Monthly Reporting Form RS 2402 Office of the New York State Osc State Ny

Understanding the Monthly Reporting Form RS-2402

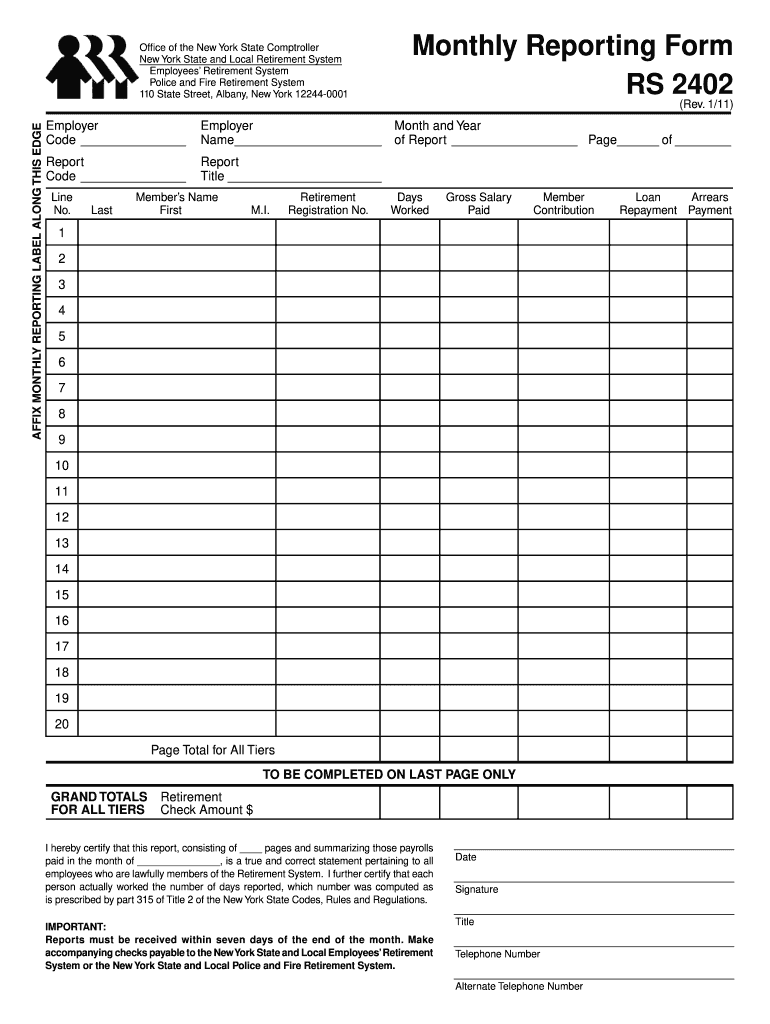

The Monthly Reporting Form RS-2402 is a crucial document used by employers in New York State to report wages, taxes withheld, and other relevant payroll information. This form is essential for compliance with state regulations and ensures that the Office of the New York State Comptroller (OSC) receives accurate data regarding employee compensation. Employers must be aware of the specific requirements and deadlines associated with this form to avoid penalties and ensure proper reporting.

Steps to Complete the Monthly Reporting Form RS-2402

Completing the Monthly Reporting Form RS-2402 involves several key steps:

- Gather all necessary payroll records for the reporting period.

- Fill out the form with accurate information regarding employee wages and tax withholdings.

- Ensure that all calculations are correct to avoid discrepancies.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline to the OSC.

Following these steps carefully will help ensure that the form is filled out correctly and submitted on time.

Legal Use of the Monthly Reporting Form RS-2402

The Monthly Reporting Form RS-2402 is legally binding and must be completed in accordance with New York State laws. Employers are required to submit this form to report wages paid and taxes withheld, which contributes to the state's overall tax revenue. Failure to comply with these requirements can result in penalties, including fines or additional scrutiny from the OSC. It is essential for employers to understand their legal obligations when using this form.

Obtaining the Monthly Reporting Form RS-2402

The Monthly Reporting Form RS-2402 can be obtained directly from the Office of the New York State Comptroller's website or through designated state offices. Employers should ensure they are using the most current version of the form to comply with any updates or changes in reporting requirements. Accessing the form online allows for easy downloading and printing, facilitating a smoother reporting process.

State-Specific Rules for the Monthly Reporting Form RS-2402

New York State has specific regulations governing the use of the Monthly Reporting Form RS-2402. Employers must adhere to the guidelines set forth by the OSC, which include deadlines for submission, the types of information required, and the method of reporting. Understanding these state-specific rules is critical for maintaining compliance and avoiding potential penalties.

Examples of Using the Monthly Reporting Form RS-2402

Employers may encounter various scenarios when using the Monthly Reporting Form RS-2402. For instance, a business may need to report changes in employee status, such as new hires or terminations, which can affect the information reported on the form. Additionally, seasonal businesses must accurately reflect fluctuations in payroll during peak and off-peak periods. These examples illustrate the importance of careful reporting to ensure compliance with state regulations.

Quick guide on how to complete monthly reporting form rs 2402 office of the new york state osc state ny

Effortlessly Prepare Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly and without issues. Manage Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Simplest Method to Alter and eSign Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny Without Hassle

- Obtain Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to store your modifications.

- Select your preferred method to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and eSign Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Is it possible to run a NY LLC out of the New York State and even out of the US?

Sure, it is possible.Registering Business in New YorkIf you decided to open a new business that will be based in New York you can choose from several options:Sole OwnersSole Proprietorship: Sole owners of New York-based businesses could opt for sole proprietorship as the easiest form of business organization. Not the most recommended, given the liability a sole proprietor assumes as a result of owning a business. No registration with New York State Department of State is necessary, but it is recommended to obtain a Business Certificate (DBA), and if you plan to hire employees then also obtain an EIN.Single Member LLC: Limited liability company, as the name suggests, is an entity that allows its owners to limit the liability of the business to the entity itself, shielding the owners' personal assets. This type of entity is recommended for most small businesses. By default your LLC will be taxed as "disregarded entity", meaning you will file your LLC tax return as part of your personal tax return. Keep in mind though - LLC is a flexible entity, which means you have the option of electing it to be taxed as S-Corp (assuming you are a U.S. person) or C-Corp. Learn more about LLC here, and about the details of forming LLC in New York here.Corporation: You can also form a corporation and be a sole shareholder with 100% of all shares. Corporations have more formalities than LLCs (for example in New York you are required to have bylaws and maintain minutes of meetings in corporate records), but provide similar limited liability protection. That's one of the reasons this entity type is often more suitable for bigger companies, or those who seek major investment. Corporations can be taxed as S-Corp or C-Corp, with each form of taxation having its pros and cons. Keep in mind, you can elect your corporation to be S-Corp only if you, as the sole shareholder, are a U.S. person. Learn more about corporations here, and about the details of incorporating in New York here.PartnersGeneral Partnership: Like sole proprietorship, this entity type does not require registration with the New York State Department of State, but it also does not protect the owners from business liability, and therefore is usually not recommended. A General Partnership needs to obtain a Business Certificate (DBA), and obtain an EIN.Multiple Member LLC: like Single Member LLC for sole owner, Multiple Member LLC is often the entity of choice for small and new businesses with more than one partner.Corporation: Since corporation can have many shareholders, and transfering ownership is relatively easy (though share transfer) corporation might be a good choice of entity for business with partners. Keep in mind though - S Corporations are limited to 100 shareholders who must be physical U.S. persons. That means corporations owned (partially or fully) by non-U.S. persons or legal entities, cannot be elected as S-Corp, and therefore subject to double taxation of an C-Corp. In cases like that it would be recommended to consider choosing LLC instead.Limited Partnerships: Limited partnerships come in different forms, depending on the state (LP, LLP, LLLP). Though Limited Partnerships have their own purpose and place, for most cases we believe an LLC would serve its owners well enough, therefore at this point we do not cover Limited Partnerships.Existing Out-of-State CompaniesAn existing company registered in another state or country (called "foreign corporation", "foreign LLC", etc) looking to conduct business in New York might be required to foreign qualify in New York. This rule typically applies to companies looking to open a physical branch in New York, lease an office or warehouse, hire employees, etc."Foreign" businesses that do not create "strong nexus" by moving physically to New York might still be required to obtain Certificate of Authority to Collect Sales Tax from New York Department of Taxation and Finance if selling taxable products or services using local dropshippers.

-

Should a resident of New York register their business in Delaware? The business will operate in NY before rolling out to other states.

Delaware native here!“Register” is a misleading term. Do you mean form your business in Delaware? That is usually when Delaware comes up — forming an entity (whether an LLC, a partnership, or a C Corporation) is fast and cheap in Delaware, especially compared to New York.It doesn’t really matter where you do business or when you’re rolling out to other states. The two most important things to consider in formation:The difficulty and expense of formation (annual taxes and filings due), andThe laws of the state that will govern your entity.Your business only becomes “a company” or “a corporation” because it is duly recognized as such under the laws of a state. Those laws (and the mechanism for disputes that occur under those laws) are different in every state.I have never heard a single argument for why New York is preferable to Delaware in either of those cases, and when I lived in New York, I filed for our company’s formation in Delaware. I’m in Texas today but happily pay Delaware’s annual franchise tax of $300.This is different than “registering,” which you may need to do as a foreign entity doing business or employing people in one or more stats. This definition (usually tied to a term like “nexus”) varies by state and it depends on the activity you’re engaged in. You may have to collect sales tax. You may have to provide worker’s comp. You may have to withhold employee taxes. The key distinction here is that you register when you have to do so because some activity you’re engaged in triggers the requirement. But you choose where you form your entity and it really doesn’t have a lot to do with your location.

-

What forms do I need to fill out to sue a police officer for civil rights violations? Where do I collect these forms, which court do I submit them to, and how do I actually submit those forms? If relevant, the state is Virginia.

What is relevant, is that you need a lawyer to do this successfully. Civil rights is an area of law that for practical purposes cannot be understood without training. The police officer will have several experts defending if you sue. Unless you have a lawyer you will be out of luck. If you post details on line, the LEO's lawyers will be able to use this for their purpose. You need a lawyer who knows civil rights in your jurisdiction.Don't try this by yourself.Get a lawyer. Most of the time initial consultations are free.

-

What do you think of the New York Times report that states that Donald Trump’s doctor diagnosed him with bone spurs to get him out of the Vietnam War as a favor to Donald’s father, Fred Trump?

I remember when the MSM , said Bush was a draft dodger , then it came out sometime later after the media slandered Bush that he actually volunteered for service in Vietnam but was declined as a pilot because he did not have enough flight hours .The LAME stream media never prints retractions of these types of story’s they just throw slander around like the liberals who read their articles without a care in the world for things like facts and evidence ,They media likes to tout bad poll numbers on politicians but never mentions they have less then a 14 percent approval rating .The media has such low poll numbers for a reason , no one believes much they have to say .

-

How do I get a loved one out of a voluntary commitment to a mental hospital in New York State? The conditions and treatment there are making her worse.

talk to an attorney about it. i don’t think there’s anything you can do if you don’t have legal custody of the person. or, if possible, take action as far as her treatment is concerned. go in and speak with the director, if possible, with a big, yellow legal pad and take notes. if you still can’t get anywhere, call up a couple of newspapers and get some nosy reporters on their backs. that usually does the trick. good luck!!

-

I was sentenced to 30 days house arrest and 12 months probation by the state of Pennsylvania (misdemeanor). I currently live in New York. Will I be able to return home to NY after completing my 30 days of house arrest?

That's one hell of a sentence for a misdemeanor. I would fire your current attorney, if you bothered to get one.I take it that you are unemployed and have a relative or very close friend who lives in Pennsylvania because, if not, how do they plan on your spending 30 days of house arrest in a state where you don't live? And what are you supposed to use to buy food and pay your debts if you cannot earn a living?Did you take the above sentence as a plea bargain? Because it's a terrible sentence that you most likely are going to fail at, simply because you don't live in the state and trying to serve it will likely cause you serious financial problems. Your attorney should have discussed that with the court and the prosecution as some people might be inclined to leave the jurisdiction rather than serving such a difficult sentence.You need to discuss this matter with an attorney. He or she should be able to help obtain a sentence modification where you aren't harmed financially and that can be completed by a brief period of incarceration or some program in your home state, especially since Pennsylvania and Ne York border one another.Not that I would ever want to be in a similar situation, but if I was , I would have to carefully consider whether or not to remain in Pennsylvania to serve a misdemeanor sentence given the fact that extradition is extremely unlikely to happen.

Create this form in 5 minutes!

How to create an eSignature for the monthly reporting form rs 2402 office of the new york state osc state ny

How to generate an eSignature for your Monthly Reporting Form Rs 2402 Office Of The New York State Osc State Ny in the online mode

How to make an eSignature for your Monthly Reporting Form Rs 2402 Office Of The New York State Osc State Ny in Chrome

How to create an eSignature for signing the Monthly Reporting Form Rs 2402 Office Of The New York State Osc State Ny in Gmail

How to create an electronic signature for the Monthly Reporting Form Rs 2402 Office Of The New York State Osc State Ny from your smart phone

How to create an electronic signature for the Monthly Reporting Form Rs 2402 Office Of The New York State Osc State Ny on iOS devices

How to generate an electronic signature for the Monthly Reporting Form Rs 2402 Office Of The New York State Osc State Ny on Android OS

People also ask

-

What is the Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny?

The Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny is a document required for reporting financial information to the Office of the New York State Comptroller. This form helps ensure compliance with state regulations and provides transparency in financial reporting. Utilizing airSlate SignNow can streamline the completion and submission process for this form.

-

How can airSlate SignNow help with the Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny?

airSlate SignNow simplifies the process of filling out and submitting the Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny by allowing users to eSign and send documents digitally. This not only saves time but also reduces the likelihood of errors and enhances record-keeping. With its user-friendly interface, you can efficiently manage your reporting tasks.

-

Is there a cost associated with using airSlate SignNow for the Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for those who need to complete the Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny. The plans are designed to be cost-effective, ensuring that small and large businesses alike can find a solution that fits their budget while benefiting from robust features.

-

What features does airSlate SignNow provide for handling the Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, making it ideal for managing the Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny. These features enhance efficiency by allowing users to create, sign, and store documents all in one platform. Additionally, real-time tracking ensures you never miss a submission deadline.

-

Can I integrate airSlate SignNow with other tools while working on the Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny?

Absolutely! airSlate SignNow allows for seamless integration with various software applications, making it easy to incorporate your existing tools while working on the Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny. This flexibility helps streamline your workflows and ensures that all your data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for the Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny?

Using airSlate SignNow for the Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny offers numerous benefits, including reduced processing time, enhanced accuracy, and improved compliance with state regulations. The platform's electronic signature capabilities allow for quick approvals, while cloud storage ensures that your documents are safe and easily accessible.

-

Is airSlate SignNow secure for submitting the Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny?

Yes, airSlate SignNow prioritizes security, employing industry-standard encryption to protect your data while submitting the Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny. The platform also complies with various data protection regulations, giving you peace of mind that your sensitive information is safe during the entire document lifecycle.

Get more for Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny

- Cause of action products liability 98216 cause of action products liability 98216 form

- Personal injury property damage complaint california courts form

- Cross defendant form

- Notice and acknowledgment of receipt civil form

- Shc civ 05 orange county superior court form

- Attachment to proof of service form

- Essential forms 42 for windows california courts cagov

- Fillable online pos 030d fax email print pdffiller form

Find out other Monthly Reporting Form RS 2402 Office Of The New York State Osc State Ny

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now