Island, as it plays a significant role in the state's tax system.

How to use the Form RI 00431 C

Using the Form RI 00431 C involves several straightforward steps. First, ensure you have the latest version of the form, which can typically be obtained from the Rhode Island Department of Revenue website. Next, carefully read the instructions accompanying the form to understand the required information. Fill out the form accurately, providing all necessary details to avoid delays or complications in processing. Once completed, submit the form as directed, either online or via mail.

Steps to complete the Form RI 00431 C

Completing the Form RI 00431 C requires attention to detail. Follow these steps for accurate submission:

- Download the form from the official Rhode Island Department of Revenue website.

- Read the instructions thoroughly to understand the information required.

- Fill in your personal or business information as requested.

- Double-check all entries for accuracy.

- Submit the form through the designated method, ensuring you keep a copy for your records.

Legal use of the Form RI 00431 C

The Form RI 00431 C is legally binding when filled out correctly and submitted according to state regulations. It is essential to comply with all legal requirements to ensure that the document holds up in any potential audits or reviews by tax authorities. Utilizing a reliable electronic signature solution can enhance the legitimacy of the submission, as it provides a secure method for signing and storing the document.

Key elements of the Form RI 00431 C

Several key elements must be included in the Form RI 00431 C for it to be considered complete. These elements typically include:

- Taxpayer identification information, such as name and address.

- Specific tax information relevant to the filing period.

- Signature and date to verify the authenticity of the submission.

- Any supporting documentation that may be required.

Form Submission Methods (Online / Mail / In-Person)

There are multiple methods for submitting the Form RI 00431 C. Taxpayers can choose to file online through the Rhode Island Department of Revenue's portal, which often provides a quicker processing time. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own guidelines, so it is important to follow the instructions provided with the form to ensure proper submission.

Quick guide on how to complete form ri 00431 c

Complete Form RI 00431 C effortlessly on any gadget

Online document management has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly and efficiently. Manage Form RI 00431 C on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The easiest way to modify and eSign Form RI 00431 C without hassle

- Find Form RI 00431 C and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important parts of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your PC.

Eliminate the stress of lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any gadget you prefer. Modify and eSign Form RI 00431 C to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form RI 00431 C?

Form RI 00431 C is a specific form used for various official purposes in the state of Rhode Island. The form may need to be completed and signed by individuals or businesses for legal compliance. Using airSlate SignNow simplifies the process of filling out and eSigning Form RI 00431 C securely and efficiently.

-

How can I use airSlate SignNow to fill out Form RI 00431 C?

To fill out Form RI 00431 C using airSlate SignNow, simply upload the document to our platform. You can then easily add the necessary information and send it for eSignature. This ensures that your form is completed correctly and promptly.

-

Is there a cost to use airSlate SignNow for Form RI 00431 C?

airSlate SignNow offers flexible pricing plans suitable for various business needs, including those who need to handle Form RI 00431 C regularly. You can choose a plan that fits your budget, and you might find that our cost-effective solutions provide signNow savings, especially with volume use.

-

What are the benefits of using airSlate SignNow for Form RI 00431 C?

Using airSlate SignNow for Form RI 00431 C offers multiple benefits, including faster turnaround times and enhanced security for your documents. You can track the status of your eSignatures in real-time and ensure compliance with legal requirements, making it an efficient solution for your business.

-

Can I integrate airSlate SignNow with other software for managing Form RI 00431 C?

Yes, airSlate SignNow supports integrations with various software solutions that can help you manage Form RI 00431 C more effectively. Whether you use CRM tools, document management systems, or other cloud applications, our platform seamlessly connects with them to optimize your workflow.

-

Is it safe to eSign Form RI 00431 C with airSlate SignNow?

Absolutely! airSlate SignNow provides a secure environment for eSigning Form RI 00431 C. We utilize advanced encryption and authentication methods to ensure that your data, along with any signed forms, remain private and protected.

-

Can multiple people sign Form RI 00431 C using airSlate SignNow?

Yes, airSlate SignNow allows multiple parties to sign Form RI 00431 C easily. You can add all necessary signers, and they will receive an email invitation to review and eSign the document, streamlining the process and saving time.

Get more for Form RI 00431 C

- Dissolution judgment packet san diego superior court state of form

- Order for publication los angeles superior court form

- Stipulation for civil judgment los angeles superior court form

- Applicationpetition for resentencing and peopleamp39s response form

- Form crim 016h capital case checklist and guidelines 1doc

- Form crim 016d counsels declaration 110911doc

- Felony bail computation worksheet form

- At the time of service i was over 18 years of age form

Find out other Form RI 00431 C

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document