26 U S C 5891 U S Code Title 26 Internal Revenue Code Form

What is the 26 U S C 5891 U S Code Title 26 Internal Revenue Code

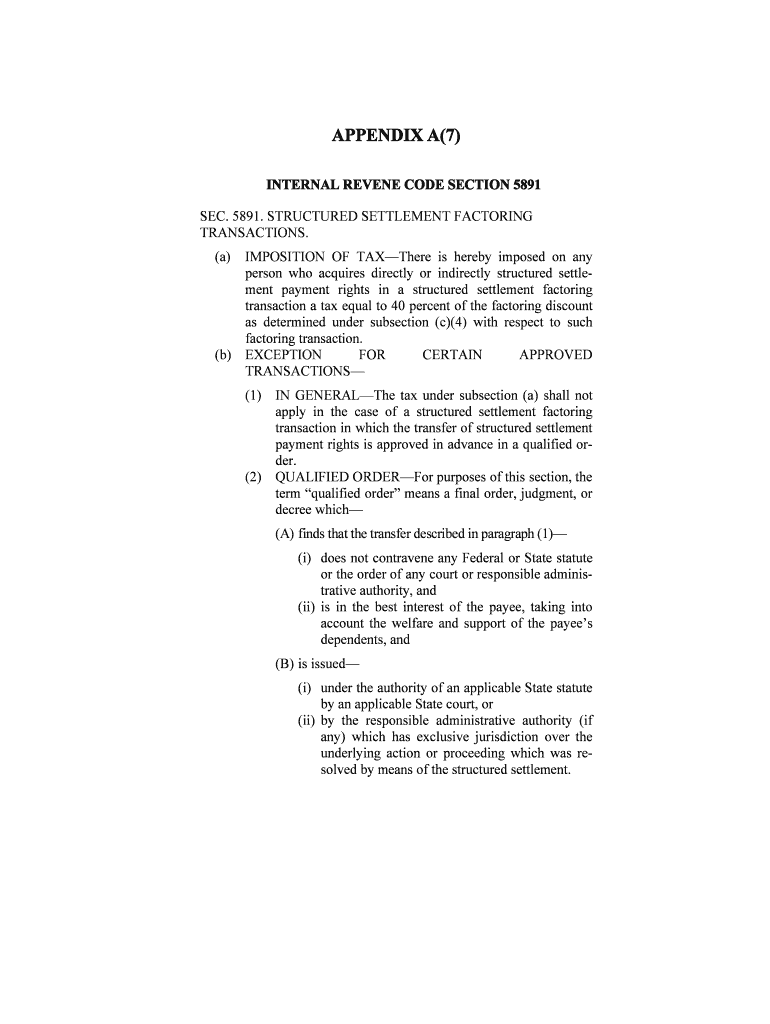

The 26 U S C 5891 refers to a specific section of the Internal Revenue Code that addresses the tax implications associated with certain types of transactions. This section is particularly relevant for individuals and businesses involved in the issuance of tax-exempt bonds. Understanding this code is essential for compliance with federal tax laws and regulations.

How to use the 26 U S C 5891 U S Code Title 26 Internal Revenue Code

Utilizing the 26 U S C 5891 involves understanding its provisions and how they apply to your financial activities. Taxpayers must ensure that they are accurately reporting any transactions related to tax-exempt bonds. This may include calculating the appropriate tax liabilities and filing the necessary documentation with the IRS. Proper use of this code can help in minimizing tax exposure and ensuring compliance.

Steps to complete the 26 U S C 5891 U S Code Title 26 Internal Revenue Code

Completing the requirements of the 26 U S C 5891 involves several steps:

- Review the specific provisions of the code to understand applicability.

- Gather necessary financial documents related to tax-exempt bonds.

- Calculate any tax liabilities as dictated by the code.

- Complete the required IRS forms accurately.

- Submit documentation by the specified deadlines to ensure compliance.

Legal use of the 26 U S C 5891 U S Code Title 26 Internal Revenue Code

The legal use of the 26 U S C 5891 is crucial for both individuals and businesses. Compliance with this code ensures that taxpayers adhere to federal tax laws regarding tax-exempt bonds. Failure to comply can result in penalties, including fines and interest on unpaid taxes. It is advisable to consult with a tax professional to navigate the complexities of this code effectively.

IRS Guidelines

The IRS provides specific guidelines regarding the implementation of the 26 U S C 5891. These guidelines outline the requirements for reporting transactions involving tax-exempt bonds, including necessary forms and deadlines. Taxpayers should regularly consult the IRS website or official publications to stay updated on any changes or clarifications related to this section of the tax code.

Required Documents

When dealing with the 26 U S C 5891, certain documents are essential for compliance:

- Financial statements related to tax-exempt bonds.

- IRS forms specific to the reporting of tax-exempt transactions.

- Documentation supporting the calculations of tax liabilities.

Penalties for Non-Compliance

Non-compliance with the provisions of the 26 U S C 5891 can lead to significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal repercussions. It is important for taxpayers to understand these risks and take proactive steps to ensure adherence to the code to avoid such penalties.

Quick guide on how to complete 26 usc5891 us code title 26 internal revenue code

Effortlessly Prepare 26 U S C 5891 U S Code Title 26 Internal Revenue Code on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to draft, modify, and electronically sign your documents swiftly without any hassles. Manage 26 U S C 5891 U S Code Title 26 Internal Revenue Code on any device using airSlate SignNow apps for Android or iOS and enhance any document-focused task today.

How to Edit and Electronically Sign 26 U S C 5891 U S Code Title 26 Internal Revenue Code with Ease

- Obtain 26 U S C 5891 U S Code Title 26 Internal Revenue Code and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that necessitate reprinting new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from your chosen device. Edit and electronically sign 26 U S C 5891 U S Code Title 26 Internal Revenue Code and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is 26 U.S. Code 5891 and how does it relate to e-signatures?

26 U.S. Code 5891 refers to the tax regulations surrounding certain financial transactions. While this code does not specifically cover e-signatures, airSlate SignNow ensures compliance with legal standards when electronically signing documents, providing peace of mind for users navigating tax-related documentation.

-

Can airSlate SignNow help with documents related to 26 U.S. Code 5891?

Yes, airSlate SignNow can assist you in managing documents that relate to 26 U.S. Code 5891. Our platform supports the creation, signing, and storage of essential financial documents, helping you stay organized while complying with regulatory requirements.

-

What are the pricing options for airSlate SignNow?

Our pricing options for airSlate SignNow are designed to be cost-effective, catering to businesses of all sizes. We offer various plans that provide access to features that support document management and electronic signatures relevant to 26 U.S. Code 5891, allowing you to choose a plan that best fits your needs.

-

What features does airSlate SignNow offer for compliance with 26 U.S. Code 5891?

AirSlate SignNow features electronic signature capture, document audit trails, and compliance-check tools, which are essential when handling documents tied to 26 U.S. Code 5891. Our platform enhances your document workflow while ensuring adherence to legal standards.

-

How does airSlate SignNow integrate with other software for handling 26 U.S. Code 5891 transactions?

AirSlate SignNow offers integrations with various software solutions, allowing seamless handling of transactions associated with 26 U.S. Code 5891. This means you can connect our e-signing capabilities with your existing workflows, enhancing efficiency and compliance.

-

What are the benefits of using airSlate SignNow for legal documents?

Using airSlate SignNow for legal documents provides multiple benefits including increased efficiency, better security, and compliance with laws including those related to 26 U.S. Code 5891. Our platform simplifies the signing process, allowing for faster transaction completion and improved document management.

-

Is airSlate SignNow secure for handling sensitive information under 26 U.S. Code 5891?

Absolutely, airSlate SignNow prioritizes security, employing encryption and other security measures to protect sensitive information associated with 26 U.S. Code 5891. You can securely manage and sign important documents without concerns about data bsignNowes.

Get more for 26 U S C 5891 U S Code Title 26 Internal Revenue Code

- Ct dissolution civil form

- Connecticut execution order form

- Financial institution execution proceedings judgment debtor who jud ct form

- Connecticut uniform sale

- Connecticut short claim form

- Exemption order form

- Sentence modification online form

- Appeal joint appeal cross appeal amended appeal jud ct form

Find out other 26 U S C 5891 U S Code Title 26 Internal Revenue Code

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word