Maine Form Rew 1 1040

What is the Maine Form Rew 1 1040

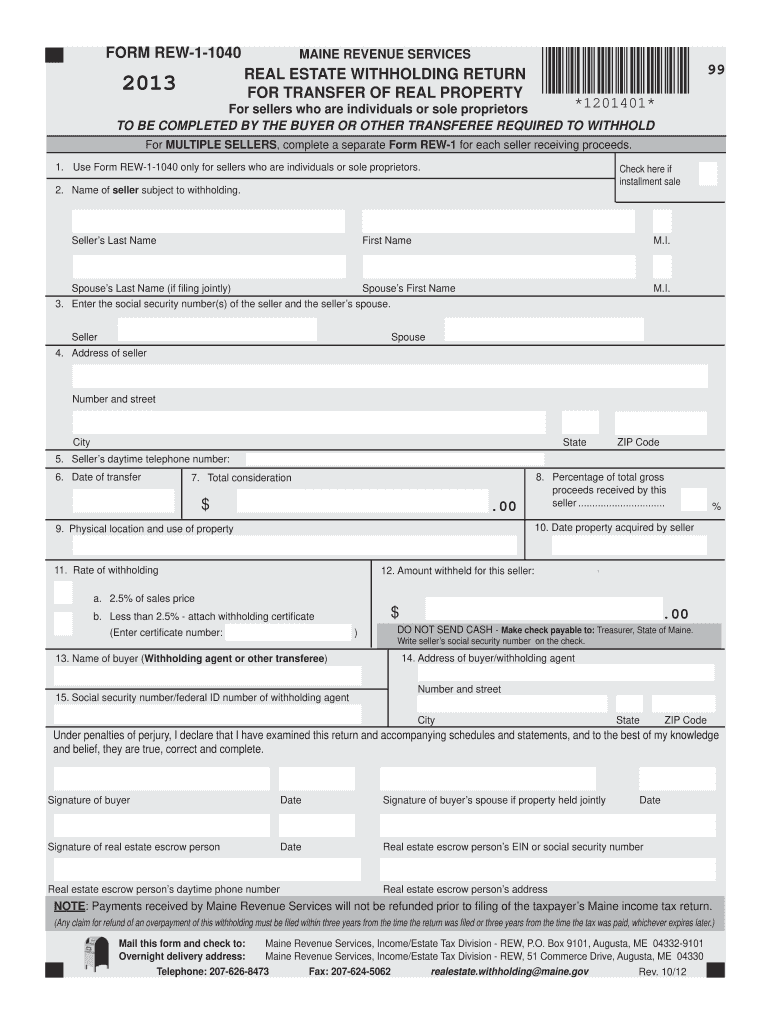

The Maine Form Rew 1 1040 is a state-specific tax form used by residents of Maine to claim a refund of income tax withheld from their wages or other income. This form is essential for individuals who have overpaid their state taxes throughout the year. It allows taxpayers to report their income, deductions, and credits to determine their eligibility for a refund.

Steps to complete the Maine Form Rew 1 1040

Completing the Maine Form Rew 1 1040 involves several key steps:

- Gather necessary documents, including W-2 forms and any other income statements.

- Fill out personal information, such as name, address, and Social Security number.

- Report total income earned during the tax year.

- Calculate deductions and credits applicable to your situation.

- Determine the total tax withheld and compare it to your calculated tax liability.

- Sign and date the form to validate your submission.

How to obtain the Maine Form Rew 1 1040

The Maine Form Rew 1 1040 can be obtained through several channels:

- Visit the official Maine Revenue Services website to download a PDF version of the form.

- Request a physical copy by contacting the Maine Revenue Services directly.

- Access the form through tax preparation software that includes state tax forms.

Legal use of the Maine Form Rew 1 1040

The Maine Form Rew 1 1040 is legally recognized for filing state income tax returns. To ensure its legal standing, it must be completed accurately and submitted by the designated deadlines. Compliance with state tax laws is essential to avoid penalties or issues with the Maine Revenue Services.

Filing Deadlines / Important Dates

Filing deadlines for the Maine Form Rew 1 1040 typically align with federal tax deadlines. For most taxpayers, the deadline to submit the form is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Maine Form Rew 1 1040:

- Online submission through the Maine Revenue Services e-filing system.

- Mailing a completed paper form to the appropriate state tax office.

- In-person submission at designated state tax offices, if available.

Quick guide on how to complete rew 1 1040 form

Effortlessly Prepare Maine Form Rew 1 1040 on Any Device

The management of online documents has gained popularity among both companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and electronically sign your documents without delays. Manage Maine Form Rew 1 1040 across any platform with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

Easily Modify and Electronically Sign Maine Form Rew 1 1040

- Find Maine Form Rew 1 1040 and click on Get Form to initiate.

- Utilize our provided tools to complete your form.

- Mark relevant sections of the documents or obscure sensitive details using the tools offered by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and then click the Done button to save your changes.

- Choose your preferred method for sending your form: through email, SMS, invite link, or download to your computer.

Say goodbye to lost or mishandled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Modify and electronically sign Maine Form Rew 1 1040 to ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How do I determine the tax form to be filed -1040 or 1040NR?

Greeting !!!The Substantial Presence Test and Definition of Exempt IndividualTo meet the substantial presence test, you must be physically present in the U.S. during a period you do not hold an A, F, G, J, M or Q visa on at least:31 days during the current year, and183 days during the 3-year period that includes the current year and the previous two years, counting:all of the days you were present in the current year, and1/3 of the days you were present in the first preceding year, and1/6 of the days you were present in the second preceding year.Exempt IndividualsAn exempt individual is someone whose days in the United States are not counted toward the substantial presence test, not someone who is exempt from tax. If you are an exempt individual, you are a nonresident alien until you are no longer an exempt individual, or until you receive permanent residency status. You are generally in this category if you are:An individual temporarily present in the United States as a foreign government related individual (A or G visa holder).A teacher or trainee temporarily present in the United States under a J or Q visa, who substantially complies with the requirements of the visa.A student temporarily present in the United States under an F, J, M or Q visa, who substantially complies with the requirements of the visa.A professional athlete temporarily in the United States to compete in a charitable sports evenIf above Condition is satisfied then you are Resident and you need to file 1040 other wise 1040NR.non resident files a special tax form (Form 1040NR), pays tax only on U.S. source income, is subject to special rates, and might qualify for treaty exemptions. Conversely, if you are a resident for U.S. tax purposes, you are generally under the same rules and file the same forms as a U.S. citizen. That means you report your worldwide income rather than just U.S. source income.Be Peaceful !!!

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

Create this form in 5 minutes!

How to create an eSignature for the rew 1 1040 form

How to generate an electronic signature for the Rew 1 1040 Form online

How to create an electronic signature for your Rew 1 1040 Form in Chrome

How to make an eSignature for putting it on the Rew 1 1040 Form in Gmail

How to create an electronic signature for the Rew 1 1040 Form straight from your mobile device

How to create an eSignature for the Rew 1 1040 Form on iOS devices

How to generate an eSignature for the Rew 1 1040 Form on Android

People also ask

-

What is the Maine Form Rew 1 1040?

The Maine Form Rew 1 1040 is a state tax form used for reporting personal income tax in Maine. It is essential for residents and businesses to accurately complete this form to comply with state tax regulations. Using airSlate SignNow, you can easily eSign and send your Maine Form Rew 1 1040 securely and efficiently.

-

How can airSlate SignNow help with filling out the Maine Form Rew 1 1040?

airSlate SignNow provides an intuitive platform that allows you to fill out the Maine Form Rew 1 1040 digitally. With our easy-to-use interface, you can input your information, save progress, and securely eSign the form all in one place. This saves time and ensures that your form is filled out accurately.

-

Is there a cost associated with using airSlate SignNow for the Maine Form Rew 1 1040?

Yes, there is a subscription fee for using airSlate SignNow, which varies based on your plan. However, the cost is often outweighed by the convenience and efficiency gained when preparing and eSigning the Maine Form Rew 1 1040. Plus, our solution is designed to be cost-effective for businesses and individuals alike.

-

What features does airSlate SignNow offer for managing the Maine Form Rew 1 1040?

airSlate SignNow offers a variety of features for managing the Maine Form Rew 1 1040, including document templates, eSignature capabilities, and secure cloud storage. Additionally, you can track the status of your documents in real-time and collaborate with others, ensuring a smooth filing process.

-

Can I integrate airSlate SignNow with other software for handling the Maine Form Rew 1 1040?

Absolutely! airSlate SignNow easily integrates with a variety of software applications, such as CRMs and document management systems. This integration allows you to streamline your workflow when preparing and submitting the Maine Form Rew 1 1040, making the process more efficient.

-

What are the benefits of using airSlate SignNow for the Maine Form Rew 1 1040?

Using airSlate SignNow for the Maine Form Rew 1 1040 provides numerous benefits, including enhanced security for your documents, reduced turnaround time, and improved organization. With our digital platform, you can ensure that your tax form is completed accurately and submitted on time, minimizing the risk of errors.

-

How secure is airSlate SignNow when handling the Maine Form Rew 1 1040?

airSlate SignNow takes security seriously, employing advanced encryption methods to protect your sensitive information, including the Maine Form Rew 1 1040. Our platform complies with industry standards for data security, ensuring that your documents remain confidential and secure during the eSigning process.

Get more for Maine Form Rew 1 1040

Find out other Maine Form Rew 1 1040

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document