Yearly Expenses Form

What is the Yearly Expenses

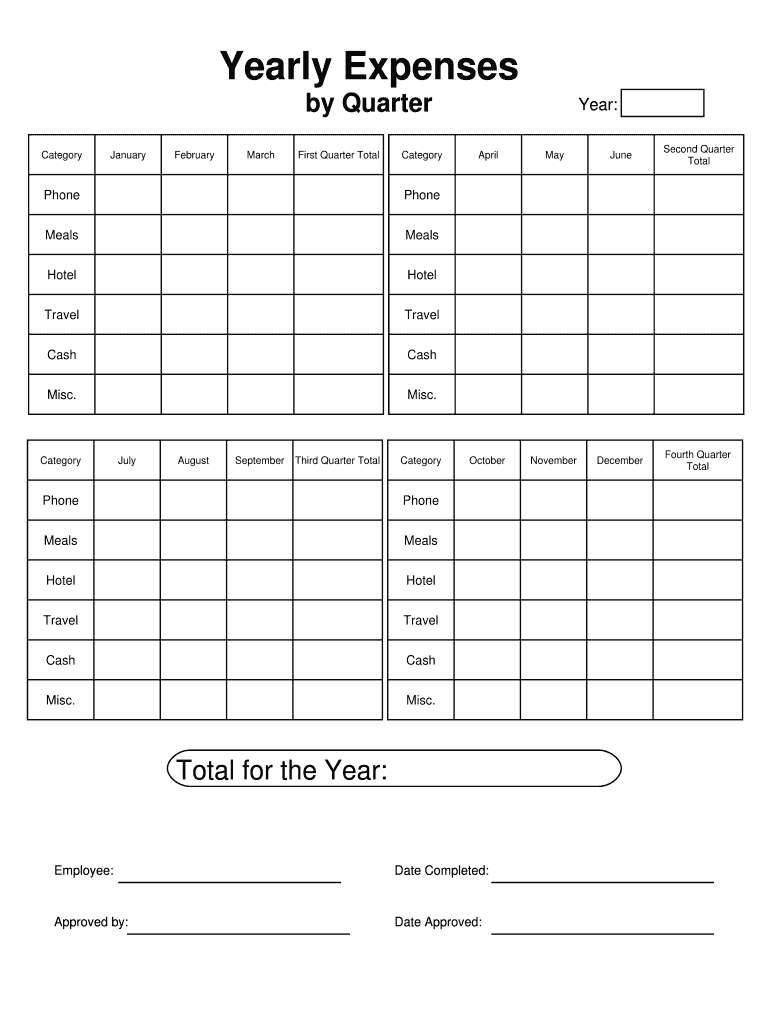

The yearly expenses form is a document that allows individuals and businesses to summarize and report their financial expenditures over a twelve-month period. This form is essential for budgeting, tax preparation, and financial planning. It typically includes various categories of expenses, such as housing, utilities, transportation, and personal spending. By accurately detailing these expenses, users can gain insights into their financial health and make informed decisions moving forward.

How to use the Yearly Expenses

Using the yearly expenses form involves several straightforward steps. First, gather all relevant financial documents, including receipts, bank statements, and invoices. Next, categorize your expenses into predefined sections such as housing, food, transportation, and entertainment. Once categorized, enter the amounts in the corresponding fields of the form. After completing the form, review it for accuracy and completeness before submitting it as required, either for personal records or for tax purposes.

Steps to complete the Yearly Expenses

Completing the yearly expenses form can be broken down into a series of manageable steps:

- Collect all financial records for the year.

- Organize expenses into categories such as utilities, groceries, and insurance.

- Input the total amount spent in each category on the form.

- Double-check for accuracy and ensure all expenses are accounted for.

- Submit the completed form through the appropriate channels.

Legal use of the Yearly Expenses

The yearly expenses form serves various legal purposes, particularly in tax reporting and financial assessments. When filled out correctly, it can be used to substantiate claims for deductions or credits on tax returns. Compliance with IRS regulations is crucial, as inaccuracies can lead to penalties. It is important to retain copies of the form and any supporting documents for future reference, especially in the event of an audit.

Key elements of the Yearly Expenses

Several key elements are essential to include in the yearly expenses form to ensure its effectiveness:

- Expense Categories: Clearly defined sections for different types of expenses.

- Total Amounts: Accurate totals for each category to reflect overall spending.

- Date Range: A specified period covering the twelve months of reporting.

- Signature: A signature or eSignature to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the yearly expenses form can vary depending on individual circumstances and tax regulations. Generally, the form should be completed and submitted by the tax filing deadline, which is typically April fifteenth for individuals. It is advisable to check for specific state deadlines or extensions that may apply. Keeping track of these dates helps ensure compliance and avoids potential penalties.

Quick guide on how to complete yearly expenses

Effortlessly Prepare Yearly Expenses on Any Device

Managing documents online has become increasingly favored by both corporations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle Yearly Expenses on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Yearly Expenses with Ease

- Find Yearly Expenses and click on Get Form to begin.

- Use the tools provided to fill out your form.

- Mark important sections of your documents or obscure sensitive details with the tools available through airSlate SignNow designed specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Yearly Expenses to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow that help manage Yearly Expenses?

airSlate SignNow offers various features such as automated document workflows, custom branding, and secure eSigning which can signNowly reduce Yearly Expenses. These features streamline the signing process, eliminate paper-related costs, and enhance overall efficiency in managing documents.

-

How does airSlate SignNow help in tracking Yearly Expenses?

With airSlate SignNow, you can track Yearly Expenses easily through comprehensive reporting tools and analytics. By monitoring document usage and signing patterns, businesses can gain insights into their expenses and optimize their processes.

-

Is airSlate SignNow cost-effective for small businesses managing Yearly Expenses?

Yes, airSlate SignNow is designed with small businesses in mind, offering scalable pricing plans that cater to limited budgets. By using this electronic signature solution, small businesses can cut down on operational costs, effectively managing Yearly Expenses.

-

What integrations does airSlate SignNow provide to manage Yearly Expenses effectively?

airSlate SignNow integrates seamlessly with various accounting and financial software like QuickBooks and Xero. These integrations help businesses automate and track Yearly Expenses, ensuring a more efficient workflow and better financial oversight.

-

Can airSlate SignNow improve the efficiency of handling Yearly Expenses documentation?

Absolutely! airSlate SignNow transforms the way businesses handle documents by providing an efficient platform for electronic signatures. This not only speeds up the process but also reduces paper usage, ultimately lowering Yearly Expenses associated with documentation.

-

How secure is airSlate SignNow for handling sensitive Yearly Expenses documents?

airSlate SignNow prioritizes the security of your documents with features like encryption and compliance with regulations such as GDPR. This ensures that all sensitive information related to Yearly Expenses is protected, giving you peace of mind.

-

What types of businesses can benefit from using airSlate SignNow for Yearly Expenses?

airSlate SignNow is suitable for a wide range of businesses, from startups to large enterprises. Any organization that relies on document signing and wishes to reduce Yearly Expenses can thrive with this effective eSigning solution.

Get more for Yearly Expenses

Find out other Yearly Expenses

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast