Chapter 6 Delinquent Debt Collection Bureau of the Fiscal Form

What is the Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal

The Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal is a formal document used in the United States to address issues related to overdue debts. This form is essential for individuals or businesses that have outstanding financial obligations and need to resolve them through official channels. It serves as a record of the debt and the actions taken to collect it, ensuring that both parties have a clear understanding of the situation. Understanding this form is crucial for anyone dealing with delinquent debts, as it outlines the legal framework for debt collection and the responsibilities of both creditors and debtors.

Steps to Complete the Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal

Completing the Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal involves several key steps to ensure accuracy and compliance with legal standards. Begin by gathering all necessary information related to the debt, including the amount owed, the debtor's details, and any relevant communication records. Next, fill out the form carefully, ensuring that all fields are completed accurately. Pay special attention to sections that require signatures, as these are crucial for the form's validity. Once completed, review the form for any errors before submitting it through the appropriate channels, whether online or via mail.

Legal Use of the Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal

The legal use of the Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal is governed by various federal and state laws designed to protect both creditors and debtors. It is important to understand that this form must be completed in compliance with the Fair Debt Collection Practices Act (FDCPA), which outlines permissible practices for debt collection. Using this form legally requires that all information provided is truthful and that the debtor is given the opportunity to respond to the claims made against them. Failure to adhere to these legal standards can result in penalties or invalidation of the debt collection process.

How to Obtain the Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal

Obtaining the Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal is a straightforward process. Typically, this form can be accessed through the official website of the Bureau of Fiscal Services or other government agencies responsible for debt collection. It may also be available at local government offices or through legal aid organizations. Ensure that you are using the most current version of the form to avoid any complications during the submission process. If assistance is needed, consulting with a legal professional can provide guidance on obtaining and completing the form correctly.

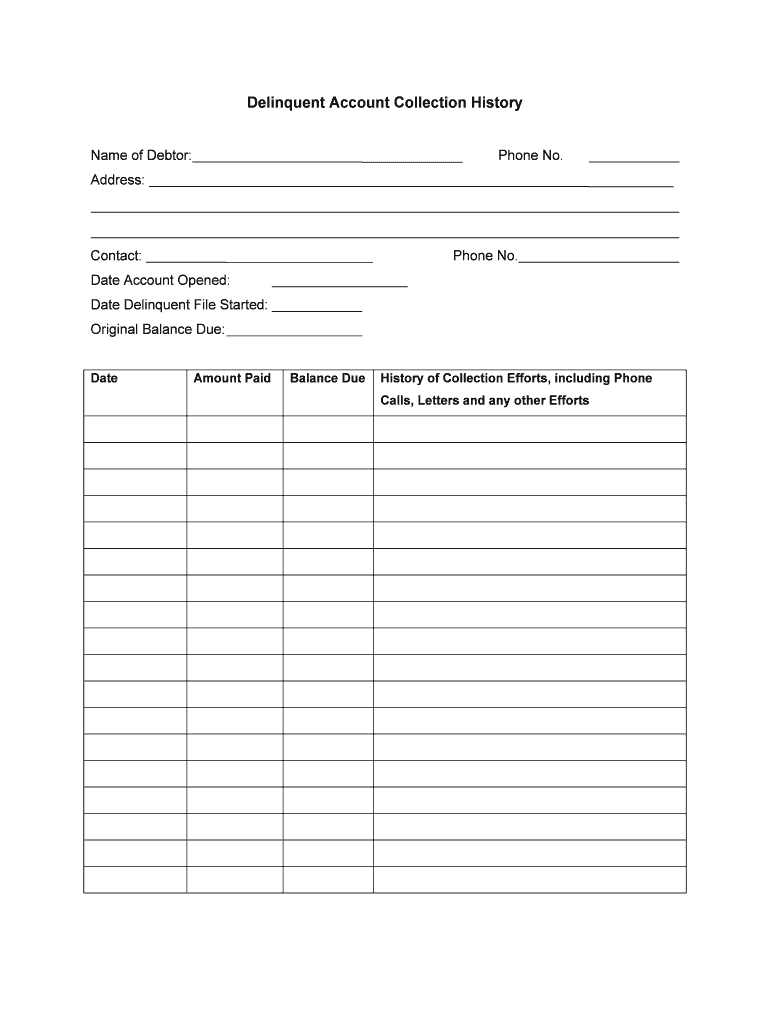

Key Elements of the Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal

Key elements of the Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal include essential information that must be accurately reflected on the form. This includes the debtor's name, address, and contact information, as well as the creditor's details. The amount of the debt, the nature of the obligation, and any relevant dates, such as when the debt was incurred, should also be clearly stated. Additionally, the form may require signatures from both parties to validate the agreement and confirm the debt's legitimacy. Understanding these elements is crucial for ensuring that the form serves its intended purpose effectively.

Form Submission Methods for the Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal

Submitting the Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal can be done through various methods, depending on the requirements set by the issuing authority. Common submission methods include online submission through designated government portals, mailing a physical copy of the form to the appropriate agency, or delivering it in person to a local office. Each method has its own set of guidelines and timelines, so it is important to choose the one that best fits your circumstances while ensuring that all submission protocols are followed to avoid delays.

Quick guide on how to complete chapter 6 delinquent debt collection bureau of the fiscal

Complete Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal without fuss

- Find Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that task.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the purpose of Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal?

Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal outlines the legal framework governing debt collection practices. It aims to protect consumers while ensuring that debt collectors follow fair procedures. By understanding this chapter, businesses can better navigate compliance while managing delinquent accounts.

-

How can airSlate SignNow assist with Chapter 6 Delinquent Debt Collection documentation?

airSlate SignNow streamlines the documentation process for Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal. Our platform enables you to eSign and manage important contracts and notices efficiently. This ensures that all necessary documentation is handled professional and compliant with regulatory standards.

-

What are the pricing options for using airSlate SignNow in relation to Chapter 6 Delinquent Debt Collection?

We offer flexible pricing plans for airSlate SignNow, each designed to cater to varying business needs. With our competitive pricing options, you can utilize features relevant to Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal without breaking the bank. Contact our sales team for a detailed quote tailored to your requirements.

-

What features does airSlate SignNow offer for Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal?

Our platform includes features such as document templates, bulk sending, and real-time tracking that are crucial for managing Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal. Additionally, our robust security measures ensure all documents are safe and compliant. These features help you improve efficiency and maintain legal standards.

-

Are there any integrations available for airSlate SignNow related to Chapter 6 Delinquent Debt Collection?

Yes, airSlate SignNow integrates seamlessly with various CRM systems, accounting software, and document storage solutions. This ensures that when working within the context of Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal, you can manage your documents efficiently across platforms. Automation reduces manual errors and saves time.

-

What benefits does airSlate SignNow provide for businesses dealing with Chapter 6 Delinquent Debt Collection?

By using airSlate SignNow, businesses can benefit from faster document turnaround times and improved compliance with Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal. The platform’s user-friendly interface makes it easy to track documents and gather eSignatures. This efficiency enhances customer relationships and can lead to better repayment outcomes.

-

How secure is airSlate SignNow for managing Chapter 6 Delinquent Debt Collection documents?

Security is paramount at airSlate SignNow. We utilize advanced encryption and compliance measures to protect all documents related to Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal. With our secure platform, you can ensure that sensitive data associated with debt collections remains confidential and complies with industry regulations.

Get more for Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal

Find out other Chapter 6 Delinquent Debt Collection Bureau Of The Fiscal

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form