To Approve an Employee Stock Option Plan Which Recognizes Eight Levels of Form

What is the To Approve An Employee Stock Option Plan Which Recognizes Eight Levels Of

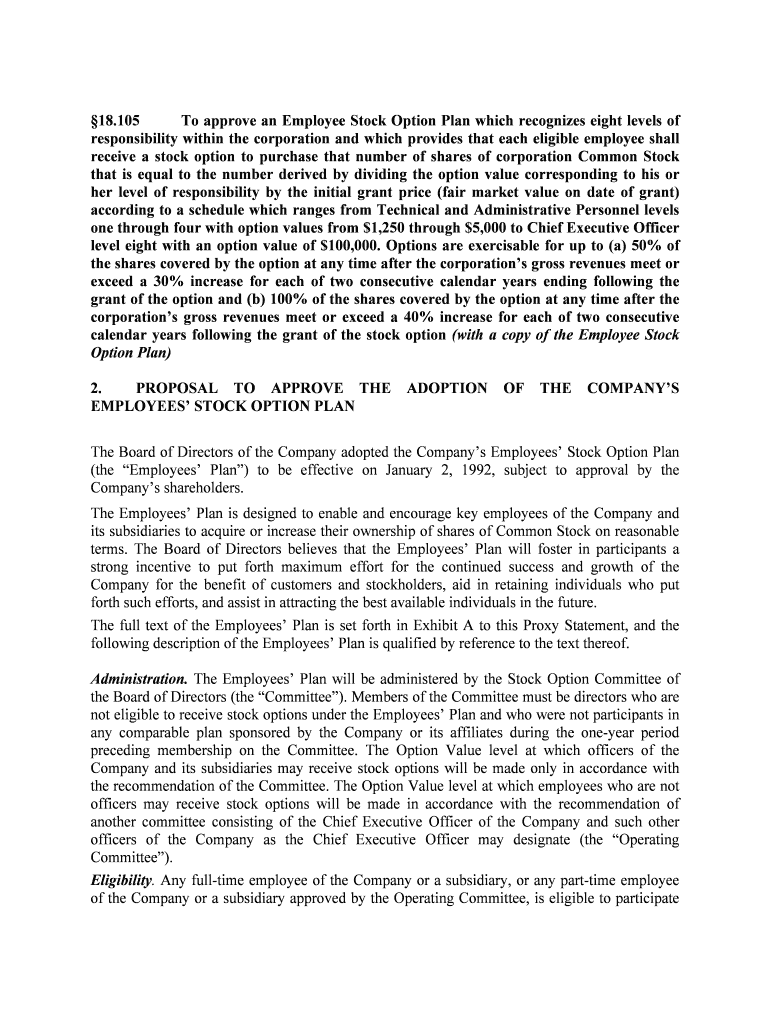

The form to approve an employee stock option plan which recognizes eight levels of is a crucial document for organizations looking to implement a structured employee incentive program. This plan allows companies to grant stock options to employees at various levels within the organization, aligning their interests with those of shareholders. By recognizing eight distinct levels, the plan can cater to a diverse workforce, ensuring that employees at different stages of their careers have access to equity compensation.

This form outlines the eligibility criteria, the number of options available at each level, and the vesting schedule. It serves as a formal agreement between the employer and employees, detailing the terms under which stock options will be granted and exercised. Understanding the specifics of this plan is essential for both employers and employees to maximize its benefits.

Steps to complete the To Approve An Employee Stock Option Plan Which Recognizes Eight Levels Of

Completing the form to approve an employee stock option plan which recognizes eight levels of involves several key steps. First, gather all necessary information regarding the company’s stock options, including the number of shares available and the criteria for each level. Next, ensure that the plan complies with relevant regulations and internal policies.

Once the information is compiled, fill out the form accurately, paying close attention to details such as employee eligibility and option pricing. After completing the form, it should be reviewed by legal counsel or an HR professional to ensure compliance with applicable laws. Finally, obtain the necessary signatures from authorized personnel to finalize the approval process.

Legal use of the To Approve An Employee Stock Option Plan Which Recognizes Eight Levels Of

The legal use of the form to approve an employee stock option plan which recognizes eight levels of is governed by federal and state laws. It is essential for the plan to comply with the Internal Revenue Code, particularly sections dealing with stock options and employee benefits. Additionally, the plan must adhere to the Employee Retirement Income Security Act (ERISA) if applicable.

To ensure that the plan is legally binding, it must be properly executed, with all required signatures obtained. The organization should also maintain thorough records of the plan’s terms and any amendments made over time. This documentation is critical for defending the plan’s validity in case of disputes or regulatory inquiries.

Key elements of the To Approve An Employee Stock Option Plan Which Recognizes Eight Levels Of

Understanding the key elements of the form to approve an employee stock option plan which recognizes eight levels of is vital for effective implementation. The primary components include:

- Eligibility Criteria: Defines which employees qualify for stock options based on their role and tenure.

- Option Grant Levels: Specifies the eight levels of stock options available, detailing the number of options for each level.

- Vesting Schedule: Outlines when employees can exercise their options, often based on time or performance metrics.

- Exercise Price: Indicates the price at which employees can purchase shares, typically set at the market value at the time of grant.

- Expiration Date: States the duration for which the options are valid before they expire.

These elements collectively ensure that the plan is structured, equitable, and compliant with legal standards, providing a clear framework for both the employer and employees.

How to use the To Approve An Employee Stock Option Plan Which Recognizes Eight Levels Of

Using the form to approve an employee stock option plan which recognizes eight levels of requires a systematic approach. Begin by familiarizing yourself with the plan's structure and the specific levels of options available. This understanding will help in communicating the benefits to employees effectively.

Next, distribute the form to relevant stakeholders, including HR and legal teams, for input and review. Once finalized, present the plan to employees, explaining how it works and the advantages of participating in the stock option program. Ensure that employees have access to resources that can help them understand the implications of stock options on their compensation and potential tax liabilities.

Finally, monitor the plan's implementation and gather feedback from employees to make necessary adjustments in future iterations of the plan.

Quick guide on how to complete to approve an employee stock option plan which recognizes eight levels of

Effortlessly Prepare To Approve An Employee Stock Option Plan Which Recognizes Eight Levels Of on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documentation, enabling you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage To Approve An Employee Stock Option Plan Which Recognizes Eight Levels Of on any device with the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to Modify and Electronically Sign To Approve An Employee Stock Option Plan Which Recognizes Eight Levels Of with Ease

- Obtain To Approve An Employee Stock Option Plan Which Recognizes Eight Levels Of and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Select how you'd like to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form finding, or mistakes requiring the printing of new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign To Approve An Employee Stock Option Plan Which Recognizes Eight Levels Of while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to approve an employee stock option plan which recognizes eight levels of compensation?

To approve an employee stock option plan which recognizes eight levels of compensation, it typically involves drafting the plan document, ensuring compliance with regulations, and obtaining necessary approvals from stakeholders. It's crucial to clearly define levels and eligibility criteria to avoid future complications. Utilizing a robust eSignature solution like airSlate SignNow can streamline document approvals efficiently.

-

How does airSlate SignNow help with employee stock option plan documentation?

airSlate SignNow simplifies the documentation process required to approve an employee stock option plan which recognizes eight levels of. Our platform allows you to create, send, and eSign documents seamlessly, ensuring that all necessary paperwork is completed accurately and quickly. This saves time and reduces the risk of errors in critical documentation.

-

Are there any costs associated with using airSlate SignNow for employee stock option plan approvals?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for enterprises managing to approve an employee stock option plan which recognizes eight levels of. The pricing is competitive and based on features you select, ensuring you only pay for what your business requires. Check our website for specific pricing details.

-

What features does airSlate SignNow offer for managing employee stock option plans?

airSlate SignNow provides features such as customizable templates, document tracking, and secure eSignatures, which are essential when you need to approve an employee stock option plan which recognizes eight levels of. Additionally, our platform supports integrations with various tools, making it easier to manage all your documentation seamlessly.

-

Can I integrate airSlate SignNow with other HR software for stock option management?

Absolutely! airSlate SignNow is designed to integrate with a range of HR and business software, allowing you to create a streamlined process to approve an employee stock option plan which recognizes eight levels of. Integrations help enhance workflow efficiency, ensuring all documentation and approvals are in one place.

-

Is airSlate SignNow secure for handling sensitive employee stock option information?

Yes, airSlate SignNow prioritizes security, utilizing encryption and secure storage to protect all sensitive information, including when you approve an employee stock option plan which recognizes eight levels of. Our system complies with industry standards to ensure that your data remains confidential and protected from unauthorized access.

-

What benefits can businesses expect from using airSlate SignNow for stock option plans?

Businesses can expect enhanced efficiency, reduced paperwork, and improved compliance when using airSlate SignNow to approve an employee stock option plan which recognizes eight levels of. Our platform accelerates the signing process, minimizes delays, and helps maintain proper documentation, ultimately leading to better management of employee stock options.

Get more for To Approve An Employee Stock Option Plan Which Recognizes Eight Levels Of

Find out other To Approve An Employee Stock Option Plan Which Recognizes Eight Levels Of

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney