Rhode Island Installments Fixed Rate Promissory Note Secured Form

What is the Rhode Island Installments Fixed Rate Promissory Note Secured

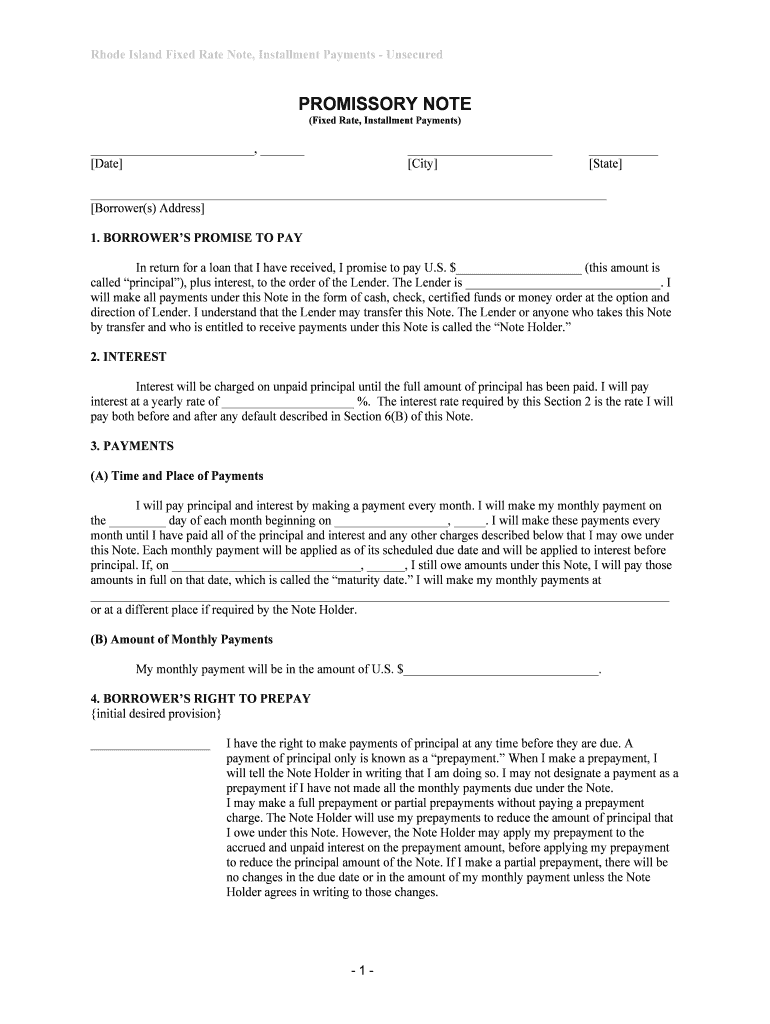

The Rhode Island Installments Fixed Rate Promissory Note Secured is a legal document that outlines a borrower’s promise to repay a loan in fixed installments over a specified period. This note is secured by collateral, which provides assurance to the lender in case of default. The document typically includes details such as the loan amount, interest rate, repayment schedule, and the specific assets pledged as security. Understanding this form is crucial for both borrowers and lenders to ensure compliance with state laws and protect their financial interests.

How to use the Rhode Island Installments Fixed Rate Promissory Note Secured

To effectively use the Rhode Island Installments Fixed Rate Promissory Note Secured, both parties should first agree on the loan terms, including the amount, interest rate, and repayment schedule. Once these terms are established, the borrower should complete the form accurately, including all required information about the collateral. After filling out the document, both parties must sign it to make it legally binding. It is advisable to retain copies for personal records and consult legal advice if there are any uncertainties regarding the terms or implications of the note.

Steps to complete the Rhode Island Installments Fixed Rate Promissory Note Secured

Completing the Rhode Island Installments Fixed Rate Promissory Note Secured involves several key steps:

- Gather necessary information, including borrower and lender details, loan amount, and collateral description.

- Clearly outline the repayment terms, including the fixed interest rate and the schedule of payments.

- Fill in the form, ensuring all sections are completed accurately to avoid any legal issues.

- Review the document with all parties involved to confirm agreement on the terms.

- Sign the document in the presence of a witness or notary, if required, to enhance its legal standing.

Key elements of the Rhode Island Installments Fixed Rate Promissory Note Secured

Several key elements are essential for the Rhode Island Installments Fixed Rate Promissory Note Secured to be valid and enforceable:

- Loan Amount: The total sum being borrowed.

- Interest Rate: The fixed rate of interest applied to the loan.

- Payment Schedule: Specific dates and amounts for each installment payment.

- Collateral Description: Detailed information about the asset securing the loan.

- Signatures: Required signatures from both the borrower and lender to validate the agreement.

Legal use of the Rhode Island Installments Fixed Rate Promissory Note Secured

The legal use of the Rhode Island Installments Fixed Rate Promissory Note Secured is governed by state laws that ensure the document meets specific requirements for enforceability. This includes adhering to regulations regarding interest rates, disclosure of terms, and the rights of both parties. It is important for both borrowers and lenders to understand their rights and obligations under this agreement, as well as any potential legal recourse in the event of a default. Consulting with a legal professional can provide clarity on these aspects and help ensure compliance with all applicable laws.

State-specific rules for the Rhode Island Installments Fixed Rate Promissory Note Secured

Rhode Island has specific regulations that govern the use of promissory notes, including the Installments Fixed Rate Promissory Note Secured. These rules dictate the maximum allowable interest rates, the required disclosures that must be provided to borrowers, and the procedures for enforcing the note in case of default. It is essential for both parties to familiarize themselves with these state-specific rules to ensure that the promissory note is valid and enforceable in Rhode Island courts. Non-compliance with these regulations can lead to penalties or the invalidation of the note.

Quick guide on how to complete rhode island installments fixed rate promissory note secured

Complete Rhode Island Installments Fixed Rate Promissory Note Secured effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a fantastic environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Rhode Island Installments Fixed Rate Promissory Note Secured on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Rhode Island Installments Fixed Rate Promissory Note Secured with ease

- Locate Rhode Island Installments Fixed Rate Promissory Note Secured and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you want to share your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in a few clicks from your preferred device. Modify and eSign Rhode Island Installments Fixed Rate Promissory Note Secured and ensure effective communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Rhode Island Installments Fixed Rate Promissory Note Secured?

A Rhode Island Installments Fixed Rate Promissory Note Secured is a legally binding financial document that allows a borrower to secure a loan with collateral, while establishing fixed repayment terms. This instrument protects the lender by providing a clear repayment schedule and guaranteeing payment with pledged assets. Understanding this note is crucial for both borrowers and lenders in Rhode Island.

-

How does the Rhode Island Installments Fixed Rate Promissory Note Secured work in practice?

The Rhode Island Installments Fixed Rate Promissory Note Secured involves a borrower agreeing to pay back the loan in installments, with interest, over a defined period. The note is secured by collateral, which can include property or other assets, ensuring that the lender has recourse in case of default. This structure provides peace of mind for both parties and facilitates smooth financial transactions.

-

What are the benefits of using a Rhode Island Installments Fixed Rate Promissory Note Secured?

Using a Rhode Island Installments Fixed Rate Promissory Note Secured offers stability and predictability in your financial planning. With fixed interest rates and scheduled payments, borrowers can effectively manage their cash flow. Additionally, it provides protection for lenders, making it a powerful tool for securing loans.

-

What is the typical pricing for a Rhode Island Installments Fixed Rate Promissory Note Secured?

The pricing for a Rhode Island Installments Fixed Rate Promissory Note Secured can vary depending on the lender and the terms of the loan. Typically, costs include interest rates that are fixed for the duration of the note, and potential fees related to the processing and legal verification of the document. It’s advisable to compare offers from different lenders to find the best terms.

-

Can I customize a Rhode Island Installments Fixed Rate Promissory Note Secured?

Yes, a Rhode Island Installments Fixed Rate Promissory Note Secured can be customized to fit the specific needs of both the borrower and the lender. This includes adjusting terms such as the repayment schedule, interest rate, and collateral requirements. Customization ensures that both parties' interests are adequately represented.

-

What integrations are available for managing a Rhode Island Installments Fixed Rate Promissory Note Secured?

Many online solutions allow for seamless integration when managing a Rhode Island Installments Fixed Rate Promissory Note Secured. Tools like airSlate SignNow enable businesses to streamline document management, e-signing, and storage, making it easier to track your note and ensure compliance with legal requirements. Integrations with accounting and financial software further enhance efficiency.

-

What happens if a borrower defaults on a Rhode Island Installments Fixed Rate Promissory Note Secured?

If a borrower defaults on a Rhode Island Installments Fixed Rate Promissory Note Secured, the lender has the legal right to claim the collateral pledged in the agreement. The specific process can vary based on the terms outlined in the note and state laws. It's important for both parties to understand these implications before entering into the agreement.

Get more for Rhode Island Installments Fixed Rate Promissory Note Secured

Find out other Rhode Island Installments Fixed Rate Promissory Note Secured

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT