Form R 20128 Louisiana Department of Revenue Revenue Louisiana 2006-2026

What is the Form R-20128?

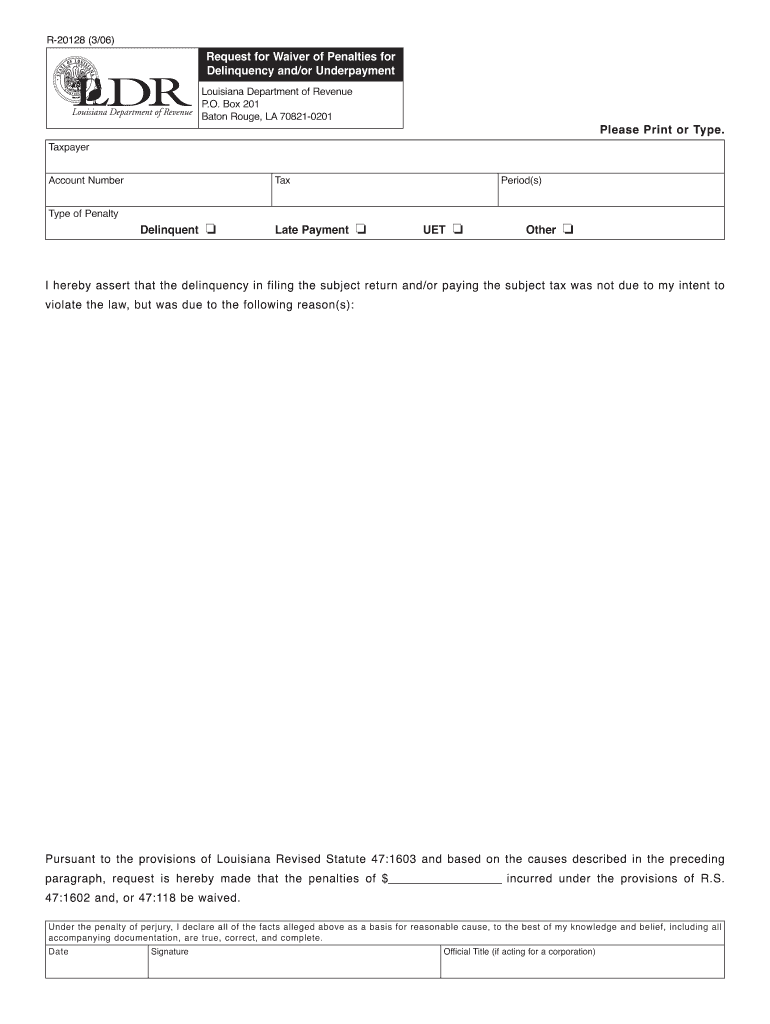

The Form R-20128 is a specific tax form issued by the Louisiana Department of Revenue. This form is utilized for reporting certain tax-related information, ensuring compliance with state tax regulations. It is essential for taxpayers in Louisiana to understand the purpose of this form, as it plays a crucial role in the accurate reporting of income and tax obligations. The Louisiana Department of Revenue mandates its use for specific situations, making it important for individuals and businesses to familiarize themselves with its requirements.

Steps to Complete the Form R-20128

Completing the Form R-20128 involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and any relevant tax records. Next, carefully fill in the required fields, ensuring that all information is accurate and up to date. It is advisable to double-check entries for any errors. After completing the form, review the filing instructions specific to Form R-20128 to ensure compliance with state regulations. Finally, submit the form according to the guidelines provided by the Louisiana Department of Revenue.

How to Obtain the Form R-20128

The Form R-20128 can be obtained directly from the Louisiana Department of Revenue's official website. It is available for download in a printable format, allowing taxpayers to fill it out manually or electronically. Additionally, physical copies may be available at local Department of Revenue offices. Ensuring you have the most current version of the form is crucial, as outdated forms may not be accepted during the filing process.

Legal Use of the Form R-20128

The legal use of the Form R-20128 is governed by the regulations set forth by the Louisiana Department of Revenue. This form must be completed accurately and submitted within the designated time frames to avoid penalties. Using the form for its intended purpose is essential for maintaining compliance with state tax laws. Taxpayers should ensure that they meet all eligibility criteria and follow the guidelines provided by the Department of Revenue to avoid any legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form R-20128 are established by the Louisiana Department of Revenue and are typically aligned with the state's tax filing calendar. It is critical for taxpayers to be aware of these deadlines to ensure timely submission and avoid penalties. Important dates may include the initial filing deadline and any extensions that may apply. Keeping track of these dates can help taxpayers manage their tax obligations effectively.

Form Submission Methods

The Form R-20128 can be submitted through various methods, including online, by mail, or in person. Submitting the form online is often the most efficient method, allowing for quicker processing and confirmation of receipt. For those choosing to mail the form, it is important to send it to the correct address provided by the Louisiana Department of Revenue to avoid delays. In-person submissions can also be made at designated Department of Revenue offices, where assistance may be available if needed.

Quick guide on how to complete form r 20128 louisiana department of revenue revenue louisiana

Your assistance manual on how to prepare your Form R 20128 Louisiana Department Of Revenue Revenue Louisiana

If you’re curious about how to finalize and submit your Form R 20128 Louisiana Department Of Revenue Revenue Louisiana, here are some brief guidelines to simplify the tax submission process.

To start, you just need to set up your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is an exceptionally intuitive and robust document solution that enables you to modify, create, and finish your tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and return to adjust answers as necessary. Enhance your tax handling with sophisticated PDF editing, eSigning, and easy sharing options.

Follow the steps below to complete your Form R 20128 Louisiana Department Of Revenue Revenue Louisiana in just a few minutes:

- Establish your account and begin working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through types and schedules.

- Click Get form to open your Form R 20128 Louisiana Department Of Revenue Revenue Louisiana in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Use the Sign Tool to add your legally-recognized eSignature (if applicable).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it onto your device.

Refer to this manual to file your taxes online with airSlate SignNow. Please be aware that submitting in paper form can lead to return errors and delay refunds. Naturally, before e-filing your taxes, consult the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form r 20128 louisiana department of revenue revenue louisiana

How to create an electronic signature for the Form R 20128 Louisiana Department Of Revenue Revenue Louisiana online

How to generate an eSignature for your Form R 20128 Louisiana Department Of Revenue Revenue Louisiana in Google Chrome

How to make an electronic signature for putting it on the Form R 20128 Louisiana Department Of Revenue Revenue Louisiana in Gmail

How to create an electronic signature for the Form R 20128 Louisiana Department Of Revenue Revenue Louisiana from your smartphone

How to create an electronic signature for the Form R 20128 Louisiana Department Of Revenue Revenue Louisiana on iOS devices

How to create an eSignature for the Form R 20128 Louisiana Department Of Revenue Revenue Louisiana on Android devices

People also ask

-

What is Form R 20128 from the Louisiana Department of Revenue?

Form R 20128 is a specific tax form required by the Louisiana Department of Revenue for certain tax filings. This form is essential for businesses operating in Louisiana to ensure compliance with state tax regulations. Using airSlate SignNow, you can easily eSign and submit Form R 20128, streamlining your tax filing process.

-

How can airSlate SignNow help with Form R 20128 submissions?

AirSlate SignNow offers a user-friendly platform that simplifies the process of eSigning and managing Form R 20128 submissions to the Louisiana Department of Revenue. With our solution, you can quickly send the form for signatures, track its status, and ensure timely submissions, reducing the risk of delays or errors.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow provides flexible pricing plans tailored to meet the needs of various businesses, from startups to larger enterprises. Our plans include features that support the efficient handling of documents like Form R 20128 from the Louisiana Department of Revenue. You can choose a plan that best fits your document management needs and budget.

-

Are there any features specifically designed for tax forms like Form R 20128?

Yes, airSlate SignNow includes features that cater specifically to the needs of tax filings, such as templates for Form R 20128 from the Louisiana Department of Revenue. These features allow for quick access, easy customization, and secure eSigning, ensuring your tax documents are managed efficiently.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! AirSlate SignNow offers seamless integrations with various accounting and finance software, making it easier to manage documents like Form R 20128 from the Louisiana Department of Revenue. This integration ensures that your workflow remains uninterrupted and that all necessary documents are easily accessible.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow for eSigning documents like Form R 20128 from the Louisiana Department of Revenue brings numerous benefits, including enhanced security, faster turnaround times, and improved compliance. Our platform ensures that your documents are securely signed and stored, allowing you to focus on your business operations.

-

Is airSlate SignNow compliant with Louisiana's eSignature laws?

Yes, airSlate SignNow is fully compliant with Louisiana's eSignature laws, ensuring that your eSigned documents, including Form R 20128 from the Louisiana Department of Revenue, are legally valid. Our platform adheres to all necessary regulations, providing you with peace of mind regarding your document management.

Get more for Form R 20128 Louisiana Department Of Revenue Revenue Louisiana

- Control number ky p077 pkg form

- Kentucky living will form formswift

- Identity theft and security freezes kentucky attorney general form

- Control number ky p085 pkg form

- Control number ky p086 pkg form

- Control number ky p088 pkg form

- Postnuptial property agreement kentuckyus legal forms

- Control number ky p092 pkg form

Find out other Form R 20128 Louisiana Department Of Revenue Revenue Louisiana

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter