VAEnrollment Data Sheet Financial Aid Appalachian State 2002-2026

What is the VA Enrollment Data Sheet for Financial Aid at Appalachian State?

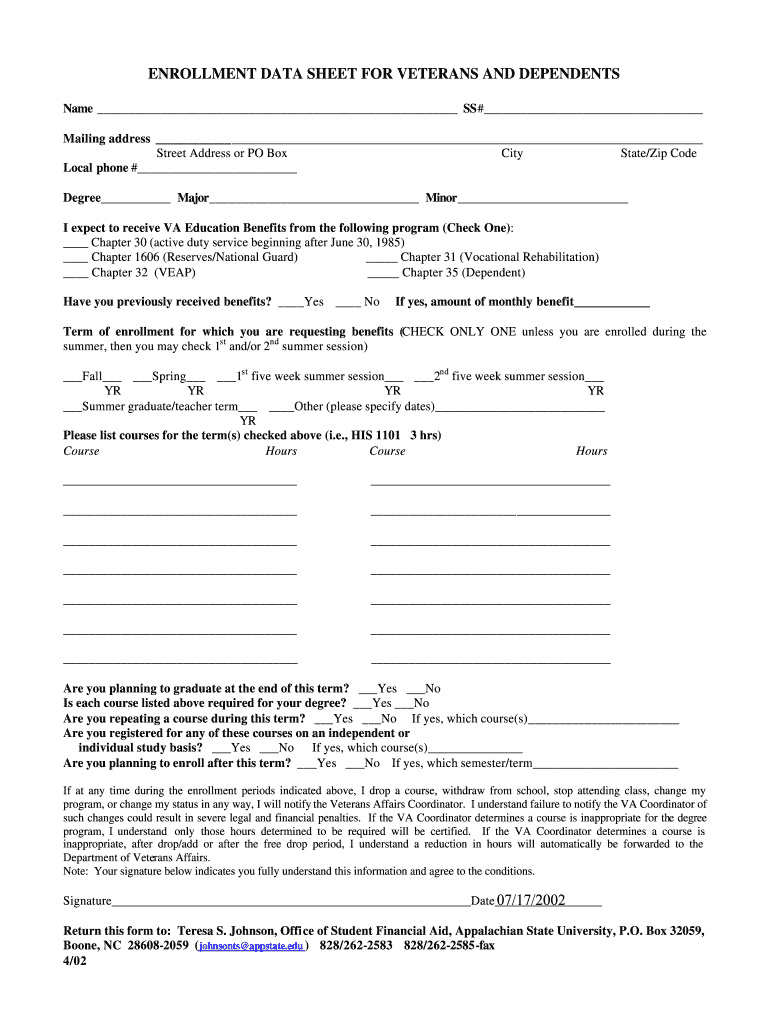

The VA Enrollment Data Sheet is a crucial document for students at Appalachian State University who are applying for financial aid through the Veterans Affairs (VA) program. This form collects essential information about a student’s enrollment status, including the number of credit hours and the type of courses taken. It serves as a verification tool to ensure that veterans and eligible dependents receive the appropriate educational benefits. Understanding this form is vital for students to secure their financial aid effectively.

How to Use the VA Enrollment Data Sheet for Financial Aid at Appalachian State

Using the VA Enrollment Data Sheet involves several key steps. First, students must fill out their personal information accurately, including their name, student ID, and contact details. Next, they should indicate their enrollment status by specifying the number of credit hours they are taking and the start and end dates of their courses. It is important to review the form for any errors before submission to avoid delays in the financial aid process. Once completed, the form can be submitted to the financial aid office at Appalachian State for processing.

Steps to Complete the VA Enrollment Data Sheet for Financial Aid at Appalachian State

Completing the VA Enrollment Data Sheet requires careful attention to detail. Follow these steps:

- Gather necessary documents, including your student ID and course schedule.

- Fill in your personal information, ensuring all details are accurate.

- Specify your enrollment status by listing the number of credit hours.

- Double-check the dates of your courses to ensure they align with the academic calendar.

- Review the form for any mistakes or missing information.

- Submit the completed form to the financial aid office either online or in person.

Key Elements of the VA Enrollment Data Sheet for Financial Aid at Appalachian State

The VA Enrollment Data Sheet includes several key elements that are essential for processing financial aid. These elements typically consist of:

- Personal Information: Name, student ID, and contact information.

- Enrollment Status: Number of credit hours and course types.

- Dates: Start and end dates of the enrollment period.

- Signature: Required for verification of the information provided.

Legal Use of the VA Enrollment Data Sheet for Financial Aid at Appalachian State

The VA Enrollment Data Sheet is legally binding, meaning that the information provided must be accurate and truthful. Misrepresentation or failure to disclose relevant information can lead to penalties, including the loss of financial aid eligibility. It is essential for students to understand their responsibilities when completing this form, as it impacts their access to educational benefits under the VA program.

Eligibility Criteria for the VA Enrollment Data Sheet for Financial Aid at Appalachian State

To be eligible for financial aid through the VA program at Appalachian State, students must meet specific criteria. These typically include:

- Being a veteran or an eligible dependent of a veteran.

- Enrolling in an approved program of study at Appalachian State.

- Maintaining satisfactory academic progress as defined by the institution.

Quick guide on how to complete vaenrollment data sheet financial aid appalachian state

The simplest method to locate and endorse VAEnrollment Data Sheet Financial Aid Appalachian State

On the level of a whole organization, ineffective workflows surrounding paper approvals can take up signNow working hours. Endorsing documents like VAEnrollment Data Sheet Financial Aid Appalachian State is an inherent aspect of operations across various sectors, which is why the effectiveness of each agreement’s lifecycle has a substantial impact on the overall performance of the company. With airSlate SignNow, endorsing your VAEnrollment Data Sheet Financial Aid Appalachian State is as straightforward and quick as possible. You will discover with this platform the most recent version of virtually any document. Even better, you can endorse it immediately without needing to install any external software on your computer or printing out physical copies.

Steps to obtain and endorse your VAEnrollment Data Sheet Financial Aid Appalachian State

- Browse our collection by category or use the search feature to locate the document you require.

- Check the document preview by clicking Learn more to confirm it is the correct one.

- Click Get form to begin editing immediately.

- Fill out your document and include any required information using the toolbar.

- Once finished, click the Sign tool to endorse your VAEnrollment Data Sheet Financial Aid Appalachian State.

- Choose the signature option that works best for you: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options as needed.

With airSlate SignNow, you have everything necessary to handle your documentation efficiently. You can discover, complete, edit, and even send your VAEnrollment Data Sheet Financial Aid Appalachian State in one tab without any complications. Optimize your workflows by employing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What can I do when a divorced parent refuses to fill out a college financial aid form?

Anything that does not involve going to university and paying for it with loans/grants.Join the service.Get a full time job and take a class at a time and pay with cash.Find an employer that will pay for your schooling.Get married so you can be considered an independent student 9but not from your husband).Jus t get a job. By the time the government lets you file as an independent student(age 24) you may have found an even better pattern that doesn’t involve college at all.

-

Do I have to fill out both the FAFSA (since I'm a US citizen living abroad) and a CSS profile form to get financial aid for colleges?

There’s nothing about the FAFSA that is exclusive or required for US citizens living abroad. The FAFSA is simply the most commonly used application form for student aid applications GENERALLY, and almost every college and university asks for it rather than go to the trouble of inventing their own - even though, in fact, many of them DO have their own application, and STILL want to see a FAFSA.What you actually should do, is go to the website OF THE COLLEGES you are interested in, and check the parts where financial aid is discussed, and see what they want to see.Probably 90% or more will want a FAFSA, maybe 10% will want their own form IN ADDITION to the FAFSA, and a certain number will also want to see the CSS profile.So fill out the FAFSA online. There is part of it which asks for the codes (every college has one) for the colleges you want to have them send the form to. You can send a FAFSA to TEN colleges when you fill out the FAFSA in the first place - AND, you can go back later, and add more colleges.Fill out the FAFSA. The one for fall semester 2018- spring 2019 is available to be filled out beginning, I believe, around October 2017. Most colleges want to have that in their possession by January 2018.Unless, of course, you are independently wealthy, and can afford to pay for college by yourself.Other notes:you fill out the FAFSA every year for the next college year.you can link to the IRS website to pre-fill in a lot of the information the FAFSA asks for (this saves time).you need your own tax return data (if you have such a thing yet) and your parents’ information also.It looks intimidating, but it really isn’t terribly difficult - I would suggest going through the FAFSA website and reading most of the information there before you start, because there are various documents and numbers you will need to have to fill out the form, and it is easier if you have collected all that stuff before you sit down to fill the form out.By the way - I see this idea often and it is wrong - ‘FAFSA’ does NOT give anybody any money. It is an APPLICATION FOR AID. The college you apply to and get accepted at will look at your application, your FAFSA form, all the other required forms you supply to them, and THEN the Financial Aid office will decide a) whether to offer you an aid package and b) what that aid package will contain.It could be a mix of scholarships (great!), grants (wonderful!), student loans of various kinds (read the fine print) and perhaps an offer of work-study. You can accept or refuse any of those, individually.Good luck!

-

If you are disowned by your family before college at age 18, how would you fill out the financial aid form?

I’m not sure what ‘disowned’ means, is this a legal situation where you are emancipated or are you just out of the house and not supported?If you are just on your own and not supported you are out of luck. It isn’t any different than any other kid. Until you are 24, you are not independent for aid and have to file FAFSA with your information and your parent financial information. This does not require your parents to pay anything. But it is used for the aid calculations.There are a limited set of circumstances where you can file with just your information only. This is called being an Independent Student for aid and it is not based on your parents supporting you are not. It is based on these criteria:https://studentaid.ed.gov/sa/faf...Now if your parents refuse to provide information you are still out of luck. You may file a FAFSA with only your information but aid will be limited. The most you will get is a federal loan starting at $5,500 for freshman year. You will have to contact the financial aid office at the colleges where you are accepted in order to get the override instructions. You won’t get any Pell Grant or college aid in this case.

-

How can you get financial aid to study out of state?

I can't believe that no one has said anything about the FAFSA!!!FAFSA - Free Application for Federal Student AidThis will get you all of the federal aid that you can qualify for. It will not matter if you go in or out of state for school.That said, many states offer aid programs to students if they stay in-state. Some of these require that you out an in-state institution first on your list or at least somewhere on your list.Secondly, most schools will offer scholarships and grants to both in-state and out-of-state students. Depending on your location, you may qualify for some reciprocity ( Midwest Student Exchange Program), or many institutions will offer in-state discounts and grants to neighboring states.Check with the institutions you are interested in attending for opportunities at each.

-

Does UCLA give financial aid to out of state students? How much?

No, they do not do that any longer. They used to, but they never covered the $22,000 or so extra per year for out of state tuition anyway. Now they give none at all, with the rare exception if you get a Regents/Chancellor’s merit scholarship, they will take a look at your ‘Need’.UC’s are not a good choice for OOSers seeking need aid. Now they use OOS students for when the budget is exausted for instate students, they can admit OOSers who can be full payers. They always want some OOS in the mix but that’s the method.

-

My father is depressed. He refuses to fill out tax forms for financial aid. Telling his friends/exwife (my mom) will make him worse. What should I do?

If you’re living with him, is there a way for you to fill them out? I wouldn’t recommend it for legal reasons, but if you have his W2 and other information, you could always submit it yourself. If he can’t help you right now because of his depression, I would talk about it with a counselor at your school. They might have ways to work around the situation so that you can get your financial aid on time.In regards to your father, I would broach the topic of him seeking out his own counseling. Though you feel you can’t tell his friends or your mother about the situation, keeping it bottled up with the two of you is unhealthy in the long-run. Do you have someone you can talk to about this? Having a parent suffering from depression affects the whole family, and navigating your way through his episode might prove difficult without your own support system. I wish you the best of luck.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

When is it mandatory to fill out a personal financial statement for one's bank? The form states no deadline about when it must be returned.

The only time I know that financial statements are asked for is when one applies for a business or personal loan, or applying for a mortgage. Each bank or credit union can have their own document requirements, however for each transaction. It really is at their discretion.

Create this form in 5 minutes!

How to create an eSignature for the vaenrollment data sheet financial aid appalachian state

How to generate an electronic signature for the Vaenrollment Data Sheet Financial Aid Appalachian State online

How to create an eSignature for the Vaenrollment Data Sheet Financial Aid Appalachian State in Google Chrome

How to generate an eSignature for signing the Vaenrollment Data Sheet Financial Aid Appalachian State in Gmail

How to generate an electronic signature for the Vaenrollment Data Sheet Financial Aid Appalachian State from your smart phone

How to make an electronic signature for the Vaenrollment Data Sheet Financial Aid Appalachian State on iOS

How to create an eSignature for the Vaenrollment Data Sheet Financial Aid Appalachian State on Android OS

People also ask

-

What is the Appalachian Credit Union routing number?

The Appalachian Credit Union routing number is a unique identifier used for electronic transactions, like direct deposits and wire transfers. It's essential to use this number accurately to ensure that your funds are directed to the correct account. Typically, you can find the routing number on your checks or by contacting customer service.

-

How do I find my Appalachian Credit Union routing number?

You can find your Appalachian Credit Union routing number printed on the bottom of your checks, usually as the first nine digits. Additionally, you can easily access this information through your online banking account or by calling the credit union directly for assistance.

-

Why is the Appalachian Credit Union routing number important?

The Appalachian Credit Union routing number is crucial for various financial transactions, including setting up direct deposits and making electronic payments. Using the correct routing number ensures that your money is processed accurately and efficiently. Incorrect routing numbers can lead to delays or misdirected funds.

-

Can I use the Appalachian Credit Union routing number for wire transfers?

Yes, you can use the Appalachian Credit Union routing number for wire transfers. However, it's important to confirm with the credit union if there is a specific number you should use for domestic or international wire transfers. Always verify this information to avoid any potential issues with your transactions.

-

What fees should I expect when using the Appalachian Credit Union routing number for transactions?

While using the Appalachian Credit Union routing number for direct deposits and ACH transfers is typically free, some transactions such as wire transfers may incur fees. It's best to check with the credit union for specific pricing information related to various services. Understanding these fees helps manage your budget effectively.

-

How does airSlate SignNow integrate with banking services using the Appalachian Credit Union routing number?

AirSlate SignNow allows users to conveniently sign and send documents while incorporating banking details, including the Appalachian Credit Union routing number, for seamless transactions. This integration enhances the efficiency of electronic agreements, saving time and reducing errors. By utilizing SignNow, you can streamline document management alongside banking tasks.

-

Are there any benefits to using the Appalachian Credit Union routing number with eSignature solutions?

Using the Appalachian Credit Union routing number in conjunction with eSignature solutions like airSlate SignNow can provide numerous benefits, such as ensuring accurate payment processing and enhancing transactional transparency. This combination allows for quicker and more secure document exchanges, which is essential for both personal and business transactions.

Get more for VAEnrollment Data Sheet Financial Aid Appalachian State

- Umn petition supreme court of the united states form

- Mji michigan judicial institute state of michigan form

- Hunt v state cr 92 1300casetext form

- The citytown of form

- Ohio rules of criminal procedure supreme court of ohio form

- Rule 4 appeal as of right when taken ala r app p 4 form

- Request for production of documents in debt collection suit form

- Advance sheets supreme court north carolina judicial branch form

Find out other VAEnrollment Data Sheet Financial Aid Appalachian State

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe