Marital Deduction Trust with Lifetime Income and Power of Form

What is the Marital Deduction Trust With Lifetime Income And Power Of

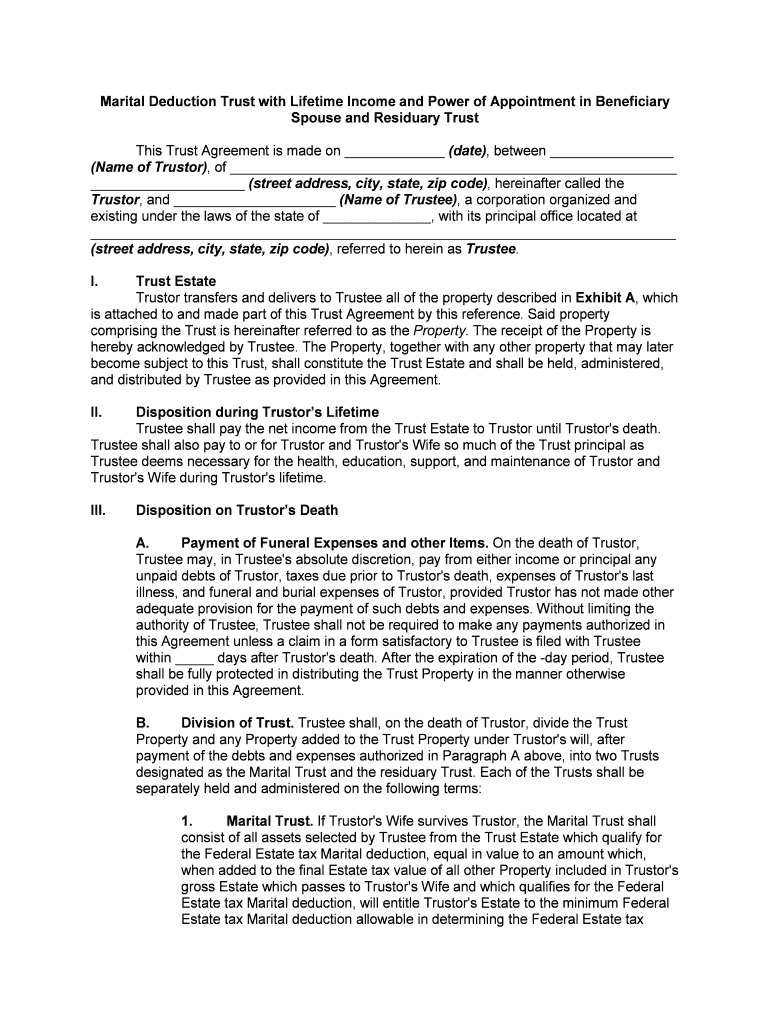

The Marital Deduction Trust With Lifetime Income And Power Of is a specialized estate planning tool designed to provide financial security to surviving spouses while minimizing estate taxes. This trust allows the surviving spouse to receive income from the trust assets during their lifetime, ensuring they have the necessary resources to maintain their standard of living. Upon the death of the surviving spouse, the remaining assets in the trust are transferred to the beneficiaries specified in the trust document, often children or other family members. This structure not only helps in tax efficiency but also ensures that the assets are managed according to the wishes of the deceased spouse.

How to Use the Marital Deduction Trust With Lifetime Income And Power Of

Using the Marital Deduction Trust With Lifetime Income And Power Of involves several key steps. Initially, it is essential to consult with an estate planning attorney to draft the trust document, ensuring it meets all legal requirements and reflects the grantor's intentions. Once established, the grantor can fund the trust with various assets, such as cash, investments, or real estate. The surviving spouse can then receive income from these assets throughout their lifetime. It is important to regularly review and update the trust to accommodate any changes in family circumstances or tax laws, ensuring it remains effective and aligned with the grantor's goals.

Steps to Complete the Marital Deduction Trust With Lifetime Income And Power Of

Completing the Marital Deduction Trust With Lifetime Income And Power Of involves a systematic approach:

- Consult with an estate planning attorney to understand the implications and requirements.

- Draft the trust document, specifying the terms, beneficiaries, and powers granted to the surviving spouse.

- Fund the trust by transferring assets into it, ensuring proper documentation for each asset.

- Review the trust periodically to make adjustments as needed, particularly after significant life events.

- Ensure compliance with all state and federal laws to maintain the trust's validity.

Legal Use of the Marital Deduction Trust With Lifetime Income And Power Of

The legal use of the Marital Deduction Trust With Lifetime Income And Power Of is governed by federal and state laws. This trust qualifies for the marital deduction under the Internal Revenue Code, allowing the transfer of assets to the surviving spouse without incurring immediate estate taxes. However, it is crucial to adhere to specific legal requirements, such as ensuring that the trust provides the surviving spouse with the right to receive income during their lifetime. Failure to comply with these regulations may result in the loss of tax benefits or legal challenges to the trust's validity.

Key Elements of the Marital Deduction Trust With Lifetime Income And Power Of

Several key elements define the Marital Deduction Trust With Lifetime Income And Power Of:

- Income Provision: The trust must provide for the surviving spouse to receive income during their lifetime.

- Beneficiary Designation: Clear identification of beneficiaries who will receive the remaining assets after the surviving spouse's death.

- Tax Efficiency: The trust should be structured to take advantage of the marital deduction, minimizing estate taxes.

- Management of Assets: Provisions for how the trust assets will be managed and invested to generate income.

Examples of Using the Marital Deduction Trust With Lifetime Income And Power Of

Examples of using the Marital Deduction Trust With Lifetime Income And Power Of can illustrate its practical applications:

- A couple with significant assets establishes the trust to ensure that the surviving spouse has access to income while preserving the estate for their children.

- A surviving spouse who relies on income from the trust to maintain their lifestyle after the death of their partner, with the trust assets eventually passing to their children.

- Individuals with complex family dynamics use the trust to provide for a current spouse while ensuring that children from a previous marriage are also beneficiaries.

Quick guide on how to complete marital deduction trust with lifetime income and power of

Complete Marital Deduction Trust With Lifetime Income And Power Of seamlessly on any device

Online document management has gained popularity among companies and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without holdups. Manage Marital Deduction Trust With Lifetime Income And Power Of on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Marital Deduction Trust With Lifetime Income And Power Of effortlessly

- Obtain Marital Deduction Trust With Lifetime Income And Power Of and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Marital Deduction Trust With Lifetime Income And Power Of and guarantee exceptional communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Marital Deduction Trust With Lifetime Income And Power Of?

A Marital Deduction Trust With Lifetime Income And Power Of is a financial tool designed to provide income to a surviving spouse while minimizing estate taxes. This type of trust allows the trust maker to allocate assets in a way that ensures their spouse receives benefits during their lifetime. Ultimately, this structure helps preserve wealth for future generations.

-

How does the Marital Deduction Trust With Lifetime Income And Power Of benefit my estate planning?

Incorporating a Marital Deduction Trust With Lifetime Income And Power Of into your estate plan ensures that your spouse is financially supported after your passing while reducing the overall taxable estate. This dual benefit allows you to secure your loved one's future while optimizing tax liabilities. It's a strategic approach to protecting your family's financial interests.

-

Are there any fees associated with setting up a Marital Deduction Trust With Lifetime Income And Power Of?

Setting up a Marital Deduction Trust With Lifetime Income And Power Of may involve legal and administrative fees, which can vary depending on the complexity of your estate. However, these costs are generally outweighed by the tax benefits and financial security the trust provides to your spouse. It's advisable to consult with an estate planning attorney to understand the total cost involved.

-

How can I integrate a Marital Deduction Trust With Lifetime Income And Power Of with other investment strategies?

A Marital Deduction Trust With Lifetime Income And Power Of can be seamlessly integrated with various investment strategies to create a well-rounded estate plan. By combining this trust with life insurance policies, retirement accounts, and other investment vehicles, you can enhance your financial security and ensure a stable income for your spouse. Consult with a financial advisor for tailored advice on integration.

-

What are the key features of a Marital Deduction Trust With Lifetime Income And Power Of?

Key features of a Marital Deduction Trust With Lifetime Income And Power Of include the provision of lifetime income to the surviving spouse, the ability to minimize estate taxes, and the flexibility of asset allocation. Additionally, this trust can provide control over the final distribution of assets after the surviving spouse passes away, ensuring they are passed to the desired beneficiaries.

-

Who should consider a Marital Deduction Trust With Lifetime Income And Power Of?

Individuals with signNow assets or those wishing to provide for a surviving spouse while minimizing estate taxes should consider a Marital Deduction Trust With Lifetime Income And Power Of. It is particularly beneficial for married couples where one spouse may need long-term financial support after the other's passing. Consulting with legal and financial professionals can help determine if this trust is right for you.

-

Can I modify a Marital Deduction Trust With Lifetime Income And Power Of after it is established?

Yes, once a Marital Deduction Trust With Lifetime Income And Power Of is established, it can often be modified to reflect any changes in circumstances or personal preferences. However, modifications may require formal legal procedures and should always be done in consultation with a qualified estate attorney to ensure compliance with relevant laws and tax implications.

Get more for Marital Deduction Trust With Lifetime Income And Power Of

- Nc e 585 faq 2015 fill out tax template onlineus form

- Pdf request for taxpayer identification number and umass amherst form

- Electronic filing specifications handbook form

- 355 7004 instr with coupon form

- Form st mab 4 rev 315 instructions for sales tax on

- 2019 form 1 massachusetts resident income tax return

- Massachusetts form m 1310 statement of claimant to

- Images for who is httpswwwmassgovfilesdocuments20190109for 2018 inc sch ecpdf form

Find out other Marital Deduction Trust With Lifetime Income And Power Of

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe