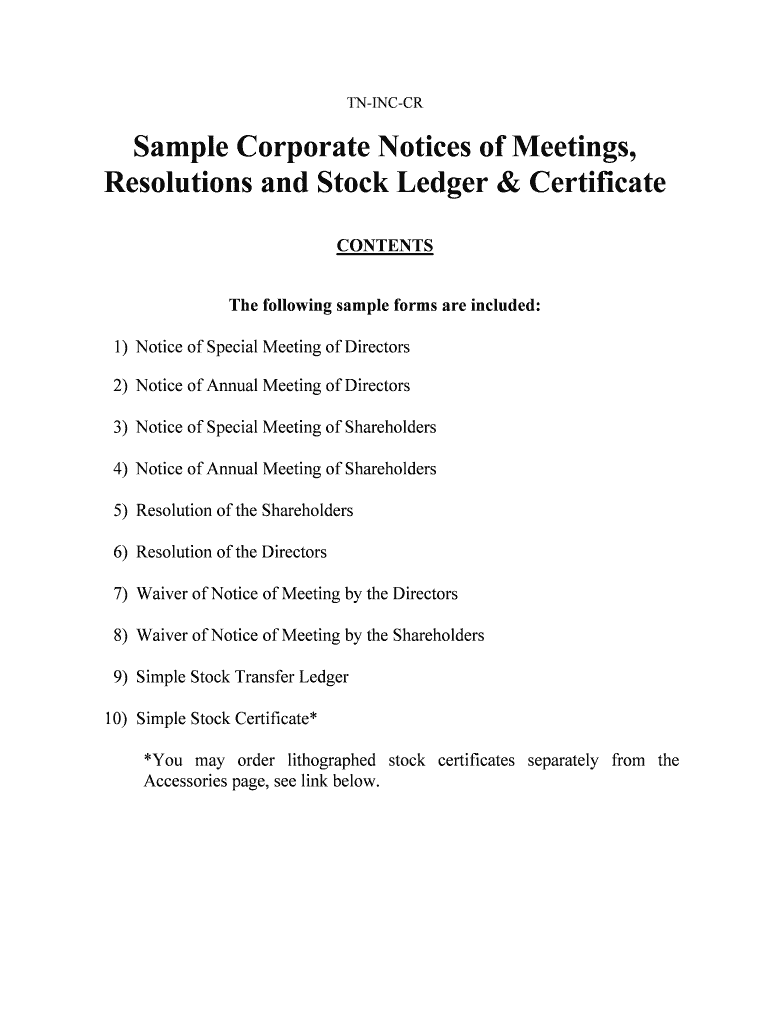

TN INC CR Form

What is the TN INC CR

The TN INC CR form is a crucial document for businesses operating in the United States, specifically for those looking to register or incorporate in Tennessee. This form is essential for establishing a corporation and provides the necessary information to the state regarding the business structure, ownership, and operational details. By completing the TN INC CR, businesses can ensure compliance with state regulations and gain legal recognition, which is vital for conducting business activities within Tennessee.

Steps to complete the TN INC CR

Completing the TN INC CR form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the business, including its name, address, and the names of the directors and officers. Next, fill out the form with precise details, ensuring that all sections are completed as required. After filling out the form, review it for any errors or omissions. Once confirmed, submit the form to the appropriate state office along with any required fees. It is important to retain a copy for your records.

How to obtain the TN INC CR

To obtain the TN INC CR form, businesses can visit the official Tennessee Secretary of State website, where the form is available for download. Alternatively, businesses can request a physical copy by contacting the Secretary of State's office directly. It is advisable to ensure that you are using the most current version of the form to avoid any compliance issues.

Legal use of the TN INC CR

The TN INC CR form serves a legal purpose in the incorporation process, making it essential for businesses to understand its implications. Once filed, the form establishes the business as a separate legal entity, which provides liability protection for its owners. Additionally, the information provided in the form becomes part of the public record, ensuring transparency and compliance with state laws. Proper use of this form is critical for maintaining the legal standing of the business.

Required Documents

When completing the TN INC CR form, several supporting documents may be required. These typically include a certificate of existence or good standing from the state, identification for the business owners, and any prior filings related to the business. It is important to check the specific requirements outlined by the Tennessee Secretary of State to ensure that all necessary documentation is included with the form submission.

State-specific rules for the TN INC CR

Tennessee has specific regulations that govern the completion and submission of the TN INC CR form. These rules include requirements for the business name, which must be unique and not misleading. Additionally, the form must be signed by an authorized individual, and any fees associated with the filing must be paid at the time of submission. Familiarizing yourself with these state-specific rules is essential for ensuring a smooth incorporation process.

Quick guide on how to complete tn inc cr

Effortlessly prepare TN INC CR on any device

Web-based document management has become increasingly favored by both organizations and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly without hassles. Manage TN INC CR on any device with the airSlate SignNow applications for Android or iOS, and enhance any document-driven process today.

How to edit and electronically sign TN INC CR effortlessly

- Obtain TN INC CR and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Verify all the details and then click the Done button to finalize your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and electronically sign TN INC CR to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is TN INC CR and how does it relate to airSlate SignNow?

TN INC CR refers to a business structure that many companies adopt for effective operations. With airSlate SignNow, organizations can streamline their document management processes and utilize eSigning features tailored for TN INC CR compliance, ensuring all signatures meet legal standards.

-

What pricing plans are available for airSlate SignNow tailored for TN INC CR?

airSlate SignNow offers competitive pricing plans suitable for TN INC CR businesses of all sizes. Plans include features such as unlimited document signing and customizable workflows, ensuring that your organization gets the best value while staying compliant with TN INC CR regulations.

-

What features does airSlate SignNow offer to enhance TN INC CR workflows?

airSlate SignNow includes features like document templates, e-signature tracking, and automated reminders, which can signNowly enhance your TN INC CR workflows. These tools ensure that all documents are processed efficiently, saving time and reducing errors.

-

How can airSlate SignNow benefit my TN INC CR operations?

By implementing airSlate SignNow, your TN INC CR operations can signNowly improve efficiency and reduce paperwork. The platform provides an easy-to-use interface for managing documents digitally, ensuring quicker turnaround times and enhanced collaboration among team members.

-

Does airSlate SignNow integrate with other tools for TN INC CR businesses?

Yes, airSlate SignNow offers robust integration options with various business applications, making it an ideal solution for TN INC CR organizations. You can seamlessly connect it with CRM systems, cloud storage, and other software, optimizing your overall operations.

-

Is airSlate SignNow secure for handling TN INC CR documents?

Absolutely, airSlate SignNow prioritizes security, implementing advanced encryption and compliance measures to protect TN INC CR documents. This ensures that all your sensitive information remains secure while meeting the necessary legal requirements.

-

How can I get started with airSlate SignNow for my TN INC CR needs?

Getting started with airSlate SignNow for your TN INC CR needs is simple. You can sign up for a free trial on our website, explore the features, and see how our platform can streamline your document processes before committing to a plan.

Get more for TN INC CR

- Business tax forms and publications for 2019 tax filing

- Resale certificate current 51a105 form

- Minnesota residency place an x in one box and enter other state of residency form

- Instructions for form nj 1065 instructions for form nj 1065

- Appointment of taxpayer representative form m 5008 r

- State of new jersey department of the form

- Nj 1040x amended resident return form

- Form l 9 affidavit for real property tax waiver resident decedent

Find out other TN INC CR

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy