Instructions for Form 5227 Internal Revenue Service

What is the Instructions For Form 5227 Internal Revenue Service

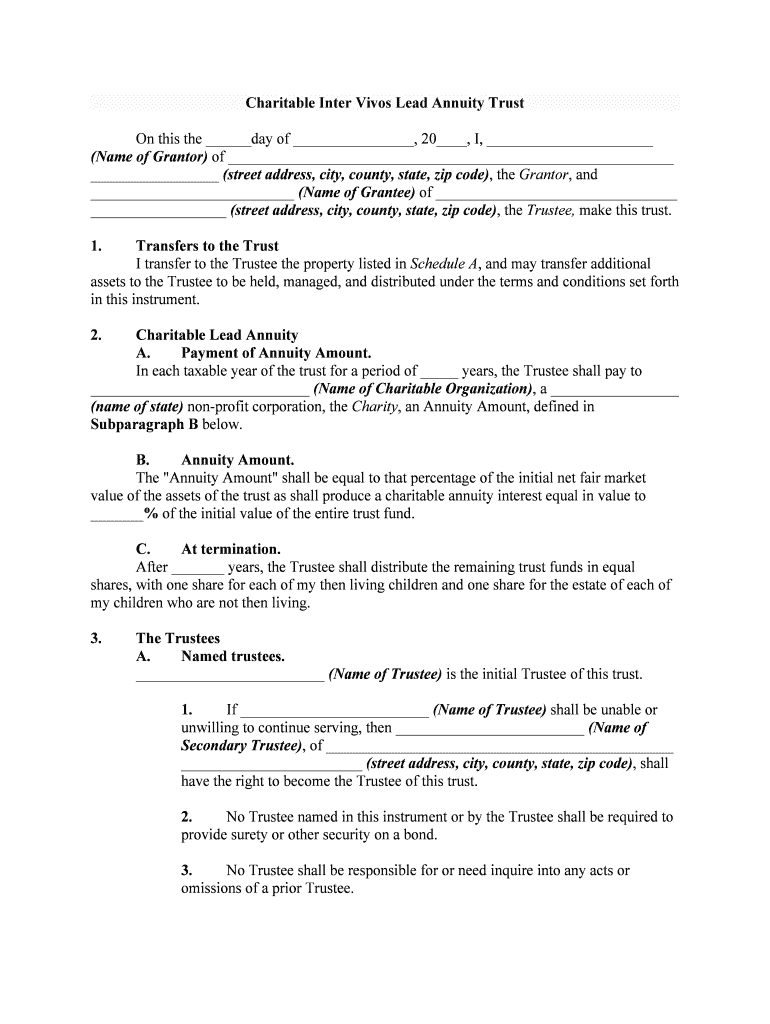

The Instructions for Form 5227, issued by the Internal Revenue Service (IRS), provide guidelines for completing the form, which is used to report information regarding certain tax-exempt organizations. This form is crucial for organizations that operate under specific tax provisions, ensuring compliance with federal tax regulations. Understanding these instructions is essential for accurate reporting and maintaining tax-exempt status.

Steps to complete the Instructions For Form 5227 Internal Revenue Service

Completing the Instructions for Form 5227 involves several key steps:

- Gather necessary financial documents and records related to the tax-exempt organization's activities.

- Review the specific sections of the form, noting any unique requirements or calculations.

- Fill out the form accurately, ensuring all information aligns with the gathered documents.

- Double-check for any errors or omissions before submission.

- Submit the completed form to the IRS by the required deadline, either electronically or via mail.

Legal use of the Instructions For Form 5227 Internal Revenue Service

The legal use of the Instructions for Form 5227 is paramount for organizations seeking to maintain their tax-exempt status. Compliance with these instructions ensures that the organization adheres to IRS regulations, thereby avoiding potential penalties. It is essential to follow the guidelines meticulously, as inaccuracies can lead to legal complications or loss of tax-exempt status.

Filing Deadlines / Important Dates

Filing deadlines for Form 5227 vary based on the organization's tax year. Typically, the form must be submitted on or before the fifteenth day of the fifth month after the end of the organization's tax year. It is crucial to keep track of these dates to avoid late filing penalties. Organizations should also be aware of any extensions that may apply to their specific situation.

Form Submission Methods (Online / Mail / In-Person)

Organizations can submit the Instructions for Form 5227 through various methods:

- Online: Many organizations prefer electronic submission for efficiency and tracking purposes.

- Mail: The form can be printed and mailed to the appropriate IRS address, as specified in the instructions.

- In-Person: In certain cases, organizations may choose to deliver the form directly to an IRS office.

Key elements of the Instructions For Form 5227 Internal Revenue Service

Key elements of the Instructions for Form 5227 include:

- Eligibility Criteria: Guidelines outlining which organizations must file the form.

- Required Information: Specific details that must be included in the form, such as financial data and organizational structure.

- Compliance Requirements: Information on maintaining tax-exempt status and adhering to IRS regulations.

Quick guide on how to complete instructions for form 5227 2019internal revenue service

Complete Instructions For Form 5227 Internal Revenue Service effortlessly on any device

Web-based document management has become favored among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without delays. Manage Instructions For Form 5227 Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

Steps to update and eSign Instructions For Form 5227 Internal Revenue Service with ease

- Find Instructions For Form 5227 Internal Revenue Service and click Get Form to begin.

- Make use of the resources we offer to complete your form.

- Underline signNow sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and hit the Done button to save your changes.

- Select how you wish to share your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or mismanaged documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from the device you prefer. Edit and eSign Instructions For Form 5227 Internal Revenue Service and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the basic Instructions For Form 5227 Internal Revenue Service?

The Instructions For Form 5227 Internal Revenue Service provide guidance on how to fill out the form accurately, which is essential for tax compliance. It outlines the necessary information you need to include, such as details about the trust and its beneficiaries. Following these instructions can help avoid delays and penalties.

-

How can airSlate SignNow assist with completing the Instructions For Form 5227 Internal Revenue Service?

airSlate SignNow streamlines the process of completing the Instructions For Form 5227 Internal Revenue Service by allowing you to easily fill out and eSign your documents. Its user-friendly interface helps you manage necessary forms without confusion, ensuring all required information is captured. This enhances compliance and reduces the stress associated with tax documentation.

-

Is there a cost associated with accessing the Instructions For Form 5227 Internal Revenue Service using airSlate SignNow?

Using airSlate SignNow to handle the Instructions For Form 5227 Internal Revenue Service comes at a competitive pricing structure that is cost-effective for businesses. You can choose from different subscription plans based on your needs. Each plan offers features to make your document management seamless and affordable.

-

What features does airSlate SignNow offer for handling the Instructions For Form 5227 Internal Revenue Service?

airSlate SignNow provides features such as cloud storage, advanced editing tools, and easy eSigning that facilitate the management of the Instructions For Form 5227 Internal Revenue Service. These tools help ensure that your documents are accurate and securely stored. Additionally, you can track the signing process and manage your forms efficiently.

-

Are there integrations available with airSlate SignNow for the Instructions For Form 5227 Internal Revenue Service?

Yes, airSlate SignNow offers various integrations with other business applications that can complement your processing of the Instructions For Form 5227 Internal Revenue Service. These integrations enhance productivity by allowing seamless data transfer and workflow automation between platforms. This ensures your tax documentation processes remain efficient.

-

What are the benefits of using airSlate SignNow for Instructions For Form 5227 Internal Revenue Service?

The main benefits of using airSlate SignNow for the Instructions For Form 5227 Internal Revenue Service include enhanced document security, quick turnaround times, and ease of use. The platform is designed to improve efficiency in document handling while ensuring compliance with IRS standards. This not only saves time but also provides peace of mind during tax season.

-

Can I access the Instructions For Form 5227 Internal Revenue Service on mobile devices with airSlate SignNow?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to access the Instructions For Form 5227 Internal Revenue Service from any device. This mobile capability ensures you can manage, sign, and send your forms whenever and wherever you need. This flexibility is particularly beneficial for busy professionals.

Get more for Instructions For Form 5227 Internal Revenue Service

- An extra measure of security for the rental property form

- Nci institute form

- Dom rel 61 form

- Silver buffalo award form

- H1200 form 500015809

- Colonial life claim form pdffiller

- Distribution request for 401a 401k amp 403b form

- Los angeles zoo and botanical gardens scavenger hunt general www2 canyons form

Find out other Instructions For Form 5227 Internal Revenue Service

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online