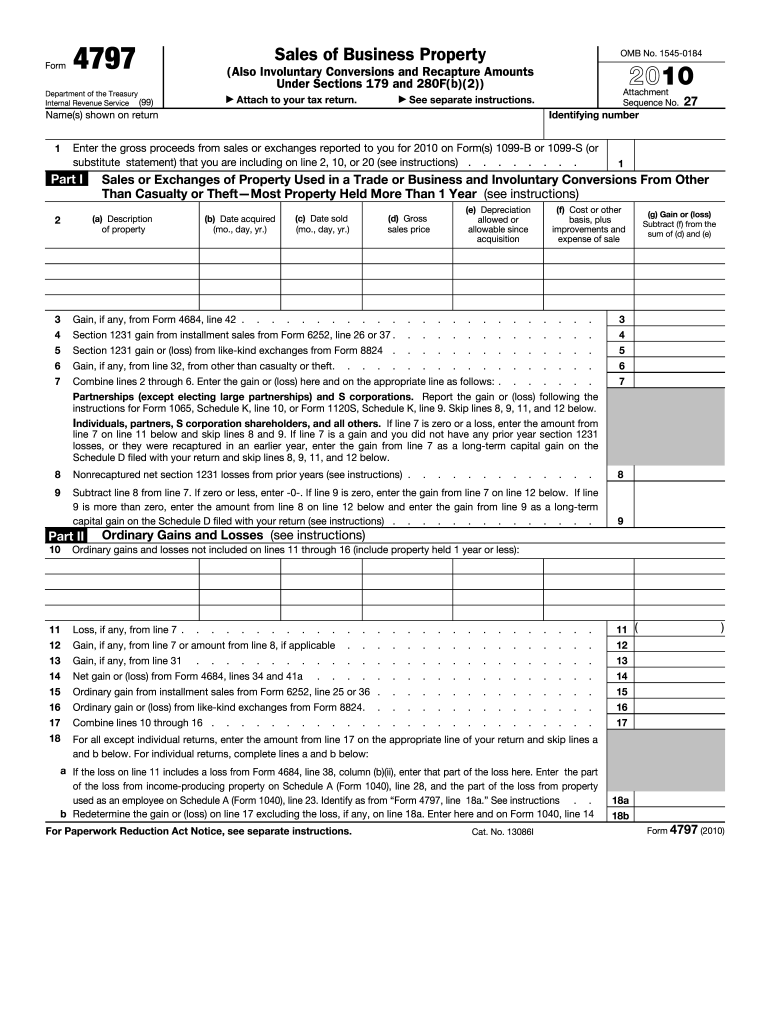

Form 4797 Internal Revenue Service Irs

What is Form 8958?

Form 8958, officially known as the "Allocation of Tax Amounts Between Certain Individuals in Community Property States," is a document used by taxpayers in community property states to allocate tax amounts between spouses. This form is particularly relevant for couples who file their taxes separately and need to divide income, deductions, and credits accurately. Understanding how to complete Form 8958 is essential for ensuring compliance with IRS regulations and for optimizing tax liabilities.

Key Elements of Form 8958

Form 8958 includes several important sections that require detailed information. Taxpayers must provide their names, Social Security numbers, and the total amounts for various tax-related items. The form also requires an allocation of income and deductions between spouses, which is crucial for accurate tax reporting. Additionally, the form features instructions for calculating the amounts to be reported, ensuring that both parties understand their respective tax responsibilities.

Steps to Complete Form 8958

Completing Form 8958 involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, determine the total income and deductions for both spouses. Then, allocate these amounts according to the community property laws applicable in your state. Finally, fill out the form carefully, ensuring that all calculations are correct before submitting it with your tax return.

Legal Use of Form 8958

Form 8958 is legally binding when completed and submitted in accordance with IRS guidelines. It is essential for taxpayers in community property states to use this form to avoid discrepancies in tax filings. Proper use of Form 8958 can help prevent audits and penalties by providing clear documentation of income and deductions shared between spouses. Compliance with IRS regulations regarding this form is crucial for maintaining legal standing in tax matters.

Filing Deadlines for Form 8958

The filing deadline for Form 8958 aligns with the standard tax return deadline, which is typically April 15th for most taxpayers. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure that Form 8958 is filed alongside their tax return to avoid any potential penalties or issues with the IRS.

Examples of Using Form 8958

Form 8958 is commonly used by married couples in community property states who choose to file their taxes separately. For instance, if one spouse earns a significant income while the other has minimal earnings, Form 8958 allows for a fair allocation of tax responsibilities. By accurately reporting income and deductions, both spouses can benefit from potential tax credits and deductions that may otherwise be overlooked.

Quick guide on how to complete form 4797 internal revenue service irs

Effortlessly Prepare Form 4797 Internal Revenue Service Irs on Any Device

Digital document management has become increasingly popular among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, alter, and electronically sign your documents quickly and without delays. Manage Form 4797 Internal Revenue Service Irs on any platform using the airSlate SignNow Android or iOS applications, and enhance any document-based process today.

Efficiently Alter and Electronically Sign Form 4797 Internal Revenue Service Irs with Ease

- Find Form 4797 Internal Revenue Service Irs and click Get Form to initiate.

- Use our tools to complete your document.

- Emphasize important sections of your documents or redact sensitive information with specialized tools that airSlate SignNow provides.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 4797 Internal Revenue Service Irs to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Internal Revenue Service (IRS): How do you attach a W2 form to your tax return?

A number of answers — including one from a supposed IRS employee — say not to physically attach them, but just to include the W-2 in the envelope.In fact, the 1040 instructions say to “attach” the W-2 to the front of the return, and the Form 1040 itself —around midway down the left-hand side — says to “attach” Form W-2 here; throwing it in the envelope is not “attaching.” Anything but a staple risks having the forms become separated, just like connecting the multiple pages of the return, scheduled, etc.

-

Which Internal Revenue Service forms do I need to fill (salaried employee) for tax filing when my visa status changed from F1 OPT to H1B during 2015?

You can use the IRS page for residency test: Substantial Presence TestIf you live in a state that does not have income tax, you can use IRS tool: Free File: Do Your Federal Taxes for Free or any other free online software. TaxAct is one such.If not and if you are filing for the first time, it might be worth spending few dollars on a tax consultant. You can claim the fee in your return.

-

Internal Revenue Service (IRS): How many W-2s were issued in 2012? How many Forms 1099-MISC?

I don't have an answer as I was also unable to find this statistic anywhere. I can tell you that the Social Security Administration actually processes W2's and forwards the information to the IRS. 1099's however are processed by the IRS directly.The closest statistic I can find is that in 2010 there were 117,820,074 tax returns processed that showed salaries and wages (W2 income) on them. That does not allow for returns where the taxpayers have multiple W2's nor does it allow for people who received a W2 and did not file a tax return, so all I can say is the number of W2's is something larger than 117M.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Internal Revenue Service (IRS): Where can i pick up tax forms ? utah

Assuming you have access to a printer, your best bet is to go online. http://tax.utah.gov/forms/curren... for state forms and http://www.irs.gov for federal forms. Any good tax preparation software will generate the forms automatically. It looks like you can also prepare and file your state taxes online.If for some reason you want to pick up physical, paper forms in person, you might call or visit one of the offices listed here. http://incometax.utah.gov/2007/c...(Please note, I do not live in Utah or pay taxes there, so the above is the result of several entire minutes spent searching the web.)

Create this form in 5 minutes!

How to create an eSignature for the form 4797 internal revenue service irs

How to make an electronic signature for the Form 4797 Internal Revenue Service Irs online

How to generate an eSignature for your Form 4797 Internal Revenue Service Irs in Google Chrome

How to make an eSignature for signing the Form 4797 Internal Revenue Service Irs in Gmail

How to generate an eSignature for the Form 4797 Internal Revenue Service Irs straight from your mobile device

How to create an electronic signature for the Form 4797 Internal Revenue Service Irs on iOS devices

How to create an electronic signature for the Form 4797 Internal Revenue Service Irs on Android

People also ask

-

What is an example of completed form 8958?

An example of completed form 8958 is a filled-out version that illustrates how to accurately report the income of spouses in community property states. This form is essential for individuals to ensure compliance with IRS requirements. Reviewing an example can help users understand the necessary details and correct completion required for their own forms.

-

How does airSlate SignNow help with form 8958?

airSlate SignNow streamlines the process of completing form 8958 by providing an easy-to-use eSignature solution. Users can upload, sign, and share their documents securely, which ensures that their completed forms are properly managed. This efficiency can save time, especially when dealing with important tax documents like form 8958.

-

What features should I look for in a platform to complete form 8958?

When choosing a platform to complete form 8958, look for features such as document upload capabilities, eSignature functionality, and cloud storage. These features enable users to create, edit, and securely manage their forms without hassle. Additionally, templates specific to form 8958 can further simplify the process.

-

Is airSlate SignNow a cost-effective solution for completing form 8958?

Yes, airSlate SignNow is a cost-effective solution for completing form 8958. Plans are affordable and often come with features that enhance productivity and legal compliance. Considering the importance of accurate tax filings, the investment in a reliable eSignature service like airSlate SignNow is worthwhile.

-

Can I integrate airSlate SignNow with other applications for form 8958?

Absolutely! airSlate SignNow offers various integrations with leading applications, making it easy to manage form 8958 alongside your other financial processes. Whether you're using accounting software or document management tools, these integrations can enhance your overall workflow.

-

What benefits does airSlate SignNow provide for small businesses needing form 8958?

For small businesses, airSlate SignNow provides several benefits when handling form 8958. It simplifies eSigning documents, which speeds up the approval process and reduces paper waste. This efficiency helps small businesses save time and resources that can be directed towards growth and compliance.

-

How secure is airSlate SignNow when handling form 8958?

airSlate SignNow prioritizes security, ensuring that your completed form 8958 and other documents are protected. With robust encryption and compliance with privacy regulations, users can feel confident that their sensitive data is safe. This commitment to security makes airSlate SignNow a trustworthy choice for managing important documents.

Get more for Form 4797 Internal Revenue Service Irs

- Deed of dedication middlesex county form

- Form 10 proof of restricted account from financial

- Proprietary information requestoffice of the attorney

- Payson roundup 101014 by payson roundup issuu form

- Estates powers ampampamp trusts part 6 7 69 manner of form

- Nomination of custodian a a person having the right to form

- Name mailing address city state zip code daytime form

- Two joint tenants to two individuals form

Find out other Form 4797 Internal Revenue Service Irs

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney