Morrow Co Ohio School Tax Form

What is the Morrow Co Ohio School Tax Form

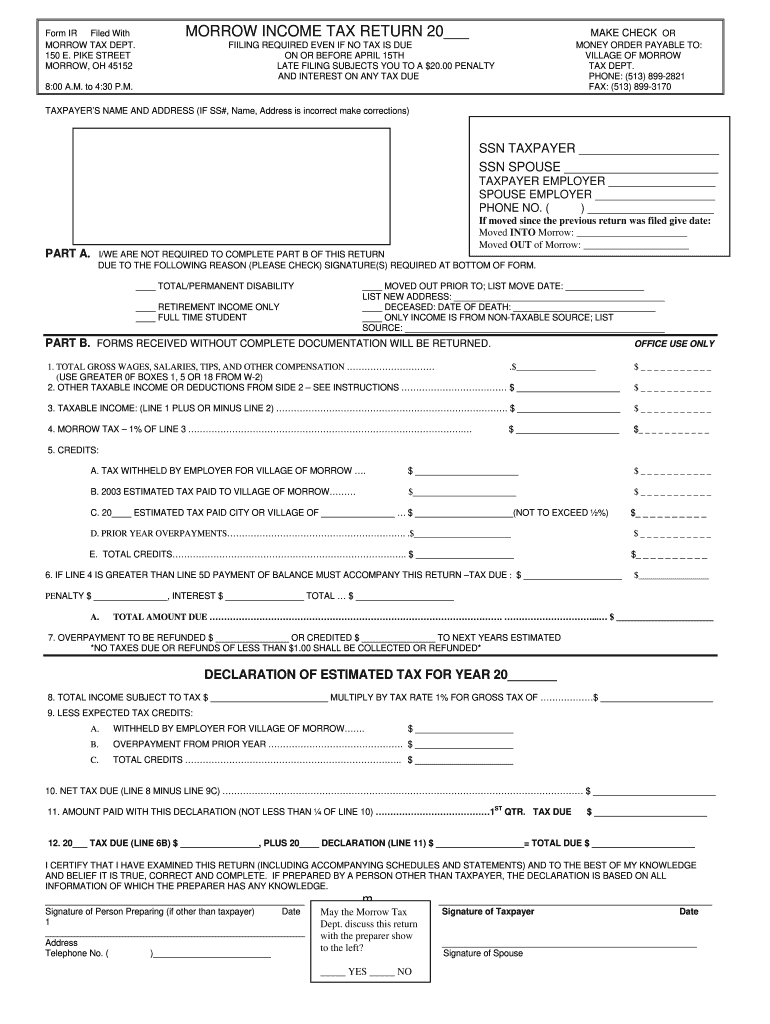

The Morrow Co Ohio School Tax Form is a specific document used by residents of Morrow County, Ohio, to report and pay local school taxes. This form is essential for individuals and businesses that are subject to the local school income tax, which helps fund educational services within the community. Understanding the purpose and requirements of this form is crucial for compliance with local tax laws.

How to use the Morrow Co Ohio School Tax Form

Using the Morrow Co Ohio School Tax Form involves several steps to ensure accurate reporting. First, gather all necessary financial information, including income details and any applicable deductions. Next, carefully fill out the form, ensuring that all fields are completed accurately. After completing the form, review it for any errors before submitting it to the appropriate local tax authority.

Steps to complete the Morrow Co Ohio School Tax Form

Completing the Morrow Co Ohio School Tax Form requires attention to detail. Follow these steps:

- Collect all required documentation, such as W-2 forms and other income statements.

- Download or obtain a physical copy of the Morrow Co Ohio School Tax Form.

- Fill in personal information, including your name, address, and Social Security number.

- Report your total income and any applicable deductions as per the form's instructions.

- Calculate the total school tax owed based on the provided tax rates.

- Sign and date the form to certify its accuracy.

- Submit the completed form by the designated deadline.

Legal use of the Morrow Co Ohio School Tax Form

The Morrow Co Ohio School Tax Form must be used in accordance with local tax laws to ensure its legal validity. Taxpayers are required to file this form annually if they meet the income threshold set by the county. Failure to use the form correctly can result in penalties or fines, making it essential to adhere to all legal guidelines when completing and submitting the document.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Morrow Co Ohio School Tax Form. Typically, the deadline for submission aligns with the federal tax filing deadline, which is usually April fifteenth. However, local regulations may dictate specific dates, so it is advisable to check with the Morrow County tax authority for the most accurate information regarding deadlines and any potential extensions.

Form Submission Methods (Online / Mail / In-Person)

The Morrow Co Ohio School Tax Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Some residents may be able to file electronically through designated online platforms.

- Mail: Completed forms can be mailed to the local tax office. Ensure to use the correct address and consider certified mail for tracking.

- In-Person: Taxpayers can also submit their forms in person at the local tax office during business hours.

Quick guide on how to complete village of morrow income tax return form

Your assistance manual on how to prepare your Morrow Co Ohio School Tax Form

If you’re interested in learning how to create and dispatch your Morrow Co Ohio School Tax Form, below are several straightforward recommendations on how to streamline tax submissions.

To start, you simply need to sign up for your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that allows you to modify, draft, and finalize your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to adjust details as necessary. Simplify your tax administration with sophisticated PDF editing, eSigning, and intuitive sharing.

Follow these steps to finalize your Morrow Co Ohio School Tax Form in just a few minutes:

- Set up your account and begin working on PDFs within moments.

- Utilize our catalog to find any IRS tax form; explore versions and schedules.

- Click Get form to access your Morrow Co Ohio School Tax Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if required).

- Review your document and amend any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to mistakes and delay in refunds. Naturally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

-

How do I submit income tax returns online?

Here is a step by step guide to e-file your income tax return using ClearTax. It is simple, easy and quick.From 1st July onwards, it is mandatory to link your PAN with Aadhaar and mention it in your IT returns. If you have applied for Aadhaar, you can mention the enrollment number in your returns.Read our Guide on how to link your PAN with Aadhaar.Step 1.Get startedLogin to your ClearTax account.Click on ‘Upload Form 16 PDF’ if you have your Form 16 in PDF format.If you do not have Form 16 in PDF format click on ‘Continue Here’Get an expert & supportive CA to manage your taxes. Plans start @ Rs.799/-ContinueWhat are you looking for?Account & Book KeepingCompany RegistrationGST RegistrationGST Return FilingIncome Tax FilingTrademark RegistrationOtherStep 2.Enter personal infoEnter your Name, PAN, DOB and Bank account details.Step 3.Enter salary detailsFill in your salary, employee details (Name and TAN) and TDS.Tip: Want to claim HRA? Read the guide.Step 4.Enter deduction detailsEnter investment details under Section 80C(eg. LIC, PPF etc., and claim other tax benefits here.Tip: Do you have kids?Claim benefits on their tuition fees under Section 80CStep 5.Add details of taxes paidIf you have non-salary income,eg. interest income or freelance income, then add tax payments that are already made. You can also add these details by uploading Form 26ASStep 6.E-file your returnIf you see “Refund” or “No Tax Due” here, Click on proceed to E-Filing.You will get an acknowledgement number on the next screen.Tip: See a “Tax Due” message? Read this guide to know how to pay your tax dues.Step 7: E-VerifyOnce your return is file E-Verify your income tax return

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill an income tax return with the 16A form in India?

The applicable Form for filing of your income tax return shall need to examine nature of your income.If you are receiving Form 16A only, then it means you are earning income other than salaries, and therefore possibly you shall need to file Income Tax Return in Form ITR 3 or ITR 4 (depends over the nature of income as already said in above para).You shall need to register your PAN on the website of income tax efiling, thereafter you shall need to link your PAN if you are a resident of India.After successful registration, you may file your income tax return through applicable form. Show your income as being appearing in Form 16A, your bank interest and any other income if you do have.For any assistance/queries related to taxation, you may contact me on pkush39@gmail.com

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

Create this form in 5 minutes!

How to create an eSignature for the village of morrow income tax return form

How to create an eSignature for the Village Of Morrow Income Tax Return Form online

How to make an electronic signature for the Village Of Morrow Income Tax Return Form in Chrome

How to generate an electronic signature for signing the Village Of Morrow Income Tax Return Form in Gmail

How to make an electronic signature for the Village Of Morrow Income Tax Return Form from your mobile device

How to make an eSignature for the Village Of Morrow Income Tax Return Form on iOS devices

How to create an electronic signature for the Village Of Morrow Income Tax Return Form on Android

People also ask

-

What is oh morrow and how does it relate to airSlate SignNow?

Oh morrow is a phrase often associated with looking forward to future innovations and improvements in document management. At airSlate SignNow, we ensure that our eSigning solutions are at the forefront of technology, helping businesses streamline their document workflows.

-

What features does airSlate SignNow offer for users?

AirSlate SignNow provides a range of features that make document management simple and efficient. With tools for eSigning, document sharing, and templates, businesses can fully embrace the future of paperwork—oh morrow—by simplifying their processes.

-

How can airSlate SignNow benefit my business?

By utilizing airSlate SignNow, your business can enhance productivity and reduce turnaround times for document approvals. Embracing this cost-effective solution means your team can focus on growth, paving the way for a more successful oh morrow in your operations.

-

What are the pricing options available for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans tailored to fit various business needs. Whether you’re a small startup or a large enterprise, you’ll find a cost-effective solution that aligns with your goals for a better oh morrow in document management.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports integrations with numerous applications, enhancing your workflow efficiency. By connecting with other tools, you can create a seamless experience that brings your business into the digital oh morrow of document handling.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! AirSlate SignNow prioritizes security and compliance, ensuring that your sensitive documents are protected with top-level encryption. Trusting airSlate SignNow means investing in a secure future—an oh morrow where your data is safe.

-

How does eSigning with airSlate SignNow work?

The eSigning process with airSlate SignNow is straightforward and user-friendly. Simply upload your document, add signers, and send it for signature—making it an ideal solution for businesses looking toward a more efficient oh morrow in their document workflows.

Get more for Morrow Co Ohio School Tax Form

- Control number ca 08 77 form

- Control number ca 08 78 form

- Wcab ca form 10214 e ver1 9 08 08 dir

- Control number ca 09 77 form

- How a husband and wife can form an llclegalzoom

- Pre trial conference statement dir form

- Specifically the facts supporting my claim that wild animals are loose on the premises include form

- That it is extremely problematic due to problems described as follows form

Find out other Morrow Co Ohio School Tax Form

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed