Contractor Request for Payment for Use with a Construction Manager Public Works Administration State of Idaho Form

Understanding the Contractor Request for Payment

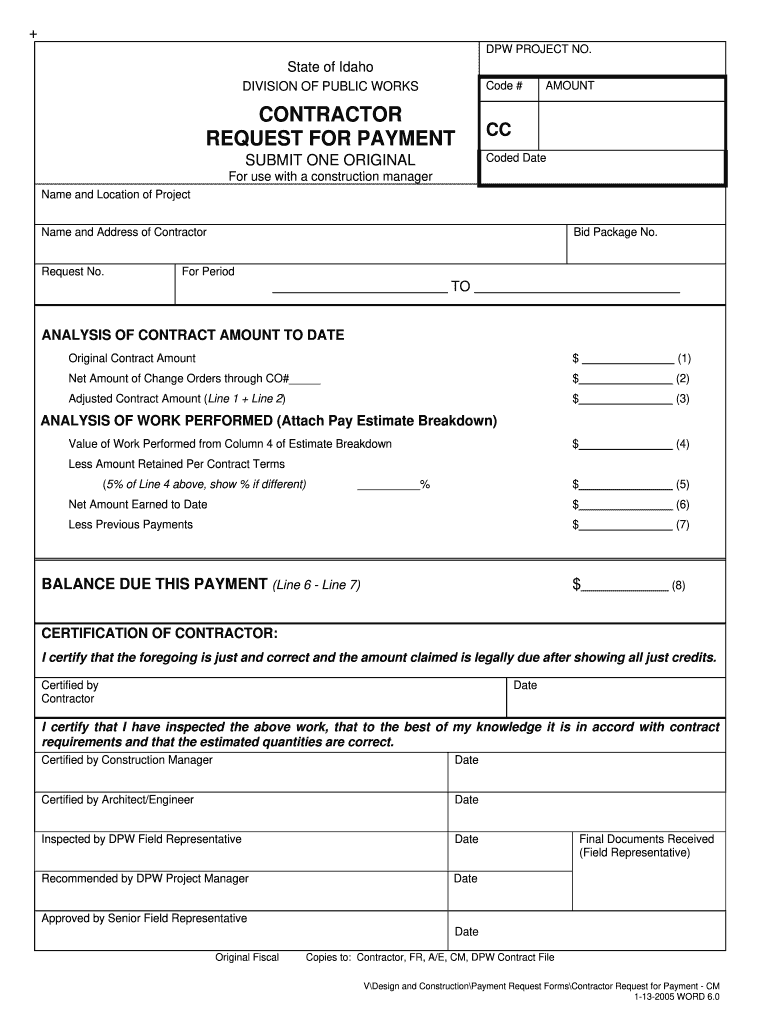

The Contractor Request for Payment is a crucial document for contractors working on public works projects in Idaho. This form serves as a formal request for payment for services rendered, materials supplied, or work completed. It is essential for ensuring that contractors receive timely compensation for their efforts. The form typically includes details such as the project name, contract number, payment amount requested, and a breakdown of work completed to date. Understanding the specific requirements and components of this request is vital for compliance with state regulations and for maintaining positive cash flow on construction projects.

Steps to Complete the Contractor Request for Payment

Completing the Contractor Request for Payment involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including the contract and any previous payment records. Next, fill out the form with precise details, including the project name, contractor information, and the amount being requested. It is important to provide a clear breakdown of the work completed, as this supports the request and helps prevent delays in payment. After completing the form, review it for accuracy before submitting it to the appropriate authority, ensuring that all required signatures are included.

Legal Use of the Contractor Request for Payment

The legal use of the Contractor Request for Payment is governed by state laws and regulations. In Idaho, this form must comply with the guidelines set forth by the Public Works Administration. To be considered legally binding, the request must be properly filled out and submitted in accordance with the contract terms. Additionally, electronic signatures are recognized under U.S. law, provided that the signing process adheres to the standards set by the ESIGN Act and UETA. Ensuring that the request meets these legal requirements is essential for protecting the rights of the contractor and facilitating the payment process.

Key Elements of the Contractor Request for Payment

Several key elements must be included in the Contractor Request for Payment to ensure its effectiveness. These elements typically encompass:

- Project Information: Name and description of the project.

- Contractor Details: Name, address, and contact information of the contractor.

- Payment Amount: Total amount requested, along with a breakdown of costs.

- Work Completed: Detailed description of work completed to date.

- Signatures: Required signatures from the contractor and any relevant parties.

Including these elements helps ensure that the request is clear and complete, facilitating a smoother payment process.

State-Specific Rules for the Contractor Request for Payment

Idaho has specific rules governing the Contractor Request for Payment, which must be adhered to by all contractors working on public works projects. These rules may include deadlines for submission, required documentation, and specific formats for the request. Familiarity with these regulations is crucial for contractors to avoid penalties or delays in payment. It is advisable for contractors to consult the Idaho Public Works Administration guidelines to ensure compliance with all state-specific requirements.

Examples of Using the Contractor Request for Payment

Understanding how to effectively use the Contractor Request for Payment can be enhanced through practical examples. For instance, a contractor may submit a payment request after completing a significant phase of a construction project, such as the foundation work. In this case, the request would detail the work performed, the corresponding costs, and any supporting documentation, such as invoices for materials used. Another example could involve a contractor requesting payment for change orders that have been approved during the project. These examples illustrate the versatility of the payment request form and its importance in ensuring that contractors are compensated fairly and promptly.

Quick guide on how to complete contractor request for payment for use with a construction manager public works administration state of idaho

Effortlessly Prepare Contractor Request For Payment For Use With A Construction Manager Public Works Administration State Of Idaho on Any Device

Managing documents online has gained traction among businesses and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly and without interruptions. Handle Contractor Request For Payment For Use With A Construction Manager Public Works Administration State Of Idaho on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-focused transaction today.

How to effortlessly edit and eSign Contractor Request For Payment For Use With A Construction Manager Public Works Administration State Of Idaho

- Find Contractor Request For Payment For Use With A Construction Manager Public Works Administration State Of Idaho and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your modifications.

- Choose your preferred method to submit the form, via email, SMS, invite link, or download it to your computer.

Eliminate the worry about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Contractor Request For Payment For Use With A Construction Manager Public Works Administration State Of Idaho to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the contractor request for payment for use with a construction manager public works administration state of idaho

How to create an electronic signature for your Contractor Request For Payment For Use With A Construction Manager Public Works Administration State Of Idaho in the online mode

How to make an eSignature for your Contractor Request For Payment For Use With A Construction Manager Public Works Administration State Of Idaho in Google Chrome

How to create an electronic signature for signing the Contractor Request For Payment For Use With A Construction Manager Public Works Administration State Of Idaho in Gmail

How to create an eSignature for the Contractor Request For Payment For Use With A Construction Manager Public Works Administration State Of Idaho from your smart phone

How to make an electronic signature for the Contractor Request For Payment For Use With A Construction Manager Public Works Administration State Of Idaho on iOS

How to make an eSignature for the Contractor Request For Payment For Use With A Construction Manager Public Works Administration State Of Idaho on Android

People also ask

-

What is a payment request for construction?

A payment request for construction is an official document that contractors send to clients to request payment for completed work. It includes details about the services rendered and the amount due. Using airSlate SignNow, you can easily create and send these payment requests, streamlining your billing process.

-

How does airSlate SignNow facilitate payment requests for construction?

airSlate SignNow allows you to create customizable payment requests for construction quickly. You can add project-specific details, attach invoices, and send them for eSignature to ensure prompt payment. This feature enhances efficiency by reducing paperwork and minimizing delays in payment processing.

-

What are the pricing options for using airSlate SignNow for construction payment requests?

airSlate SignNow offers various pricing plans to suit different business needs, including options for occasional and frequent users. By assessing your requirements for creating payment requests for construction, you can choose a plan that provides the best value and features your business needs to thrive.

-

Can I track the status of my payment request for construction on airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your documents including payment requests for construction. You can easily see when a request has been sent, opened, signed, or completed, allowing for better management of your payment processing timeline.

-

What features does airSlate SignNow offer for managing payment requests for construction?

AirSlate SignNow offers a suite of features tailored for managing payment requests for construction, including document templates, easy eSigning, cloud storage, and mobile access. These features help streamline your workflow, making it easy to send and track payment requests directly from your device.

-

How can airSlate SignNow help improve the efficiency of my construction business?

By using airSlate SignNow for payment requests for construction, you reduce the time spent on documentation and approvals. This efficient process improves cash flow and allows you to focus more on project management rather than administrative tasks, ultimately benefiting your bottom line.

-

Does airSlate SignNow integrate with other tools I use for my construction projects?

Yes, airSlate SignNow integrates smoothly with various applications commonly used in construction management, including project management software and accounting tools. This integration streamlines your process for payment requests for construction, ensuring all your systems work together seamlessly.

Get more for Contractor Request For Payment For Use With A Construction Manager Public Works Administration State Of Idaho

- Alabama no fault agreed uncontested us legal forms

- Kansas last will and testamentlegal will formsus

- Kansas mutual wills package of last wills us legal forms

- Kansas mutual wills package with last us legal forms

- Kansas legal last will and testament form with all

- I of county kansas form

- Kansas passed away on form

- Will codicils to will form

Find out other Contractor Request For Payment For Use With A Construction Manager Public Works Administration State Of Idaho

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word