Notice of Increase in Charge for CreditBased on Information Received from Person Other Than Consumer Reporting Agency

What is the Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency

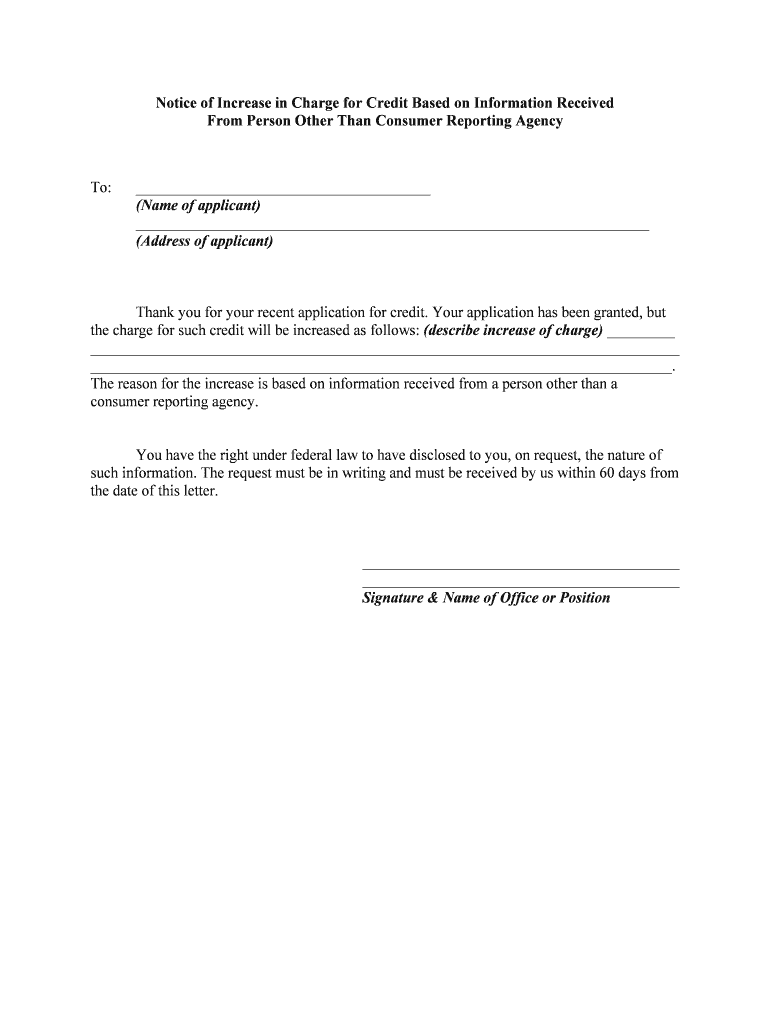

The Notice Of Increase In Charge For Credit Based On Information Received From Person Other Than Consumer Reporting Agency is a formal document that informs consumers about changes in fees or charges related to their credit accounts. This notice is typically issued when a creditor relies on information obtained from sources other than traditional consumer reporting agencies, such as third-party data providers. The purpose of this notice is to ensure transparency and provide consumers with the necessary information to understand the basis for any increases in charges.

Steps to Complete the Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency

Completing the Notice Of Increase In Charge requires careful attention to detail. Here are the steps to follow:

- Begin by entering your personal information, including your name, address, and account number.

- Clearly state the reason for the increase in charges, referencing the specific information obtained from the third party.

- Include the date of the notice and the effective date of the charge increase.

- Provide details on how the consumer can dispute the information if they believe it is inaccurate.

- Ensure that the document is signed and dated properly to validate its authenticity.

Legal Use of the Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency

This notice serves a critical legal function by fulfilling the requirements set forth by the Fair Credit Reporting Act (FCRA). Under this legislation, creditors must notify consumers of any adverse actions taken based on information from sources other than consumer reporting agencies. By issuing this notice, creditors protect themselves from potential legal repercussions and provide consumers with their rights to contest the information used against them.

Key Elements of the Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency

Key elements of this notice include:

- Consumer's identifying information, such as name and account number.

- A clear explanation of the charge increase.

- The source of the information that prompted the increase.

- Instructions on how to dispute the information, if applicable.

- The date the notice is issued and when the changes take effect.

How to Use the Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency

Using the Notice Of Increase In Charge is straightforward. After completing the document, ensure it is delivered to the consumer in a timely manner, typically through postal mail or electronic communication, depending on the consumer's preference. It is essential to keep a copy of the notice for your records, as it serves as proof of compliance with legal requirements. Additionally, if the consumer disputes the charge, be prepared to provide further documentation supporting the increase.

State-Specific Rules for the Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency

While federal laws govern the issuance of this notice, some states may have additional requirements. It is important to check your state’s regulations to ensure compliance. For instance, certain states may require specific language to be included in the notice or additional disclosures regarding consumer rights. Familiarizing yourself with these state-specific rules can help avoid potential legal issues and enhance consumer trust.

Quick guide on how to complete notice of increase in charge for creditbased on information received from person other than consumer reporting agency

Prepare Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency on any device using airSlate SignNow's Android or iOS applications and simplify your document-based processes today.

How to modify and eSign Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency with ease

- Locate Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any preferred device. Modify and eSign Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does the 'Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency' mean?

The 'Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency' refers to a formal notification informing consumers of a charge increase due to information obtained from sources other than consumer reporting agencies. Understanding this notice is crucial for consumers to manage their credit effectively and address any discrepancies.

-

How can airSlate SignNow help with the 'Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency'?

AirSlate SignNow facilitates the seamless sending and eSigning of documents, making it easier for businesses to manage communications regarding the 'Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency.' Our platform ensures that these critical documents are handled securely and efficiently.

-

Is there a cost involved in using airSlate SignNow for managing notices related to credit increases?

Yes, there are pricing plans available for using airSlate SignNow, designed to accommodate various business needs. Our cost-effective solution provides a range of features to manage documents, including those related to the 'Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency.'

-

What features does airSlate SignNow offer to help with document management?

AirSlate SignNow offers features including customizable templates, secure cloud storage, real-time collaboration, and easy electronic signatures. These tools are specifically designed to streamline processes such as handling the 'Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency,' ensuring compliance and efficiency.

-

Can I integrate airSlate SignNow with other tools for better management of credit notices?

Absolutely! AirSlate SignNow integrates with various third-party applications to enhance your document management process. This makes it easier to handle notices like the 'Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency' alongside your existing tools for a more cohesive workflow.

-

What are the benefits of using airSlate SignNow for sending notices?

Using airSlate SignNow to send notices like the 'Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency' offers numerous benefits, including enhanced security, improved efficiency, and tracking capabilities. This allows businesses to ensure that their communications are timely and compliant.

-

Is eSigning legally valid for the 'Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency'?

Yes, eSigning with airSlate SignNow is legally valid and compliant with electronic signature laws. This means you can confidently send notices such as the 'Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency' knowing they hold legal standing.

Get more for Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency

- Form no ogc sf 2003 02

- Employment application pdf missouri form

- University of louisville transcripts 448042292 form

- Style guide university of north carolina form

- Outdoor facility application form ucsc arboretum

- Eop income verification form 516708441

- Health insurance waiver form for tufts universitys boston amp grafton campuses 2019 2020

- Forensic and insurance claim submission formc

Find out other Notice Of Increase In Charge For CreditBased On Information Received From Person Other Than Consumer Reporting Agency

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy