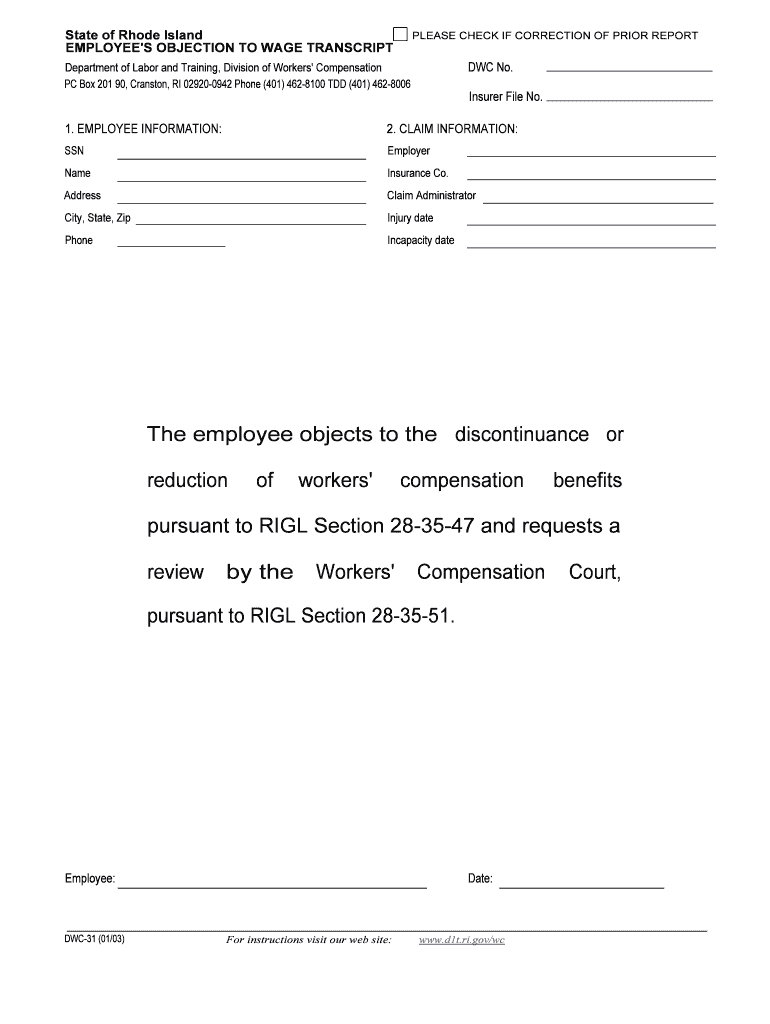

EMPLOYEE'S OBJECTION to WAGE TRANSCRIPT Form

What is the EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT

The EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT is a formal document that allows an employee to dispute the accuracy of their wage records. This form is essential for employees who believe their wages have been misreported or incorrectly calculated. It serves as a means for employees to formally communicate their concerns to their employer or relevant authorities, ensuring that discrepancies are addressed and rectified. This document is particularly important in maintaining transparency and fairness in wage reporting.

How to use the EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT

Steps to complete the EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT

Completing the EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT involves a systematic approach to ensure accuracy and clarity. Follow these steps:

- Review your wage records and identify discrepancies.

- Collect supporting documentation, such as pay stubs and tax forms.

- Obtain the EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT form from your employer or relevant authority.

- Fill out the form, clearly stating the nature of your objection and attaching any evidence.

- Submit the completed form to the designated department, ensuring you keep a copy for your records.

Legal use of the EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT

Key elements of the EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT

The key elements of the EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT include:

- Employee Information: Name, address, and contact details.

- Employer Information: Name of the company and relevant department.

- Details of the Objection: Specific discrepancies in wage records.

- Supporting Documentation: Any evidence that supports the employee's claim.

- Signature: The employee's signature to validate the objection.

Who Issues the Form

The EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT is typically issued by the employer's Human Resources or Payroll department. Employers have the responsibility to provide this form to employees who wish to dispute their wage records. In some cases, state labor departments may also have standardized forms available for employees to use when filing objections. It is important for employees to check with their employer regarding the specific process and any required documentation.

Quick guide on how to complete employees objection to wage transcript

Complete EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and electronically sign EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT without hassle

- Find EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would prefer to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT?

An EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT is a formal document used when an employee disputes the details of their wage records. This document outlines the discrepancies and provides a basis for negotiation. Understanding this process is vital for both employers and employees to resolve pay disputes effectively.

-

How can airSlate SignNow help with handling EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT?

airSlate SignNow simplifies the documentation process for EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT by allowing businesses to quickly create, send, and eSign necessary documents. This streamlines communication and ensures that all parties can respond promptly. With our platform, you can track the status of these documents in real time.

-

Does airSlate SignNow offer templates for EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT?

Yes, airSlate SignNow provides customizable templates for various employment-related documents, including EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT. These templates are designed to save time and ensure compliance with legal standards. You can easily modify them according to your company's needs.

-

What are the pricing options for airSlate SignNow regarding EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT services?

airSlate SignNow offers a variety of pricing plans catering to different business needs, all of which include features for managing EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT. You'll find competitive pricing that aligns with the volume of documents you handle. Sign up to explore a plan that suits your organization best.

-

What features does airSlate SignNow provide for managing documents like EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT?

airSlate SignNow comes equipped with features such as eSignature, document tracking, and customizable templates specifically tailored for EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT. Additionally, it offers user-friendly dashboards and analytics to help monitor the workflow. These features enhance efficiency and ensure timely resolution of issues.

-

Is airSlate SignNow compliant with regulations related to EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT?

Absolutely! airSlate SignNow is designed to comply with legal standards and regulations regarding document processing, including EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT. Our platform ensures that all documents are securely stored and managed, protecting both employer and employee rights throughout the process.

-

Can I integrate airSlate SignNow with other platforms for handling EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT?

Yes, airSlate SignNow offers robust integration capabilities with various HR and payroll systems to streamline the handling of EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT. By integrating with your existing applications, you can achieve a seamless workflow that maximizes efficiency in handling payroll disputes.

Get more for EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT

- Publication 1932 rev 1 2005 form

- Publication 3864 rev june 2002 form

- Publication 3204 rev march 2002 uncle feds taxboard form

- Circular form

- Page 1 of 288 application for federal assistance sf 424 form

- Application for suspension of prosecution violation of firearm laws 480133260 form

- Order of protection 4 965 nm form

- Purchase lease application bf1 once the applicat form

Find out other EMPLOYEE'S OBJECTION TO WAGE TRANSCRIPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation