Application for Special Fuel Tax License Nd Form

What is the Application for Special Fuel Tax License Nd?

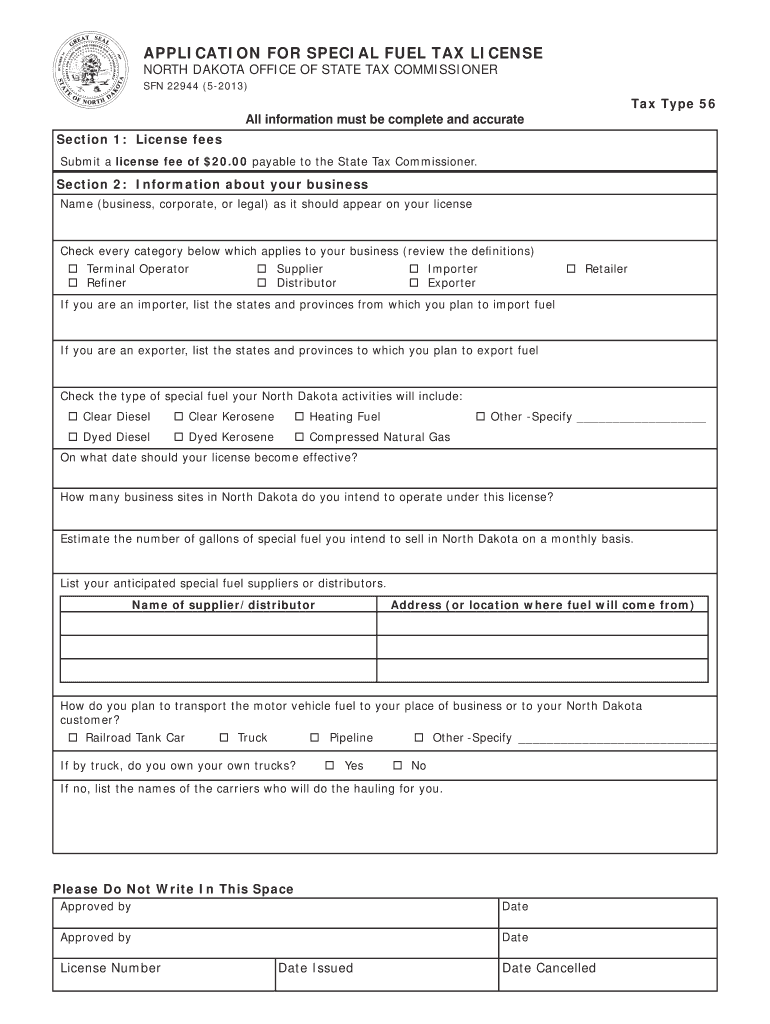

The Application for Special Fuel Tax License Nd is a formal document required for businesses that wish to engage in activities involving special fuel. This form serves as a means for the state to regulate the distribution and use of special fuel, ensuring compliance with tax obligations. It is essential for companies that operate in transportation sectors or those that utilize special fuel for machinery and equipment. By submitting this application, businesses can obtain the necessary license to operate legally within the framework of state regulations.

Steps to Complete the Application for Special Fuel Tax License Nd

Completing the Application for Special Fuel Tax License Nd involves several key steps to ensure accuracy and compliance. Follow these steps for a successful submission:

- Gather required information, including business details, tax identification number, and fuel usage specifics.

- Fill out the application form accurately, ensuring all sections are completed without omissions.

- Review the form for any errors or missing information before submission.

- Submit the application through the designated method, whether online, by mail, or in person.

- Keep a copy of the submitted application for your records.

How to Obtain the Application for Special Fuel Tax License Nd

The Application for Special Fuel Tax License Nd can typically be obtained from the state’s tax authority website or office. Many states provide downloadable forms online, allowing businesses to access them conveniently. Additionally, businesses may request a physical copy by contacting their local tax office directly. It is advisable to check the specific requirements and guidelines provided by the state to ensure that the correct form is used.

Legal Use of the Application for Special Fuel Tax License Nd

The legal use of the Application for Special Fuel Tax License Nd is crucial for maintaining compliance with state tax laws. This form is legally binding once submitted and approved, granting the applicant the authority to use special fuel under the regulations set forth by the state. Ensuring that the application is filled out correctly and submitted on time helps avoid potential legal issues, including penalties for non-compliance. It is important to understand the legal implications of using special fuel without the proper license.

Required Documents for the Application for Special Fuel Tax License Nd

When applying for the Special Fuel Tax License Nd, certain documents are typically required to support the application. These may include:

- Proof of business registration, such as a state-issued business license.

- Tax identification number (EIN or SSN).

- Documentation of fuel usage, including estimates of consumption.

- Any additional forms or certifications as specified by the state tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the Application for Special Fuel Tax License Nd vary by state and can be crucial for compliance. It is important to be aware of the specific dates set by the state tax authority to avoid late submissions. Generally, applications should be submitted well in advance of the intended use of special fuel. Keeping track of renewal dates for the license is equally important, as licenses may require periodic renewal to remain valid.

Quick guide on how to complete application for special fuel tax license nd

Complete Application For Special Fuel Tax License Nd effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely preserve it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents rapidly without delays. Manage Application For Special Fuel Tax License Nd on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Application For Special Fuel Tax License Nd seamlessly

- Find Application For Special Fuel Tax License Nd and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Application For Special Fuel Tax License Nd and ensure excellent communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

What is the last date to fill NDA application form?

HeyNDA 1 application form was available from January 9 in online mode. The last date to fill the application form of NDA was February 4 till 6 pm whereas NDA 2 application form will be available from August 7 to September 3. As per the exam dates of NDA, NDA 1 written test will be conducted on April 21 whereas NDA 2 will be held on November 17.UPSC has activated the facility to withdraw the application form on February 8. Applicants can withdraw their application till February 14, 2019, till 6.Thanks!

-

How to fill the apple U.S tax form (W8BEN iTunes Connect) for indie developers?

This article was most helpful: Itunes Connect Tax Information

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

What tax form do I have to fill out for the money I made on Quora?

For 2018, there is only form 1040. Your income is too low to file. Quora will issue you a 1099 Misc only if you made over $600

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

Create this form in 5 minutes!

How to create an eSignature for the application for special fuel tax license nd

How to create an electronic signature for your Application For Special Fuel Tax License Nd in the online mode

How to create an electronic signature for your Application For Special Fuel Tax License Nd in Google Chrome

How to create an electronic signature for putting it on the Application For Special Fuel Tax License Nd in Gmail

How to make an eSignature for the Application For Special Fuel Tax License Nd straight from your mobile device

How to make an eSignature for the Application For Special Fuel Tax License Nd on iOS devices

How to generate an electronic signature for the Application For Special Fuel Tax License Nd on Android devices

People also ask

-

What is the Application For Special Fuel Tax License Nd?

The Application For Special Fuel Tax License Nd is a necessary document for businesses operating with special fuel in North Dakota. It allows companies to legally collect and remit fuel taxes, ensuring compliance with state regulations. This application is essential for fuel distributors and consumers who wish to participate in the special fuel tax program.

-

How can I complete the Application For Special Fuel Tax License Nd online?

Completing the Application For Special Fuel Tax License Nd online is simple with airSlate SignNow. Our platform allows you to fill out the application electronically, ensuring all necessary information is included. Once completed, you can easily eSign the document and submit it directly to the state authorities.

-

What are the benefits of using airSlate SignNow for the Application For Special Fuel Tax License Nd?

Using airSlate SignNow for the Application For Special Fuel Tax License Nd offers numerous benefits, including time efficiency and ease of use. Our platform streamlines the application process, allowing for quick edits, electronic signatures, and secure submissions. Additionally, you can track your application status directly through our service.

-

Is there a fee for filing the Application For Special Fuel Tax License Nd?

There may be a nominal fee associated with filing the Application For Special Fuel Tax License Nd, depending on the state regulations. However, using airSlate SignNow can minimize costs by eliminating the need for paper, printing, and manual submissions. We provide a cost-effective solution to manage your application efficiently.

-

What features does airSlate SignNow offer for managing the Application For Special Fuel Tax License Nd?

airSlate SignNow provides several features to manage the Application For Special Fuel Tax License Nd effectively. These include customizable templates, an intuitive editing interface, and secure eSigning capabilities. Our platform also supports document storage and easy access for future reference, enhancing your workflow.

-

Can I track my Application For Special Fuel Tax License Nd after submission?

Yes, with airSlate SignNow, you can easily track your Application For Special Fuel Tax License Nd after submission. Our platform provides real-time updates on your document status, so you can stay informed about any changes or requirements from the state. This feature helps ensure that you are always in compliance.

-

What integrations does airSlate SignNow offer for the Application For Special Fuel Tax License Nd?

airSlate SignNow seamlessly integrates with various applications to enhance your experience while completing the Application For Special Fuel Tax License Nd. You can connect with CRM tools, cloud storage providers, and productivity software to streamline your document management process. This flexibility allows you to work more efficiently.

Get more for Application For Special Fuel Tax License Nd

Find out other Application For Special Fuel Tax License Nd

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word