How Long Does an Insurer Have to Pay My Claim Form

What is the How Long Does An Insurer Have To Pay My Claim

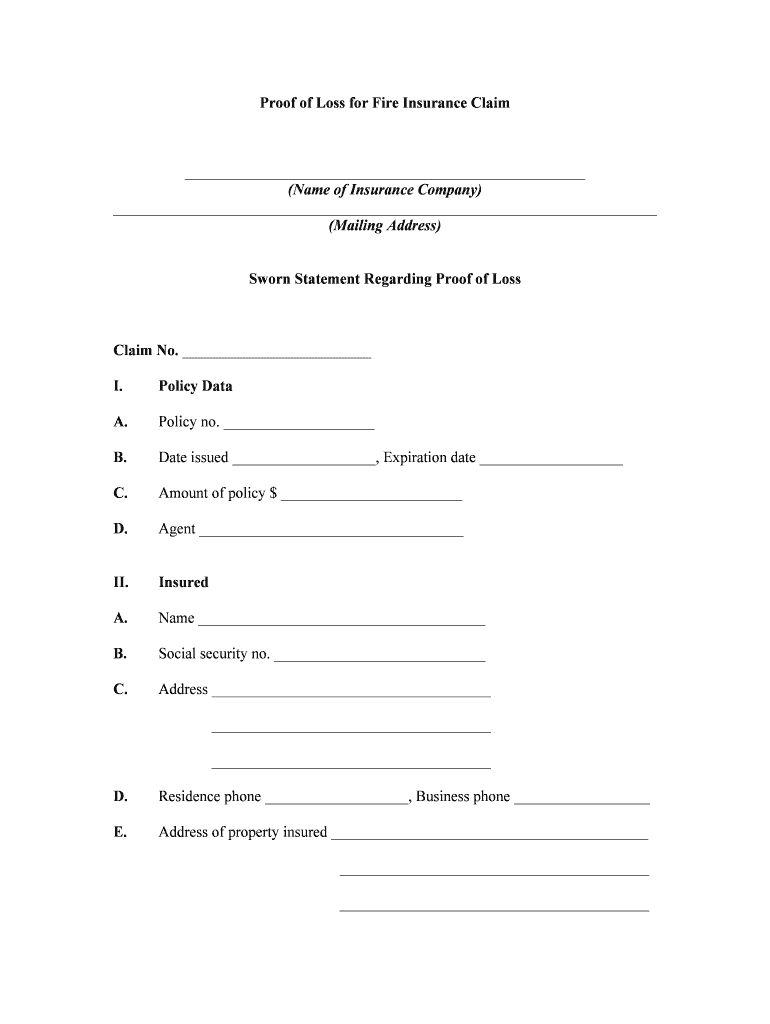

The form titled "How Long Does An Insurer Have To Pay My Claim" is a crucial document that outlines the timeline and processes associated with insurance claims. This form serves to inform policyholders about the expected duration for insurers to settle claims after they have been submitted. Understanding this timeline is essential for individuals navigating the often complex world of insurance, as it helps manage expectations and ensures that claims are processed in a timely manner.

Key elements of the How Long Does An Insurer Have To Pay My Claim

This form includes several key elements that are vital for both the insurer and the policyholder. These elements typically consist of:

- Claim Submission Date: The date on which the claim was officially filed.

- Insurer Response Time: The legally mandated period within which the insurer must acknowledge receipt of the claim.

- Payment Timeline: The timeframe in which the insurer is required to pay the claim after it has been approved.

- Documentation Requirements: Any necessary documents that must be submitted to support the claim.

- Contact Information: Details for reaching out to the insurer for follow-up or inquiries.

Steps to complete the How Long Does An Insurer Have To Pay My Claim

Completing the "How Long Does An Insurer Have To Pay My Claim" form involves several important steps. These steps ensure that the claim is filed correctly and processed efficiently:

- Gather all necessary documents, including your policy number, claim details, and any supporting evidence.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form through the designated method, which may include online submission, mail, or in-person delivery.

- Keep a copy of the submitted form and any confirmation received for your records.

State-specific rules for the How Long Does An Insurer Have To Pay My Claim

Insurance regulations can vary significantly from state to state in the United States. Each state has its own laws governing the timeframe in which insurers must pay claims. It is important for policyholders to be aware of these state-specific rules, as they can impact the claims process. For instance, some states may require insurers to pay claims within a certain number of days, while others may have different stipulations. Checking with your state's insurance department can provide clarity on the specific rules that apply to your situation.

Legal use of the How Long Does An Insurer Have To Pay My Claim

The "How Long Does An Insurer Have To Pay My Claim" form is legally binding when completed correctly. To ensure its legal validity, it must comply with relevant regulations and guidelines set forth by state and federal laws. This includes adhering to the requirements for documentation, signatures, and submission methods. Utilizing a reliable digital signing platform can enhance the legal standing of the form by providing secure signatures and maintaining compliance with eSignature laws.

Examples of using the How Long Does An Insurer Have To Pay My Claim

Understanding how to effectively use the "How Long Does An Insurer Have To Pay My Claim" form can be illustrated through various scenarios. For example:

- A homeowner filing a claim for storm damage may use this form to understand when they can expect payment for repairs.

- A business owner seeking reimbursement for a business interruption claim can reference this form to track the insurer's response time.

- An individual filing a health insurance claim can utilize the form to ensure timely payment for medical expenses.

Quick guide on how to complete how long does an insurer have to pay my claim

Complete How Long Does An Insurer Have To Pay My Claim effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents promptly without delays. Handle How Long Does An Insurer Have To Pay My Claim on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign How Long Does An Insurer Have To Pay My Claim with ease

- Find How Long Does An Insurer Have To Pay My Claim and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which only takes moments and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign How Long Does An Insurer Have To Pay My Claim and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How Long Does An Insurer Have To Pay My Claim?

The duration for an insurer to pay your claim varies by state laws, but generally, it should be settled within 30 to 60 days after all necessary documents have been submitted. It's important to follow up with your insurance company to ensure that your claim is processed promptly. Understanding 'How Long Does An Insurer Have To Pay My Claim' can help you navigate the process effectively.

-

What features of airSlate SignNow can help expedite my insurance claims?

airSlate SignNow provides features such as electronic signatures, document tracking, and automated workflows, which can signNowly expedite the submission of your insurance claims. By using these tools, you can ensure all documentation is signed and submitted quickly. This process understanding may directly impact 'How Long Does An Insurer Have To Pay My Claim.'

-

How does airSlate SignNow improve document management for insurance claims?

With airSlate SignNow, document management for insurance claims becomes seamless. You can create, send, and manage all your documents in one secure platform, reducing delays. Proper document management might influence 'How Long Does An Insurer Have To Pay My Claim.'

-

What is the cost structure for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose from monthly or annual subscriptions based on your needs. Understanding the cost structure helps you evaluate how airSlate SignNow can facilitate claims processing and potentially impact 'How Long Does An Insurer Have To Pay My Claim.'

-

Can airSlate SignNow integrate with other platforms I currently use?

Yes, airSlate SignNow integrates with various platforms including CRM systems and document management software. This ensures that you can streamline your processes, making it easier to handle claims. Faster processes can enhance your understanding of 'How Long Does An Insurer Have To Pay My Claim.'

-

What benefits does eSignature provide in the insurance claims process?

Using eSignatures via airSlate SignNow allows for quicker turnaround times as documents can be signed remotely in real-time. This speeds up the entire claims process, giving you insight into 'How Long Does An Insurer Have To Pay My Claim.'

-

Is there customer support available if I have questions about my claims?

Yes, airSlate SignNow offers robust customer support to help you with any inquiries regarding your insurance claims. Having access to dedicated support can alleviate concerns regarding the timing of claims payments, specifically related to 'How Long Does An Insurer Have To Pay My Claim.'

Get more for How Long Does An Insurer Have To Pay My Claim

- Degree verification form

- Request for fitness for duty or return to work evaluation the ohio state university office of human resources policy 440 form

- Baruch reinstatement form

- Igc project english 2 form

- Lesson 3 extra practice angles of triangles answer key form

- Observation and referral form for adaptive physical education

- Nyit opt form

- Year 3 spelling bee list moodle skhplism catholic edu aufile form

Find out other How Long Does An Insurer Have To Pay My Claim

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later