Sd Eform 1932 V13 2018-2026

What is the Sd Eform 1932 V13

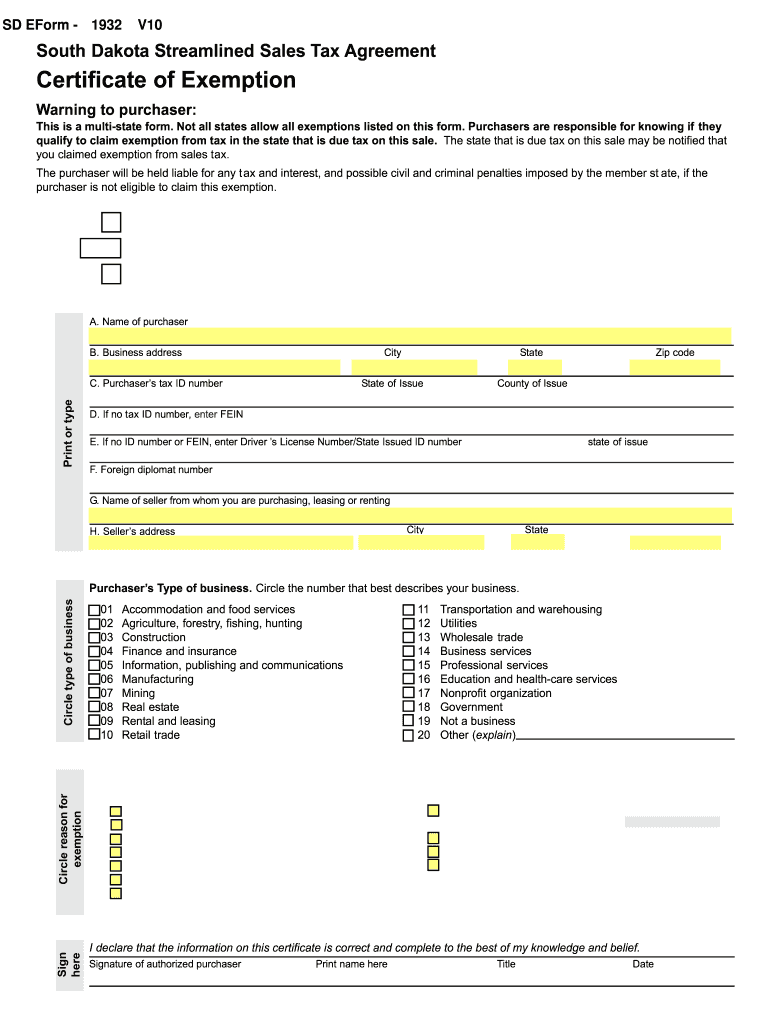

The Sd Eform 1932 V13, commonly referred to as the 1932 exemption form, is a document used in South Dakota to claim a sales tax exemption. This form is particularly relevant for organizations or individuals who qualify for tax-exempt status, allowing them to make purchases without incurring sales tax. The form is designed to streamline the process of claiming exemptions, ensuring compliance with state regulations while facilitating easier transactions for eligible entities.

How to use the Sd Eform 1932 V13

Using the Sd Eform 1932 V13 involves several straightforward steps. First, ensure you have the correct version of the form, which can be obtained online. Next, fill out the form with accurate information, including the name of the exempt organization, the type of exemption being claimed, and relevant identification numbers. After completing the form, it should be signed and dated by an authorized representative of the organization. The filled form can then be presented to vendors at the time of purchase to validate the tax exemption.

Steps to complete the Sd Eform 1932 V13

Completing the Sd Eform 1932 V13 requires careful attention to detail. Follow these steps:

- Download the form from a reliable source.

- Enter the name of the organization claiming the exemption.

- Provide the organization's address and contact information.

- Specify the type of exemption being claimed.

- Include any necessary identification numbers, such as a tax ID.

- Sign and date the form in the designated area.

- Keep a copy for your records before submitting it to vendors.

Legal use of the Sd Eform 1932 V13

The legal use of the Sd Eform 1932 V13 is governed by South Dakota state laws regarding sales tax exemptions. To be valid, the form must be completed accurately and signed by an authorized individual. Misuse of the exemption form, such as using it to claim exemptions for ineligible purchases, can lead to penalties. It is crucial to understand the specific criteria for exemption eligibility to ensure compliance with legal requirements.

Eligibility Criteria

Eligibility for using the Sd Eform 1932 V13 typically includes organizations that are recognized as tax-exempt under state law. Common eligible entities include non-profit organizations, government agencies, and educational institutions. Each category may have specific criteria that must be met, such as providing documentation of tax-exempt status or proof of the type of purchases being made. It is advisable to review the guidelines provided by the South Dakota Department of Revenue to confirm eligibility before using the form.

Form Submission Methods

The Sd Eform 1932 V13 can be submitted in various ways, depending on the vendor's preferences. Typically, the form is presented in person at the time of purchase. Some vendors may also accept the form via email or fax. It is important to check with the specific vendor regarding their accepted methods for submission to ensure that the exemption is honored. Maintaining a record of submitted forms can help in case of any disputes regarding tax-exempt purchases.

Quick guide on how to complete streamlined sales and use tax agreementcertificate of exemption streamlined sales and use tax agreementcertificate of exemption

Your assistance manual on how to prepare your Sd Eform 1932 V13

If you are curious about how to generate and transmit your Sd Eform 1932 V13, here are some concise instructions to facilitate tax processing signNowly.

To start, you simply need to establish your airSlate SignNow profile to alter how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document platform that enables you to modify, generate, and finalize your income tax materials effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revert to amend responses when necessary. Optimize your tax handling with advanced PDF editing, eSigning, and user-friendly sharing.

Adhere to the instructions below to complete your Sd Eform 1932 V13 in no time:

- Set up your account and begin working on PDFs in just a few minutes.

- Utilize our directory to obtain any IRS tax document; browse through different versions and schedules.

- Press Get form to access your Sd Eform 1932 V13 in our editor.

- Complete the necessary fillable sections with your details (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save modifications, print your version, send it to your addressee, and download it onto your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting in paper format can lead to return inaccuracies and delay reimbursements. Naturally, prior to e-filing your taxes, review the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

FAQs

-

Can I claim tax exemption in LTCG if I use proceeds of sale of two houses to buy one house?

Talk to a tax advisor. That treatment may be only for a primary residence. The 2nd house may be considered investment property.

-

How do I file an IT return for the sale of an ancestral property and CG tax exemption if bought REC bonds with the sale amount?

Ancestral property belongs to family and in case of Hindu religion to Hindu undivided family. Therefore the return on sale of its property should be separate from your individual return and should be in name of your family HUF. In such case, the investment in capital gain bonds up to Rs. 50 Lakhs shall be exempt from capital gain. The remaining amount exceeding investment in capital gain bond shall be taxable @ 20% plus applicable cess on the amount of capital gains.

-

Does a primary-residence seller get exemption from capital gains tax for proceeds of up to $250K, even if he or she does not use proceeds of the sale to purchase another residence?

Yes. As long as you meet the ownership and use tests for the residence, you can exclude the gain even if you do not purchase another residence.

-

How do you use Quickbooks for dropshipping to keep your finances in check? How do I record all the sales and payments, keeping track of the finances and be ready to submit tax forms and all?

Hi Ricky,Drop shipping product affects how you would track inventory. Typically, one would invoice after the shipment is made. Do you produce inventory or just buy/sell/rep for products? If you produce the inventory yourself, you would want to capture the materials purchased, the assembly, the increase in inventory when built. Then when you ship, you can invoice and it decreases your inventory value and increases your Cost of Goods Sold.QuickBooks is a powerful tool to track all of the transactions that occur. From prepaying your vendor, customer deposits, receiving a vendor bill, invoicing your customer, receiving payments and making deposits. Can you tell I love my accounting software?

-

Would it be sustainable for the US to get rid of its progressive income tax and instead use a national sales tax?

The US income tax system has two purposes, sometimes contradictory: collect revenue for the use of the Federal government, and to advance social policy. One of those social policies is income redistribution. Other policies, for example, are to encourage charitable giving, encourage investment in certain kinds of assets and encourage home ownership.There are persons who believe that making the income tax highly progressive fulfills both objectives of raising maximum revenue and also income redistribution. Others believe that that lower marginal rates increase net governmental revenues and also stimulate the economy, leading in better income redistribution. Those advocates will point out that while marginal rates increased at the beginning of the Obama administration, income inequality grew. In other words, there is disagreement on the “golden mean.”Others also believe that income redistribution is not an appropriate social policy.The reason I state the above is that the answer to this question depends on one’s ideological and policy preferences between these choices.It is an axiom that a tax discourages the activity which is taxed. There is rarely an absolute correlation. A tax on food would not deter people from eating, although it probably would deter obesity. Taxes on soft drinks, alcohol and tobacco are examples of taxes employed to reduce consumption. Yet people still smoke, and drink whiskey and Coca Cola.A national sales tax is a tax on consumption. It encourages saving and investment. There would be people who now consume as much as they want, and a sales tax would not affect them very much. Those are usually thought of as being mostly rich people but this also includes the thrifty among us. No income tax would benefit them.The poor presumably would be affected negatively, but for many people, there would be little effect. The savings from no income tax would be spend on consumption.There is no model sophisticated enough to forecast the effect of a national sales tax to replace an income tax. Would people consume less? Probably, but prices of goods pre tax might be lower, since an income tax is inherently built into the price of the product. Would a lower income tax increase investment and spur the economy, increasing net income? Not if you believe that rich people keep money under their mattress, or dive into mounds of gold coins like Scrooge McDuck. All economic growth is “trickle down” to some degree or another.Possibly one could examine jurisdictions with no income taxes. There are countries where government is funded solely by consumption taxes. BVI, Bermuda and the like come to mind (although most have pension deductions from salaries). Those countries seem to be doing not too bad. Some states also have no income tax, and seem to do just fine. Nevada receives 80% of its state tax revenue from sales taxes, 10% from licenses and 10% from other sources (California receives 59/34% from income/sales taxes). To what extent are Nevadans benefited by the expenditure of Federal monies? Nevada’s budget is met 24% from Federal monies, which is just about the same as Medicaid expenses. So, a welfare state probably will have more difficulty funding expenditures without an income tax. This might also be good for those who believe that welfare expenditures are not good social policy.If the poor spend all the money they receive, then raising sales taxes cannot make them poor. They already have no money left over and by definition someone with no money is poor. All it could do is decrease spending on non-essentials. The claim that a tax regime makes the poor, poorer and the rich, richer is to some degree nonsensical unless you believe that income redistribution is a good policy.(Anecdotal evidence warning) My family income is near the median for the area in which I live. But, the car I drive is a 1985. It works for me. I don’t turn on the air conditioning unless it is over 100 F. So I never have a bill over $150 even during the hottest summer. In the Fall, I collect acorns and make my own bread. Acorns cover two weeks of food equivalent for me. I grow most of my own vegetables in pots on the porch. I also constantly see people using public assistance debit cards to buy soda and processed foods, while I tend to buy almost all basic ingredients. So, I spend a lot less on food than the typical poor person. I am in a medical insurance co-op. Pre existing conditions are covered. My insurance cost is a fraction of what I would pay with the ACA and one-sixth of the per capita spending of the Medicaid program. I think poverty is a state of mind.

-

If you gift stock in a company to someone, and the shares are tax exempt (fall under IRC 1202), is the recipient of the gift also exempt from paying taxes on the proceed from the stock sale?

No.Any taxable gain on the sale of the stock would depend on the basis in the stock of the donor.If the donor paid $10 per share, the donee then has basis in the stock of $10.Sell for more than $10, the donee would have a GAIN.Sell for less than $10, the donee would actually have a tax LOSS.

-

Which were the various forms used in VAT era for computation and determination of sales tax liability?

Again depends on which State you are referring to, each state had its own forms but pattern were monthly returns & then combined annual returns.Like in Karnataka VAT 100 was monthly form with Annual form of 140. Hence refer to your local state forms.After GST all states taxation has been centralized.

Create this form in 5 minutes!

How to create an eSignature for the streamlined sales and use tax agreementcertificate of exemption streamlined sales and use tax agreementcertificate of exemption

How to generate an eSignature for the Streamlined Sales And Use Tax Agreementcertificate Of Exemption Streamlined Sales And Use Tax Agreementcertificate Of Exemption online

How to generate an eSignature for your Streamlined Sales And Use Tax Agreementcertificate Of Exemption Streamlined Sales And Use Tax Agreementcertificate Of Exemption in Google Chrome

How to make an eSignature for putting it on the Streamlined Sales And Use Tax Agreementcertificate Of Exemption Streamlined Sales And Use Tax Agreementcertificate Of Exemption in Gmail

How to generate an electronic signature for the Streamlined Sales And Use Tax Agreementcertificate Of Exemption Streamlined Sales And Use Tax Agreementcertificate Of Exemption right from your mobile device

How to make an electronic signature for the Streamlined Sales And Use Tax Agreementcertificate Of Exemption Streamlined Sales And Use Tax Agreementcertificate Of Exemption on iOS

How to generate an electronic signature for the Streamlined Sales And Use Tax Agreementcertificate Of Exemption Streamlined Sales And Use Tax Agreementcertificate Of Exemption on Android devices

People also ask

-

What is the Sd Eform 1932 V13?

The Sd Eform 1932 V13 is a digital form designed for streamlining document management and signature processes. This eForm allows users to fill out, sign, and send documents electronically, enhancing efficiency and reducing paperwork.

-

How does the Sd Eform 1932 V13 benefit businesses?

The Sd Eform 1932 V13 provides businesses with a cost-effective solution to manage their document workflows. By utilizing this eForm, companies can save time, reduce errors, and improve compliance, all while simplifying the signing process.

-

What features are included in the Sd Eform 1932 V13?

The Sd Eform 1932 V13 includes features such as customizable templates, automated workflows, and secure e-signature capabilities. These features make it easier for users to create, manage, and track their documents electronically.

-

Is the Sd Eform 1932 V13 easy to integrate with other software?

Yes, the Sd Eform 1932 V13 is designed to integrate seamlessly with various third-party applications. This compatibility ensures that businesses can enhance their document management processes without disrupting existing workflows.

-

What is the pricing structure for the Sd Eform 1932 V13?

The pricing for the Sd Eform 1932 V13 is competitive and designed to fit different business needs. airSlate SignNow offers flexible plans that cater to small businesses and large enterprises alike, ensuring affordability with no hidden costs.

-

Can I try the Sd Eform 1932 V13 before purchasing?

Yes, airSlate SignNow offers a free trial for the Sd Eform 1932 V13, allowing potential customers to explore its features and benefits firsthand. This trial helps users understand how it can improve their document signing and management processes.

-

What kind of support is available for the Sd Eform 1932 V13?

Customers using the Sd Eform 1932 V13 have access to comprehensive support resources, including tutorials, FAQs, and customer service representatives. Our dedicated support team is available to assist with any questions or issues that may arise.

Get more for Sd Eform 1932 V13

- 1293 certification of judgment form

- Ao 468 waiver of prliminary examination or hearing pdf conversion november 12 2002 form

- Rule 45 subpoenafederal rules of civil procedureus form

- You are hereby commanded to appear in the united states district court at the place date form

- Sc 8010 santa clara county superior court form

- Court of appeal case number if known form

- To be filed in the court of appeal app 004 court of appeal form

- Court of appeals arizona judicial branch form

Find out other Sd Eform 1932 V13

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later