Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift Form

What is the acknowledgment by charitable or educational institution of receipt of pledged gift?

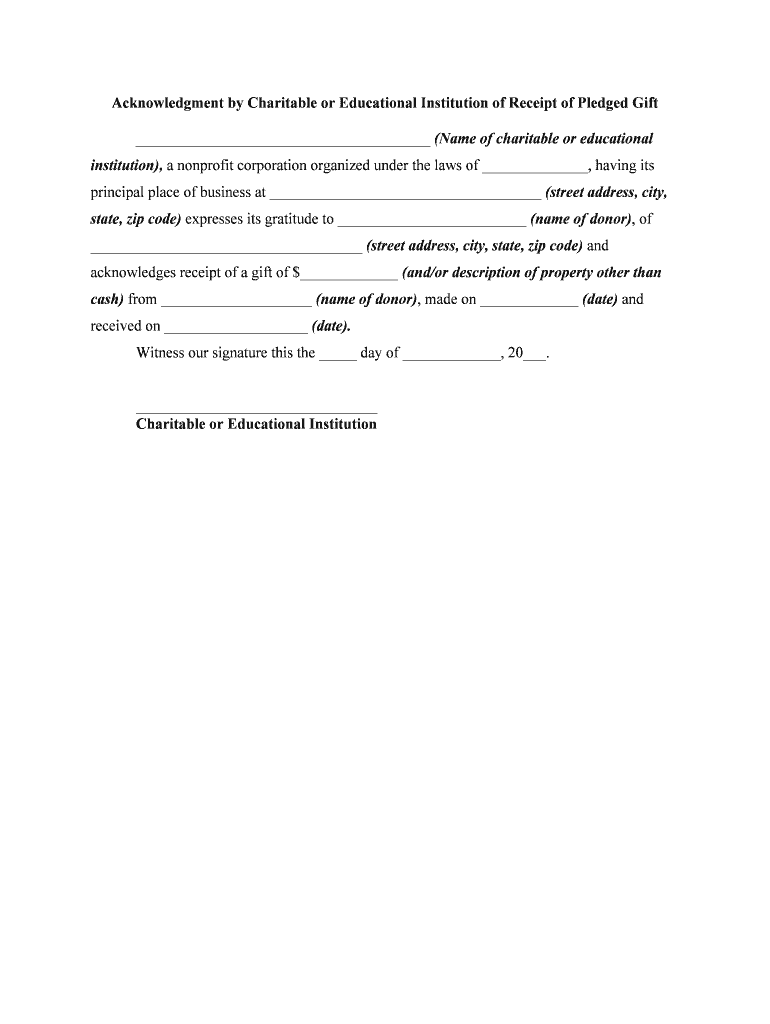

The acknowledgment by charitable or educational institution of receipt of pledged gift is a formal document that verifies the receipt of a promised donation. This document serves as proof for both the donor and the receiving organization, ensuring that the donation is recognized for tax purposes. It typically includes details such as the donor's name, the amount pledged, and the date of the gift. This acknowledgment is crucial for donors who wish to claim tax deductions, as it provides the necessary documentation required by the IRS.

Key elements of the acknowledgment by charitable or educational institution of receipt of pledged gift

To ensure the acknowledgment is valid, several key elements must be included:

- Donor Information: The full name and address of the donor.

- Organization Details: The name and address of the charitable or educational institution.

- Gift Amount: The total amount of the pledged gift.

- Date of Receipt: The date when the gift was received.

- Statement of No Goods or Services Provided: A declaration that the donor did not receive any goods or services in exchange for the gift, which is essential for tax deduction purposes.

Steps to complete the acknowledgment by charitable or educational institution of receipt of pledged gift

Completing the acknowledgment involves a few straightforward steps:

- Gather Information: Collect all necessary details about the donor and the gift.

- Fill Out the Form: Input the gathered information into the acknowledgment template, ensuring accuracy.

- Review the Document: Check for any errors or omissions before finalizing the form.

- Sign the Document: Obtain the necessary signatures from authorized representatives of the organization.

- Distribute Copies: Provide a copy of the acknowledgment to the donor for their records.

Legal use of the acknowledgment by charitable or educational institution of receipt of pledged gift

This acknowledgment is legally significant as it serves as evidence of the donation for tax purposes. Under IRS regulations, donors must have this documentation to substantiate their claims for deductions. Failure to provide a proper acknowledgment may result in the denial of tax deductions. Therefore, organizations must adhere to the legal requirements when issuing these acknowledgments to ensure compliance with tax laws.

How to obtain the acknowledgment by charitable or educational institution of receipt of pledged gift

To obtain this acknowledgment, donors typically need to request it from the charitable or educational institution to which they have pledged a gift. Organizations often have standard templates for this acknowledgment, which can be filled out and signed electronically. Utilizing digital signing solutions can streamline the process, ensuring that both parties can execute the acknowledgment efficiently and securely.

IRS Guidelines

The IRS has specific guidelines regarding the acknowledgment of charitable contributions. For donations of $250 or more, the donor must receive a written acknowledgment from the organization. This acknowledgment must include the amount of cash or a description of non-cash contributions, along with a statement indicating whether any goods or services were provided in exchange for the gift. Adhering to these guidelines is essential for donors to successfully claim their tax deductions.

Quick guide on how to complete acknowledgment by charitable or educational institution of receipt of pledged gift

Complete Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily locate the needed form and store it securely online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without delay. Handle Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift on any device using airSlate SignNow's Android or iOS applications and streamline all your document-related tasks today.

The simplest way to edit and eSign Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift seamlessly

- Obtain Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred way to share your form, whether via email, text message (SMS), invite link, or download it to your computer.

No more lost or misplaced documents, tiresome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift and ensure outstanding communication at every step of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the importance of Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

The Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift is crucial for maintaining transparency and trust with donors. It provides a formal record confirming that a nonprofit has received a pledged gift, which is essential for both accounting and tax purposes.

-

How does airSlate SignNow assist in creating Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift documents?

With airSlate SignNow, users can easily create customizable templates for Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift documents. The platform streamlines the process of drafting and sending these important acknowledgments efficiently and securely.

-

Can I integrate airSlate SignNow with my existing CRM for handling Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

Yes, airSlate SignNow offers seamless integrations with various CRMs such as Salesforce and HubSpot. This ensures that you can manage your donor relations efficiently and automate the process of sending Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift without additional efforts.

-

What are the pricing options available for airSlate SignNow to issue Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

airSlate SignNow offers a range of pricing plans, starting from a basic plan to premium options suitable for large institutions. Each plan provides features necessary for creating Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift, allowing you to choose one that fits your budget and requirements.

-

Are Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift valid for tax deduction purposes?

Yes, an Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift is often required for donors to claim tax deductions. It serves as proof that a charitable organization has received a pledge, which is essential for compliance with IRS regulations.

-

What features does airSlate SignNow offer for Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

airSlate SignNow includes features such as document templates, electronic signatures, and the ability to track the status of sent Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift. These streamline the process, ensuring quick delivery and record-keeping.

-

How secure is the electronic signature process for Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

The electronic signature process in airSlate SignNow is compliant with industry standards, ensuring high levels of security and authenticity. This provides assurance to both organizations and donors regarding the integrity of the Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift.

Get more for Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift

Find out other Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free