Ohio State Board of Cosmetology Independent Contractor 2011-2026

What is the Ohio State Board of Cosmetology Independent Contractor?

The Ohio State Board of Cosmetology Independent Contractor license allows professionals in the cosmetology field to operate independently. This license is essential for individuals who wish to provide services such as hairstyling, esthetics, or nail care without being tied to a specific salon or employer. The license ensures that independent contractors meet state regulations and standards, promoting safety and professionalism within the industry.

How to Obtain the Ohio State Board of Cosmetology Independent Contractor License

To obtain an independent contractor license in Ohio, applicants must first complete the necessary education and training requirements as mandated by the Ohio State Board of Cosmetology. This typically includes completing a state-approved cosmetology program and obtaining a cosmetology license. Once licensed, individuals can apply for the independent contractor license by submitting the required application form, along with any supporting documents, such as proof of liability insurance and a copy of their cosmetology license. The application can be submitted online or via mail.

Steps to Complete the Ohio State Board of Cosmetology Independent Contractor Application

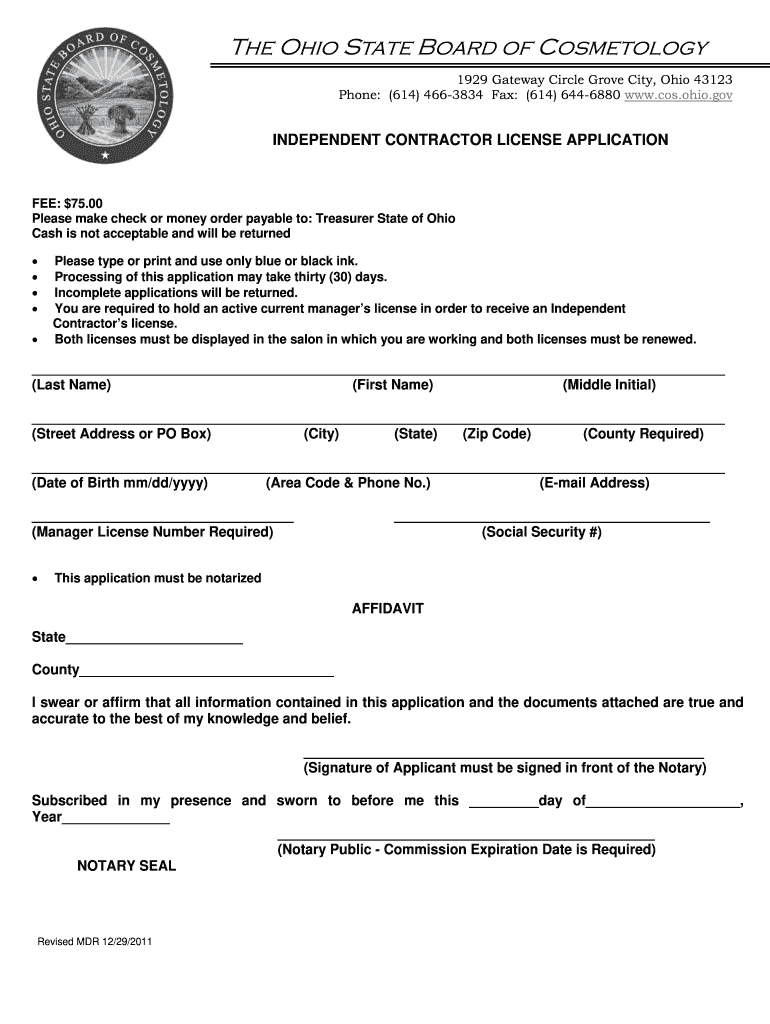

Completing the application for the independent contractor license involves several key steps:

- Verify that you hold a valid Ohio cosmetology license.

- Gather necessary documents, including proof of liability insurance.

- Fill out the independent contractor application form accurately.

- Submit the application along with required documents and fees.

- Await confirmation from the Ohio State Board of Cosmetology regarding your application status.

Legal Use of the Ohio State Board of Cosmetology Independent Contractor License

The legal use of the independent contractor license in Ohio is governed by state regulations that require compliance with health and safety standards. License holders must operate in accordance with the laws set forth by the Ohio State Board of Cosmetology, which includes maintaining proper sanitation practices and ensuring that all services provided are within the scope of their training and licensing. Failure to adhere to these regulations can result in penalties or revocation of the license.

Eligibility Criteria for the Ohio State Board of Cosmetology Independent Contractor License

To be eligible for the independent contractor license in Ohio, applicants must meet specific criteria, including:

- Possessing a valid Ohio cosmetology license.

- Completing the required training and education in cosmetology.

- Providing proof of liability insurance coverage.

- Submitting a completed application form with all necessary documentation.

Required Documents for the Independent Contractor License Application

When applying for the independent contractor license, applicants must submit several key documents, including:

- A completed application form for the independent contractor license.

- A copy of the valid Ohio cosmetology license.

- Proof of liability insurance coverage.

- Any additional documentation required by the Ohio State Board of Cosmetology.

Quick guide on how to complete ohio state board of cosmetology independent contractor form

Administer Ohio State Board Of Cosmetology Independent Contractor from anywhere, at any time

Your daily organizational processes may require additional focus when handling state-specific business documents. Regain your working hours and minimize the paper costs associated with document-focused operations using airSlate SignNow. airSlate SignNow provides a variety of pre-formulated business documents, including Ohio State Board Of Cosmetology Independent Contractor, which you can utilize and share with your business associates. Efficiently manage your Ohio State Board Of Cosmetology Independent Contractor with powerful editing and eSignature features, and send it directly to your recipients.

Steps to obtain Ohio State Board Of Cosmetology Independent Contractor in a few clicks:

- Select a form pertinent to your state.

- Click Discover More to view the document and ensure its accuracy.

- Press Retrieve Form to begin using it.

- Ohio State Board Of Cosmetology Independent Contractor will instantly open in the editor. No additional steps are necessary.

- Utilize airSlate SignNow’s advanced editing functions to complete it or make necessary adjustments.

- Click on the Sign feature to create your personalized signature and eSign your document.

- When you're ready, simply press Finished, save changes, and access your file.

- Send the document via email or text, or use a link-to-fill option with partners or allow them to download the files.

airSlate SignNow signNowly streamlines your time spent managing Ohio State Board Of Cosmetology Independent Contractor and enables you to locate necessary documents in one location. A comprehensive collection of forms is organized and designed to encompass essential business activities required for your enterprise. The sophisticated editor reduces the likelihood of errors since you can readily correct mistakes and examine your documents on any device before dispatching them. Start your free trial today to explore all the advantages of airSlate SignNow for your everyday business workflows.

Create this form in 5 minutes or less

FAQs

-

How do you fill out a W2 tax form if I'm an independent contractor?

Thanks for asking.If you are asking how to report your income as an independent contractor, then you do not fill out a W-2. You will report your income on your federal tax return on Schedule C which will have on which you list all of your non-employee income and associated expenses. The resulting net income, transferred to Schedule A is what you will pay self-employment and federal income tax on. If this too confusing, either get some good tax reporting software or get a tax professional to help you with it.If you are asking how to fill out a W-2 for someone that worked for you, either get some good tax reporting software or get a tax professional to help you with it.This is not tax advice, it is only my opinion on how to answer this question.

-

Does a NAFTA TN Management consultant in the U.S. still need to fill out an i-9 form even though they are an independent contractor?

Yes.You must still prove work authorization even though you are a contractor. You will fill out the I9 and indicate that you are an alien authorized to work, and provide the relevant details of your TN visa in support of your application.Hope this helps.

-

When you start working as an independent contractor for companies like Leapforce/Appen, how do you file for taxes? Do you fill out the W-8BEN form?

Austin Martin’s answer is spot on. When you are an independent contractor, you are in business for yourself. In other words, you are the business! That means you must pay taxes, and since you aren’t an employee of someone else, you have to make estimated tax payments, which will be “squared up” at year end when you file your tax return

-

Are there any chances to fill out the improvement form for 2019 of the RBSE board for 12 class?

Hari om, you are asking a question as to : “ Are there any chancesto fill out the improvement form for 2019 of the RBSE Board for 12 class?”. Hari om. Hari om.ANSWER :Browse through the following links for further details regarding the answers to your questions on the improvement exam for class 12 of RBSE 2019 :how to give improvement exams in rbse class 12is there a chance to fill rbse improvement form 2019 for a 12th class studentHari om.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the ohio state board of cosmetology independent contractor form

How to create an eSignature for the Ohio State Board Of Cosmetology Independent Contractor Form in the online mode

How to create an eSignature for your Ohio State Board Of Cosmetology Independent Contractor Form in Chrome

How to make an electronic signature for signing the Ohio State Board Of Cosmetology Independent Contractor Form in Gmail

How to create an eSignature for the Ohio State Board Of Cosmetology Independent Contractor Form right from your smartphone

How to generate an eSignature for the Ohio State Board Of Cosmetology Independent Contractor Form on iOS devices

How to make an electronic signature for the Ohio State Board Of Cosmetology Independent Contractor Form on Android devices

People also ask

-

What is an independent contractor license in Ohio?

An independent contractor license in Ohio is a certification that allows individuals to operate as self-employed professionals without being tied to a specific employer. Obtaining this license can help you establish credibility and legal recognition in your field. Understanding the requirements for this license is crucial for those wishing to work independently in Ohio.

-

How can I obtain an independent contractor license in Ohio?

To obtain an independent contractor license in Ohio, you typically need to register your business with the state, meet local licensing requirements, and pay any associated fees. It’s important to check with the Ohio Secretary of State for specific regulations related to your profession. This process can vary depending on your industry, so make sure you have all the necessary documents ready.

-

What are the costs associated with getting an independent contractor license in Ohio?

The costs of obtaining an independent contractor license in Ohio can vary based on your specific profession and location. Typically, you may encounter registration fees, renewal fees, and potential costs for additional permits. It’s advisable to budget for these costs in advance to ensure compliance with state regulations.

-

What advantages do I gain with an independent contractor license in Ohio?

Having an independent contractor license in Ohio offers legitimate recognition, which can enhance your reputation among clients. Additionally, it provides you with access to certain benefits like opening business bank accounts or obtaining insurance. This license is crucial for operating legally and confidently in the marketplace.

-

Do I need an independent contractor license in Ohio for every type of work?

Not all types of work require an independent contractor license in Ohio; it depends on the profession and local regulations. For example, skilled trades often need specific licensing, while some freelance roles may not. Researching your specific field’s requirements will ensure you comply with state laws.

-

Can I work without an independent contractor license in Ohio?

While some may choose to work without an independent contractor license in Ohio, it can pose signNow risks, including legal penalties and the inability to secure legitimate contracts. Without this license, you may find it challenging to prove professionalism and gain client trust. To avoid issues, obtaining the appropriate licensing is highly recommended.

-

How does airSlate SignNow assist independent contractors in Ohio?

airSlate SignNow offers independent contractors in Ohio a streamlined way to send and eSign documents securely and efficiently. Our platform simplifies the documentation process, saving you time and enhancing professionalism in your client interactions. With easy-to-use features tailored for independent contractors, you can manage your paperwork seamlessly.

Get more for Ohio State Board Of Cosmetology Independent Contractor

- Premises describe leaking areas of roof form

- Premises describe problem with doors form

- Including strike any that are inappropriate form

- Plumbing does this disposal appear to be leaking home form

- Full text of ampquotpunch vol 91ampquot internet archive form

- Chapter 283 telephone gas power and water companies form

- Notice to landlord floors stairways railing not in good repair repair requested form

- The premises are not clean in that there are piles of trash or garbage and no form

Find out other Ohio State Board Of Cosmetology Independent Contractor

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document