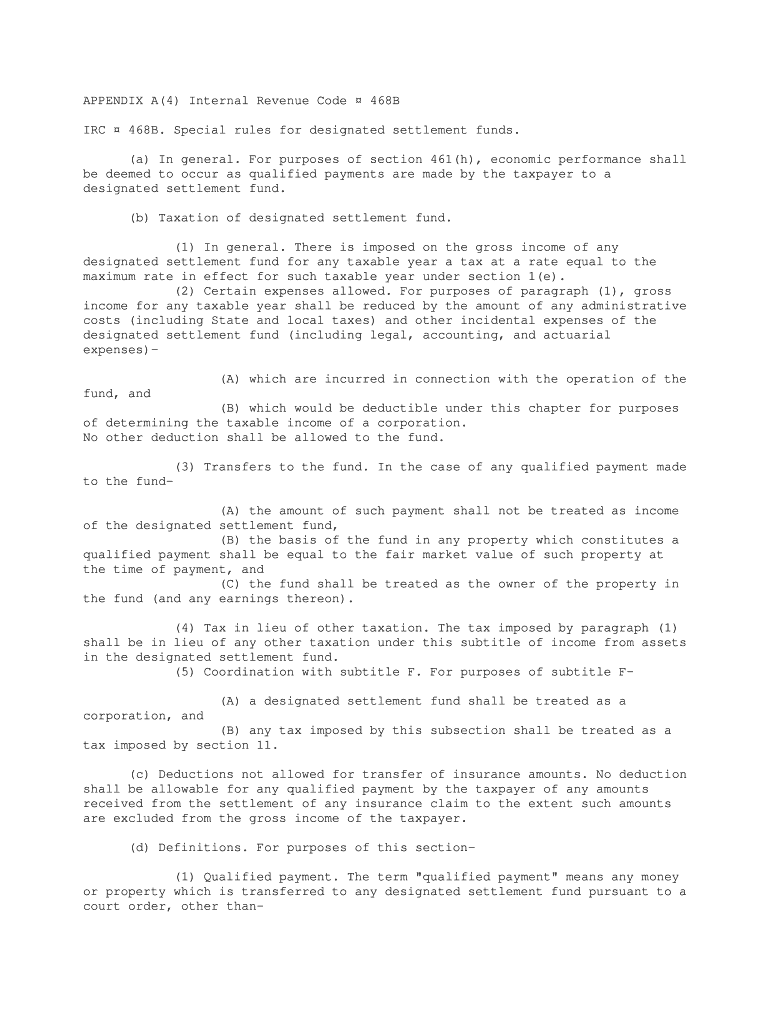

APPENDIX A4 Internal Revenue Code 468B Form

Understanding the appendix A4 Internal Revenue Code 468B

The appendix A4 form is associated with the Internal Revenue Code 468B, which pertains to the tax treatment of certain types of trusts. This form is primarily used to report information regarding the tax obligations of these trusts, ensuring compliance with federal tax regulations. Understanding this form is crucial for trustees and beneficiaries to navigate their tax responsibilities effectively.

Steps to complete the appendix A4 Internal Revenue Code 468B

Completing the appendix A4 form involves several key steps:

- Gather necessary information about the trust, including its name, tax identification number, and the names of beneficiaries.

- Determine the applicable tax year for which the form is being filed.

- Fill out the required sections of the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate tax authority by the specified deadline.

Legal use of the appendix A4 Internal Revenue Code 468B

The appendix A4 form is legally binding when completed and submitted according to IRS guidelines. It is essential for ensuring that the trust complies with federal tax obligations. Failure to properly file this form can result in penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of this form is vital for trustees.

Obtaining the appendix A4 Internal Revenue Code 468B

The appendix A4 form can be obtained directly from the IRS website or through tax preparation software that supports IRS forms. It is important to ensure that you are using the most current version of the form to comply with any recent tax law changes. Additionally, consulting with a tax professional can provide guidance on obtaining and completing the form correctly.

IRS Guidelines for the appendix A4 Internal Revenue Code 468B

The IRS provides specific guidelines for completing the appendix A4 form. These guidelines include instructions on which information must be reported, how to calculate any applicable taxes, and the deadlines for submission. Adhering to these guidelines is essential for ensuring compliance and avoiding potential penalties.

Filing deadlines for the appendix A4 Internal Revenue Code 468B

Filing deadlines for the appendix A4 form typically align with the tax year for which the form is being submitted. It is crucial to be aware of these deadlines to avoid late filing penalties. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the tax year. Keeping track of these dates helps ensure timely compliance.

Quick guide on how to complete appendix a4 internal revenue code 468b

Easily manage APPENDIX A4 Internal Revenue Code 468B on any device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to acquire the accurate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage APPENDIX A4 Internal Revenue Code 468B on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

Effortlessly modify and electronically sign APPENDIX A4 Internal Revenue Code 468B

- Obtain APPENDIX A4 Internal Revenue Code 468B and click on Get Form to begin.

- Use the tools we offer to fill in your form.

- Mark essential parts of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, the hassle of tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign APPENDIX A4 Internal Revenue Code 468B and ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the appendix A4 form and why is it important?

The appendix A4 form is a crucial document used in various business processes, particularly for compliance and record-keeping. Understanding its structure and requirements ensures that your business meets necessary regulations, making it essential for any organization.

-

How can airSlate SignNow help with the appendix A4 form?

airSlate SignNow simplifies the process of creating, sending, and eSigning the appendix A4 form. With its user-friendly interface, you can streamline documentation and ensure that all signatures and necessary information are captured efficiently.

-

What features does airSlate SignNow offer for managing the appendix A4 form?

airSlate SignNow offers features such as templates for the appendix A4 form, real-time tracking of document status, and automated reminders for signers. These tools enhance productivity and ensure that your important documents are processed swiftly.

-

Is airSlate SignNow a cost-effective solution for the appendix A4 form?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to manage the appendix A4 form. With various pricing plans, you can choose a package that fits your budget while still enjoying comprehensive features.

-

Can I easily integrate airSlate SignNow with other software for the appendix A4 form?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, allowing you to link your workflows for the appendix A4 form with tools you already use. This enhances efficiency and maintains your existing systems.

-

What are the benefits of eSigning the appendix A4 form with airSlate SignNow?

eSigning the appendix A4 form with airSlate SignNow offers numerous benefits, including faster turnaround times and reduced paperwork. Additionally, eSigning ensures document security and provides an audit trail for compliance.

-

How secure is the appendix A4 form when using airSlate SignNow?

Security is a top priority for airSlate SignNow. The appendix A4 form is protected through advanced encryption methods, ensuring that your documents remain confidential and secure during transmission and storage.

Get more for APPENDIX A4 Internal Revenue Code 468B

Find out other APPENDIX A4 Internal Revenue Code 468B

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe