Standard Voucher 1994-2026

What is the Standard Voucher

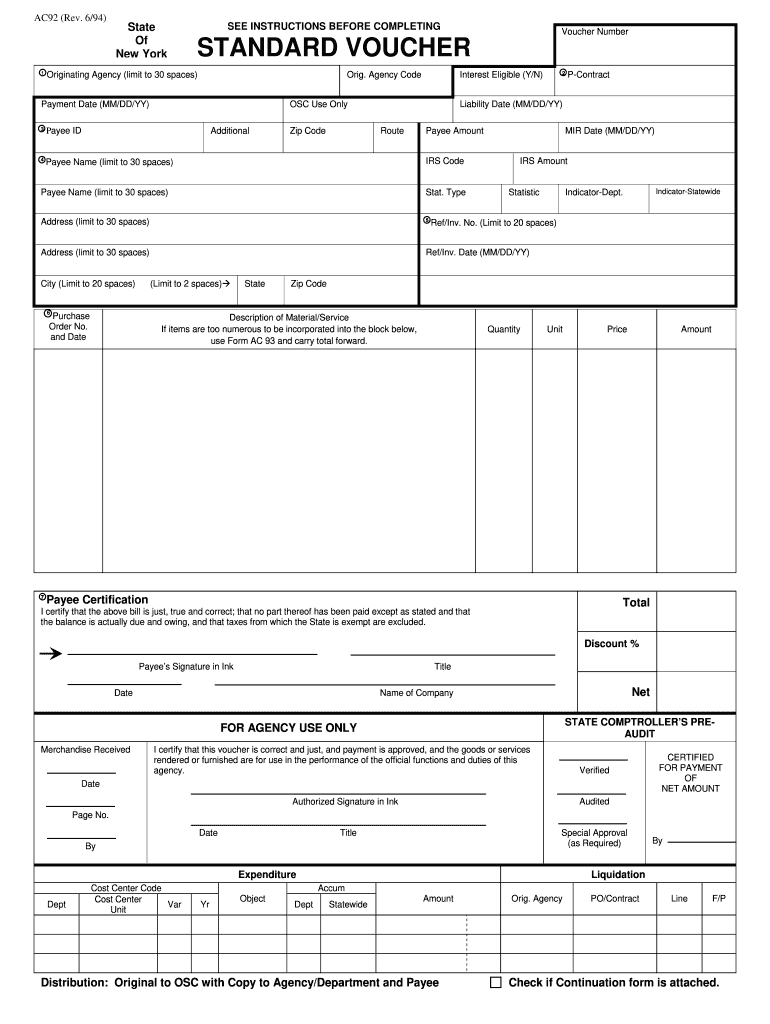

The standard voucher is a crucial document used primarily in New York State for various official purposes, including tax reporting and educational assessments. This form serves as a means to verify and document financial transactions or claims. It is essential for individuals and businesses to understand its role within the broader context of compliance and record-keeping.

How to use the Standard Voucher

Using the standard voucher involves several straightforward steps. First, ensure that you have the correct version of the form, as variations may exist for different purposes. Next, fill in the required fields accurately, providing all necessary information, such as your name, address, and any relevant identification numbers. Once completed, the voucher can be submitted electronically or via traditional mail, depending on the requirements of the specific agency or organization requesting it.

Steps to complete the Standard Voucher

Completing the standard voucher requires careful attention to detail. Follow these steps:

- Obtain the correct form from an official source.

- Fill in your personal information, including your name and address.

- Provide any required identification numbers or codes.

- Clearly state the purpose of the voucher and any related financial details.

- Review the form for accuracy before submission.

Taking these steps ensures that your voucher is processed without delays.

Legal use of the Standard Voucher

The legal use of the standard voucher is governed by specific regulations and guidelines. It is important to ensure that the form is used in compliance with state laws and agency requirements. For instance, when filing taxes or applying for educational assessments, the voucher must accurately reflect the information being reported. Misuse or inaccuracies can lead to penalties or legal complications.

Key elements of the Standard Voucher

Key elements of the standard voucher include:

- Identification Information: This includes the name, address, and identification numbers of the individual or entity submitting the voucher.

- Purpose Statement: A clear declaration of the purpose for which the voucher is being submitted.

- Financial Details: Any relevant financial information that supports the claims made on the voucher.

- Signature: A signature is often required to validate the form, confirming that the information provided is accurate.

Filing Deadlines / Important Dates

Filing deadlines for the standard voucher can vary based on its purpose. For tax-related vouchers, it is essential to adhere to the IRS deadlines to avoid penalties. Educational assessments may also have specific submission dates. Always check the relevant agency’s guidelines to ensure timely filing.

Quick guide on how to complete nys standard voucher ac92 fillable form

Your assistance manual on how to prepare your Standard Voucher

If you’re wondering how to create and file your Standard Voucher, here are some brief guidelines on how to simplify tax processing.

To begin, you just need to set up your airSlate SignNow account to change how you manage documents online. airSlate SignNow is a very user-friendly and robust document solution that enables you to modify, generate, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to update information whenever necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Standard Voucher in a matter of minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Obtain form to open your Standard Voucher in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Use the Signing Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and fix any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that submitting in hard copy may increase return discrepancies and delay refunds. Before e-filing your taxes, ensure to verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

How do I write qualification details in order to fill out the AIIMS application form if a student is appearing in 12th standard?

There must be provision in the form for those who are taking 12 th board exam this year , so go through the form properly before filling it .

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the nys standard voucher ac92 fillable form

How to create an eSignature for the Nys Standard Voucher Ac92 Fillable Form online

How to create an electronic signature for your Nys Standard Voucher Ac92 Fillable Form in Google Chrome

How to generate an electronic signature for signing the Nys Standard Voucher Ac92 Fillable Form in Gmail

How to create an electronic signature for the Nys Standard Voucher Ac92 Fillable Form straight from your smartphone

How to create an eSignature for the Nys Standard Voucher Ac92 Fillable Form on iOS

How to create an eSignature for the Nys Standard Voucher Ac92 Fillable Form on Android devices

People also ask

-

What is a standard voucher in the context of airSlate SignNow?

A standard voucher is a digital document provided by airSlate SignNow that enables businesses to efficiently manage transactions and agreements. It serves as a legally binding contract, facilitating seamless communication and signatures between parties.

-

How does airSlate SignNow enhance the use of standard vouchers?

airSlate SignNow streamlines the process of creating, sending, and managing standard vouchers. Its easy-to-use platform allows users to quickly upload templates, customize fields, and seamlessly obtain eSignatures, making the entire process efficient and user-friendly.

-

What are the pricing options for using standard vouchers with airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different business needs. For using standard vouchers, you can choose from monthly or yearly subscription options that provide flexibility and access to features essential for managing your documents effectively.

-

Can I integrate airSlate SignNow with other applications to manage standard vouchers?

Yes, airSlate SignNow supports integrations with numerous applications such as Google Drive, Salesforce, and Zapier. This allows for seamless collaboration and ensures that your workflow involving standard vouchers remains efficient across different platforms.

-

What features make airSlate SignNow ideal for managing standard vouchers?

Key features of airSlate SignNow include customizable templates, automated workflows, and secure eSignature options. These functionalities not only enhance the efficiency of handling standard vouchers but also improve document compliance and tracking.

-

What are the benefits of using standard vouchers with airSlate SignNow?

Using standard vouchers with airSlate SignNow provides businesses with faster turnaround times, reduced paperwork, and enhanced security. It empowers users to manage their agreements electronically, thus promoting eco-friendliness and operational efficiency.

-

Is it easy to track the status of standard vouchers in airSlate SignNow?

Absolutely! airSlate SignNow offers real-time tracking of standard vouchers, allowing you to monitor the progress of each document. You receive notifications when a voucher is viewed, signed, or completed, ensuring you are always informed.

Get more for Standard Voucher

- Ampquotampquotcertificate of independent review i have reviewed attorneys name and have form

- Terms and policy service agreement for northwest form

- Dwc claims administrator information california department

- State of colorado department of labor and employment form

- Power of attorney us legal forms

- Case initiation document form

- Vra dmin r ulesrev 2 hawaii department of labor form

- California everything you need to know about ad decisions form

Find out other Standard Voucher

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself