EMPLOYEE PAYROLL RECORDS Form

What is the employee payroll records

The employee payroll records are essential documents that detail an employee's earnings, tax withholdings, and other deductions. These records serve as a comprehensive account of an employee's financial history with a company, including wages, bonuses, overtime, and benefits. Maintaining accurate payroll records is crucial for compliance with federal and state regulations, as well as for providing employees with transparency regarding their compensation.

How to use the employee payroll records

Using employee payroll records involves several key steps. Employers should regularly update these records to reflect any changes in an employee's pay rate, tax status, or benefits. Payroll records can be utilized for various purposes, including tax reporting, employee inquiries, and audits. It is important to ensure that these records are easily accessible and organized, allowing for efficient retrieval when needed.

Steps to complete the employee payroll records

Completing employee payroll records involves a systematic approach. First, collect all necessary information, including employee names, Social Security numbers, and pay rates. Next, calculate gross pay by multiplying hours worked by the pay rate. After determining gross pay, calculate deductions for taxes, benefits, and other withholdings. Finally, document the net pay and ensure that all information is accurately recorded in the payroll system.

Legal use of the employee payroll records

Employee payroll records must comply with various legal requirements to be considered valid. In the United States, the Fair Labor Standards Act (FLSA) mandates that employers maintain accurate records of hours worked and wages paid. Additionally, payroll records should be kept for a minimum of three years to comply with IRS regulations. Ensuring that these records are accurate and up-to-date helps protect both employers and employees in the event of disputes or audits.

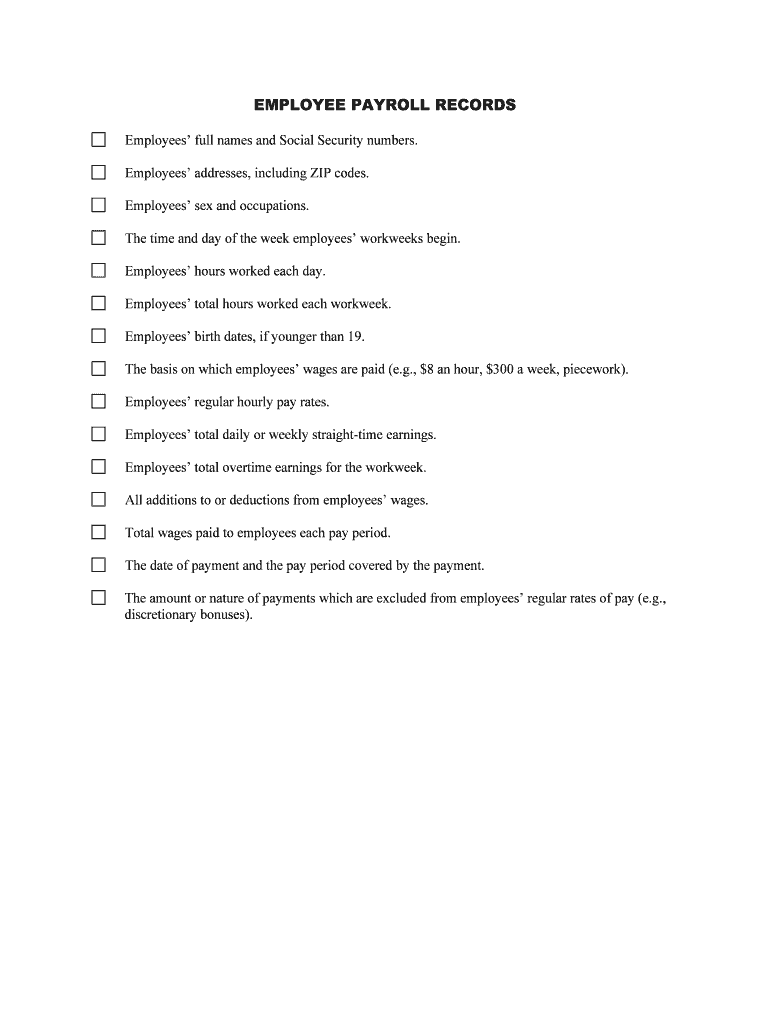

Key elements of the employee payroll records

Key elements of employee payroll records include the employee's full name, Social Security number, pay rate, hours worked, gross pay, net pay, and deductions. It is also important to document any bonuses, overtime, and benefits provided. Maintaining these elements ensures that payroll records are comprehensive and meet legal standards, providing a clear picture of an employee's compensation.

Form submission methods for employee payroll records

Employee payroll records can be submitted through various methods, depending on the employer's preference and the requirements of the relevant authorities. Common submission methods include online filing through payroll software, mailing physical copies to the appropriate tax agencies, or submitting in person at local offices. Each method has its own advantages, such as speed and convenience, making it essential for employers to choose the best option for their needs.

Quick guide on how to complete employee payroll records

Complete EMPLOYEE PAYROLL RECORDS smoothly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, revise, and electronically sign your documents swiftly without delays. Manage EMPLOYEE PAYROLL RECORDS on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign EMPLOYEE PAYROLL RECORDS effortlessly

- Find EMPLOYEE PAYROLL RECORDS and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for such tasks.

- Create your signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Modify and electronically sign EMPLOYEE PAYROLL RECORDS and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are EMPLOYEE PAYROLL RECORDS?

EMPLOYEE PAYROLL RECORDS are essential documents that track the earnings, tax deductions, and benefits of employees. Keeping these records organized helps ensure compliance with labor laws and facilitates efficient payroll processing.

-

How can airSlate SignNow help with EMPLOYEE PAYROLL RECORDS?

airSlate SignNow streamlines the management of EMPLOYEE PAYROLL RECORDS by allowing businesses to eSign and send necessary documents quickly. This helps maintain accurate records while saving time and improving overall efficiency in payroll processing.

-

What pricing plans are available for managing EMPLOYEE PAYROLL RECORDS?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs for managing EMPLOYEE PAYROLL RECORDS. These plans provide flexibility and scalability, ensuring you only pay for the features you need.

-

Are there integrations available for managing EMPLOYEE PAYROLL RECORDS?

Yes, airSlate SignNow integrates seamlessly with popular payroll and HR software to enhance the management of EMPLOYEE PAYROLL RECORDS. These integrations facilitate data transfer and ensure all information remains up-to-date and accurate.

-

What features does airSlate SignNow offer for EMPLOYEE PAYROLL RECORDS?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage to manage EMPLOYEE PAYROLL RECORDS. These features enhance productivity and ensure that documents are always accessible and properly signed.

-

How secure are EMPLOYEE PAYROLL RECORDS when using airSlate SignNow?

Security is a top priority for airSlate SignNow, and we use advanced encryption protocols to protect your EMPLOYEE PAYROLL RECORDS. Our platform complies with industry standards to ensure the confidentiality and integrity of your sensitive data.

-

Can I track changes made to EMPLOYEE PAYROLL RECORDS in airSlate SignNow?

Absolutely! airSlate SignNow provides robust tracking capabilities, allowing you to monitor any changes made to EMPLOYEE PAYROLL RECORDS. You can easily view version histories and ensure that all modifications are documented and transparent.

Get more for EMPLOYEE PAYROLL RECORDS

Find out other EMPLOYEE PAYROLL RECORDS

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast