Form B11A

What is the Form B11A

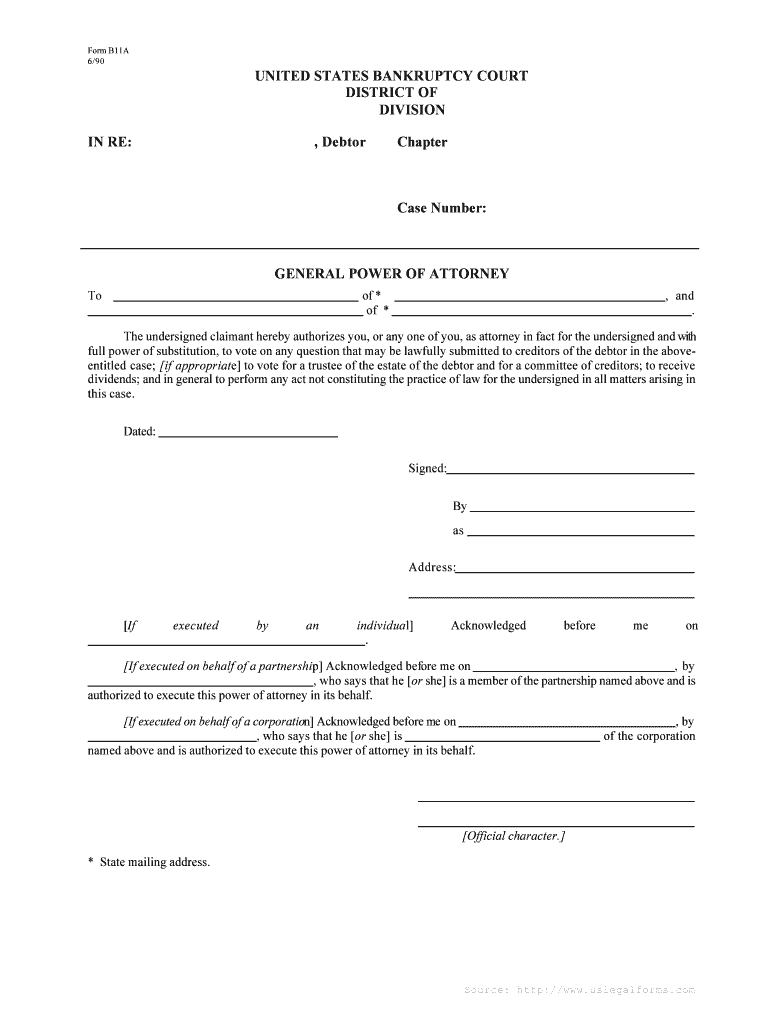

The Form B11A is a specific document used in various legal and administrative contexts within the United States. It serves as a formal declaration or application, often required by governmental agencies or organizations. Understanding its purpose is essential for individuals and businesses that need to comply with regulatory requirements or seek specific approvals. The form typically includes sections for personal information, relevant details pertaining to the request, and any necessary signatures.

How to use the Form B11A

Using the Form B11A involves several key steps to ensure proper completion and submission. First, gather all necessary information and documents required to fill out the form accurately. Next, complete each section of the form, paying close attention to detail to avoid errors. Once completed, review the form for any mistakes or missing information. Finally, submit the form according to the instructions provided, which may include online submission, mailing, or in-person delivery.

Steps to complete the Form B11A

Completing the Form B11A can be straightforward if you follow these steps:

- Read the instructions carefully to understand the requirements.

- Gather all necessary documents, such as identification and supporting materials.

- Fill out the form, ensuring all required fields are completed.

- Double-check for accuracy and completeness.

- Sign the form where indicated, either digitally or with a handwritten signature.

- Submit the form through the designated method, ensuring it is sent to the correct address or online portal.

Legal use of the Form B11A

The legal use of the Form B11A is governed by specific regulations that ensure its validity. When filled out correctly and submitted according to the applicable laws, the form is considered legally binding. It is crucial to adhere to relevant legal frameworks, such as federal and state laws, to avoid issues related to compliance. Additionally, using a reliable electronic signature solution can enhance the form's legitimacy and security.

Required Documents

When preparing to complete the Form B11A, certain documents may be required to support your application or declaration. These documents can include:

- Proof of identity, such as a driver's license or passport.

- Supporting documentation relevant to the request, like financial statements or legal agreements.

- Any prior forms or applications that may be necessary for context.

Form Submission Methods

The Form B11A can typically be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission through a designated portal.

- Mailing the completed form to the appropriate address.

- In-person delivery at specified locations, such as government offices.

Quick guide on how to complete form b11a

Manage Form B11A effortlessly on any device

Digital document handling has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed files, allowing you to obtain the correct format and securely keep it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly without delays. Handle Form B11A on any platform with airSlate SignNow Android or iOS applications and streamline any document-based task today.

How to adjust and eSign Form B11A with ease

- Obtain Form B11A and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize necessary sections of your documents or conceal confidential information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate worries about lost or disorganized documents, tiresome form browsing, or errors that require reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Form B11A and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form B11A and how can airSlate SignNow help with it?

Form B11A is a specific document often required in various administrative processes. airSlate SignNow enables users to easily send and eSign Form B11A, streamlining the approval process and ensuring compliance. With our user-friendly interface, managing and submitting this form becomes quick and efficient.

-

Is there a cost associated with using airSlate SignNow for Form B11A?

Yes, airSlate SignNow offers competitive pricing plans to accommodate various business needs. By choosing our platform to handle Form B11A, you also gain access to features that enhance document management, making it a valuable investment. You can calculate potential savings and improved efficiency on our pricing page.

-

What features does airSlate SignNow offer for handling Form B11A?

airSlate SignNow provides a suite of features designed to simplify the management of Form B11A. Users can utilize templates, automated workflows, and secure storage to enhance their document processes. These features help ensure that Form B11A is filled out correctly and stored safely.

-

How does airSlate SignNow ensure the security of Form B11A documents?

Security is a top priority at airSlate SignNow. We utilize SSL encryption and comply with industry standards to protect your Form B11A and other documents. Additionally, access controls and audit trails ensure that only authorized personnel can view or edit sensitive information.

-

Can I integrate airSlate SignNow with other tools for Form B11A management?

Absolutely! airSlate SignNow offers robust integrations with various tools, such as CRMs and document storage solutions, to enhance your workflow. These integrations make it easier to manage Form B11A alongside your other business processes, providing a seamless experience.

-

What are the benefits of using airSlate SignNow for eSigning Form B11A?

Using airSlate SignNow to eSign Form B11A can signNowly increase efficiency and reduce turnaround times. The electronic signature process is faster, and you can track the progress of your document in real time. This simplification allows you to focus more on your core business activities.

-

Is airSlate SignNow user-friendly for filling out Form B11A?

Yes, airSlate SignNow is designed with user-friendliness in mind. With a straightforward interface, users can quickly fill out Form B11A without any technical expertise. Our helpful tutorials and customer support further assist users in navigating their document needs.

Get more for Form B11A

Find out other Form B11A

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form